Apple Finance Empire rising: Apple Cash adds recurring payments 💳; Mastercard is getting aggressive w Open Banking 😎; Cash App Pay + Stripe, or how Cash App is growing beyond just a financial app 🚀

FinTech is Eating the World, 8 June

Hey Everyone,

Happy Friday! Today’s issue is undoubtedly the most important one this week so far 🤯We’re going to look at the rising Apple Finance Empire as Apple Cash adds recurring payments (why this is BIG + dive into how Apple is building JPMorgan 2.0), Mastercard which is getting aggressive with Open Banking (why it makes sense & why OB is crucial now), and Cash App Pay that just got integrated into Stripe (& how Cash App is growing beyond just a FinServ app + bonus dive into Cash App as PayPal 2.0). Let’s jump straight into the fascinating stuff 🌶

Apple Finance Empire is rising: Apple Cash adds recurring payments 💳

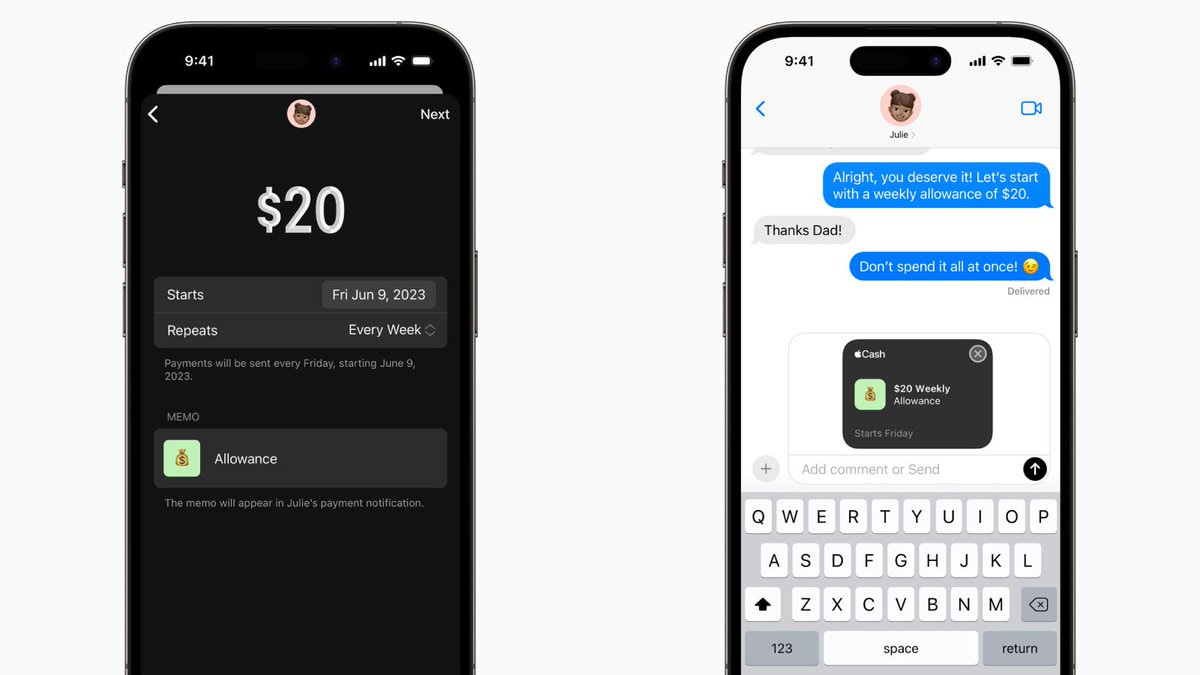

The launch 🚀 Tech titan Apple AAPL 0.00%↑ is adding support for recurring payments from its Apple Cash digital card.

More on this 👉 The feature, coming in the autumn with the arrival of iOS 17, means that Apple Cash users will be able to set up weekly, biweekly, or monthly payments.

Apple says this will make it easier, for example, for parents to pay allowances or for users to pay back friends and family for regularly shared expenses, such as rent payments.

Users can also choose to automatically top up their Apple Cash balance from their designated bank accounts when it runs low.

✈️ THE TAKEAWAY

Building Finance Empire 💸 Step by step Apple has been bringing new features to Apple Pay thus offering users more options for how to send money and facilitating growth. Recurring payments join its expanding financial services ecosystem, which now includes Apple Card, Apple Pay Later, and a high-yield savings account. These products are not only attracting new users but also tie customers to the company more closely, which could drive spending and revenues from services. More importantly, Apple’s fiercely loyal customer base includes many younger consumers, which should help sustain Apple Pay’s long-term growth as Gen Zers get more buying power. The tech giant can easily use the new feature to appeal to families and younger consumers by automating things like allowance payments. If this gets good adoption, Apple could seriously start challenging other payment platforms like Venmo or Cash App. Huge.

ICYMI: Apple Savings account is a massive hit 🤑

Apple is building JPMorgan 2.0 😳 [deeper dive + lots of bonus reads]