Apple now runs one of the largest neobanks in the world 🤯; AI takes center stage in the Front Office to help marketers and customer service teams in financial services 🤖💸

FinTech is Eating the World, 3 August

Hey Everyone,

Happy Thursday! Today’s issue is incredibly hot as we’re looking at Apple which now runs one of the largest neobanks in the world (why it matters, what’s next + lots of bonus deep dives), and AI that takes center stage in the front office to help different teams in financial services (value-adding use cases + a bonus read on the key building blocks of AI Bank of the Future & lots of deep dives on AI + Finance). So let’s jump straight into the fascinating stuff 🌶

Apple now runs one of the largest neobanks in the world 🤯

The NEWS 🗞 Apple AAPL 0.00%↑ just announced that Apple Card's Savings Account has racked up more than $10 billion in deposits since launching in April.

That’s in less than 4 months 🤯

More on this 👉 We can remember that the long-trailed Apple Card savings account powered by Goldman Sachs GS 0.00%↑ was launched in mid-April with a headline-grabbing 4.15% annual percentage yield. That’s more than 10 times the national average, as per FDIC data.

All Daily Cash rewards earned through the Apple Card are automatically deposited into the savings account. Users can deposit additional funds through a linked bank account, or from their Apple Cash balance.

Apple now says that 97% of users have chosen to have their Daily Cash automatically deposited into their account.

The love affair might not last… 💔 Despite the impressive numbers, Goldman is currently seeking to exit its partnership with Apple as part of its retreat from the consumer market.

I recently did a deep dive into this, which you can access here (+ lots of bonus reads):

✈️ THE TAKEAWAY

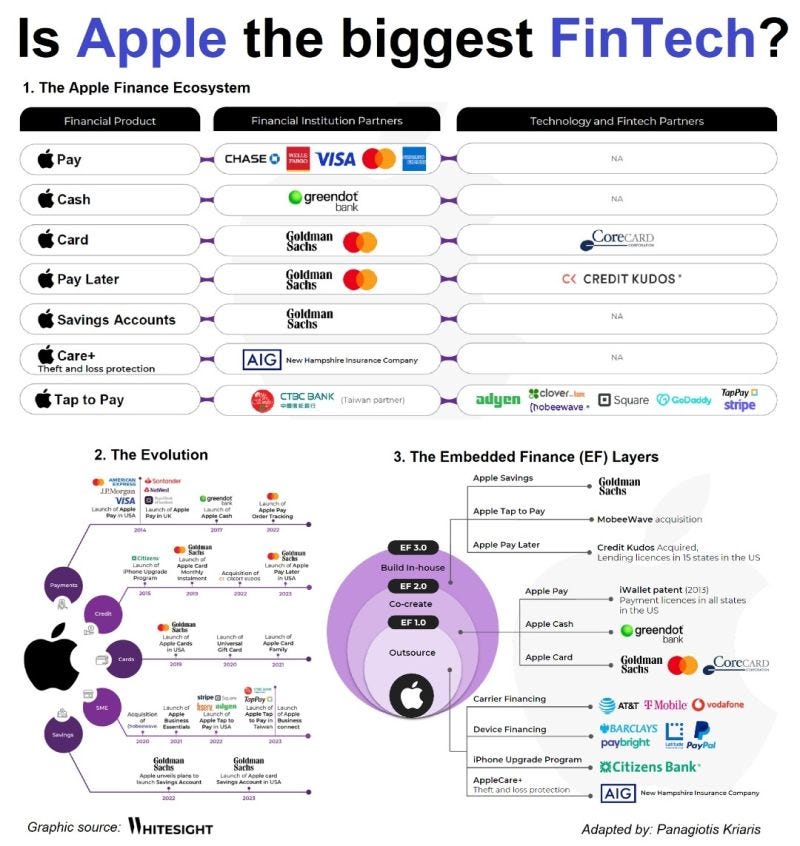

Tech is eating Wall Street 🍎 During the launch of Apple Savings I said that this product is going to be a hit simply because Apple’s convenience and brand trust is second to none. 4 months and $10 billion in deposits later, Apple is effectively running one of the biggest challenger banks in the world. To put this into perspective: Monzo holds around $6B in customer deposits, Starling has >$10B, while Nubank NU 0.00%↑ - the biggest challenger bank in the world - has amassed over $16B in customer deposits. The key difference here is that Apple is just getting started. Zooming out, this is yet another good illustration of how carefully Apple is executing its long-term vision - block by block the tech giant is building the Apple Finance empire that's going to disrupt the financial services space as we know it. In other words, Apple is building JPMorgan 2.0, and it’s one of the reasons why in his shareholder letter, the CEO of JPM 0.59%↑, Jamie Dimon called out Apple by name as one of their biggest competitors. Huge.

Worth reread: Apple might become the First Super App of the West 🍎 [+4 more reads]