BREAKING: Silicon Valley Bank. Silvergate 2.0? 🤯; Coinbase moves into the asset management business 😳; Wix + Stripe = 🚀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Revolut revenue drama 🎭 [red flags, things that don’t add up & why it’s a big deal]

Generative AI will completely transform FinTech and Banking over the next 3 years 🤖🏦

BREAKING: Silvergate is shutting down operations & liquidating its bank 🤯🏦 [why it matters for the crypto industry as such + a deeper dive into Silvergate]

Coinbase’s Wallet-as-a-Service (WaaS) is a game-changer for crypto adoption 🤯

Investors are devaluing Revolut and Varo as confidence in neobanks weakens 😳

As for today, here are the 3 FinTech stories that were changing the world of finance as we know it. It was definitely the most game-changing week in 2023 so far, so make sure to check all the above stories.

BREAKING: Silicon Valley Bank. Silvergate 2.0? 🤯

Another one… 😳 Yesterday we had Silvergate, today it’s Silicon Valley Bank (SVB) that’s fighting for survival. Investors dumped shares of SVB SIVB 0.00%↑ and a swath of U.S. banks after the tech-focused lender said it lost nearly $2 billion selling assets following a larger-than-expected decline in deposits.

This is worrisome and could be bigger than Silvergate, so let’s unpack the story.

More on this 👉 Founded in 1983, SVB is on the list of largest banks in the United States, and is the biggest bank in Silicon Valley based on local deposits.

How we got here? 🤔 Here’s a step-by-step breakdown:

SVB is a leading provider of banking and financial services to the technology and life sciences sectors, which are major areas of focus for many VC firms. Those companies raised lots of money from VC in a low-interest-rate environment.

The bank had parked $91 billion of its deposits into long-dated securities such as US Treasuries, which are considered safe but have decreased in value since SVB purchased them because of rising rates. To be more precise, the company's $21 billion bond portfolio had a yield of 1.79% and a duration of 3.6 years. Compare that to today’s 3-year Treasury yield of 4.71%. Ups 😬

As rates went up, the tech market corrected and VC funding (which is a major source of deposits for SVB) dried up.

As the Fed increased rates, the value of the lower-rate bond holdings of SVB went down.

Thus, SVB sold $21.8B of those securities at a $1.8B loss in a bid to reposition the portfolio to maximize yield. To put this into perspective, that’s more than the net income of the entire company in 2021 ($1.5 billion). SVB is now raising capital to cover those losses.

The worst part is that it also has $91B of bonds labeled "held to maturity". The problem here is that, because of accounting rules, SVB does not have to recognize paper losses on those bonds. And this is exactly why the markets are shaking about the extent of those losses and whether SVB can cover their deposits:

If that wouldn’t be enough, most of the board members, investors, founders, etc. started advising everyone to remove all the funds from SVB. If that happens, it would cause a bank run, making everything very ugly very quickly.

Why is this important? 🤔 The collapse of Silvergate was already bad. But this could be much worse. Here’s more on this + the takeaway:

Systemic risk? 🤔 The biggest worry in this whole situation is that SVB isn’t the only bank facing this situation. It might be the first one to proactively attempt to fix the problem, but the market expects more pain in the banking sector. As covered yesterday, Silvergate already announced it was closing down.

Reread: BREAKING: Silvergate is shutting down operations & liquidating its bank 🤯🏦

