a16z goes international as it opens its first overseas office in the UK🇬🇧; Open Banking is gaining more and more traction 🚀; Banks are investing massively in AI 😳

FinTech is Eating the World, 12 June

Hey Everyone,

Good morning! We’re starting the new week on Tuesday but it’s super hot 😎 We’re looking at a16z going international and opening its first overseas office in the UK (why this is BIG + priceless resources for startup building), Open Banking that’s gaining more and more traction (it’s a major shift in the market + what card networks are doing to stay relevant), and banks which are investing massively in AI (what top players are doing + a deeper look into how gen AI will transform banking & FinTech forever). So let’s jump straight into the exciting stuff 🌶

a16z goes international as it opens its first overseas office in the UK🇬🇧

The launch 🚀 A16z Crypto, the Andreessen Horowitz venture capital fund dedicated to crypto and Web3 startups, has chosen the UK as its first overseas office outside the US, various sources reported.

This is a BIG move, so let’s take a look.

More on this 👉 The VC was attracted to the UK by its regulatory regime, which has embraced the crypto and Web3 economy in a bid to stamp out the 'casino culture' that has tarnished the industry.

In a blog post announcing the move, the firm said:

While there is still work to be done, we believe that the UK is on the right path to becoming a leader in crypto regulation. The UK also has deep pools of talent, world-leading academic institutions, and a strong entrepreneurial culture. It is home to more “unicorns” than Germany, France, and Sweden combined; to some of the world’s largest financial markets and pools of capital; and to highly sophisticated, world-class regulators. All of these make the UK strongly positioned to lead in web3.

The new office, set to open later this year, will be led by GP Sriram Krishnan, who along with a team, will work to grow the crypto and startup ecosystem in the UK and Europe.

✈️ THE TAKEAWAY

Why this matters? 🤔 First and foremost, a16z’s expansion to the UK is not about the capital - it’s a strong and timely signaling to US policymakers about crypto and how they are damaging the industry.

ICYMI: Regulating crypto industry gets aggressive: SEC sues Coinbase and Binance 😳

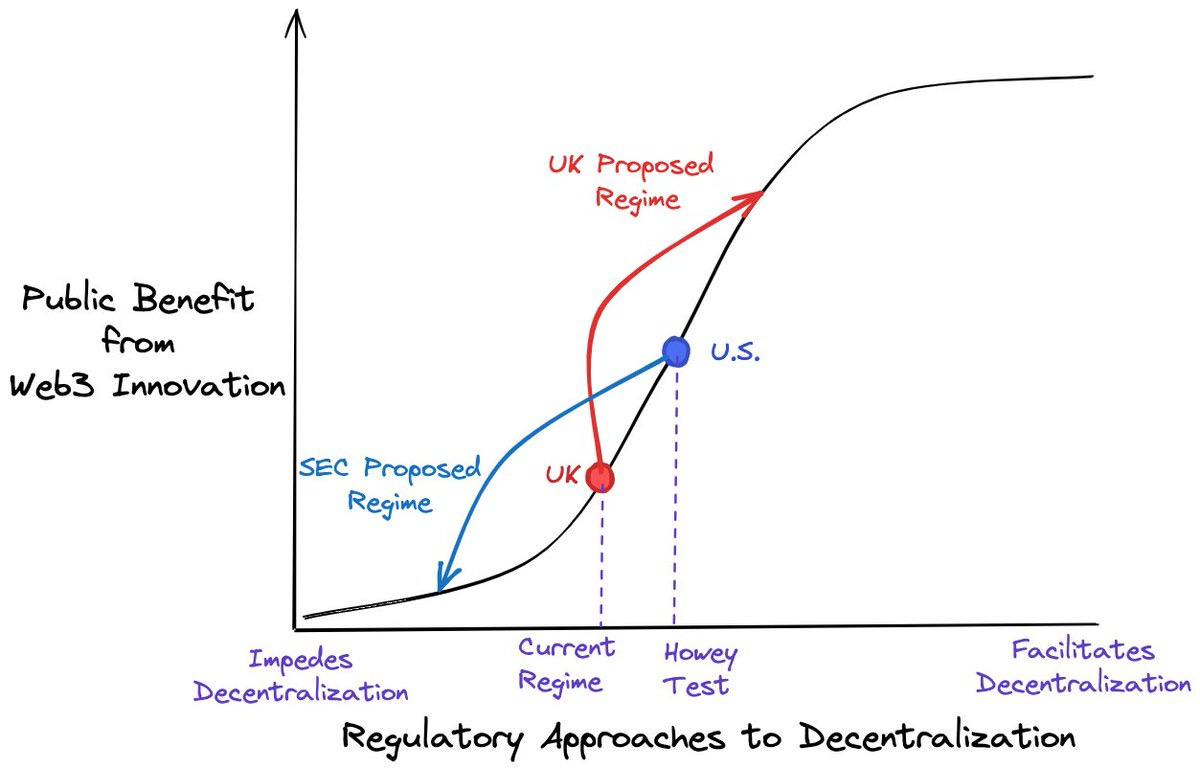

Secondly, it potentially indicates that the UK is doing something right and its quest to become a global web3 hub might not be too far-fetched. Even Prime Minister Rishi emphasized the country’s support for web3 and its aim to provide regulatory clarity for crypto businesses. And that’s crucial for everyone - from startups to VCs. Here’s a brilliant comparison of the SEC's proposed approach vs. the UK government's proposed approach to crypto (the winner is more than obvious):

Finally, there’s clearly a money moment too. Although the level of deal flow and access to LPs in the UK is nothing close to the US, but the fact that another top VC is coming to Europe definitely means that there will be more investments and more opportunities. Having Sequoia, Bessemer, Lightspeed, Leftlane, Thoma Bravo, Coatue, General Catalyst, and now Andreessen Horowitz opening UK offices in the last 3 years alone shows that the startup ecosystem in Europe is getting more vibrant. So again - it’s time to build! 🚀

To make it easier, you can start here:

You will also unlock a breakdown of the most powerful pitch deck framework and essential resources for building a startup in 2023 (a global investor database, how to raise money in a challenging market, etc.).