Apple Finance Empire strikes again: adds recurring payments 💳; Google’s killer new features to drive Wallet growth 🚀; Regulating crypto industry gets aggressive: SEC sues Coinbase & Binance 😳

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

3 templates to make startup life easier 🚀 [you will also unlock a breakdown of the most powerful pitch deck framework and essential resources for building a startup in 2023 (a global investor database, how to raise money in a challenging market, etc.).]

Cash App Pay + Stripe, or how Cash App is growing beyond just a financial app 🚀 [& how Cash App is growing beyond just a FinServ app + bonus dive into Cash App as PayPal 2.0]

Affirm gives another masterclass in partnerships as it strengthens ties with Amazon 👏

JPMorgan is building the largest payments ecosystem in the world 😳

As for today, here are the 3 intriguing FinTech stories that were changing the world of finance as we know it. This week was super intense in the financial technology space, so make sure to check all the above stories.

Apple Finance Empire strikes again: adds recurring payments 💳

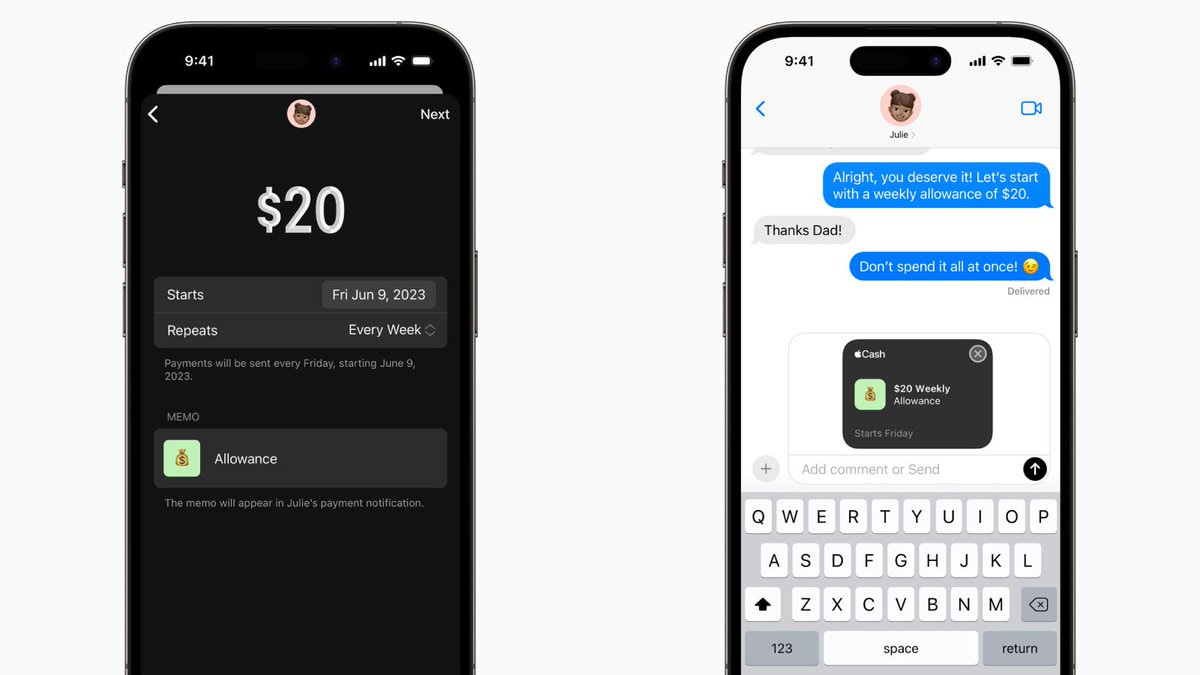

The launch 🚀 Tech titan Apple AAPL 0.36%↑ is adding support for recurring payments from its Apple Cash digital card.

More on this 👉 The feature, coming in the autumn with the arrival of iOS 17, means that Apple Cash users will be able to set up weekly, biweekly, or monthly payments.

Apple says this will make it easier, for example, for parents to pay allowances or for users to pay back friends and family for regularly shared expenses, such as rent payments.

Users can also choose to automatically top up their Apple Cash balance from their designated bank accounts when it runs low.

✈️ THE TAKEAWAY

Building Finance Empire 💸 Step by step Apple has been bringing new features to Apple Pay thus offering users more options for how to send money and facilitating growth. Recurring payments join its expanding financial services ecosystem, which now includes Apple Card, Apple Pay Later, and a high-yield savings account. These products are not only attracting new users but also tie customers to the company more closely, which could drive spending and revenues from services. More importantly, Apple’s fiercely loyal customer base includes many younger consumers, which should help sustain Apple Pay’s long-term growth as Gen Zers get more buying power. The tech giant can easily use the new feature to appeal to families and younger consumers by automating things like allowance payments. If this gets good adoption, Apple could seriously start challenging other payment platforms like Venmo or Cash App. Huge.

ICYMI: Apple Savings account is a massive hit 🤑

Apple is building JPMorgan 2.0 😳 [deeper dive + lots of bonus reads]

Google’s killer new features to drive Wallet user growth 🚀

The news 🗞 Tech titan Google GOOGL 0.82%↑ recently announced five new features for its Wallet, according to a company blog post.

These features aim to address consumer demands and resolve existing pain points in the digital wallet space. Let’s take a look.

More on this 👉 Here's what they are all about:

Passes from images: customers can now take a photo of any pass containing a barcode or QR code, such as gym memberships or transit tickets, and create a digital version in their Wallet.

Private document storage: Google enables customers to label cards as private, requiring additional verification for added security. The partnership with Humana and the UK's National Health Service (NHS) allows for the digitization of insurance information.

ID card storage: users in Maryland can save their ID cards and use them at TSA checkpoints, with support for IDs from Arizona, Colorado, and Georgia to follow.

Message integration: travel check-ins, dining reservations, and other notifications in messaging apps can be sent directly to Wallet, initially through partnerships with Vietnam Airlines, Renfe (Spain-based railway operator), and reservation service TagMe.

Corporate ID support: Google plans to add support for corporate IDs later this year.

The value add 💸 At the core, all these new features aim to consolidate payments and passes into one product, reducing fragmentation within the digital wallet ecosystem. And by digitizing more documents and offering convenient features, Google Wallet now becomes much more valuable and user-friendly.

✈️ THE TAKEAWAY

What’s next? 🤔 In short, this move should attract new users who may not have adopted Wallet for payments initially but could become proximity payment users, hence ultimately driving Google Pay's user growth. Besides, it enhances user engagement by providing reasons to return to Wallet regularly, forming habits that translate into increased spending. Finally, we can remember that store loyalty and payment consolidation, along with ease of use, are the most valued features in digital wallets, as per McKinsey. With that in mind, it should only boost Google Pay's growth that’s expected to increase by 8.5% this year, surpassing 33.8M users in the US alone and strengthening its position against competitors like Samsung Pay.

Regulating crypto industry gets aggressive: SEC sues Coinbase and Binance 😳

The news 🗞 The Securities and Exchange Commission (SEC) has taken an aggressive regulatory stance in the crypto industry by filing lawsuits against crypto giants Coinbase COIN -10.04%↓ and Binance.

More on this 👉 Recently, the SEC brought 13 charges against Binance, accusing them of operating unregistered exchanges, violating securities regulations, and mishandling customer funds.

These are pretty serious accusations.…

ICYMI: SEC sues Binance and CEO Changpeng Zhao 🤯

Following that, the SEC sued Coinbase for not registering its crypto trading platform and violating securities laws.

What does this mean? 🤔 With a lack of a clear regulatory framework in the US, the SEC is adopting a stronger enforcement approach to crack down on non-compliance.

By targeting two prominent crypto firms within such a short timeframe, the SEC aims to demonstrate its willingness to legally challenge companies that it believes are not adhering to regulations, irrespective of their size and impact.

Members of the crypto industry have rightly criticized the SEC for its heavy-handed approach and highlighted the regulatory gaps in the US.

✈️ THE TAKEAWAY

What’s next? 👀 The SEC's actions yet again convey its belief that cryptocurrencies should be treated as securities, and it is thus prepared to take legal action against firms that fail to do so. This means that crypto companies relying on the "ask forgiveness, not permission" approach may face significant repercussions (Coinbase and Binance won’t be the last ones). Zooming out, these lawsuits against prominent crypto companies could further erode consumer confidence in cryptocurrencies and distance them from mainstream finance. On top of that, financial incumbents like Goldman Sachs GS 1.29%↑ and JPMorgan JPM -0.11%↓, which have invested in crypto operations as well as have both indirect and direct exposure, may consider reevaluating their positions as cryptocurrencies increasingly operate on the fringes of financial services.

🔎 What else I’m watching

Another banking chatbot 🤖 Israeli digital bank One Zero is to introduce a generative AI chatbot capable of providing immediate replies to free-flowing customer queries. ONE ZERO Bank has initiated a pilot programme involving 450 customers, with plans to roll out the service to the general public in Q4 2023. One of the first genAI chat platforms for private banking, it will also give money management advice, says Gal Bar Dea, CEO of One Zero Bank. The new virtual assistant utilizes the LLM technology of AI21 Labs, co-founded by Prof. Amnon Shashua, Prof. Yoav Shoham, and Uri Goshen. Unlike conventional chatbots that can only answer specific questions, the generative AI chat machine can analyze customer requests (using free language), comprehend their intentions, and respond to both general and specific inquiries regarding their accounts. ICYMI: Game-changer: the world’s first banking-specific large language model 🤯

Hello Romania 🇷🇴 Sweden-based Buy Now, Pay Later provider Klarna has launched in Romania with its ‘Pay in 3’ service and shopping app. According to Klarna’s consumer research, 45% of Romanians prefer an interest-free, Buy Now, Pay Later service for their more expensive purchases, while 54% of Romanians using the internet think that new technology encourages improvement in the financial industry, through more transparent and fair services.

💸 Following the Money

Switzerland-based financial platform ElleXX has announced completing a CHF 1.43M investment round. ElleXX is an independent money media platform for women. ElleXX aims to change the structural financial inequality of women and empower them to be financially self-sufficient and invest. The company offers information on social and financial topics and focuses on equality and sustainability.

Payrails has raised $14.4M in a seed extension round led by EQT Ventures to scale its financial operations platform. General Catalyst, Andreessen Horowitz, and HV Capital joined the round for Berlin headquartered Payrails.

India-based cloud-lending company Lentra has secured $27M as part of its extended Series B round led by MUFG Bank and Dharana Capital.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: