OFFICIAL: Revolut soars to $45 billion valuation, making it the most valuable startup in Europe 😳🚀; Grab's Supersized Ambitions face profitability hurdle 👀📲

FinTech is Eating the World, 16 August

Hey Everyone,

TGIF! What a crazy week in FinTech it was… 😮💨 And it’s not yet over as today’s issue is all about Super Apps 😎 We’re looking into Revolut which just officially hit $45 billion valuation and became Europe’s most valuable startup (what happened, why it matters & what’s next + tons of bonus deep dives inside), and Grab whose supersized ambitions are facing profitability issues (breaking down their Q2 2024 numbers to see what they mean & why Grab might be worth your time and money in 2024.). So let’s just jump straight into the hot stuff 🌶️

OFFICIAL: Revolut soars to $45 billion valuation, making it the most valuable startup in Europe 😳🚀

The news 🗞️ British FinTech giant Revolut has secured a $45 billion valuation through a secondary share sale. This valuation marks a substantial increase from the company's previous $33 billion valuation in 2021, solidifying Revolut's position as Europe's most valuable private technology company.

Let’s take a closer look at this and see why it matters.

More on this 👉 The share sale, which provided liquidity for Revolut employees, was led by investors Coatue, D1 Capital Partners, and existing backer Tiger Global. The transaction allowed eligible employees who have been with the company for at least a year to sell up to 20% of their vested share options at $865.42 per share.

But that’s not it.

This valuation milestone comes on the heels of Revolut's recent acquisition of a UK banking license in July 2024, ending a prolonged three-year regulatory process.

The license enables Revolut to accept customer deposits and offer products such as loans and credit cards in its home market.

ICYMI: Paradigm shift: Revolut finally receives its long-awaited UK banking license paving the way for the new era 😳🏦 [what it’s all about & why it matters + a ton of bonus reads inside]

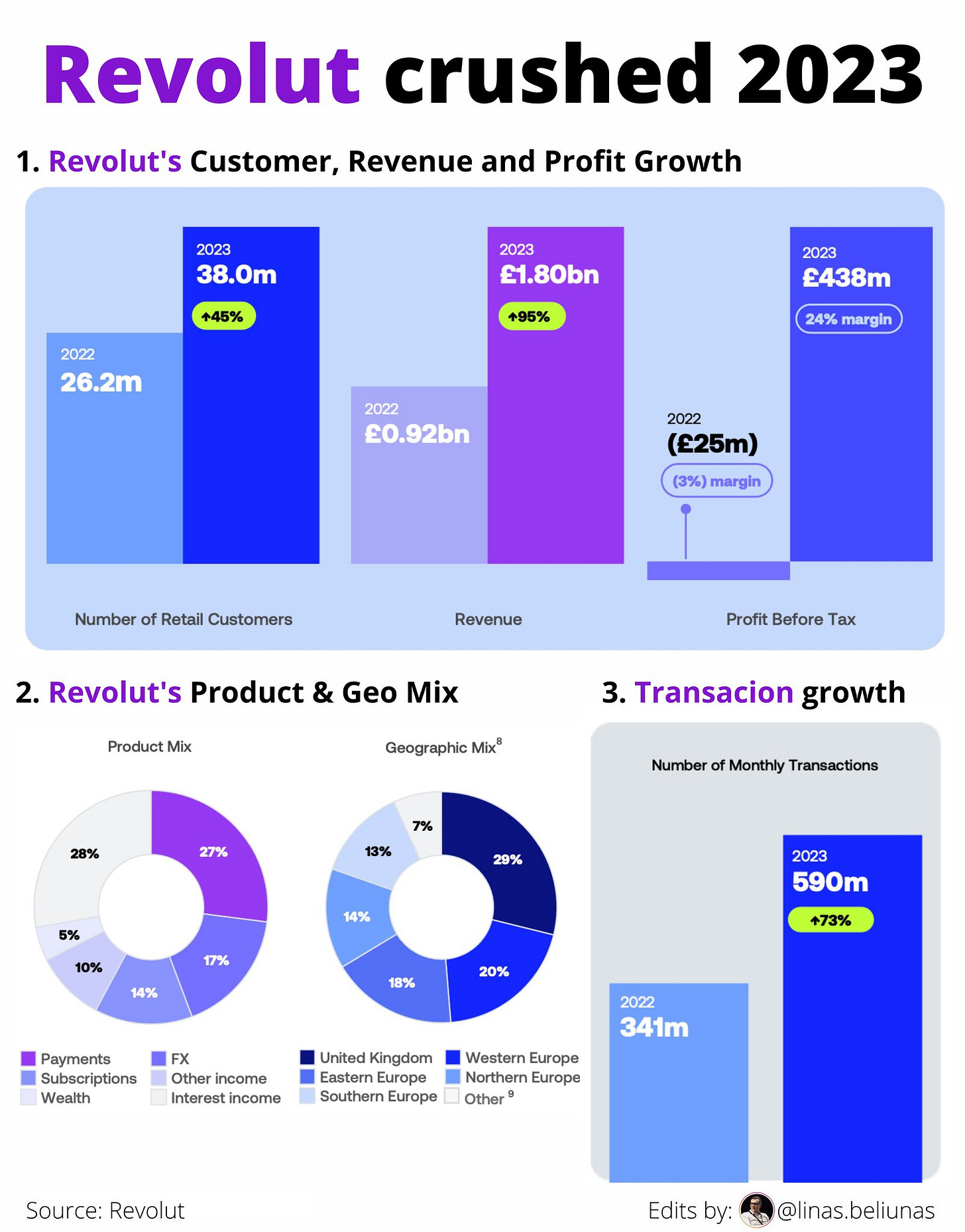

Zoom out 🔎 We can’t look at this in isolation. We must zoom out. And once we do, we remember that Revolut's financial performance has been impressive, with the company reporting pre-tax profits of £438 million in 2023, a significant turnaround from a £25 million loss the previous year.

Revenues nearly doubled to £1.8 billion, reflecting the company's strong growth trajectory.

ICYMI: Revolut’s 2023 financials: a FinTech rocket with astronomical growth, but regulatory asteroids loom 🚀☄️ [breaking down the key facts & figures, uncovering the most important numbers & what’s next for Revolut + bonus deep dives into Starling Bank, Monzo and JPMorgan]

What’s also interesting is that the $45 billion valuation positions Revolut as the UK's second-most valuable bank, surpassing traditional giants like Barclays, Lloyds Banking Group, and NatWest, and trailing only HSBC HSBC 0.00%↑.

ICYMI:

This yet again underscores the increasing influence of FinTech companies in the traditional banking sector.