Commandments for raising money in a challenging market 📉

8 key things every founder and startup CEO must know

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 170k+ FinTech leaders:

Amidst the challenges of inflation, increasing interest rates, geopolitical tensions, and economic downturn fears, the year 2022 served as a critical period for both public and private markets. Throughout the year, we witnessed significant shifts in market dynamics. The Nasdaq Composite, known for its heavy representation of tech companies, experienced a notable decline of 23%, surpassing the 14% decline of the broader S&P 500 index. Additionally, global venture funding reached its lowest point in thirteen quarters during Q1 of 2023.

ICYMI: OpenAI & Stripe kept the global VC funding alive in Q1 🥲

Venture capital funding in Europe falls to the lowest level on record 😳

These developments have had a profound impact on investor confidence. The failures of established institutions that traditionally supported the startup ecosystem, including Silicon Valley Bank, Signature Bank, and First Republic Bank, reverberated throughout capital markets and the wider financial services industry. Consequently, the current fundraising landscape is markedly different from anything we have seen in the past 15 years.

ICYMI: The rise and fall of Silicon Valley Bank 🏦

The second-largest US bank failure ever & the Microsoft of Banking 🤯

In this unfamiliar environment, founders are navigating uncharted territory. Concerns persist regarding the overall health of the fundraising environment, ranging from venture capital to growth equity. The uncertainty surrounding the funding climate has left many entrepreneurs seeking guidance and strategies to navigate these unprecedented challenges.

Precisely for that, Andreessen Horowitz (a16z), a leading VC firm globally, recently released their commandments for raising money in a challenging market. Here are the 8 key takeaways every founder and startup CEO must know:

1. Be flexible in raising capital

Ben Horowitz said:

If you are burning cash and running out of money, you are going to have to swallow your pride, face reality, and raise money even if it hurts.

Embracing flexibility increases your chances of success in challenging markets.

2. Avoid price expectation anchoring

When raising money in the current environment, founders should ignore prices and forget previous valuations. Instead, they should focus on securing low-valuation term sheets to build competitive tension and leveraging competition to obtain better terms. Remember - you just need one YES to get the ball rolling.

3. Optimize for size, not dilution

In recent years, founders have typically focused on minimizing dilution when raising capital. But in today's landscape, founders need to prioritize the round size instead. If you find yourself being offered more capital than initially planned, accepting the additional funding and getting a slightly higher dilution can be a wise decision. This approach provides a longer runway and avoids the need to raise funds again in a short period.

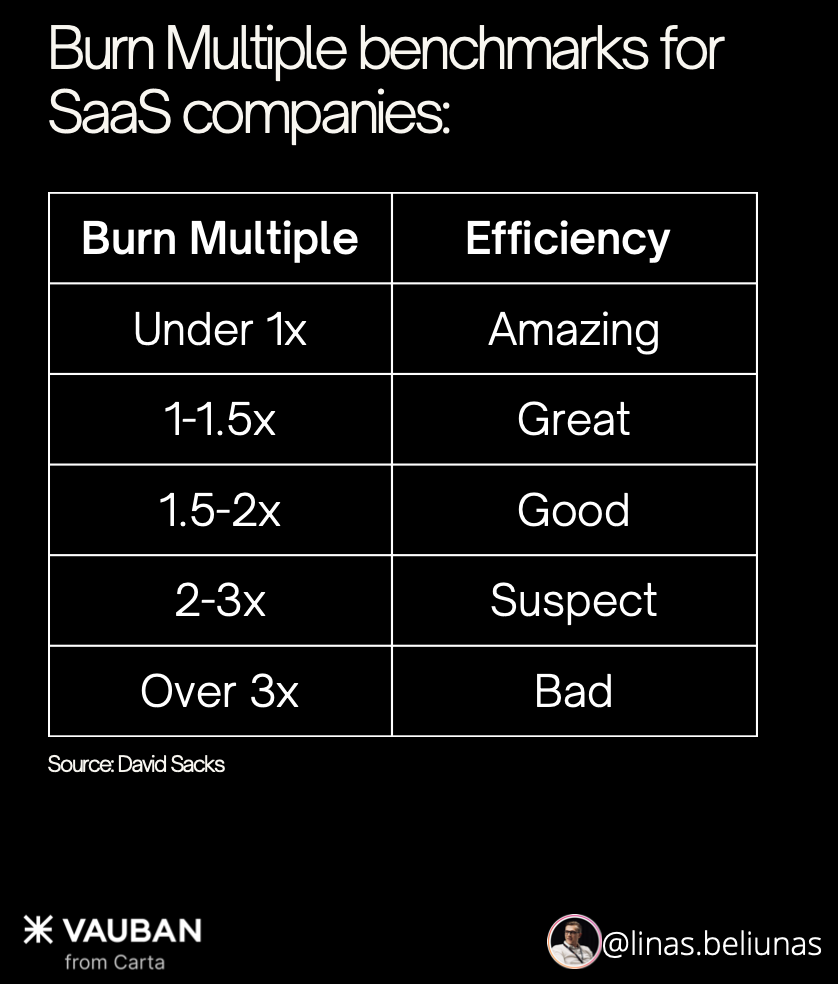

4. Stress-test your burn multiple

Your burn multiple tells you how much your business is burning to achieve each unit of growth. Burn multiple = cash burned / net ARR added. Stress-testing the burn multiple helps startups balance growth and cash burned.

5. Don't favor growth over profitability

In the current environment, profitability is more important than rapid growth. The Rule of 40 (revenue growth + profit margin ≥ 40%) is what you should be focusing on right now. Reassess unit economics and forget growth at all costs.

6. Be precise about the use of proceeds

Investors seek founders who can effectively overcome challenges. It's not sufficient to outline your future capital allocation - you must also prove that the expected outcomes will be worth the effort. Identify untapped acquisition channels that offer the greatest returns on marketing investment. Determine which customer segments to prioritize based on their economic viability at scale. Highlight the features you're focusing on to enhance customer retention. Show investors that you possess a deep understanding of your business and present a practical plan for utilizing funds to target high-return opportunities and reach specific goals.

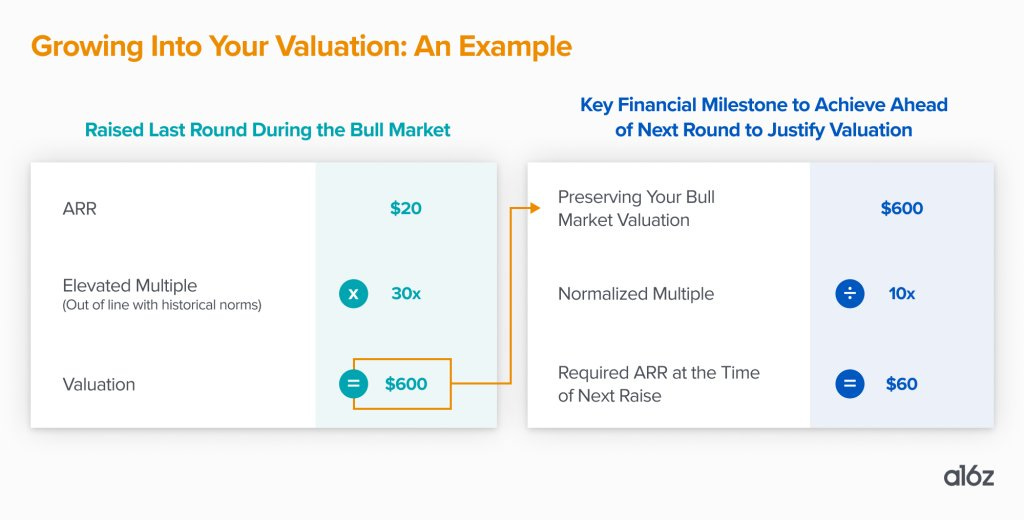

7. Grow into your valuation at normalized multiples

Startups should set near-term financial targets to grow into their valuations. If your company recently raised capital at a high valuation, it's important to adjust your strategy in light of the market correction. Set realistic short-term financial goals that allow you to grow into that valuation using standard multiples. Find a balance between proactive and defensive measures. Review your business plan and incorporate operational discipline. Evaluate how you can use the raised capital efficiently to achieve the necessary financial milestones before your next fundraising round.

8. Don't solely rely on structured up rounds

They may seem like a solution but they can cause long-term issues. Future investors may expect to receive the same rights in subsequent rounds. This will diminish returns to common equity holders, including founders and employees.

Obviously, the most critical thing above all is to build something truly valuable and solve real problems - that’s point 0. But I guess this is a no-brainer by now. 😉

To read all 16 commandments, check out the article from a16z here.

And to assist and inspire founders on their journey to success, check out this in case you missed it:

And to make your life even easier, here’s a global 6,000+ investor database to make your fundraising efforts smooth like a breeze:

It also contains a breakdown of two brilliant pitch decks (these companies are category-leading brands now) and a few more resources to triple your chances of getting your startup funded in 2023.

Now go building! 🚀

If you found this useful, share it with others and spread the word: