Wise quadruples profits as customer growth and higher rates boost income 🚀; Nubank continues strong growth and profitability momentum 📈; Banks race to harness AI, but caution reigns 🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Customer Intelligence Template💡[use this to engage with your customers more effectively 👥]

Apple Pay emerging as a key revenue driver for Apple 📲 [how Apple is positioning iPhone as the central financial hub + more bonus reads & deep dives]

Decentralized Identity: the missing link for Digital Finance? 🤔 [why it matters]

CME becomes top Bitcoin Futures Market as institutions eye crypto 🏦

Adyen launches Capital 💸 [why it matters + some solid deep dives into the FinTech giant]

As for today, here are the 3 wild FinTech stories that were transforming the world of finance as we know it. This week was crazy in the financial technology space, so make sure to check all the above stories.

Wise quadruples profits as customer growth and higher rates boost income 🚀

The news 🗞️ British FinTech star Wise saw its pre-tax profits surge 280% in the first half of 2023, boosted by strong customer growth and increased interest income from higher rates 😳

ICYMI: Wise is one of the most underrated FinTechs right now 😳 [June, 2023]

Let’s take a brief look at their numbers and see why Wise is a FinTech you cannot ignore.

More on this 👉 The London-based money transfer giant reported a pre-tax profit of £194.3 million for the six months ending September 30, 2023, up from £51 million a year earlier. Damn!

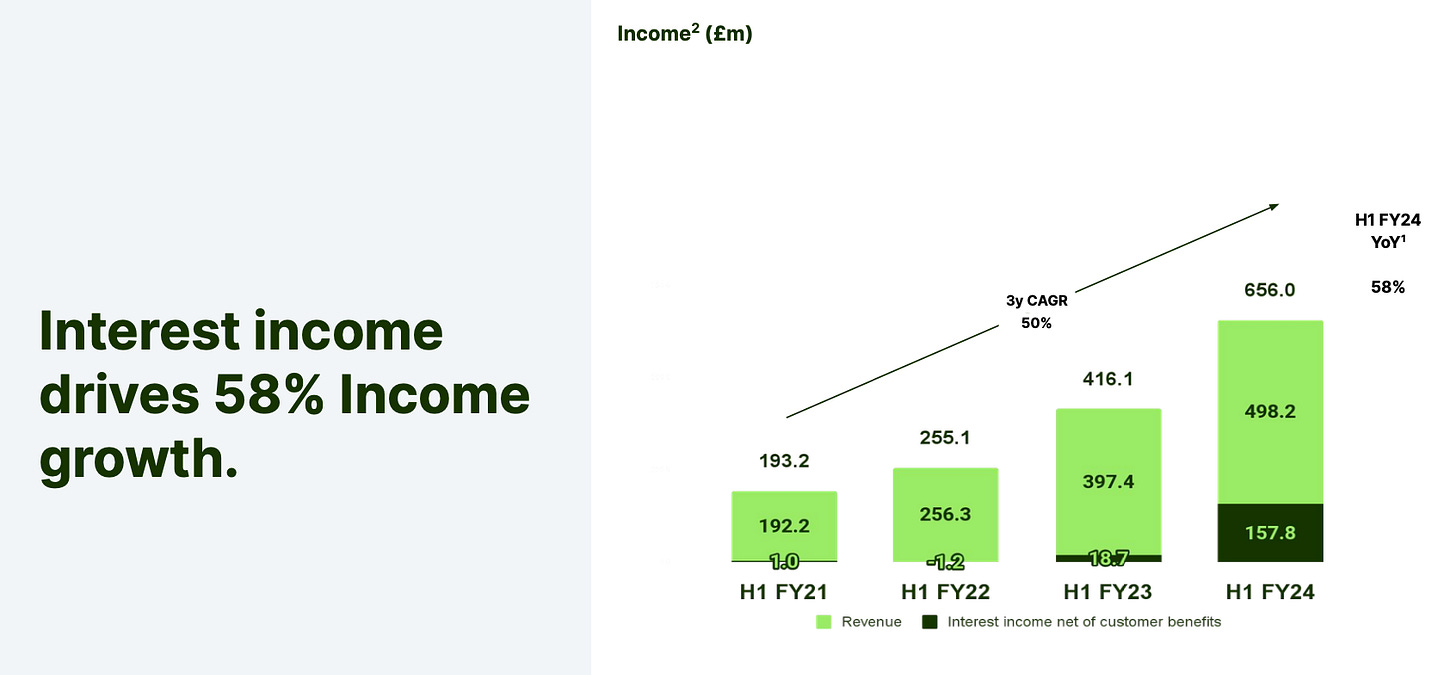

Revenue rose 25% to £498 million, driven by a 32% increase in active customers to 7.2 million.

Including interest income, Wise's total income jumped 58% to £656 million. The company benefited as global central banks raised interest rates, earning £211 million just from interest on growing customer balances now totaling over £12 billion.

Volumes grew 12% to £57 billion, matching customer growth. Wise is seeing higher adoption of its multi-feature account services like foreign exchange, debit cards, and stock investments.

The crazy part? Over half of its users now utilize more than one Wise product. That brings them closer to Nubank NU 0.00%↑, a leader in owning their customers.

ICYMI: A path towards $100 billion FinTech Giant: Nubank applies for a banking license in Mexico 🇲🇽🏦 [why this is a huge step forward + a deeper dive into NU & dLocal]

Despite impressive results, Wise stock is still down 25% from its all-time high:

Maybe a good opportunity to buy?

✈️ THE TAKEAWAY

Looking ahead 👀 Following amazing results, Wise unsurprisingly upgraded its 2023/2024 income growth guidance to 33-38%, from 28-33% previously. It now expects the structurally higher interest rate environment to keep profit margins above its medium-term 20% target. And that makes absolute sense. Why they will achieve this? Well, Wise is capitalizing on demand for cheaper, faster cross-border money transfers. Because at the core of it, they have a payments network that spans over 70 banking partners and 45 countries targeting an estimated $700 billion total addressable market. Zooming out, the strong first-half performance defied weakness across payment peers and showed the resilience of Wise's customer-focused business model. More importantly, with evangelical users driving viral growth (67% of new Wise customers join through word-of-mouth), Wise looks poised to continue gaining a share in the massive cross-border payments industry. Bullish.

ICYMI: Wise & Swift join forces. It will change the game for banks 🏦🌐 [how this will change the game forever & some solid deeper dives into Wise]

Disclaimer: this isn’t investment advice and I’m a shareholder of Wise.

Nubank continues strong growth and profitability momentum 📈

Earnings call 📞 Brazil's FinTech gem Nubank NU 0.00%↑ reported their 3Q 2023 earnings this week. LatAm’s financial powerhouse backed by Warren Buffett's Berkshire Hathaway absolutely crushed them!

The growth and numbers NU is showing makes it the best-run digital bank ever 😳

Let’s take a look.

More on this 👉 Here are the key numbers you must know:

👥 89.1 million customers (+27% Year-over-Year)

🇧🇷 51% of the adult population of Brazil now uses Nubank

🇧🇷 It's now the 5th largest financial institution in Latin America

🇲🇽 In Mexico, Nu’s customer base grew to 4.3 million

🇨🇴 In Colombia, Nu now counts ~800,000 customers

💰 $19.1 billion worth of deposits (+26% YoY)

💸 $2.1 billion in revenues (+53% YoY)

🤑 $303 million in profit (they lost $29.9M in Q2 2022)

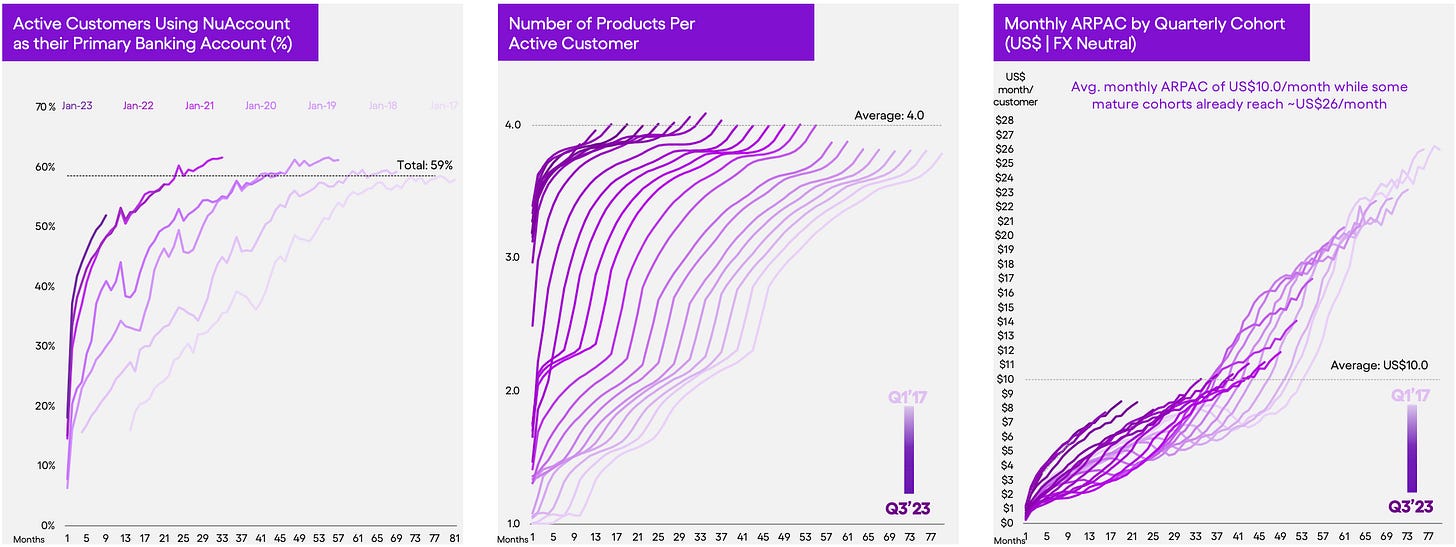

What's even more impressive is that their average customer is now using 4 products 😳

Cross-selling is how you generate high LTVs per customer in FinTech, and NU is cross-selling multiple products like nobody else in the market.

So, in addition to 38.9 million credit cards and ~64.7 million bank accounts, NU now has:

💳 7.3 million personal loans

🛡 1.2 million insurance policies

📈 12.4 million investment customers

📊 10.5 million NuCoin customers (launched just in March 2023)

But here comes the crazy part.

80-90% of Nubank's customers are acquired organically through word-of-mouth or unpaid referrals. That's the power of a brand coupled with amazing user experience.

ICYMI: Customer Intelligence Template💡 [use this to engage with your customers more effectively 👥]

Show me the money 🤑 Taking all the above into account, then comes a natural question - what's the key driver of Nubank's revenue?

The answer is both simple and not.

At the surface of it, it’s the increase in monthly revenue per active customer (ARPAC). It grew by an 18% increase in monthly ARPAC to $10.

The increase in ARPAC is thus attributed to:

More active and primary banking account customers compared to a year ago

These customers using a larger and more profitable set of financial products

The compounding effect of more engagement and cross-selling driving ARPAC expansion

But much more important is Nubank's Net Interest Income (NII) which reached $1.2 billion in Q3 2023, up 111% year-over-year on an FX-neutral basis.

The growth in NII was driven by:

Expansion of the credit card and personal loan portfolios - these grew 46% and 48% respectively year-over-year on an FX-neutral basis.

Increasing the mix of interest-earning installment balances within credit cards to 21% of the total card portfolio. This is up from 10% a year ago.

Improved portfolio yields from things like higher origination yields on personal loans.

The stable cost of funding around 80% of the Brazil CDI rate.

In other words, the higher interest-earning balances and yields are expanding Net Interest Margin, which helps drive NII growth. And NII makes up the majority (~81%) of Nubank's total revenues. Solid.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that seeing this level of growth in a 10-year-old company while maintaining solid profitability and growing customer engagement is just phenomenal. Secondly, Nubank’s NIM (which helps drive NII growth) is what European and US banks can only dream about. And with that, I must only repeat that Nubank is not only one of the best digital banks in the world. It's one of the best-run FinTechs ever. Super bullish.

ICYMI: A path towards $100B FinTech Giant: Nubank applies for a banking license in Mexico 🇲🇽🏦 [why this is a huge step towards building a $100B FinTech goliath + a deeper dive into NU & dLocal]

Disclaimer: this isn’t investment advice and I’m a shareholder of Nu.

Banks race to harness AI, but caution reigns 🤖

Recap 🔂 A year after OpenAI’s ChatGPT burst onto the scene, major banks are rushing to incorporate artificial intelligence into their operations. However, they are proceeding cautiously due to regulatory concerns.

Let’s take a look at what has been done.

More on this 👉 JPMorgan Chase JPM 0.00%↑, Goldman Sachs GS 0.00%↑, and Morgan Stanley MS 0.00%↑ have all embarked on projects to leverage generative AI's capabilities.

JPMorgan is testing earnings summary generators and advanced help desks. Goldman Sachs is working on a dozen internal initiatives, including coding and documentation. Morgan Stanley developed a virtual assistant to help advisers synthesize data.

Banks cite productivity gains, better client service, and potential advisory applications as motivations. McKinsey estimates $340 billion in value for banks from generative AI. However, many applications are still in early pilot stages given the sensitive nature of the finance industry.

Reality check ✅ JPMorgan Chase has shared its controls around developing generative models with regulators. It aims to help them understand the potential risks. The bank has also filed to trademark "IndexGPT" to select investments, though this is not an active development project yet.

Goldman Sachs says none of its dozen projects are client-facing currently. The bank wants to move "deliberately" on deploying AI to avoid issues. Morgan Stanley's virtual assistant is also not ready for client use.

Banks hope to harness AI to increase productivity, personalize services, and democratize access to financial expertise. But they are treading carefully given reputational and regulatory risk. Striking the right balance between innovation and prudence will separate leaders from laggards.

Regulation also needs to evolve to provide appropriate guardrails. With thoughtful collaboration between banks and policymakers, generative AI can transform banking for the better. However, patience and care are required to realize the full benefits while minimizing adverse impacts.

✈️ THE TAKEAWAY

Looking ahead 👀 The financial industry is on the cusp of an AI revolution. Banks have made promising starts in laying the groundwork. Now comes the harder part - developing a prudent path to operationalization at scale. The opportunities are immense, but realizing them will require sustained commitments to ethics, transparency, and responsible innovation. We’re still a long way to go.

ICYMI: Building AI Bank of the Future 🤖🏦 [key building blocks & lots of deep dives on AI + Finance]

🔎 What else I’m watching

Case closed 👏 Kenya's Asset Recovery Agency has withdrawn its last remaining court case against African FinTech giant Flutterwave, clearing the company after investigations found no evidence of criminal activity. The case alleged Flutterwave's bank and mobile money accounts contained proceeds of crime and money laundering. However, the agency now says it is satisfied the funds were legitimate amid Flutterwave's expansion efforts in Kenya. Earlier the judge criticized the agency for filing the case without completing investigations. Flutterwave will now regain access to $3M frozen in Kenya after $52.5M was released when the first case was withdrawn in March. With legal troubles resolved, Flutterwave can now focus on securing a payments license and growing its presence in the Kenyan market. Finally, Flutterwave can continue dominating in Africa. Disclaimer: I’m part of Flutterwave.

Client secured 🥂UK digital bank Starling has signed Romania's Salt Bank as its first client for Starling's Software-as-a-Service platform Engine. Salt Bank, part of Southeastern Europe's largest bank, aims to disrupt Romanian banking with a mobile experience launching in 2024. Engine's cloud-based platform will handle Salt Bank's customer onboarding, payments, transactions, operations, and more. Salt Bank CEO Gabriela Nistor says Engine provides a best-in-class platform fitting their digital strategy, noting its success powering Starling's 3.6 million UK accounts. Separately, Australia's AMP pledged $60 million for a new Engine-based app bank targeting sole traders and small businesses, showing Engine's international appeal. Starling scores wins at home and abroad with its white-label banking platform. ICYMI: Starling Bank, the underrated FinTech success story 🤌

💸 Following the Money

Block Scholes, a London-based crypto analytics firm, raised $3.3M in an investment round to expand its team and develop products.

US-based Advent International has agreed to acquire UK-based payments firm myPOS in a deal that’s expected to close by the end of 2023.

AI anti-fraud detection software company, Lynx, has recently announced it secured a Series A funding round of EUR 17M, with the participation of Forgepoint Capital. ICYMI: RegTech market set to surge to $45.3 billion by 2032 😳

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: