LEAKED: Regulators saved Big VCs & Big Tech from billions of losses in uninsured SVB deposits 🤯; Are Europe’s top VCs still investing? 🤔; Is Google buying Stripe? 😳

FinTech is Eating the World, 23 June

Hey Everyone,

Happy Saturday! We’re finishing the week on Saturday but we’re doing this with a BANG! 💥 On today’s plate we have a leaked doc showing that regulators saved Big VCs & Big Tech from billions of losses after SVB’s collapse (why this matters + a bonus read about SVB’s collapse & lessons), the latest data on Europe’s top VCs (are they still investing + resources of how to fund your startup 10X easier), and question whether Google is buying Stripe (why it does or doesn’t make sense + some solid deep dives into Stripe). Let’s jump straight into the fascinating stuff 🌶

LEAKED: Regulators saved Big VCs & Big Tech from billions of losses in uninsured SVB deposits 🤯

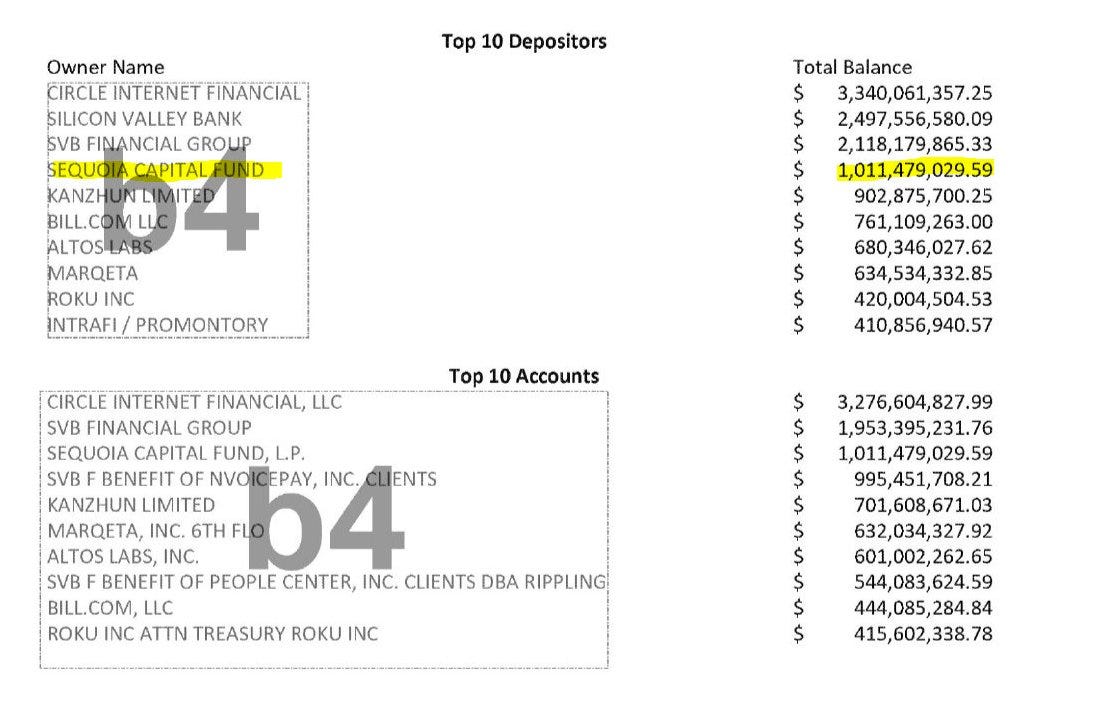

The HOT news🔥 The Federal Deposit Insurance Corporation (FDIC) accidentally posted an un-redacted document to Bloomberg showing that one of the most prominent VC firms Sequoia had $1 billion on deposit at Silicon Valley Bank when it collapsed 😳

This is a pretty wild revelation, so let’s take a closer look.

More on this 👉 We must remember that Silicon Valley Bank had 50% of US VC-backed startups as customers and when it went bust this was the biggest bank collapse in America since 2008.

By providing federal backing for Silicon Valley Bank's entire deposit base, regulators not only protected numerous small tech startups from potential devastation but also extended the safety net to larger companies that faced no immediate risk.

This move, which guaranteed accounts exceeding the $250,000 federal deposit insurance limit, benefited influential firms like Sequoia Capital, the renowned venture capital firm, which had $1 billion deposited with the bank.

The leaked document reveals not only venture capital giant Sequoia but other notable depositors that include:

Circle Internet Financial - listed as SVB’s biggest depositor with a balance of $3.3 billion.

Kanzhun - heavily backed by Chinese giant Tencent, the online recruitment firm had $902.9 million in deposits.

Bill.com BILL 0.00%↑ - the FinTech company had $761.1 million at the bank.

Altos Labs - a life sciences startup that works on cell regeneration, had $680.3 million in deposits with the bank.

Marqeta MQ 0.00%↑ - the payments startup had a total of $634.5 million at the bank.

✈️ THE TAKEAWAY

What does this mean? 🤔 First and foremost, this is yet another proof of how instrumental SVB was for startups and the whole tech ecosystem. With that in mind, the regulatory intervention not only safeguarded the stability of the sector but also ensured the security of significant financial assets held by prominent entities. On the other hand, it’s a bit concerning seeing such a Big Club here. Bailing out VCs and Big Tech with millions to billions of taxpayer money is rather intriguing….

Go deeper and learn more here: