Apple Savings account is a massive hit 🤑; PayPal brings crypto transfers to Venmo 📲; Amazon doubles down on card program 💳

FinTech is Eating the World, 3 May

Hey Everyone,

Good afternoon! Today’s issue comes out behind schedule but it’s absolutely worth the wait. On today’s radar we have Apple whose Savings account is a massive hit (it’s finally making banks run for their money + a deep dive into Apple as JPMorgan 2.0), PayPal which brings crypto transfers to Venmo (why this is a bullish development that further strengthens PayPal dominance in the digital money space), and Amazon that doubles down on card program (why + a brilliant case study on how to grow a FinTech product). Let’s jump straight into the spicy stuff 🌶

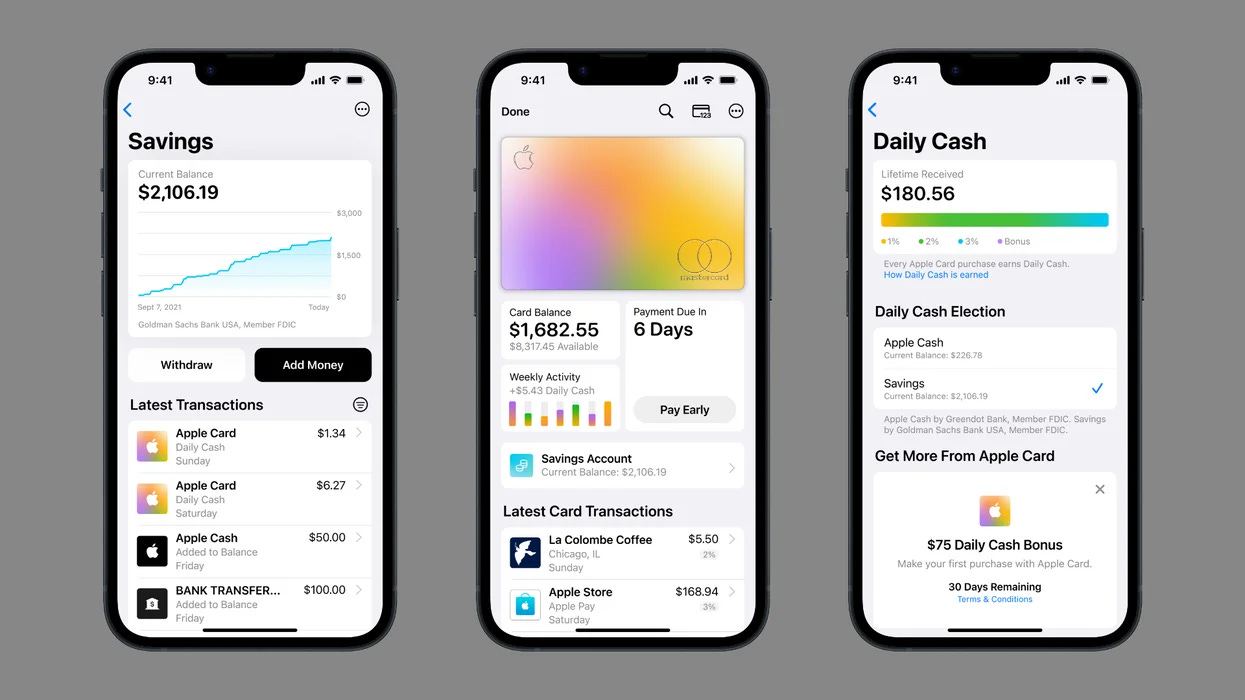

Apple Savings account is a massive hit 🤑

The news 📰 Big Tech might finally make banks run for their money as Apple's AAPL 0.00%↑ new savings account seems to be a massive hit.

More on this 👉 According to internal sources cited by Forbes, the consumer technology giant racked up nearly $1 billion in deposits. In just 5 days 🤯

In that time, more than 240,000 accounts signed up for the service.

The USP 🥊 We can remember that the long-trailed Apple Card savings account launched in partnership with Goldman Sachs GS 0.00%↑ was introduced in Mid-April with a headline-grabbing 4.15% annual percentage yield. This is more than 10X the national average, as per FDIC data.

The newest feature is part of the Apple Finance empire which seems to have resonated well with the users. The savings account not only represents a market-beating return on their cash but also a safe haven during rising interest rates and bank crashes.

✈️ THE TAKEAWAY

Looking ahead 👀 The early Apple success comes as no surprise and just further proves that the tech behemoth is building JPMorgan 2.0. Looking at the big picture, it also shows us what happens when tech companies are better than banks (not only in terms of APY but also UX, brand awareness, etc.). More importantly, Big Tech's mastery of user data coupled with their size and customer reach could really trigger rapid change in the financial services industry, leaving established banks behind and at a competitive disadvantage. So far, Apple is the Usain Bolt in this race.

ICYMI: Apple is building JPMorgan 2.0 😳 [deeper dive + lots of bonus reads]