The Finance Giants: Visa vs. Mastercard 💳; Coinbase becomes the first publicly traded company to launch its own decentralized blockchain 😳

FinTech is Eating the World, 10 August

Hey Everyone,

Happy Thursday! Today we’re looking at Visa & Mastercard (a quick breakdown + latest numbers + solid deep dives), and Coinbase which just pushed really hard into the world of Web3 (& why it’s a game-changer and a critical part of their "Master Plan" + a deeper dive into Coinbase). Let’s jump straight into the mind-blowing stuff 🌶

The Finance Giants: Visa vs. Mastercard 💳

Earnings called 📞 Visa V 0.00%↑ and Mastercard MA 0.00%↑ are two of the world's most significant and most impactful financial technology companies.

They recently reported their latest numbers, so let’s take a look at their revenue breakdown and some mind-blowing facts.

More on this 👉 Operating in hundreds of countries and territories around the globe, the FinTech giants are two of the most dominant and most recognized digital payments brands globally.

You may not know some banks, digital challengers, or FinTech startups but everyone knows Visa and Mastercard.

The companies provide a broad range of services, which include authorization, clearing and settlement for financial institutions and merchants, consulting & analytics, among other things.

The numbers 📊 Given Visa has already reported their third quarter, let’s compare Visa's Q2 FY23 performance with Mastercard's Q2 FY23 performance.

In terms of domestic volume growth, both Visa and Mastercard experienced healthy growth. Visa's credit grew by 10.5% year-over-year (YoY) in the U.S., slightly faster than the first quarter, while Mastercard's GDV (Gross Dollar Volume) increased by 6% in the U.S. with credit growth of 8%, and debit growth of 3%.

Outside of the U.S., both companies saw significant volume growth. Visa's volume increased by 16% globally, with credit growth of 14% and debit growth of 17%. Mastercard's cross-border volume increased by 24% globally for the quarter on a local currency basis, reflecting continued improvement in travel-related cross-border spending.

When comparing cross-border travel to 2019 levels, both Visa and Mastercard showed strength. Mastercard reported that cross-border travel reached 154% of 2019 levels in Q2, while Visa's cross-border travel was at 154% of 2019 levels as well.

In terms of revenue, Mastercard reported a 15% increase in net revenue, reflecting resilient consumer spending and the recovery of cross-border travel. Visa's new flows and value-added services businesses also powered ahead, with revenues growing at or about 20%.

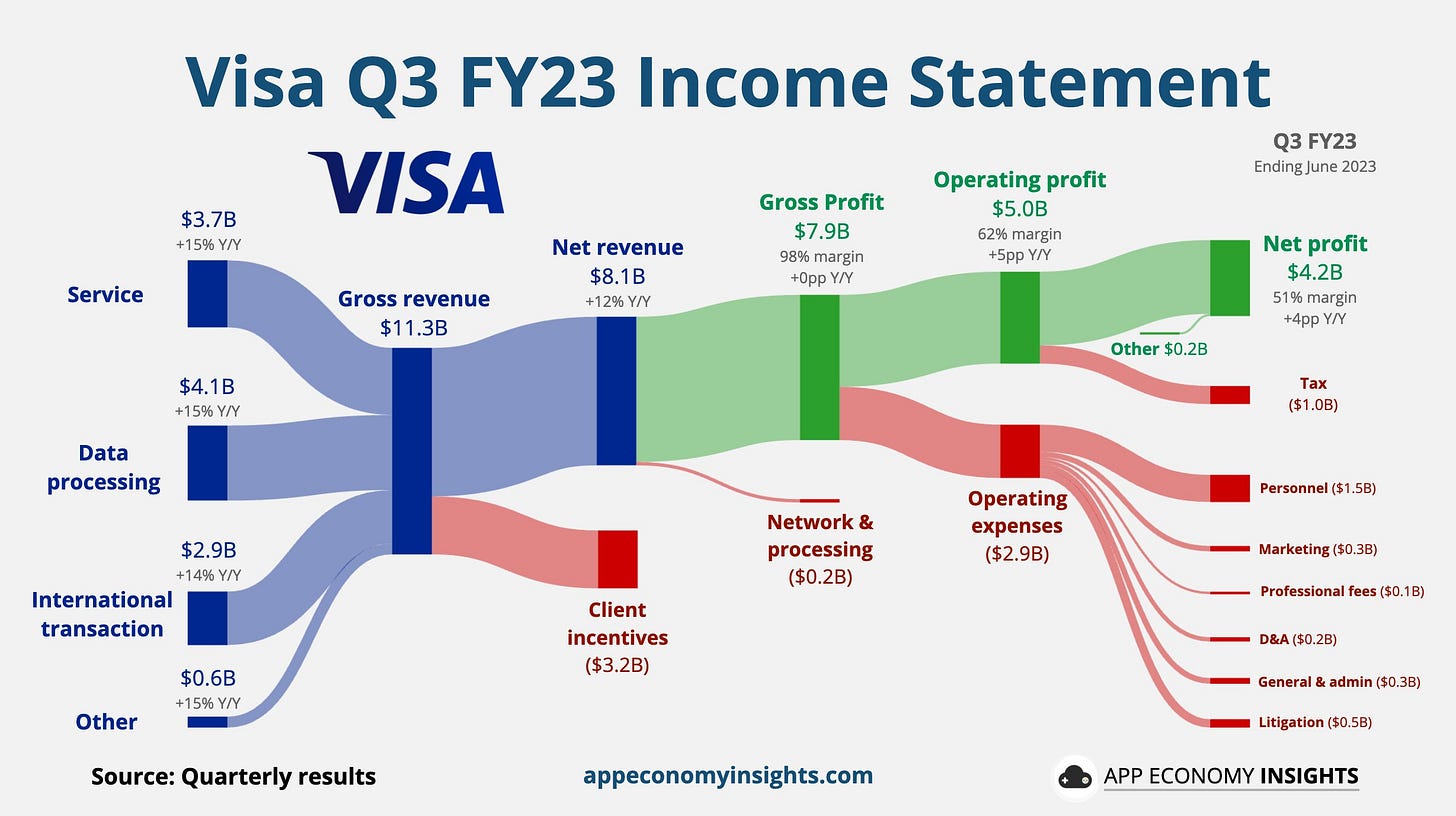

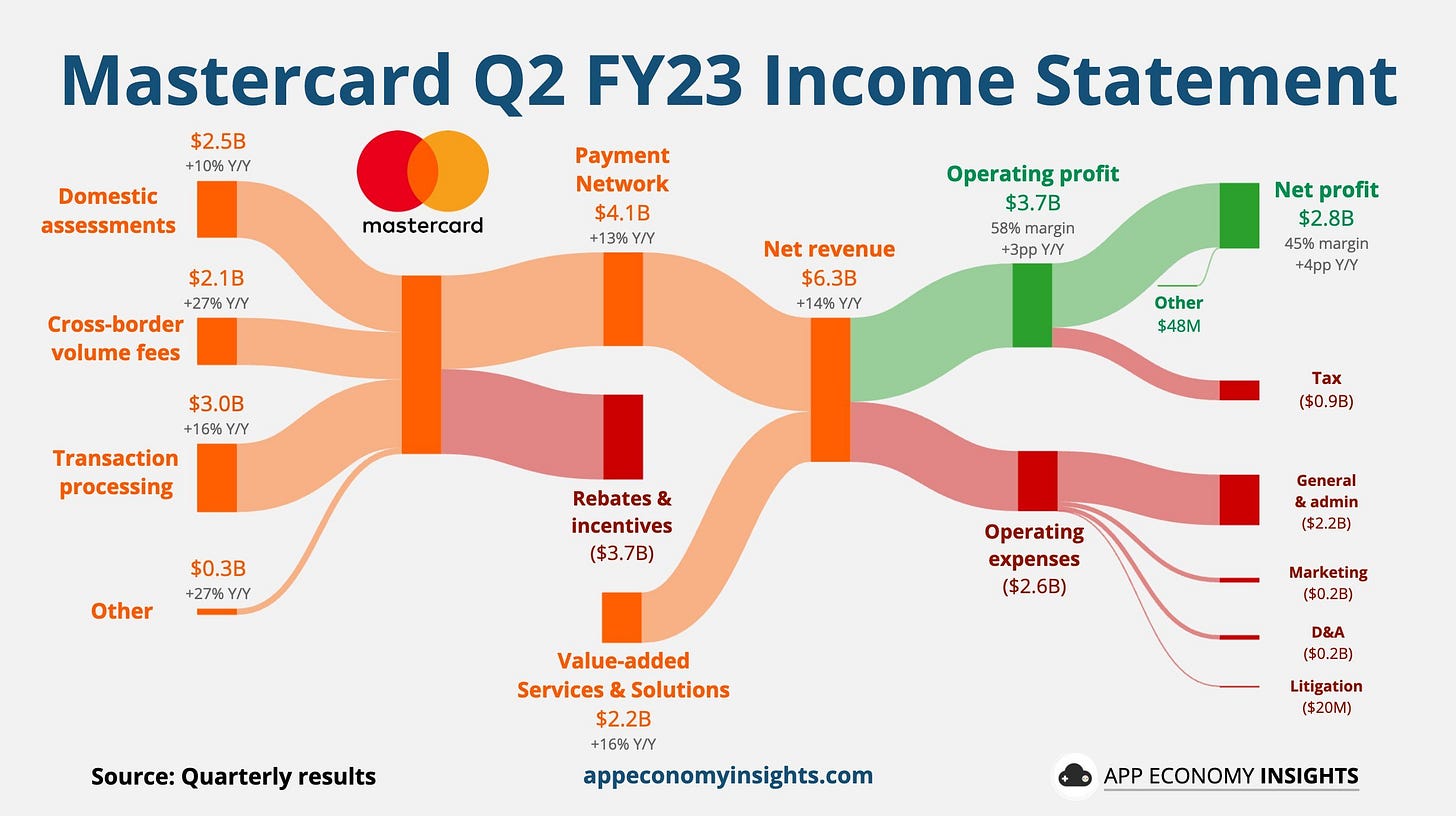

Below are some beautiful visual representations of their income statements:

Zoom out💡 What's fascinating is how well-diversified both companies' revenue is (just look above). And even with that, the finance behemoths aren't stopping and continue to expand their value-added services like:

Visa Direct & Mastercard Send

B2B Buy Now Pay Later (BNPL) solutions: Visa/Mastercard Installments

Are actively working with stablecoins and venturing into digital assets-related services, among other things.

✈️ THE TAKEAWAY

Looking ahead 👀 Overall, both Visa and Mastercard had positive performance in their latest quarters, with growth in domestic and international volumes. Their continued diversification and ventures into new verticals yet again show that they aren’t getting disrupted anytime soon (despite how much some industry experts keep on shouting). But here comes the crazy part. Both Visa & Mastercard are insanely profitable. They profit 62 cents and 58 cents respectively for every $1 in revenue. That’s everyone's dream 🤯 So is the data that they have and control. Given that ~40% of their revenue is coming from data processing, Visa & Mastercard is a living proof that data is indeed the new oil.

ICYMI: Visa is rapidly expanding beyond just cards 💳 [+ a deep dive into Visa & my investment thesis]

Mastercard just redefined digital account opening with open banking 👀 [& why open banking is now more important than ever]