Monzo to acquire Lunar in one of the biggest neobank M&As 🇬🇧🤝🇩🇰; Apple's Tap to Pay launches in the UK, or the Beginning of the End of POS 📲; European FinTech funding is in freefall 📉🫣

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

2500+ Investors that accept Cold Outreach from Founders💰 [use this list if you want to grow your startup 🚀]

Ripple’s XRP surges 96% after a partial win in SEC lawsuit 🤯

Tell me Binance is in trouble without telling me Binance is in trouble 👀

Crypto trading volumes rose for the first time in 3 months 📈

As for today, here are the 3 captivating FinTech stories that were transforming the world of finance as we know it. This week was super intense and intriguing, so make sure to check all the above stories.

Monzo to acquire Nordic digital bank Lunar in one of the biggest neobank M&As 🇬🇧🤝🇩🇰

The HOT news🔥 UK challenger bank Monzo is reportedly in talks over a merger with its Nordic equivalent Lunar, according to reports from Bloomberg.

The preliminary discussions are taking place not long after Lunar raised €35 million in funding from insiders back in February.

More on this 👉 The deal reportedly arose from Monzo’s desire to expand into Europe.

Bloomberg described the discussions as preliminary with no guarantee a deal would be reached, and that Monzo is also exploring other potential targets in Europe.

The USPs 🥊 Both neobanks are somewhat similar but operating in different markets:

Britain’s flagship digital bank Monzo was last valued at $4.5 billion after raising $475 million in late 2021. Having more than 7.5 million customers, in May Monzo reported that it had already reached profitability — at least for the first two months of the year — and expects to reach full-year profitability by the end of 2024. A jump in its lending business, where volume nearly tripled year-over-year, spurred the company to profitability.

ICYMI: The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀

Lunar offers retail and business banking services in Denmark, Sweden, and Norway, with a proposition broadly similar to that of Monzo’s in the UK and US. Last year Lunar raised €70M from existing investors including Tencent, Heartland, IDC Ventures, and Kinnevik, with an additional €35M raised this February, rounds that reportedly came at a $2.2 billion valuation. The bank also has the backing of Hollywood actor Will Ferrell, who invested in the business and starred in one of its marketing campaigns last year.

✈️ THE TAKEAWAY

Making sense of it… 🧠 Monzo is strong in the UK only while Lunar is mainly a Danish neobank. Also, given Lunar operates in non-Euro countries, it’s hard to justify this as the European expansion strategy (at least target EUR countries…). Hence, from first sight, I’m not entirely sure how this can work out... On the other hand, Nordic markets are less saturated with neobanks, so there might be more opportunities to grow vs. say continental Europe where you have Revolut, N26, and others. Also, we must remember that Lunar acquired Lendify and Paylike in the last couple of years, so Monzo might be looking at a bigger play in lending (and banking is all about lending!). Therefore, if they can successfully integrate and convert Lunar and their users to the Monzo brand, this could be a great opportunity to grow through M&A. Looking at the big picture, it’s yet another signal of growing M&A activity in the neobanking sector, as firms find it harder to raise fresh capital due to a combination of rate hikes, investor caution, and unclear macroeconomic situation.

The critical point here is to get the M&A right. And it’s all about the numbers. Use this to not miss a thing:

Bonus: Monzo's license-less US expansion. Smart move or just foolish? 🧐

Apple's Tap to Pay launches in the UK, or the Beginning of the End of Physical Payment Terminals 📲

The launch 🚀 Apple AAPL 0.32%↑ has just announced that Tap to Pay on iPhone has now rolled out to the UK🇬🇧, enabling small businesses to accept Apple Pay and contactless card payments using nothing more than their iPhone. It follows earlier international expansion to Taiwan🇹🇼 and Australia🇦🇺.

British FinTech star Revolut and banking giant NatWest are the first ones to introduce the technology across the United Kingdom.

More on this 👉 The feature, which allows iPhone owners to accept payment without a separate card reader, was first announced in February of last year, with a gradual rollout in the US through a growing range of payment processors.

It allows any modern iPhone to act as a payment terminal by utilizing the NFC chip. Here’s a brief flow of Apple Tap to Pay, or how softPOS works in general:

In short, Tap to Pay on iPhone enables users - both consumers and merchants - to accept in-person contactless payments with just a tap of their payment cards or mobile wallet, with no need for additional terminals or hardware.

✈️ THE TAKEAWAY

The shift 📲 Let us start off with some history first. One of the first companies to produce dedicated payment terminals aka POS devices was Verifone. It started in 1981 in Hawaii as a small electronic company. In 1983 they introduced the ZON terminal series, which would become the standard for modern payment terminals. Eventually, POSes became a lucrative business for banks allowing them to lock in large retailers that would process billions every month. The little guys, the SMEs, mom & pop shops, as usual, were left behind or had to pay huge fees to enable in-store payments. FinTech has challenged that with companies like Square SQ -1.57%↓, SumUp, or iZettle (now PayPal PYPL -0.96%↓) that in essence hacked the headphone jack of the phone making in-store commerce much easier and accessible. Leveraging iPhone’s Tap to Pay, today has never been easier for any online platform to accept in-person payments. In fact, for proximity payments, there is probably no better experience (at scale) than Apple’s Tap and Pay. Hence, not only it’s a game-changer for small businesses but also it marks the beginning of the end of physical POS. At the same time, it opens up even more opportunities for Apple to dominate the world of finance and ultimately become the first Super App of the West.

ICYMI: A glimpse into Apple’s plan to dominate the POS payments 📲

Apple might become the First Super App of the West 🍎 [+4 more reads]

European FinTech funding is in freefall 📉🫣

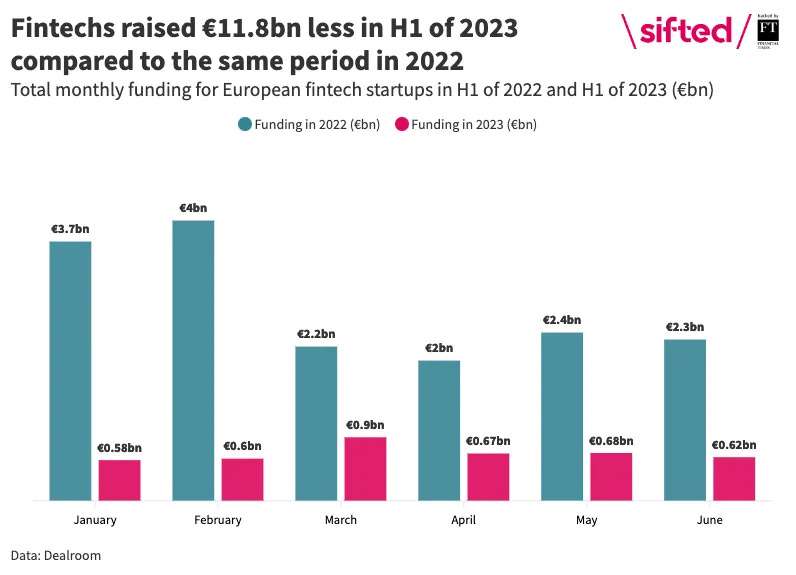

NEW data is out 📊 As we are already in July, we can now take a look at the data on European FinTech funding in the first half of 2023. And it’s not good...

Let’s take a brief look at the most important things.

More on this 👉 Top things to know from the latest Dealroom data:

Overall funding is down by a lot. European FinTechs brought in only €3.4 billion during H1 2023 compared to €15.2 billion raised during the same period last year. That’s nearly a 5X drop… 🥶

We must note that while the total funding figure for H1 2023 is likely to be higher after any reporting lag, it’s highly unlikely to be enough to bridge the €11.8 billion gap in capital. That’s a huge gap 🕳️

The subsector that brought in the most funding was mortgage and lending providers, with €409M. InsurTech took second place with around €378M. Not surprised, to be honest…

The UK was the country that attracted the most FinTech funding overall, with €1.6 billion, almost half of the total funding for the period. France was in second place, raising €405M.

The below graph from Sifted perfectly visualizes the downward spiral:

✈️ THE TAKEAWAY

What’s next? 🤔 It’s obvious now that the ongoing global macroeconomic challenges, inflation concerns, and geopolitical uncertainties are keeping VCs and investors concerned, which means that the current pullback in startup investing is likely to linger like a bad headache into Q3 and maybe even Q4 of 2023. So buckle up! And to make your life a bit easier, I’ve got some valuable stuff 👇🏼

If you’re building and scaling, read this:

If you’re raising right now, check these:

If you’re looking to do an M&A, this is a must:

🔎 What else I’m watching

Haircut ✂️ Cross-border payments firm Payoneer PAYO -1.76%↓ is to lay off nine percent of its 2000-strong workforce by the end of the third quarter. In a filing with the SEC, the firm says the workforce reduction plan is expected to "enhance productivity and efficiency and streamline the company’s organizational structure to better align operations with its growth". The initiative is expected to incur charges of $5 million in relation to severance payments and payroll taxes. The company says the termination program will result in an annual future benefit to its operating expenses of approximately $20 million. I will take a closer look at Payoneer soon, so stay tuned!

Welcome, UK 🇬🇧 Public, a US-based multi-asset investing platform, launches today in the United Kingdom, entering its first market outside the United States. With the firm's UK expansion, Public aims to be the preeminent place to invest in US-listed equities, offering over 5,000 stocks, deep data and insights, and a simple and transparent fee structure with zero commission trading and low FX fees. UK members can build a portfolio on the Public app with over 5,000 US-listed equities and access features that provide additional data and context, such as custom company metrics, Morningstar research, earnings call recordings, and insights from a community of millions of investors, all in one place. More choice is always great for the consumer like you and me, so my only question is when the rest of Europe?

💸 Following the Money

Chilean FinTech firm Shinkansen nets $3M for cross-border expansion.

Danish flat-rate point-of-sale payments startup Flatpay raised €15M in Series C funding led by Seed Capital.

Embedded finance platform Solaris has raised €38M in the first close of its Series F equity finance round.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: