Monzo's focus is paying off 💸; Neobanking consolidation continues in a bid to bring Black Banking to the next level 🏦; Wix is going hard against Shopify ⚔️

FinTech is Eating the World, 4 May

Hey Everyone,

Happy Friday! Today’s issue is super exciting as we’re going to look at Monzo's focus that is paying off big time (with lots of bonus reads & a deep dive into the Monzo Pivot), the continuing neobanking consolidation (can it bring Black Banking to the next level + a bonus read about Challenger Banks 2.0), and Wix, which is going hard against Shopify (why the stock is attractive + a look at their strategy). Let’s jump straight into the fascinating stuff 🌶

Monzo's focus is paying off 💸

The news 📰 UK neobank Monzo has reached a milestone of 250,000 business customers. This means that 1 in 23 businesses in the UK is now banking with Monzo.

Not bad, so let’s take a closer look.

More on this 👉 As reported by Finextra, Monzo moved into the market for business accounts 3 years ago, a year later than its closest rival Starling, which now claims 520,000 small business accounts. This represents an 8.9% market share. Not bad too bad! 😳

Bonus: Starling Bank, the underrated FinTech success story 🤌

Revolut should have ~500,000 business accounts as well but it would be hard to verify this number, not to mention the fact that quite a fraction of them should be outside the UK.

ICYMI: Revolut revenue drama 🎭

The money 💰 Monzo Business Pro costs £5/month and includes integrations with cloud accounting tools Xero and FreeAgent, alongside other products and features such as 'Tax Pots', which automatically set money aside for a tax bill, invoicing capabilities multiuser access, and the ability to auto-expert transactions. Monzo Lite is the free stripped-down version of the business app.

Monzo has not provided a breakdown of free and paying customers in the 250K figures.

✈️ THE TAKEAWAY

What does this mean? 🤔 At the core, this perfectly illustrates what I’ve said earlier - Monzo’s niche focus and brilliant execution is paying off. Big time! Sure, they are a bit lagging behind a rival Starling but given their bigger base in retail, the performance is definitely admirable. The biggest challenge for Monzo right now is probably growth.

The British challenger is the largest neobank in the UK, and with 5.8M customers, it’s leaning against the 3M that Revolut has and ~2M that Starling and Monese count each. Yet, Monzo only has a UK banking license and cannot operate in the EU. With 97% of UK adults already having a bank account, it means that for Monzo to grow, it has to acquire customers from traditional banks and neobanks. And that’s always tough. This is why Monzo is probably looking at the US, but I highly doubt it’s worth the effort. Here’s why:

ICYMI: Monzo's license-less US expansion. Smart move or just foolish? 🧐

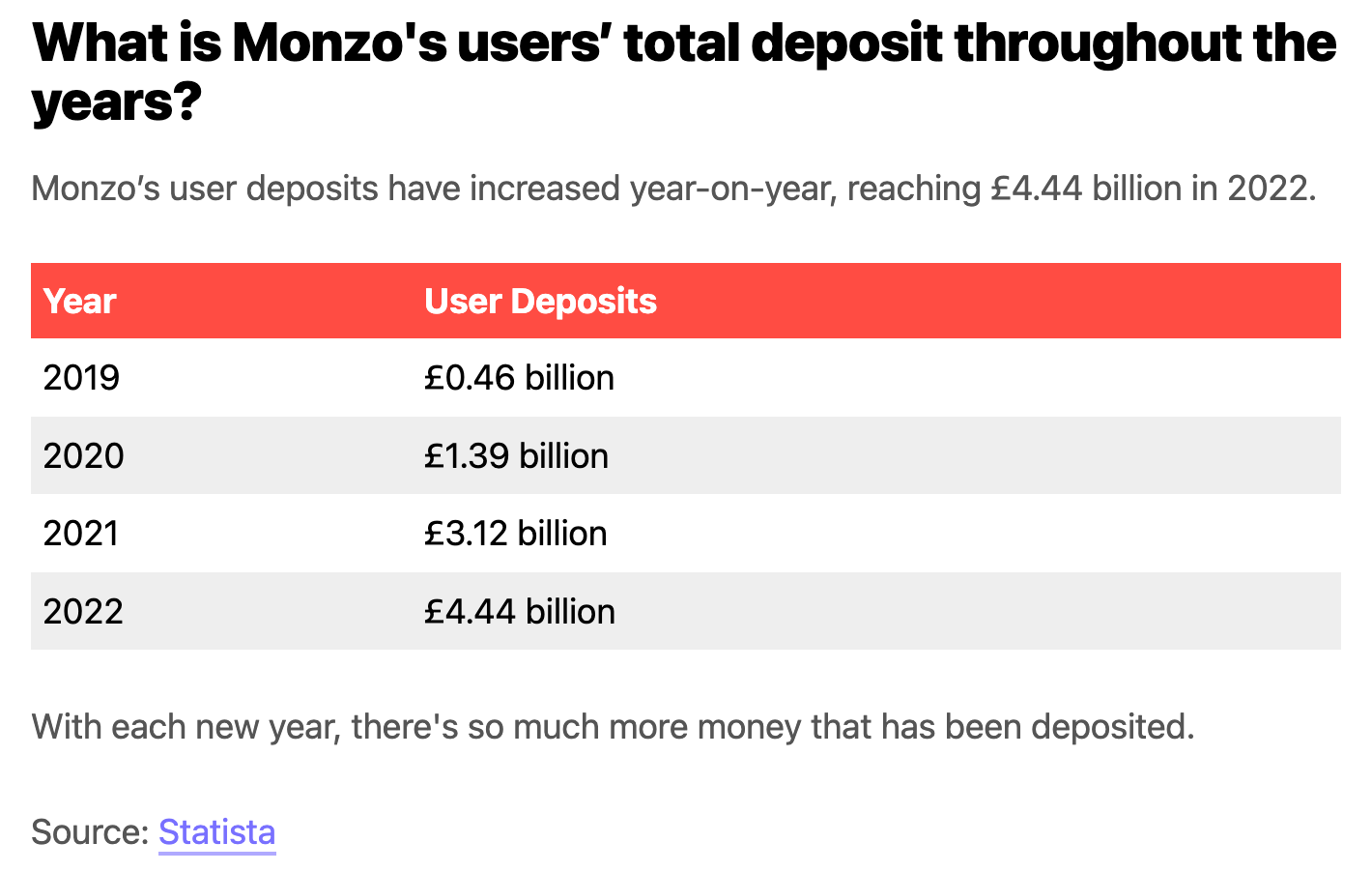

If I were Monzo, I’d better keep the current focus and double down on profitability. If they keep the current level of execution and grow their deposit base, they might soon not only further strengthen their positions as the leading neo(bank) in the UK but might also challenge the incumbents as well.

ICYMI: The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