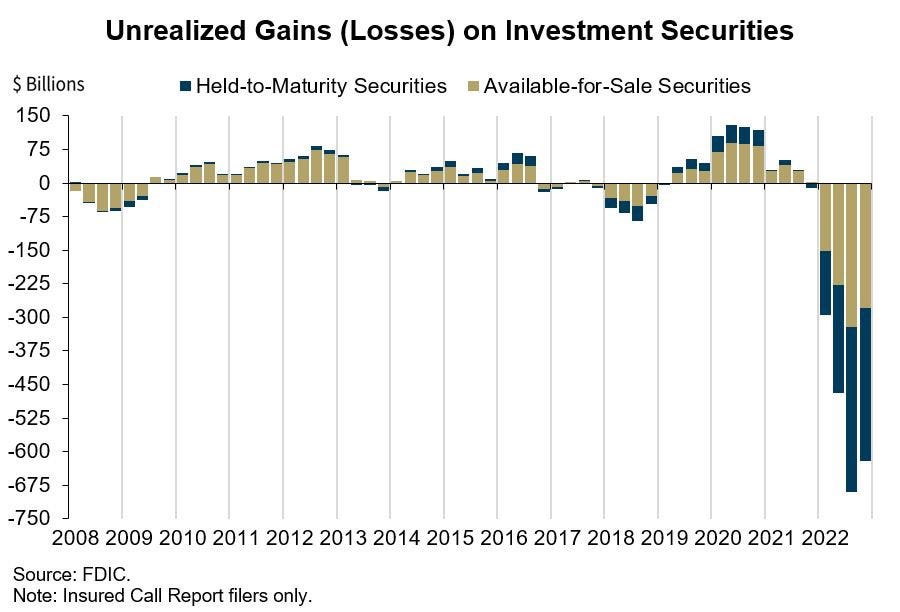

To put this into perspective, the US banking industry has $620 billion of unrealized losses on securities holdings due to rising interest rates, according to the Federal Deposit Insurance Corporation. That’s why the decline of SVB's share prices led to contagion among other financial stocks, with the four biggest US banks, JPMorgan, Citigroup, Wells Fargo, and Bank of America, losing $47 billion of market value in Thursday trading. Furthermore, the KBW Nasdaq Bank Index notched its biggest decline since the pandemic roiled the markets nearly 3 years ago.

Here’s some food for thought on the matter:

Zooming out 🔎 The current contagion is another consequence of the Federal Reserve’s aggressive campaign to control inflation. Rising interest rates have caused the value of existing bonds with lower payouts to fall in value. Banks own a lot of those bonds, including Treasurys, and are now sitting on giant unrealized losses.

Large declines in value aren’t necessarily a problem for banks unless they are forced to sell the assets to cover deposit withdrawals. Most banks aren’t doing so (especially the big guys like JPM, Bank of America, etc.), even though their customers are starting to move their deposits into higher-yielding alternatives. Yet a few banks have run into trouble this week (with SVB being the frontrunner), sparking fears that other banks could be forced to take losses to raise cash.

✈️ THE TAKEAWAY

Looking ahead 👀 The entire startup ecosystem is overly concentrated. When FTX collapsed, it was felt by the entire ecosystem. The real impact of Silvegate’s liquidation this week is yet to be felt. But SVB’s collapse and/or bank run will be worse. VC firms depend on banks like SVB to provide them with financial services, including debt financing. If SVB fails, VC firms could face a shortage of funding and liquidity, which would limit their ability to invest in new companies or support their existing portfolio companies. This could also lead to a loss of confidence in the VC industry, making it more difficult for VC firms to attract new investors and for startups to secure funding. Additionally, the failure of SVB could cause other banks and financial institutions to become more cautious about lending to the technology and life sciences sectors, further limiting the funding available to VC firms. Zooming out, this is the first sign there might be some kind of crack in the financial system. People seem to be waking up to the gravity that this was one of the biggest financial euphoria episodes.

Note: I will write a separate piece on all things SVB tomorrow, so stay tuned!

Coinbase moves into the asset management business 😳

The deal 🤝 Crypto exchange giant Coinbase COIN 0.00%↑ bought One River Digital Asset Management, an institutional digital-asset manager, as it looks to expand beyond its core business catering to retail customers, as per CoinDesk.

More on this 👉 One River Digital, a U.S. Securities and Exchange Commission-registered subsidiary of One River Asset Management, will become Coinbase Asset Management and will "form the foundation" of Coinbase's investment advisory service for institutional clients, the exchange said in a blog post on Friday. The terms of the deal weren't disclosed.

The USP 🥊 One River Digital was founded back in 2013, and Coinbase backed the startup in its Series A fundraising round alongside Goldman Sachs. The FinTech broke cover in 2020 when it emerged that the company was eyeing a $1 billion allocation to bitcoin with the backing of billionaire hedge fund manager Alan Howard.

Also, the startup teamed up with Coinbase at the start of last year to offer a platform that would allow wealth managers to provide crypto exposure to their clients.

✈️ THE TAKEAWAY

Why it’s important? 🤔 At the core, this M&A is all about scaling Coinbase’s institutional investor offerings with products that will help traditional finance embrace crypto. We all know that the crypto exchange business model is heavily reliant on retail trading. Coinbase knows that and hence it has been trying to diversify its revenue streams for quite some time now. The latest acquisition of One River Digital perfectly illustrates that and it’s a move that positions Coinbase towards institutional investors over retail in addition to providing sticker recurring revenue (i.e. Coinbase One, Management Fees, etc.). That’s definitely bullish.

Looking ahead, it might be only a matter of time until Coinbase puts this on-chain and incorporates One River Digital more deeply into its ecosystem (say - on Base). And that could be the ultimate cherry on top of Coinbase’s Master Plan 🍒

Reread: Base is a massive step for Coinbase into the world of Web3, and a critical part of their "Master Plan" 😳

Wix + Stripe = 🚀

The deal 🤝 Global SaaS platform Wix WIX 0.00%↑ has announced a partnership with payments heavyweight Stripe to bring Tap to Pay on iPhone to its US-based merchants.

More on this 👉 Following this collaboration, Wix merchants are enabled to accept contactless payments directly from their iPhones in a secure manner, without being required any additional hardware.

By leveraging Wix Owner App together with a compatible iPhone, their merchants now have the option of accepting and processing contactless payments through Wix with only an iPhone from either contactless credit or debit cards, Apple Pay, and other digital wallets.

✈️ THE TAKEAWAY

Looking ahead 👀 This partnership is the ultimate win for both companies. For Wix, the deal with Stripe enables their merchants to sell anytime, anywhere, on-the-go or in-store, with no additional hardware required. More importantly, this new payment solution supports Wix's mission to continuously evolve its platform, providing businesses with enterprise-grade performance, security, and marketing tools, with an ultimate push to be the leading player of all things commerce. When it comes to Stripe, this partnership falls in line with their recent strategy to double down on Tap to Pay product. It’s a promising development that can help the company maintain its growth trajectory and expand its merchant base. More, below👇

Reread: Stripe expands its reach with Tap to Pay for Android 🌍

🔎 What else I’m watching

Klarna is your Buddy 😉 Buddy, a budgeting app for young people, has partnered with Klarna Kosma, a financial technology platform, to offer users a better way to track expenses and gain control over their finances. With over 3M users, Buddy seeks to provide a simple way to build and share budgets, track expenses, and understand overall financial health. The app has reportedly become the most popular of its kind in countries such as Australia, Canada, Denmark, France, the Netherlands, Sweden, and others, and the second most popular in the US, according to the official press release. Through this partnership, Buddy users can connect their bank accounts to the app to automatically track expenses, monitor spending, and set up payment reminders. Klarna Kosma provides Buddy with secure access to 15,000 banks in 27 countries around the world through a single API, allowing users to track expenses and gain valuable insights into spending habits. This serves as a brilliant reminder that Klarna is NOT a BNPL company. Reread: Klarna just lost $1 billion. But it's not bad! 🤑

Nubank + Polygon 💜 Brazil-based FinTech giant Nubank NU 0.00%↑ has partnered with Polygon to expand the reach of its Nucoin loyalty programme to around 70M customers. Back in October 2022, the two companies announced the Nucoin token and launched a pilot run involving around 2000 users. Nucoin was designed to recognize customer loyalty and encourage engagement with Nubank products, and by expanding the programme, the token could reach as many as 70 million customers across Brazil. As part of the programme, customers will reportedly have the option to freeze or even exchange their Nucoins for cash or other benefits in the future. It’s worth noting that the way Nucoin transactions will operate within the Nubank app will share some similarities to buying and selling cryptocurrencies. More on this here: Brazil's FinTech giant Nubank to launch its own cryptocurrency. A game-changer or just a marketing gimmick? 😳

Getting embedded 👀 Papaya Global has launched an embedded payments platform designed for payroll and other worker-related expenditures. The new Papaya Global Payroll Payments automates all processes, reduces mistakes and enables payments to employees both locally and around the world, the company said in a press release. “We’re giving organizations with global workforces a true borderless solution for getting team members their payments quickly and accurately,” Papaya Co-founder and CEO Eynat Guez said in the release. “No more manual processes, no more late or inaccurate payments, no fees reaching the employees.” Yet another proof that Embedded Finance will explode in 2023 🚀

💸 Following the Money

StudentFinance, a Spain-based FinTech that offers financing options for career upskilling courses, has secured $41M (including $8.2M in debt) from the likes of Seedcamp and Monzo founder Tom Blomfield.

Abound, a UK-based fintech that uses a combination of open banking and artificial intelligence to offer better loan deals to consumers has raised £500M in a mixture of debt and equity finance.

Weavr, the London-based startup that allows businesses to embed banking and payments into their mobile app or SaaS platforms, has acquired the B2B Open Banking platform, Comma Payments. The terms of the deal were not disclosed.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: