Apple should launch a stock-trading feature in 2025 👀💸; Monzo is on track to be the most downloaded UK banking app in 2024 🇬🇧🚀; Strange: Square CEO to depart 🤔

FinTech is Eating the World, 21 September

Hey Everyone,

Happy Thursday! Today we’re going to look at Apple which should launch a stock-trading feature in 2025 (what it’s all about & why it makes sense + some solid deep dives), Monzo which is on track to be the most downloaded UK banking app in 2024 (this is more than deserved + a deeper dive into Monzo), and a strange departure of Square CEO (it raises more questions than answers). Let’s jump straight into the fascinating stuff 🌶

Apple should launch a stock-trading feature in 2025 👀💸

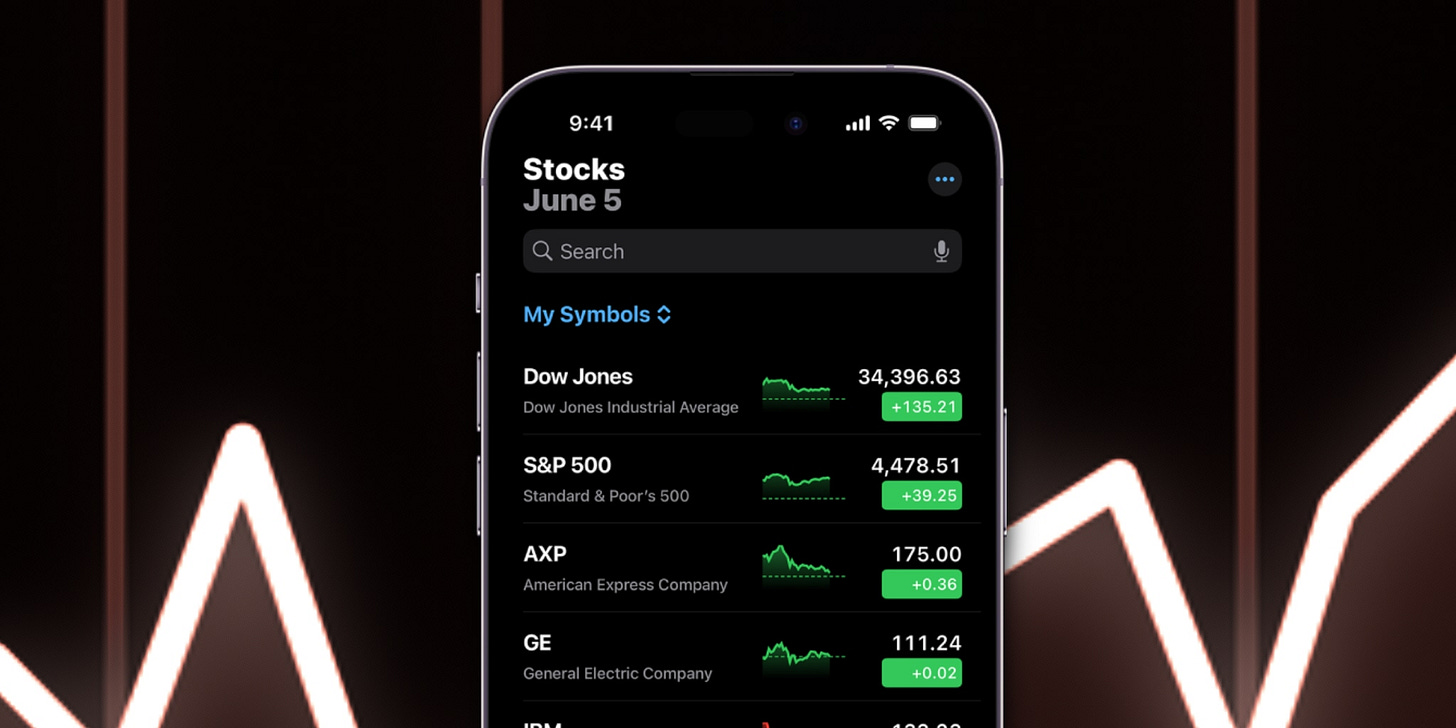

HOT news🔥 Apple AAPL 0.00%↑ was exploring the launch of an iPhone feature that would let users buy and sell stocks, according to three sources familiar with the plans, CNBC reported.

This is a potentially massive development that could completely redefine the FinTech market.

Let’s unpack it.

More on this 👉 As equities soared in 2020 and consumers flocked to trading apps like Robinhood HOOD 0.00%↑, Apple and Goldman Sachs GS 0.00%↑ were reportedly working on an investing feature that would let consumers buy and sell stocks directly within the iPhone interface.

The development effort began during that hype cycle in 2020, and the companies planned to launch the trading app in 2022 but decided to shelve the plans as the stock market declined in 2022 amid higher interest rates and inflation.

Apple feared a potential backlash from users losing money in the volatile market if they launched a trading app under current conditions.

Gold(ma)n Apple 🍎 The effort, which has been reported for the first time ever, would have added to Apple’s suite of financial products powered by Goldman.

We can remember that Apple first teamed up with the Wall Street giant to offer a credit card in 2019, and then added Buy Now, Pay Later (BNPL) loans and a high-yield savings account. Just recently, the Apple Savings account offering had climbed past $10 billion in user deposits making it one of the biggest challenger banks in the world…

ICYMI: Apple now runs one of the largest neobanks in the world 🤯

And it might not stop there as the trading app infrastructure is largely built and could potentially be launched in the future if conditions improve and Apple decides to move forward. Because it should.

✈️ THE TAKEAWAY

Not IF but WHEN 👀 I’d argue that Apple going into stock trading is only a matter of when not if. Sure, it would face stiff competition in the market from the likes of Robinhood, SoFi, or Square (Cash App). But the rewards easily outweigh the cost here as Apple is ultimately an ecosystem play while most of its to be competitors are basically standalone apps. Just think about it for a second. Apple has an enormous iPhone user base who could start trading stocks seamlessly through their devices (better UI and seamless UX alone would be good enough for switching & ditching their current apps). Or even better - imagine that every $1 you spend via Apple Pay is rounded up and invested into your favorite stock, ETF, or digital assets? Some FinTech companies are already doing that, but Apple’s size and scale would change the game entirely. As an effect, it would further expand Apple's financial services offerings beyond just payments, credit, loans (BNPL), and savings accounts. Given that investing apps are engagement drivers, this would also help retain users within the Apple Ecosystem and drive more revenue while at the same time putting Apple in a perfect position to disrupt traditional brokerages.

But why 2025, Linas? Well, Apple is known for its strategic and methodist approach when it comes to launching new products and services. That said, I believe they will sit quietly throughout 2024, and if markets are back in the green or at least trending towards that, Apple will make sure it rides on the next bull run.

Bonus: Apple should have bought Goldman Sachs’ PFM unit. Here’s why 🍎 [where’s the value at + lots of deeper dives]