Monzo Magic: UK challenger bank reaches 9 million customer milestone 🪄; Revolut takes on telecoms with eSIM launch 😮📱; Plaid appoints first president as it eyes IPO 🔔

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a regular 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Affirm stock surges on strong Q2 results: is now the time to buy? 🤔📈 [looking at the key numbers, uncovering what they mean to see what’s the potential upside for 2024]

Payments are eating Shopify while Shopify is eating FinTech 🛍️💳 [latest numbers, what they mean & how Shopify is disrupting the whole FinTech ecosystem]

Temenos shares plunge after damning report alleges accounting irregularities and failed products 😨📉 [looking at all the allegations, understanding what they mean and what’s next for Temenos + one bonus read]

Coinbase's Strategic Leap: strong 2023 earnings signal bright prospects for 2024 and beyond 🤑🚀 [a holistic view at Coinbase focusing on financial performance, market position, strategic initiatives, and potential risks & opportunities to see why their future is brighter than many think]

Robinhood posts surprise profit in Q4 2023, eyes return to growth 😳📈 [a closer look to see whether Robinhood is worth your time and money in 2024]

Peak ZIRP: how Bolt went from $11 billion valuation to being worth just $300 million 😳 [it’s the best illustration of peak ZIRP in FinTech + more reads & some valuable lessons from one other once famous one-click checkout startup]

Ripple is playing the long game: acquires crypto custody provider in the US 🤝💸

As for today, here are the 3 fascinating FinTech stories that were transforming the world of finance as we know it. This was another insane week in the financial technology space, so make sure to check all the above stories.

Monzo Magic: UK challenger bank reaches 9 million customer milestone 🪄

Achievement unlocked 🏆 Digital bank Monzo has just crossed the landmark of 9 million personal UK current account customers, cementing its position as the country's largest challenger bank.

The crazy part? Two million customers (!) joined just last year, with growth largely attributed to word-of-mouth 🤯

Let’s take a look and see what’s next for Monzo.

More on this 👉 This exponential increase now makes Monzo the 7th largest retail bank in the UK by customers. With 1 in 7 UK adults and 1 in 16 businesses choosing Monzo, it continues to disrupt the traditional banking space.

ICYMI: Monzo is on track to be the most downloaded UK banking app in 2024 🇬🇧🚀

The mobile-only bank is loved by millennials for its innovative features like real-time spending notifications, easy money management, and products like its pay-over-time credit service Flex, among other things.

CEO TS Anil described the 9 million figure as a "testament to the magic of Monzo and the customer-centricity that is part of our DNA."

Indeed, the bank's customer obsession and clever targeting of digitally-native youth has fueled impressive organic growth. Something that other neobanks should take as a case study.

Future growth 🚀 While deposits have lagged behind customer sign-ups, Monzo hopes to expand its product suite to drive engagement. It now offers investments, savings accounts, and business banking, and will likely venture into insurance soon.

ICYMI: The foray into wealth is finally here: Monzo launches investments 💸 [a deeper dive unpacking this pivotal move for Monzo + more bonus reads]

Combined with strong customer retention rates and its loyal Gen Z user base coming of financial age, Monzo seems poised for even faster growth.

The profitable future looks promising too. Despite years of losses, Monzo is expecting to finally achieve profitability in 2024 due to surging income. Last year, it reported £214.5 million in revenue, even though it still posted a £116 million overall loss.

ICYMI: Monzo hits monthly profitability for the first time ever 🥳

✈️ THE TAKEAWAY

Looking ahead 👀 With game-changing disruption and current momentum, Monzo’s “magic” may well make it a front-runner to become a top 5 UK bank. Rival Starling Bank also boasts a strong following, but at 3.6 million customers, is still playing catch-up. As customer trust in digital finance soars, Monzo looks set to continue winning market share from risk-averse traditional banks. Its genius has been making complex money management simple and intuitive. And with more digital-first innovations in the pipeline, the neo-bank shows no signs of stopping. Looking at the big picture, the key next milestone will be converting its wildly popular platform into a profitable and sustainable business model. If achieved, Monzo would demonstrate that modern mobile finance can compete head-on with centuries-old banks - all while keeping the customer truly at the heart.

ICYMI: Monzo’s second attempt to conquer US: here’s why the British neobank is more likely to fail than succeed 🇺🇸🏦 [a deep dive with lots of bonus reads]

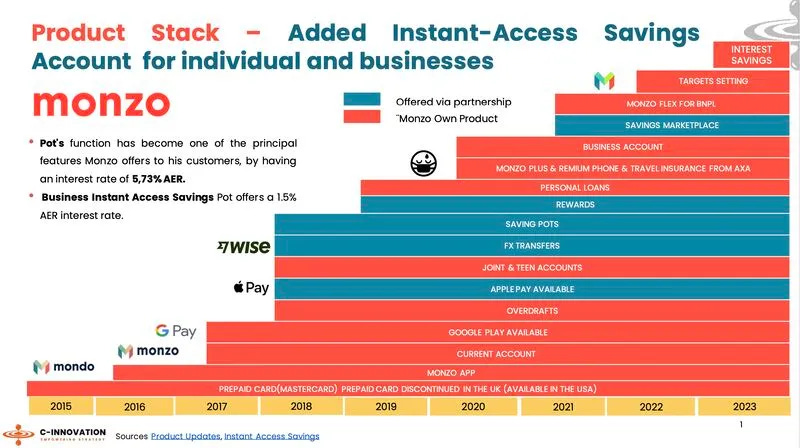

The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀

Revolut takes on telecoms with eSIM launch 😮📱

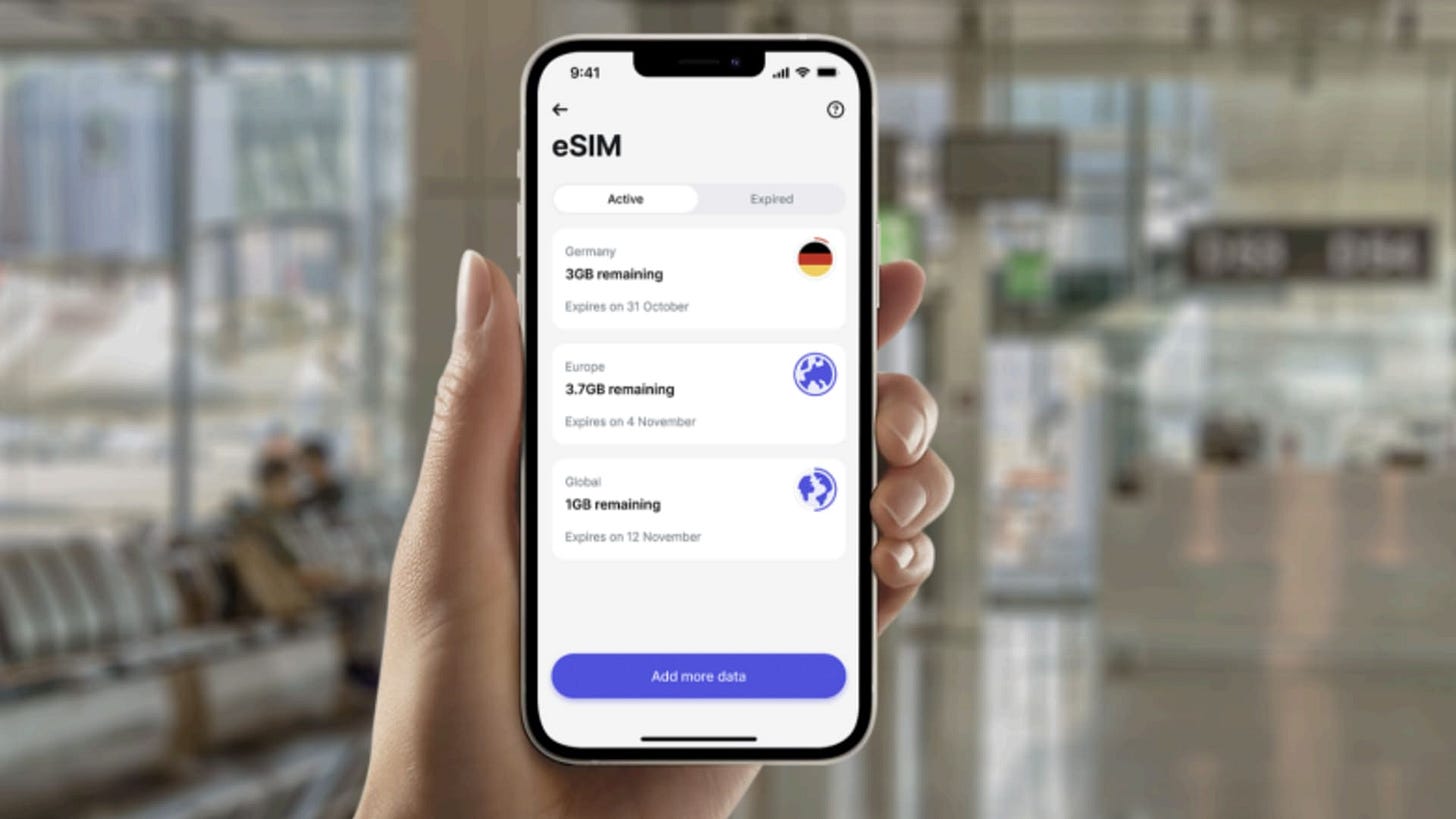

The launch 🚀 British financial technology firm Revolut is making waves by becoming the first company in the UK's financial services industry to offer its own phone plans.

The digital bank is introducing eSIMs - virtual SIM cards stored in devices rather than physical cards.

Let’s take a quick look at this and see why it makes sense.

More on this 👉 The basic eSIM plan allows all Revolut app users to easily top up their phone data as needed. So if they use up their regular data allowance abroad, they can add more via Revolut without roaming charges.

Premium Ultra subscribers get even more perks: 3GB of international data monthly that refreshes as they travel.

Show me the money 💸 The launch aims to solve some pressing pain points. Since Brexit, many UK providers reinstated pricey roaming fees in Europe. And rates in further destinations often blindside travelers.

Revolut's affordable, flexible eSIMs provide relief from unexpected bills.

✈️ THE TAKEAWAY

Why it matters? 🤔 Strategically, the move supports Revolut's goal of becoming a "financial super app." The company already lets users spend, transfer, trade, and more. Now it meets even more travel needs - connectivity. Revolut is thus bundling services to increase customer loyalty and revenue opportunities. Zooming out, the global eSIM market is projected to hit $30 billion by 2028 as demand for overseas data climbs. Revolut's novel foray sets an intriguing precedent - could more financial apps offer telecom services soon? Wouldn’t be surprised to see this from NU, for example…

The launch also furthers innovation in a company already valued at $33 billion for disrupting how consumers handle money (it’s probably not worth that much as of today…). As Revolut builds an all-in-one platform, its future looks increasingly more interesting (and hopefully, profitable!).

ICYMI: Why Revolut hasn’t conquered India🇮🇳 yet? 🤔 [status quo & challenges + bonus reads on how India’s disrupting payments globally & PhonePhe is building Indian Google]

Revolut Mafia is now bigger than Revolut itself 🦄 [what does it tell us & why it’s important + more deeper dives into Revolut]

Plaid appoints first president as it eyes IPO 🔔

The news 🗞️ Financial technology startup Plaid has named Jen Taylor, formerly Cloudflare's NET 0.00%↑ chief product officer, as its first president.

This executive appointment comes shortly after Plaid hired its first chief financial officer, signaling the company is maturing its leadership in preparation for a potential initial public offering (IPO).

Let’s take a quick look.

More on this 👉 Taylor spent nearly seven years at Cloudflare, spanning the periods before, during, and after its IPO. Her experience scaling products and teams to meet growing demand will be valuable for Plaid.

Originally founded in 2013 to connect bank accounts to financial apps, Plaid has expanded into services like lending, fraud prevention, and payments.

A $5 billion acquisition by Visa V 0.00%↑ was blocked for antitrust reasons last year. Plaid went on to raise funds at a $13.4 billion valuation.

The hiring of a president and CFO definitely suggests the next milestone Plaid is aiming for is an IPO, although the company did not provide a specific timeline. Taylor will oversee teams working on expanding Plaid's infrastructure to "power the future of finance."

Plaid now counts over 8,500 customers and 1,000 employees. Its backers include top VC firms such as Andreessen Horowitz, Index Ventures, and Kleiner Perkins.

✈️ THE TAKEAWAY

Looking ahead 👀 The appointment of an experienced product leader like Taylor indicates Plaid is entering a new growth phase. As it scales up operations and matures its business, the groundwork is being laid for a future IPO. We can expect further expansion of Plaid's services as well as financial prudence as the company heads toward a potential public listing. And it will surely be one of the bigger FinTech IPOs!

ICYMI: Plaid is building the identity layer for Finance 👀 [+ more reads]

🔎 What else I’m watching

JPM vs. Viva 🥊 Lawsuits are flying between JPMorgan JPM 0.00%↑ and Viva Wallet, the European payments platform in which the bank acquired a 49% stake last year. Viva founder Harry Karonis has begun legal action, alleging JPMorgan is suppressing Viva's growth to reduce its valuation below €5B by 2025, allowing the bank to take full control. JPMorgan filed its own claim against Karonis for allegedly limiting its rights as an investor. This follows JPMorgan's failed $175M acquisition of student financial aid firm Frank in 2021, which resulted in allegations of fake user accounts. Frank founder Charlie Javice denies falsifying data and counter-sued for reputational damage. The disputes showcase troubled JPMorgan FinTech deals. ICYMI: JPMorgan doubles down on growing the old-fashioned way: branches 🏦 [why it makes sense + a deep dive into JPM and how it recently made history]

Sign in with Klarna 💳 Klarna has launched Sign in with Klarna, a new product enabling streamlined checkouts and personalized shopping across 23 countries. The tool allows customers to automatically populate details to expedite online purchases. It also accelerates industry innovation by meeting user needs and preferences while remaining compliant. First tested with Tradera and Maitres, the secure and efficient solution provides more consumer data control. Users choose what information is shared for a personalized experience via tailored recommendations. Meanwhile, retailers access consumer data with consent and can offer memberships. By handling identity verification, Klarna also reduces costs for merchants. The product taps the rising demand for frictionless, secure checkouts. ICYMI: Klarna launches subscriptions ahead of IPO 💳 [why it makes sense + some deep dives into BNPL giant]

💸 Following the Money

US-based crypto custodian BitGo has announced the acquisition of Brassica, a provider of investment infrastructure for private securities and alternative investments.

UAE-based fintech SaaS platform Kema has raised $2M in a pre-seed funding round led by Speedinvest.

Copenhagen-based Pluto.markets, which is an investment app for consumers, raised $2.6M in funding. Magnetic led the round and was joined by investors including Y Combinator and Nordic Makers.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

thanks

Monzo is a signature example of how to run a neobank