Klarnageddon begins as Klarna will lose 85% of its valuation with the fresh funding 🤯; More crypto mess: Voyager’s bankruptcy and the big revelation of FTX’s involvement🚨; Revolut + Stripe = 🌍🚀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The verticalisation of challenger banks and why personalisation is the future of banking ❤️🏦

Booming creator economy and (huge) opportunities for FinTechs 🚀

eToro's SPAC deal falls through signaling challenges in the retail trading space 🚩

and more!

As for today, here are the 3 FinTech stories that were making a difference this week. It was a super hot week!

Klarnageddon begins as Klarna will lose 85% of its valuation with the fresh funding 🤯

The (super sad) news 📰 Swedish Buy Now, Pay Later darling Klarna is closing in on a funding round that would see the BNPL giant's valuation slashed from $45.6 billion last year to just $6.5 billion, according to the Wall Street Journal. That’s an 85% correction! 😮

More on this 👉 Klarna is reportedly working to raise about $650M, most of it from existing investors led by Sequoia Capital, as per WSJ. Just two weeks ago, I’ve written about Klarna’s attempt to raise a $15B price tag, which clearly didn’t materialize.

This graph below aged so fast it’s mindblowing… 😬

Everything becomes even crazier when you realize that back in February, Klarna was rumored to be weighing a raise at a valuation of up to $60 billion. I’m not making this up!

This clearly marks the beginning of Klarnageddon. It won’t be pretty, and it will spread beyond just Klarna and BNPL providers. Here’s the takeaway:

✈️ THE TAKEAWAY

Klarnageddon 2.0 (2022)🍿First and foremost, we must repeat again that Klarna struggling to raise fresh capital is the ultimate highlight of the current crisis of the Buy Now, Pay Later business model. The same BNPL that helped Klarna to become Europe’s largest privately held company is now turning its back on the Swedish giant in one of the biggest valuation collapses the private markets have ever seen. What's worrying here is that it might not be the last one… Furthermore, it’s obvious that despite a down round is a hundred times better than not raising money at all and inevitably dying, a much much bigger problem here is Klarna’s future. BNPL transitioning to being a feature-only should make everyone think as to whether Klarna can be a sustainable business (so as other BNPL players) at all. Maybe Klarna needs to pivot to B2B BNPL (which is still booming despite current market sentiment)? I don’t know, but what’s clear is that once BNPL giant needs to go back to the drawing board and seriously review its business model and market strategy. Zooming out, we must stress that Klarna is only one chapter of the Klarnageddon movie we’re going to see in 2022. It most definitely will spread out touching all startups with inflated valuations and weak fundamentals. Valuations will crash, there might be bankruptcies, M&As, layoffs, etc. It won’t be pretty but it’s probably inevitable.

More crypto mess: Voyager’s bankruptcy and the big revelation of FTX’s involvement🚨

The news 🗞 Crypto lender Voyager Digital has recently filed for Chapter 11 bankruptcy protection, becoming the second high-profile crypto firm to do so in recent days. It is estimated Voyager had more than 100,000 creditors and up to $10B in assets. Not too shabby!

More on this 👉 Voyager’s loan book reportedly accounted for nearly half of its total assets, and nearly 60% of that loan book was composed of loans to wobbling hedge fund Three Arrows (3AC). Voyager also faces a possible delisting from the Toronto Stock Exchange as a result of the bankruptcy.

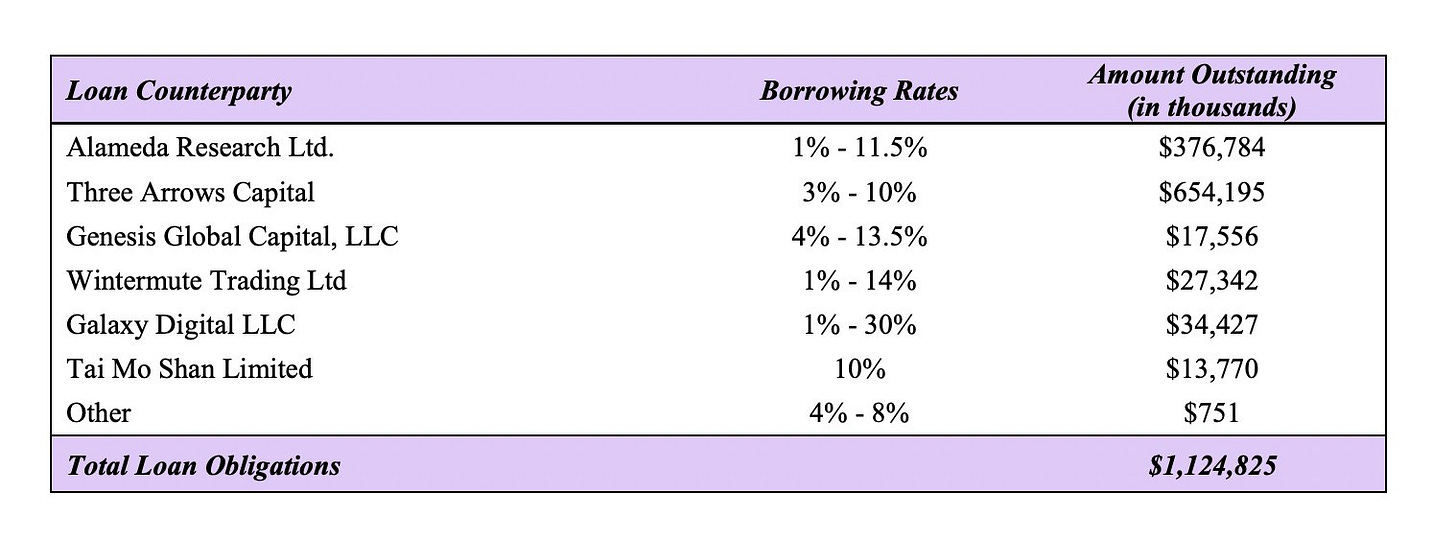

The spices🧂 The devil lies in the details, or in this case - in Chapter 11 filing. According to it, Alameda aka FTX aka SBF owes the company as much as $376M. We can remember that Alameda Research, the firm founded by crypto billionaire Sam Bankman-Fried last month extended a $500M line of credit to a crypto broker.

This raises some serious questions and concerns. Here’s the takeaway:

✈️ THE TAKEAWAY

Questions & concerns 🧐 First and foremost, this makes one wonder how SBF is supposed to bail out Voyager & the wider crypto space when he is himself in a lot of debt? Furthermore, was the extended $500M credit line mainly an attempt to keep Voyager afloat so that he doesn’t need to repay this debt immediately? Finally, it makes you seriously question whether SBF/Alameda/FTX is in such a good financial position, and how much debt they owe to other lenders such as BlockFi? If these and other questions aren’t answered soon, FTX/Alameda might start looking shadier than the public currently believes. And it might be very nasty if/when they implode.

Revolut + Stripe = 🌍🚀

The partnership 🤝 UK-based challenger banking giant that strives to become a Super App Revolut has partnered with FinTech heavyweight Stripe to support payment processing in the UK and Europe. The tie-up will also help Revolut’s expansion in Latin America and possibly India and the Philippines, per Bloomberg.

More on this 👉 Stripe is the financial infrastructure platform so it will back the FinTech giant for payment processing in the UK and Europe. Leveraging Stripe’s infrastructure in global markets, Revolut aims to provide frictionless payments that will meet local preferences.

We can remember that Stripe currently processes payments in more than 135 currencies and in over 47 countries, making it an attractive provider for businesses with a growing global presence, like Revolut.

What does it mean? 🤔 It’s all about growth and scaling. Here’s the takeaway:

✈️ THE TAKEAWAY

🌍🚀 Despite cash still being king, its usage is slowly and inevitably declining. Having said that, Revolut and Stripe’s tie-up can help fuel growth and scale for both FinTech companies. Stripe’s infrastructure can help Revolut strengthen its payments business and potentially opens the door to other tie-ups that can improve its standing in the payment sector (if you missed it, this week, Revolut unveiled its first-ever point-of-sale hardware, the Revolut Reader, which lets merchants accept cards and contactless payments. Stripe might fit here too soon). While for Stripe, it can hence use Revolut to grow its reach and sustain revenues as it contends with market headwinds (with reported 15M customers, it can help boost Stripe’s revenues as the tech fallout threatens to hamper growth). Expect more such tie-ups between the big names in FinTech this year and next.

🔎 What else I’m watching

Crypto-backed mortgages? 🤔 There’s been talk about people buying real estate with cryptocurrency for some time, but a new report from banking giant Citi finds that crypto-backed mortgages have been gaining ground for reasons that suggest loans collateralized by digital assets will have a growing place in the broader lending market. Noting that it is “rare to find ‘new’ types of mortgages in the post-crisis U.S. mortgage finance market,” Citi Global Perspectives & Solutions’ (GPS) “Home of the Future” report said that a “new crypto- adjacent mortgage product has gained prominence with a straightforward motivation: allowing crypto investors to utilize their investment gains to secure a loan without incurring” capital gains tax liability by selling cryptocurrency to pay for the property, and without parting with the digital assets many large crypto holders hope will rise dramatically in value over the long term. Haven’t we learned anything from the current crash? :/

Payback time!💰 Struggling crypto lender Celsius paid down $183M of its debt to the decentralized exchange Maker, possibly in a bid to recover bitcoin-linked collateral that otherwise would remain trapped. The beleaguered crypto lender still owes $41M to Maker, collateralized by almost 22,000 “wrapped” BTC ($440M).

Fee war 👀 Binance has announced it will cut Bitcoin (BTC) trading fees to zero worldwide as of 8 July 2022. Trading fees are being eliminated across 13 stablecoin and fiat combinations including BTC/USDT, BTC/USDC, and BTC/BUSD, as Binance announced. The cut in fees is an extension of a program the cryptocurrency exchange introduced in the US in June 2022. Zero-fee trading will take effect on 8 July to coincide with the exchange's five-year anniversary. It will remain in place until further notice.

💸 Following the Money

Gen-Z “digital assistant” Cleo has raised $80M Series C to double down on the US market and continue helping young people's financial health and wellbeing.

Finalis has raised $107M in seed funding for its investment banking platform that helps private market participants execute deals compliantly. Animo Ventures, Chaac Ventures, Ulu Ventures, Tribe Capital, and The Fund joined the round, the proceeds of which will be used by US outfit Finalis for technology development and overseas expansion.

Mexico City-based digital payments platform UnDosTres has raised $30M in a Series B funding round.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: