Tesla & Bitcoin found each other and are not holding back (credit: cryptoslate)

Elon Musk is making crypto headlines. Again. This time though the markets, the headlines, and the whole world moved a Bit after Tesla revealed it has invested $1.5 billion into Bitcoin, the most popular and valuable cryptocurrency right now.

Tesla also said that it might start accepting cryptocurrency as payment for its cars. Crypto maximalists were shouting out loud while Bitcoin surged as much as 20% following the announcement.

One must note that Tesla is not the first company to get in on Bitcoin, but its move is one of the biggest thus far, and might probably be one of the most important ones too.

P.S. Before we go forward, make yourself a favor and subscribe to this newsletter if you haven’t done so yet (I’m talking about Premium here!👀). You will get at least 2 newsletters every week, 2 monthly digests on FinTech, and Blockchain & Cryptocurrency, and more!

SEC Filing

The most valuable automaker said Monday in an annual report filed with the U.S. Securities and Exchange Commission that it has put an aggregate $1.5 billion into Bitcoin under a new investment policy and that the company may have plans for other digital assets in the future:

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.

It must be noted that Tesla is not the first company to get into Bitcoin. Last year alone, MicroStrategy poured $1 billion+ into Bitcoin, MassMutual has invested $100 million, and Square has bought $50 million worth of BTC for its corporate portfolio.

Yet, Tesla’s purchase is one of the biggest single corporate buys ever. Here’s a table with some of the biggest Bitcoin holders:

Note: this isn’t the full list. You can find the full list here.

It was Inevitable

If you are following the space closely, this move shouldn’t have surprised you too much. Elon Musk has been quite a crypto cheerleader lately, pumping the prices of both DOGE (especially) & BTC.

He recently even admitted that he should have bought [bitcoin] eight years ago and said that he thinks bitcoin is a good thing.

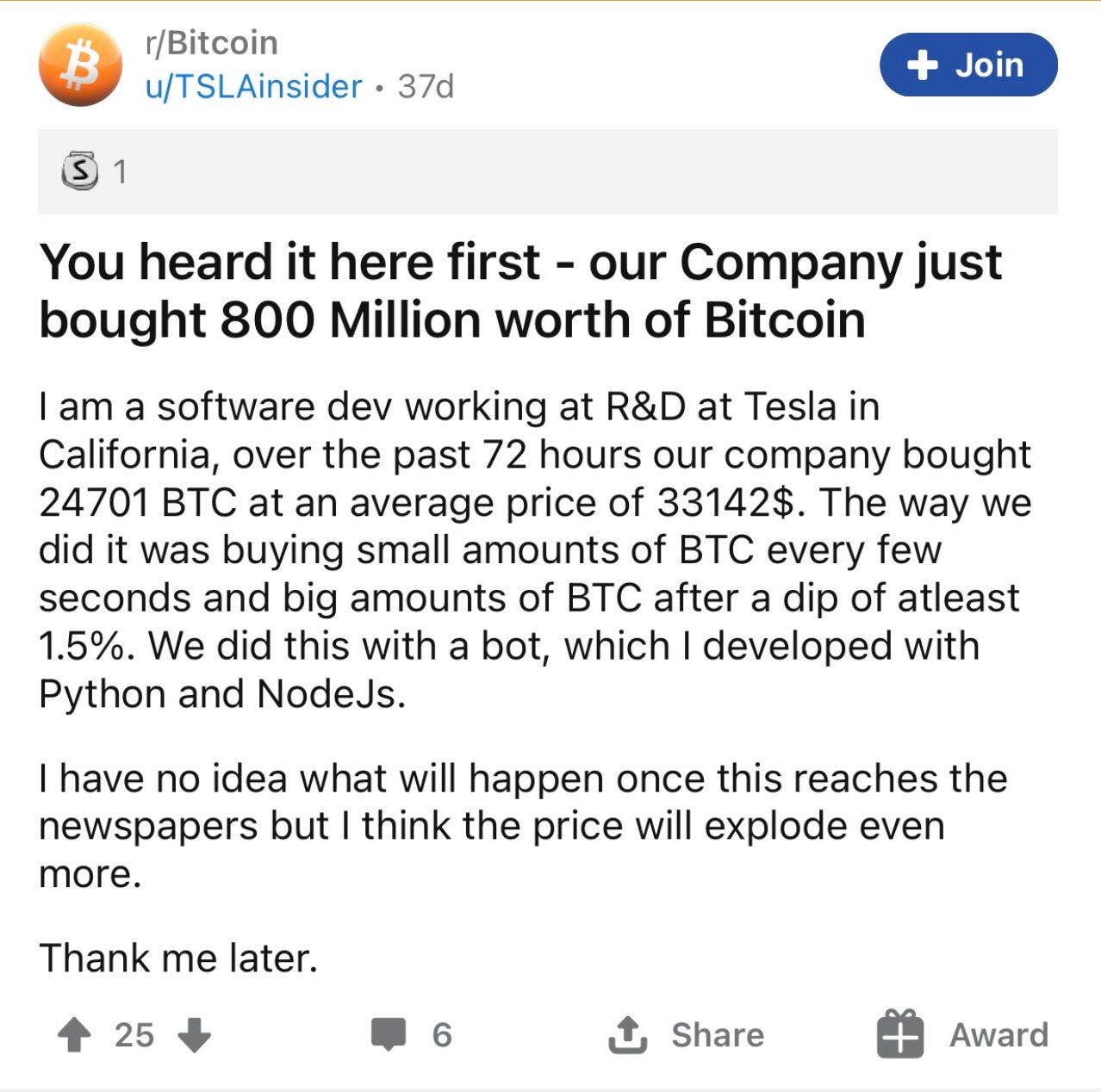

Bonus: Tesla actually bought Bitcoin more than a month ago, at an average price of $33,000+, according to a Reddit post2:

Will Holding Bitcoin in Treasury Become a Corporate Standard?

Tesla has bought almost 10% of its $19 billion cash holding 😲. Not 1%, but 10%. This looks like a very bullish sign... But why?

According to their SEC filing, it was done to diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. In simple words, it means that they have some extra cash, and they think it’s a good investment.

We might look at it as a good investment from 2 points.

First, diversification. Cash can be printed endlessly (as we’re seeing right now with an unprecedented period of a loose monetary policy during the coronavirus pandemic) while Bitcoin is capped at 21 million. Hence, if the US dollar loses too much value and prices rise, Bitcoin can act as a hedge (this is also known as the digital gold narrative).

Second, return maximization. Bitcoin is up by more than 16% in the last 30 days (primarily driven by continuing bull rally and institutional buying), and Tesla wants to capitalize on that. Also, it thinks that it’s worthwhile and more valuable than other investments or just holding cash.

Can Bitcoin become a corporate treasury standard? It’s definitely too early to say but Tesla’s move is a strong vote of confidence towards that direction.

What’s Next?

After Tesla announcing the purchase, Bitcoin saw a new record in the single-day move, rising by over $8,000 to as much as $46,000 per coin. It continued crossing new highs above $48,000 early today, while at the point of writing it’s changing hands at close to $47,000 per BTC.

Tesla is the first Fortune 500 company to diversify cash holdings into the cryptocurrency, hence, it can be viewed as a strong vote of confidence and a potential signaling effect for other companies to do the same. If that happens, the long-held narrative that Bitcoin acts as a reserve asset will finally be validated, further fueling the positive feedback loop.

Remember, money is nothing more than a belief system. If people collectively believe something has value, it becomes valuable.

On the other hand, if Bitcoin crashes and Tesla loses on its investment, the opposite effect might come into play. This becomes even more interesting given the fact that Tesla has a $1.4 billion bond maturing in March 2021. If you had the interest payable at maturity, that's around $1.5 billion to pay.

Let us see what happens in March when Tesla needs to part with $1.5 billion.

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at a global payments startup where I'm leading the company's expansion into Europe, I'm an active member of the FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment on what you think, and share the article with others. Let's spread the knowledge together!

For more, you can check me on LinkedIn & Twitter where I’m sharing my thoughts and insights daily!🔥🚀