Top FinTech stories of 2024, a year when AI took over 🤖

"You can't connect the dots looking forward. You can only connect them looking backward" - Steve Jobs

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 310k+ FinTech leaders:

The financial technology industry is in a perpetual state of evolution, significantly altering how we interact with banks, manage our finances, consume, spend money, and conduct business.

2024 has emerged as a pivotal year, particularly marked by the widespread integration and advancement of artificial intelligence (AI) and AI-powered innovations. This year has not just been about technological advancements but about how these technologies are fundamentally reshaping the landscape of financial services.

Today, more than any previous time, we can assert that it's not just FinTech transforming the world; rather, the world's needs and changes are driving the evolution of FinTech.

Was it for the better or worse? I invite you to read this reflection of mine and connect the dots yourself.

Below are the top FinTech stories of 2024, the moments that define the whole year.

Looking back at the highlights and lowlights of the world of finance and technology provides you with lots of lessons and food for thought.

This year, I learned a lot. I hope you did (or will do - after reading this) too.

#1 Everything’s better (& more expensive!) with AI 🤖📈

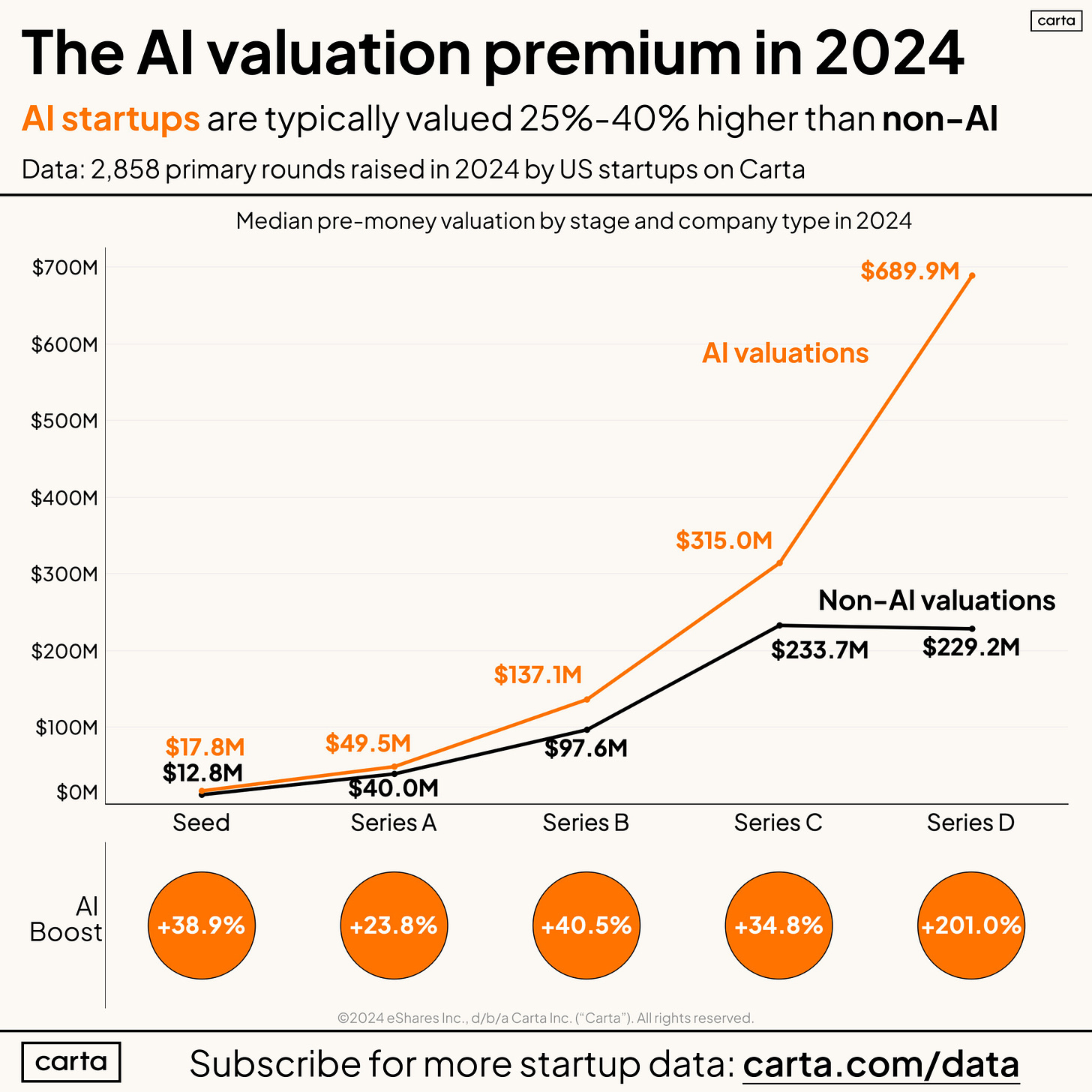

Are we living in an AI bubble? Well, in 2024, AI startups were valued up to 200% higher than their non-AI counterparts 😳

According to the latest data from Carta, AI gives a solid boost across all funding rounds:

- Seed: +39% (median pre-money valuation)

- Series A: +24%

- Series B: +40%

- Series C: +35%

- Series D: +201% 🤯

It's obvious that in 2025, every startup will be pitched as an “AI startup.”

Even if it's just an advanced IF function in Excel 🫧🤖

P.S. on a serious note, go deeper & uncover the startups that are doing the real stuff in AI:

#2 Neobanks are great again with Nubank, Revolut & Monzo shining the brightest 📲🚀

2024 was a year when FinTech came back. I mean really back. From Nubank NU 0.00%↑ hitting record after record to Revolut finally getting a banking license in the UK & becoming the most valuable startup in Europe or Monzo & N26 shining brighter and brighter. Go deeper to learn why it’s important and what’s next for them:

NU invests in Tyme signalling push into Africa & Asia 😳💰 [what it’s all about & why it makes sense + bonus deep dive into NU & its biggest competitor]

Mercado Libre and Nubank Battle is Reshaping Latin American Banking 🥊🏦 [holistic recap of what’s happening, why it matters & what’s next + bonus deep dives into the latest financials of NU & MercadoLibre and why you should be super bullish on both of them]

Revolut hits 50M users milestone, secures UK trading license in major growth push 🚀🏦 [what it’s all about, why it matters & what’s next for Revolut + a deep dive into its biggest global competitor]

Paradigm shift: Revolut finally receives its long-awaited UK banking license paving the way for the new era 😳🏦 [what it’s all about & why it matters + a ton of bonus reads inside]

Monzo's valuation soars to $5.9 billion in employee share sale 🤑🦄 [what this tells us & why it matters + bonus deep dives into Monzo & co inside]

German digital challenger bank N26 achieves first-ever profitable quarter 🥳🇩🇪

#3 Klarna & JPMorgan became leaders in AI adoption in finance 💸🤖

When it comes to artificial intelligence adoption in financial services, this year there are two clear winners - Klarna and JPMorgan JPM 0.00%↑. The Swedish tech giant is the only FinTech company that has managed to both get back up after a massive hit and ride successfully on the AI wave. It went from Buy Now, Pay Later FinTech to an AI-powered global payments network and shopping assistant, which also happens to be the most AI-first organization globally. Meanwhile, banking giant JPMorgan has established an unprecedented concentration of AI talent, employing more AI researchers than its next seven largest competitors combined, while simultaneously rolling out practical AI applications across its operations. Go deeper and learn how these giants are leveraging AI here:

Klarna says it stopped hiring thanks to AI 😳🤖 [what’s the real story here & what can we learn from Klarna + bonus list of top AI companies & their pitch decks]

Klarna's return to profitability sets stage for landmark US IPO 💸🇺🇸 [quick look at their latest numbers, what they mean & what’s next + bonus dive into Klarna’s biggest public competitor & why we should start thinking more about M&As]

JPMorgan maintains AI dominance in banking sector 💪🤖 [a quick overview of the current state of affairs when it comes to AI in Banking]

JPMorgan expands small-town presence, bucking branch closure trend 🏠👋 [what it’s all about and why it matters + a bonus deep dive into JPM & how it’s crushing it in AI + Finance]

#4 The year of stables 🪙📈

2024 was the year of stables, which yet again signals a broader transformation in the financial sector. The surge in stablecoin adoption & usage clearly suggests a growing acceptance of digital assets as legitimate financial instruments. Go deeper and learn why stables matter, where’s the biggest potential and what’s next here:

The Rise of Stablecoins: Market Cap Hits $200B as DeFi Yields Drive Adoption 📈🪙 [key drivers pushing this, why it matters & what’s next + some bonus reads on crypto & stables inside]

Stripe brings back crypto payments with USDC stablecoin 😳 [what it’s all about & why it matters + more bonus reads on Stripe & why we might not see them IPOing anytime soon]

#5 If you’re in FinTech, you’re in Media too 📱📺

Robinhood HOOD 0.00%↑, JPMorgan, Revolut, and Paypal PYPL 0.00%↑ - all of them have ventured into the media & ads business last year. Why? Because in the end, everyone and everything will become an ad platform. Go deeper and learn more here:

Another one - PayPal enters the ad business 😲 [what it’s all about & why it makes sense + a bonus deep dive into PayPal & why you should be bullish]

JPMorgan launches Ad Platform & enters the media business 🎬 [why their ad platform is brilliant, their Super App ambitions + a deep dive into JPM & how FinTechs are media companies too]

“You either die a FinTech or live long enough to see yourself selling ads” - Revolut 📢💸 [a closer look at why selling ads makes so much sense + lots of bonus reads and deeper dives into Revolut & Apple]

#6 FinServ incumbents are getting into embedded finance game 🌐🏦

The embedded finance trend is clearly growing, and it has been reshaping traditional banking relationships. As businesses increasingly seek to integrate financial services into their core offerings, in 2024 we saw three major traditional finance firms venture into this space - HSBC HSBC 0.00%↑, Green Dot GDOT 0.00%↑, and Worldline. Go deeper, learn what it’s all about & what’s next here:

HSBC launches Embedded Finance venture 😳💳 [what it’s all about & why it’s a great move + a bonus deep dive into HSBC & why the future of finance is embedded]

Another one: Green Dot launches Embedded Finance brand 😳💵 [what Green Dot’s Arc is all about & why it matters + more bonus reads on embedded finance and its importance]

Another one: Worldline dives into Embedded Finance as well 👀💳 [what it’s all about, why it matters & what’s next + a deep dive into Worldline’s latest financials]

#7 Crypto became even more mainstream 🪙📈

In addition to stables leading the front, 2024 was a very good year for crypto. The SEC approved the first spot Bitcoin ETFs in January 2024, BTC hit the $100,000 milestone, more traditional financial services firms ventured into crypto and blockchain space while the last cherry on top was Donald Trump's election victory that led to a pro-crypto administration. Go deeper and learn more about what all of this matters and what’s next here:

BlackRock's assets soar to a record $10.5 trillion. Thanks to Bitcoin 😳

Deutsche Bank's Layer 2 blockchain initiative signals a major transformation in traditional finance ⛓️🏦 [what it tells us, why it matters & what’s next + bonus reads into the latest crypto industry trends & numbers]

#8 Capital One acquired Discover for $35 billion 🤯🤑

In 2024, we didn’t have lots of mergers and acquisitions in the space. But one deal did stand out. In late February, Capital One COF 0.00%↑ announced it is officially acquiring Discover Financial DFS 0.00%↑ for a whopping $35.3 billion, in what ended up being the biggest FinTech & Finance M&A in 2024. Go deeper and learn why it matters & what’s next here:

DONE DEAL: Capital One to acquire Discover for $35 billion 🤯🤑

Capital One-Discover merger's legal challenge 🤕

#9 FinTech IPO activity started to accelerate 🔔📈

While this year didn’t have a single notable FinTech IPO, 2025 should be much better. We already have Klarna, eToro, and Chime that are planning to go public next year. Go deeper and learn more here:

Chime takes major step toward 2025 IPO with confidential SEC filing 📑🔔 [quick recap of Chime’s biz model and latest numbers, why it matters & what’s next for FinTech + bonus read with some IPO resources inside]

#10 Payment card duopoly got under fire 😳💳

2024 was a challenging year for payment giants Visa V 0.00%↑ and Mastercard MA 0.00%↑ in terms of regulatory scrutiny and legal battles. In March, the finance giants agreed to cap credit card swipe fees, which was one of the largest settlements of its kind. In September, the U.S. Department of Justice filed a civil antitrust lawsuit against Visa, alleging monopolization of debit card markets, which was driving up costs for businesses and consumers. There was also a class action lawsuit regarding interchange fees where merchants were entitled to a share of a $5.5 billion settlement. Go deeper and learn more here:

Visa and Mastercard reach $30 billion settlement in swipe fee battle, but it’s far from over 😤 [what it’s all about, what will change & why it’s not over yet + some deeper dives into both Visa & MC]

Card Giants under fire: Visa & Mastercard face £4B lawsuit over "illegal" fees 😳💳 [what it’s all about, why it matters & what’s next + a bonus deep dive in both Visa & Mastercard]

Visa is acquiring Featurespace to bolster AI-driven fraud prevention 🤖💸 [why it matters & what’s next + bonus deep dives into both Visa & Mastercard]

Mastercard's $2.65 billion bet on Cybersecurity: acquiring Recorded Future 💸🛡️ [why snapping Recorded Future for $2.65B is a great move & what it tells us about the future + bonus dives in both Visa & Mastercard]

Bonus:

Elon Musk wants X to replace your bank account within a year 😳 [uncovering current struggles & where the BIG potential is + some deep dives into the Everything App]

The Billion-Dollar (FinTech) Marketer: lessons from Ryan Reynolds💡 [how everything he touches turns gold + a deeper dive into Reynolds-backed Nuvei that just got acquired]

And that’s a wrap. 2024 was a wild year in FinTech. Let’s see what madness 2025 will bring 🥂

If you found this useful, first - go Premium:

P.S. don’t tell anyone but join the leading FinTech community today and save 20% on your subscriptions. Prices are going up in January for all new subscribers.

Then - share it with others and spread the word:

Love it! Glad to see Nubank and Revolut making waves and cannot wait for Chime & Klarna IPOs. To the great 20205 🚀