The biggest-ever FinTech divorce is over: FIS sells majority stake in Worldpay 😳; PSD3 is finally here, and it can be a game-changer 🇪🇺💳; The rise of AI-enabled fraud 🦹♂️🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The ultimate Financial Plan for SaaS Startups💰📊🚀 [an invaluable resource to all because every company is a SaaS company]

More Generative AI is coming to Finance as Ramp acquires AI startup Cohere 🤖💸 [more genAI is coming to finance + a good time to revisit 4 essential M&A templates]

American Express is doubling down on SMEs. And winning 👏 [& how it’s building a B2B FinTech giant]

Angel investment platform to close the gender investment gap? 🤔

FinTech IPOs are still alive as CAB Payments raises ~£335M in London 🇬🇧

As for today, here are the 3 fascinating FinTech stories that were changing the world of finance as we know it. This week was definitely the most intense one in the financial technology space this year thus far, so make sure to check all the above stories.

The biggest-ever FinTech divorce is over: FIS sells majority stake in Worldpay 😳

That was fast! 💨 Finance giant FIS FIS 1.23%↑ has reached an agreement to sell 45% of its Worldpay Merchant Solutions business to private equity funds managed by GTCR.

The transaction values the unit at a whopping $18.5 billion, which includes $1 billion contingent on certain thresholds being met by GTCR.

More on this 👉 We can remember that initially, FIS had planned to spin off Worldpay, but the company's new CEO, Stephanie Ferris, opted for offloading a majority stake instead.

The deal with GTCR offers an attractive upfront valuation, representing a 9.8-times multiple on expected fiscal 2023 adjusted EBITDA. FIS will receive net proceeds of around $11.7 billion and retain a non-controlling 45% ownership interest in a new joint venture.

✈️ THE TAKEAWAY

End of an era 👏 This is logical and was expected but the fact that it happened so fast rather surprised me… On the other hand, money doesn’t sleep and what had to be done was done. In short, this move will simplify operations for both FIS and Worldpay, facilitate debt reduction, and allow for capital return to shareholders. If you want to learn more, I did a deep dive into the deal with all the ins and outs here:

ICYMI: Record-breaking FinTech divorce: FIS mulls $15 billion Worldpay sale 😳

PSD3 is finally here, and it can be a game-changer 🇪🇺💳

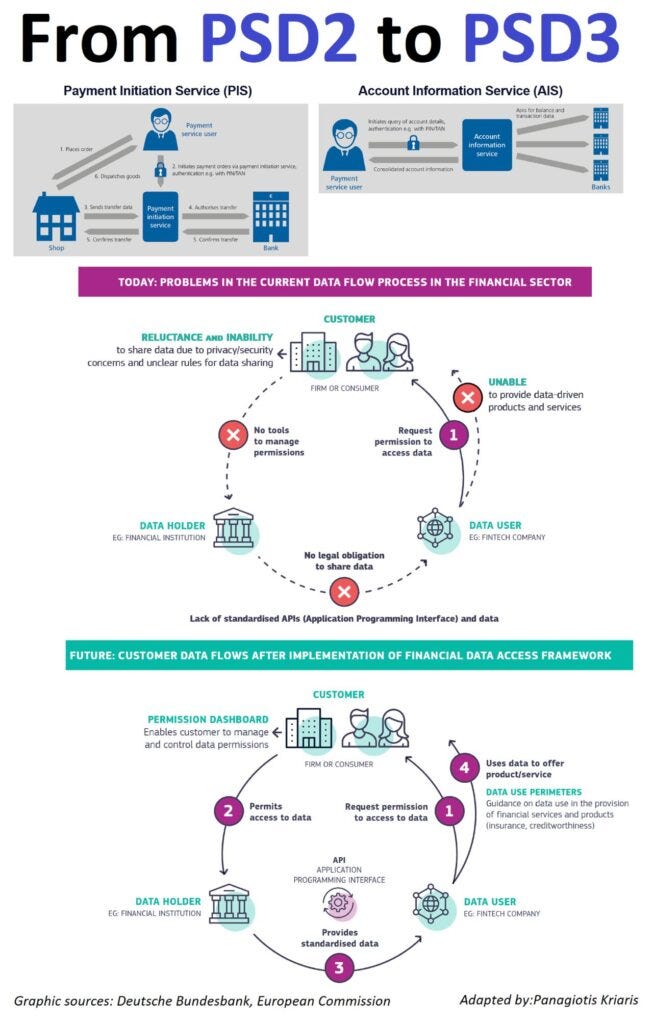

The BIG News 🗞 Last week, the European Commission introduced proposals for the Payment Services Directive (PSD3) and a Payment Services Regulation (PSR), as well as a legislative proposal for a framework for financial data access.

These proposals aim to modernize the current PSD2, ensuring that consumers can continue to make secure electronic payments within the EU while having a greater choice of payment service providers.

This is big news for FinTechs and the future of financial services. Let’s take a closer look at what this means and what might come next.

More on this 👉 We can remember that PSD2, introduced in 2015, aimed to create a more integrated and efficient European payments market, enhancing consumer protection and promoting innovation and competition.

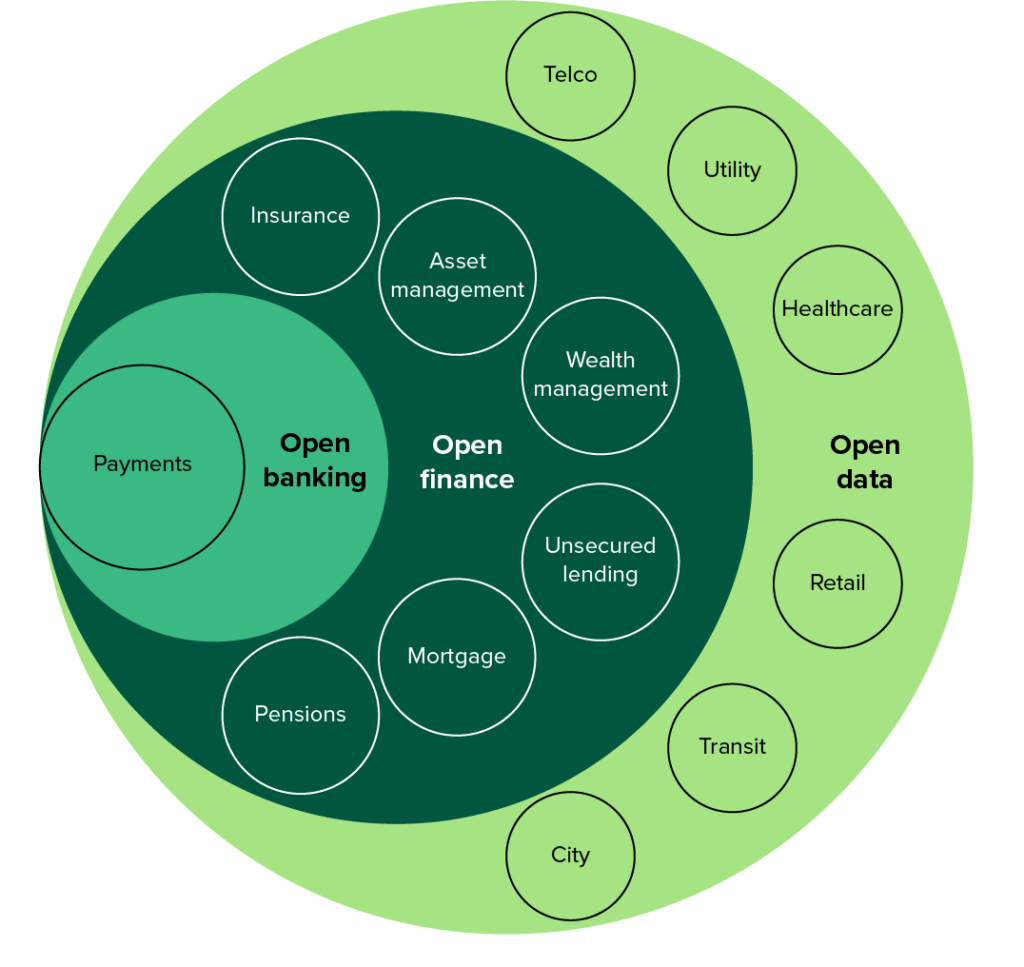

It required banks to open their payment services to third-party providers via APIs, laying the groundwork for Open Banking. PSD3 is being built on a similar foundation and its proposed framework for financial data access is intended to establish clear rights and obligations for customer data sharing in the financial sector, leading to the development of innovative financial products and services and fostering competition.

The USP 🥊 Panagiotis Kriaris shared a good summary on PSD3. Here’s what it’s all about:

Enhancements in Open Banking:

Introduction of stipulations for specialized data access interfaces.

Elimination of the necessity for banks to support dual data access interfaces.

Assurance of alternative data access for open banking providers to ensure uninterrupted business operations if the primary banking interface fails.

Implementation of a “control panel” for consumers to monitor, manage, and retract data access permissions.

Mandatory provision of access to financial data beyond payment account information.

Strengthening Measures Against Fraud:

Extension of reimbursement rights for victims of fraud

Implementation of a compulsory system to corroborate account names with IBANs

Intensification of customer authentication protocols

Establishment of a legal framework for PSPs to exchange information related to fraud

Promoting Equitable Competition Between Banks and Over 1,000 Non-Bank PSPs to Reduce Costs:

Granting PSPs access to all EU payment systems

Ensuring payment and e-money institutions (of which there are approximately 800 and 270 respectively) have access to banking services

Streamlining Processes:

Consolidation of e-money institutions (EMIs) and payment institutions (PIs) under a unified system

Integration of all payment regulations applicable to PSPs into a single, directly enforceable regulation

Augmenting the Accessibility of Cash in Stores and Through ATMs:

Permitting retailers to offer cash services to consumers without necessitating a purchase and clarifying regulations for independent ATM providers

Enhancing Consumer Rights (e.g. in situations where funds are withheld, increasing transparency in account statements and ATM fees)

All in all, while PSD2 has been successful in reducing fraud and enhancing user experiences, it faced challenges, especially in creating a level playing field for all PSPs. Non-bank PSPs often faced obstacles in accessing key payment systems directly, hindering fair competition and stifling innovation. PSD3 is thus aiming to address these issues, which are essential for fostering healthy competition and driving advancements for the future of finance.

✈️ THE TAKEAWAY

What’s next? 🤔 These proposals are good and positive developments for the future of financial services in Europe. In short, PSD3 is aimed at streamlining and securing the FinTech and financial services industry by ensuring better access to payment systems, protection for consumer data sharing, and combating fraud. It thus has the potential to harmonize the Open Banking framework across Europe and set trends for consumer protection that could be adopted globally. And Open Banking and Open Finance are considered fundamental for the future of finance in Europe.

The rise of AI-enabled fraud 🦹♂️🤖

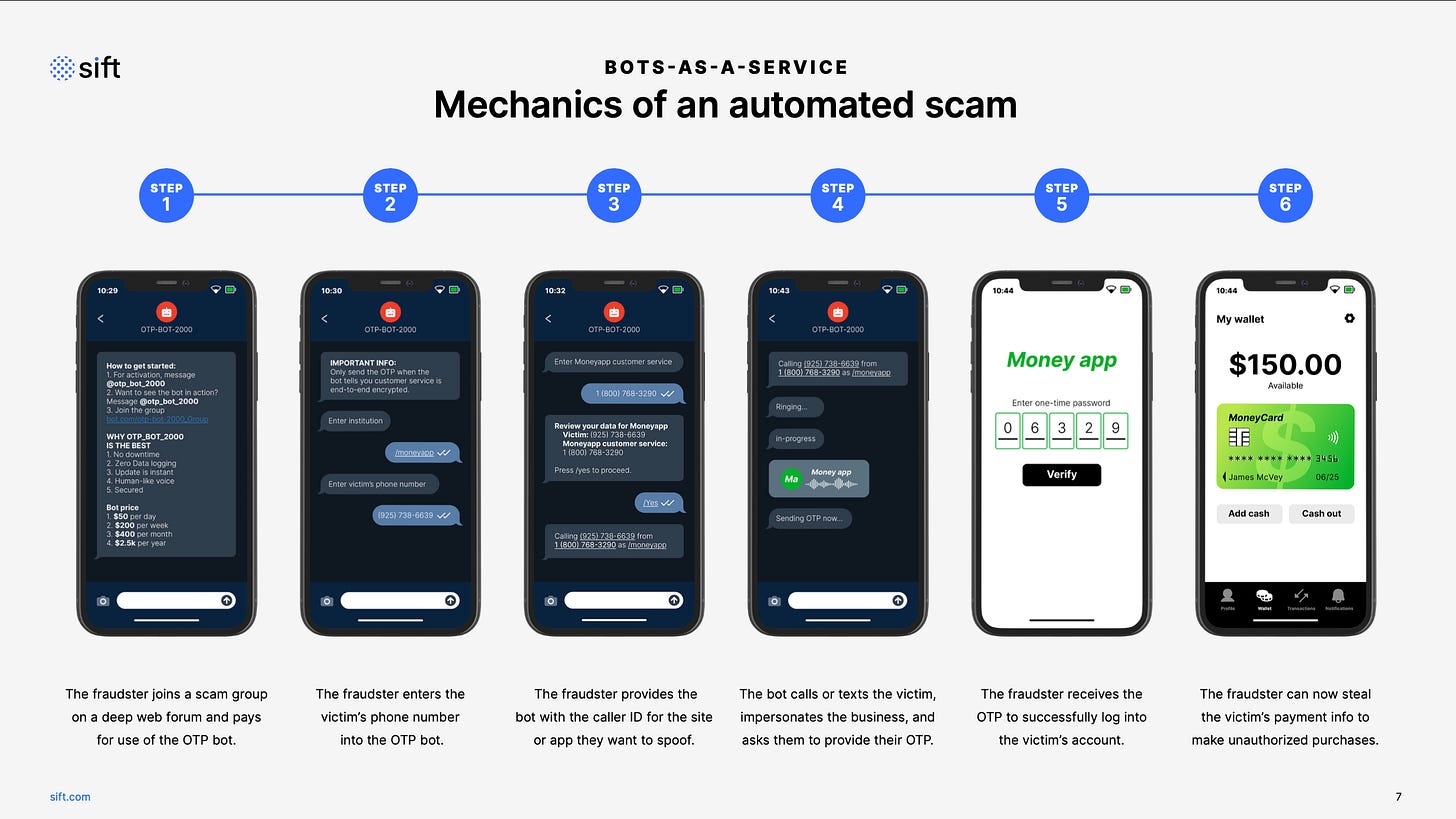

New data 📊 Sift, a US-based fraud detection provider, has released a new interesting report highlighting the rise of AI-enabled fraud.

This short yet good read provides some valuable insights we must all know. Let’s take a look.

More on this 👉 According to Sift's Q2 2023 Digital Trust & Safety Index, over two-thirds of US consumers have experienced an increase in spam and scams, attributed to the emergence of consumer-oriented generative AI tools in late 2022. That’s a lot…

The report also reveals that approximately 50% of consumers struggle to identify scams, and around 20% have fallen victim to successful phishing attempts.

On top of that, the surge in AI-empowered scams has led to a significant rise in account takeover attacks (ATO), with the ATO rate increasing by 427% in Q1 2023 compared to the entirety of 2022.

✈️ THE TAKEAWAY

What this means? 🤔 First and foremost, it’s clear that the marketability and accessibility of fraud tools - whether AI-based ones or not - are some of the key factors contributing to the democratization of fraud. This means that anyone, regardless of their prior knowledge, can now utilize stolen credentials or payment information to commit fraud. More importantly, although generative AI is a somewhat recent development, its potential for fraudulent activities and its impact on consumers and businesses cannot be ignored. To mitigate these new threats and safeguard revenue and customers, businesses must adopt AI and automation, which can not only enhance security but also reduce friction for legitimate users. With that in mind and looking at the big picture, I must say that I’ve never been more bullish on AI-powered RegTech solutions. Both in FinTech and Web3.

ICYMI: RegTech will be the hottest thing in Web3 in 2023 🚀

🔎 What else I’m watching

Monzo moves 🛡️ Insurtech Qover partners with UK digital bank Monzo to provide a tailored travel insurance solution that can be accessed by Monzo Premium account holders in the UK. The program is orchestrated by Qover, utilizing its embedded insurance orchestration platform, and underwritten by Zurich Insurance. ICYMI: The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀

Onfido's valuation ⬇️Publicly listed FinTech VC Augmentum Fintech published its annual results lately, and Sifted spotted a mark-down in its portfolio. It's downgraded the estimated value of its holding in Onfido by a third, from around £15M to £10M, which it worked out based on revenue multiples. The digital identification startup's losses were up 30% in 2022 from 2020 when it last raised funds. Ouch. ICYMI: More investors wipe 40% off Revolut valuation 😳

💸 Following the Money

AI-powered Order-to-Cash provider Sidetrade has announced the complete acquirement of the US-based real-time B2B credit risk solution provider CreditPoint Software.

UBS UBS 1.28%↑ has led a €10M seed round in Swiss business finance startup Numarics. Founded in 2020, Numaric's AI-powered platform combines software with human experts to give SMEs access to services often reserved for Big Four customers, eliminating the need to use different software for accounting, invoicing, document management, and liquidity planning.

Masroofi, an Egyptian fintech startup providing digital payment services to children between the ages of 5 and 15, has secured $1.5M in funding from unnamed investors. This amount will enable the startup to widen its reach in terms of service delivery.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: