Klarna CEO thinks they could be a $1 trillion company 🤑; Tchau: N26 exits Brazil 👋🇧🇷; Europe is playing catch-up again. This time, in alumni venture funding 💶📊

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

PE Returns Model Template💰 [use this to maximise Private Equity returns]

Klarna's remarkable comeback: how the FinTech giant went from valuation collapse to potential 2024 IPO 📈

Biden's AI executive order targets bias in financial services 🤖🏦

BlackRock files for Ethereum Spot ETF in potential gamechanger for crypto 😳

As for today, here are the 3 fascinating FinTech stories that were changing the world of finance as we know it. This week was wild in the financial technology space, so make sure to check all the above stories.

Klarna CEO thinks they could be a $1 trillion company 🤑

The money 💶 In a recent interview with Yahoo Finance, Klarna CEO Sebastian Siemiatkowski discussed the Swedish FinTech startup's ambitions to become a trillion-dollar company.

More on this 👉 He believes the buy-now-pay-later (BNPL) market presents a massive opportunity as an alternative to credit cards.

Klarna currently has over 150 million users globally. The company has been profitable for three straight quarters and plans to go public in 2024.

Despite Klarna facing challenges from economic fluctuations and rising interest rates, Siemiatkowski wants to transform BNPL pioneer into a global retail banking powerhouse through the use of AI.

He sees Klarna evolving to advise consumers on finances and mortgages in the long run.

✈️ THE TAKEAWAY

Looking ahead 👀 Despite the economic hurdles, Klarna has strong financials and a large user base that positions it well for more growth in the future as well as the IPO. However, competition is increasing in the BNPL space, not to mention the growing regulatory scrutiny. Having said that, a $1T price tag for a finance company seems to be a bit too optimistic and without little rationale behind it. In fact, $500B sounds unbelievable right now as it would make Klarna more valuable than JPMorgan JPM 0.00%↑. But I’m happy to be proven wrong here as their comeback is already impressive…

ICYMI: Klarna's remarkable comeback: how the FinTech giant went from valuation collapse to potential 2024 IPO 📈 [latest numbers, how we got here, and what’s next + a look at how leveraging AI Klarna is building the Google of Shopping]

Tchau: N26 exits Brazil 👋🇧🇷

The news 🗞️ German digital bank N26 is shutting down operations in Brazil just 7 months after finally launching its app there, marking the latest setback for foreign FinTechs attempting to challenge dominant local players in Latin America's largest economy.

Let’s take a look.

More on this 👉 We can remember that N26 entered Brazil in 2021 with ambitions to reach 100 million global customers, positioning itself as a fincare company helping Brazilians manage their finances.

However, the Berlin-based startup faced an uphill battle against deeply entrenched local competitors like Nubank NU 0.00%↑ (the absolute beast) and Inter. After testing its app with 2,000 Brazilian customers, N26 is now retreating from the market to focus on its core European operations.

N26's retreat follows a pattern of stumbles in overseas expansions. After pulling out of the UK and US in 2021, the company is narrowing its focus to continental Europe.

✈️ THE TAKEAWAY

Looking ahead 👀 At the core, N26’s withdrawal from Brazil reflects the difficulties foreign FinTechs have penetrating Latin America’s largest market. With established national champions boasting millions (or tens of millions!) of local customers already, new entrants face substantial customer acquisition costs. N26 also probably struggled to attract sufficient funding, not to mention customers to sustain its Brazil operations (its waitlist was kinda ridiculous to start with….). Zooming out, N26's exit illustrates the challenges even well-funded FinTechs face when trying to dislodge established national champions on their home turf. Especially when it comes to the Americas. To win in LatAm, robust localization strategies and substantial war chests are not enough. Joint ventures or mergers with local players who already have the scale, brand recognition, and regulatory know-how to operate successfully across LatAm might be the only viable option going forward. But even then I might not bet against NU and the local team…

P.S. for N26, the writing was always on the wall:

(July 2023) Should N26 leave Brazil? 🇧🇷 [why the exit is more than logical + some deeper dives into N26’s biz]

P.P.S. next on the exit list - Revolut:

Doomed to fail? Revolut goes live in Brazil 🇧🇷 [why I don’t think it will succeed there + deep dives into Revolut]

ICYMI: A path towards $100 billion FinTech Giant: Nubank applies for a banking license in Mexico 🇲🇽🏦 [why this is a huge step forward + a deeper dive into NU & dLocal]

Europe is playing catch-up again. This time, in alumni venture funding 💶📊

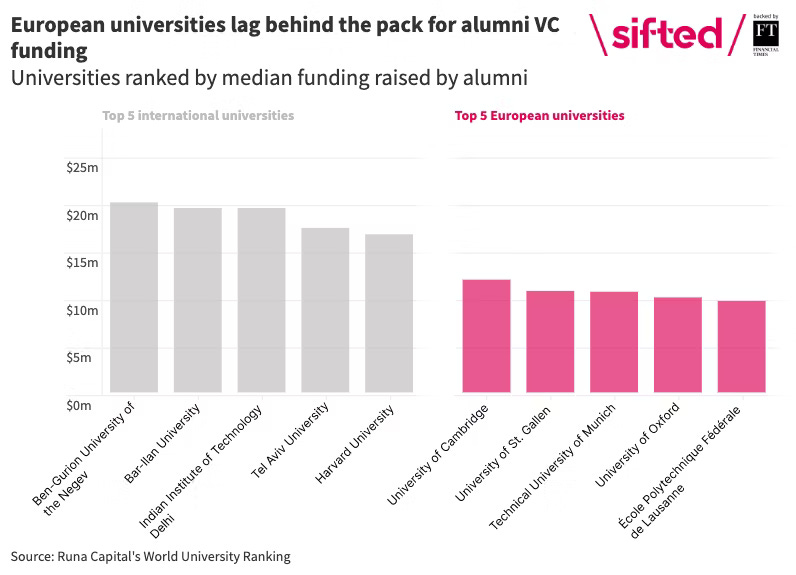

The data 📊 European universities are lagging far behind their global counterparts when it comes to venture capital funding raised by alumni founders, according to a new study by VC firm Runa Capital.

Not a single European university cracked the top 20 in the ranking, which was dominated by 13 American, 4 Israeli, and 3 Indian institutions.

Let’s take a look.

More on this 👉 The study analyzed over 17,000 alumni founders from 89 universities who have raised over $1 million in funding between 2007-2022. Cambridge was the top-performing European university, coming in at #28 with a median funding amount of $15.9 million raised per founder. The University of St. Gallen and the Technical University of Munich also cracked the top 40 at #34 and #35 respectively.

However, they were dwarfed by the top-performing university - Israel's Ben-Gurion University - which had a median funding amount of $26.8 million per founder.

American universities took over half of the spots in the top 89, with elite institutions like Harvard, Stanford, and MIT leading the way.

This massive funding gap highlights Europe's difficulty in fostering a vibrant venture capital environment and scaling startups into global leaders. Critics argue outdated attitudes toward entrepreneurship and risk-taking have hampered European universities relative to their American counterparts.

Light at the end of the tunnel 💡 However, recent initiatives aim to inject more funding into European universities. The University of Cambridge just launched a program to provide more support for alumni founders.

New alumni venture funds led by former students have also emerged in Europe, modeled after the successful Alumni Ventures network in the U.S. With over 1,000 portfolio companies, Alumni Ventures is the most active VC firm in America.

✈️ THE TAKEAWAY

Looking ahead 👀 As European policymakers emphasize the need for universities to translate academic research into entrepreneurial ventures, especially in critical fields like biotech and quantum computing, unlocking more venture funding will be critical. If Europe hopes to catch up to other innovation hubs like Israel and the U.S., reforming attitudes and expanding capital availability for university entrepreneurs will be key steps forward. Though still lagging, the early momentum is promising if Europe can build on it in the years ahead.

To really capitalize on this momentum, use these:

P.S. you will also unlock:

Financial Template Bundle for VCs 📚

The Best Startup Cap Table & Returns Model Template 💸

Acquisition Schedule Template for More Profitable Acquisitions💰

🔎 What else I’m watching

NatWest’s Cora 🤖 NatWest is enhancing its chatbot Cora with generative AI capabilities from IBM IBM 0.00%↑, enabling more human-like conversations with customers. The evolved Cora+ can access previously inaccessible information across products, services, bank info, and careers to provide personalized support. Customers can have more natural conversations, asking questions and getting conversational responses with links to requested details. NatWest's Wendy Redshaw says this leverages the latest generative AI innovations to make Cora feel more "human" and become a trusted digital partner for customers. Building on Cora's five years of service, the upgrades aim to strengthen NatWest's relationship banking in a digital world through more meaningful, personal engagement. ICYMI: ChatGPT can now predict the direction of interest rates 😳 [+more dives into how AI + Finance will change the game]

More bets on AI 🤖 Finance giant Visa V 0.00%↑ launched an AI Advisory Practice through its consulting arm Visa Consulting & Analytics to provide insights enabling clients to utilize generative AI. Leveraging a global network of over 1,000 experts, the new service guides clients through AI discovery, planning, and implementation to define responsible AI strategies meeting business goals. Visa has 30 years of AI experience enhancing its services and says it has invested over $3 billion in AI/data infrastructure in the past decade. The launch follows Visa's $100 million generative AI ventures initiative to invest in startups shaping the future of commerce and payments with transformative generative AI. Through its expertise and investments, Visa aims to empower clients to adopt AI, including emerging generative technologies, to grow and redefine their customer service. ICYMI: Riding the hype: Visa creates $100M Generative AI Venture Fund 💸 [+ lots of more reads]

💸 Following the Money

Dutch payments startup Fero has raised a $3M seed led by US hedge fund Coatue.

Private investment management platform Arch has raised $20M in a Series A funding round led by Menlo Ventures.

Diesta, a London-based InsurTech startup, has announced a $1.9M seed funding round.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: