JPMorgan bets big on Biometric Payments to revolutionize retail checkout 🖐️💳; Will Robinhood's 3rd attempt to conquer the UK pay off? 🤔; ChatGPT buzz raises the bar for banking chatbots 🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

HUGE: the DOJ is suing Apple for antitrust. What it means for FinTech? 🤔 [this is a massive deal that will have huge implications for the future of FinTech]

Inside dLocal’s 2023 financials: emerging markets FinTech trailblazer poised for sustainable growth 🚀 [diving into their key numbers, uncovering what they mean & why this emerging markets FinTech might be worth your time and money in 2024]

Apple is getting into LLMs: here’s how their MM1 can revolutionize multimodal AI & drive innovation across ecosystems 🤖🍎 [a deep dive into the tech giant’s multimodal AI breakthrough and how it will disrupt Apple Finance and other ecosystems + bonus read on how Apple can convert iPhones into financial powerhouses and lead in AI-driven finance]

BlackRock embraces Ethereum with launch of tokenized fund 😳 [what it means & what’s next + some bonus reads on Ether and its pivotal moment]

Bolt and Checkout.com team up to make online shopping a breeze. M&A to follow? 👀 [why Checkout.com should acquire Bolt soon + more bonus reads into struggling Bolt & Checkout]

Gen Z's growing spending power & their love for Apple Pay in shopping 🍎

As for today, here are the 3 brilliant FinTech stories that were transforming the world of financial technology as we know it. This is one of the most interesting weeks in the whole of 2024 thus far, so make sure to check all the above stories.

JPMorgan bets big on Biometric Payments, aiming to revolutionize retail checkout 🖐️💳

The news 🗞️ JPMorgan Chase JPM 0.00%↑, the largest US bank, is on a quest to make a significant leap in the payments industry by broadly launching biometric checkout services for its merchant clients in early 2025.

Let’s take a look at this and see why it matters.

More on this 👉 The banking giant has partnered with biometrics specialist PopID to develop a service that allows consumers to make purchases by scanning their palms or faces, aiming to streamline the checkout process and enhance the personalized shopping experience.

With global biometric payments expected to reach $5.8 trillion and attract 3 billion users by 2026, according to Goode Intelligence, JPMorgan sees immense potential in this emerging technology.

The bank has already conducted pilot programs with food service provider Aramark in Texas and plans to engage in more merchant pilots throughout 2023 before the wide-scale rollout next year.

To use the service, consumers will need to complete an initial enrollment process with JPMorgan, which involves taking a selfie and providing payment card information. This data will be securely stored with the bank, enabling customers to opt for biometric checkout at participating merchants.

While there are perceived sensitivities surrounding biometrics, the bank is working diligently to ensure compliance with state and federal regulations and is employing best practices for privacy, consent, transparency, and data minimization. The bank believes that as consumers become more accustomed to using biometrics in various settings, such as mobile banking and airport security, confidence in the technology will grow.

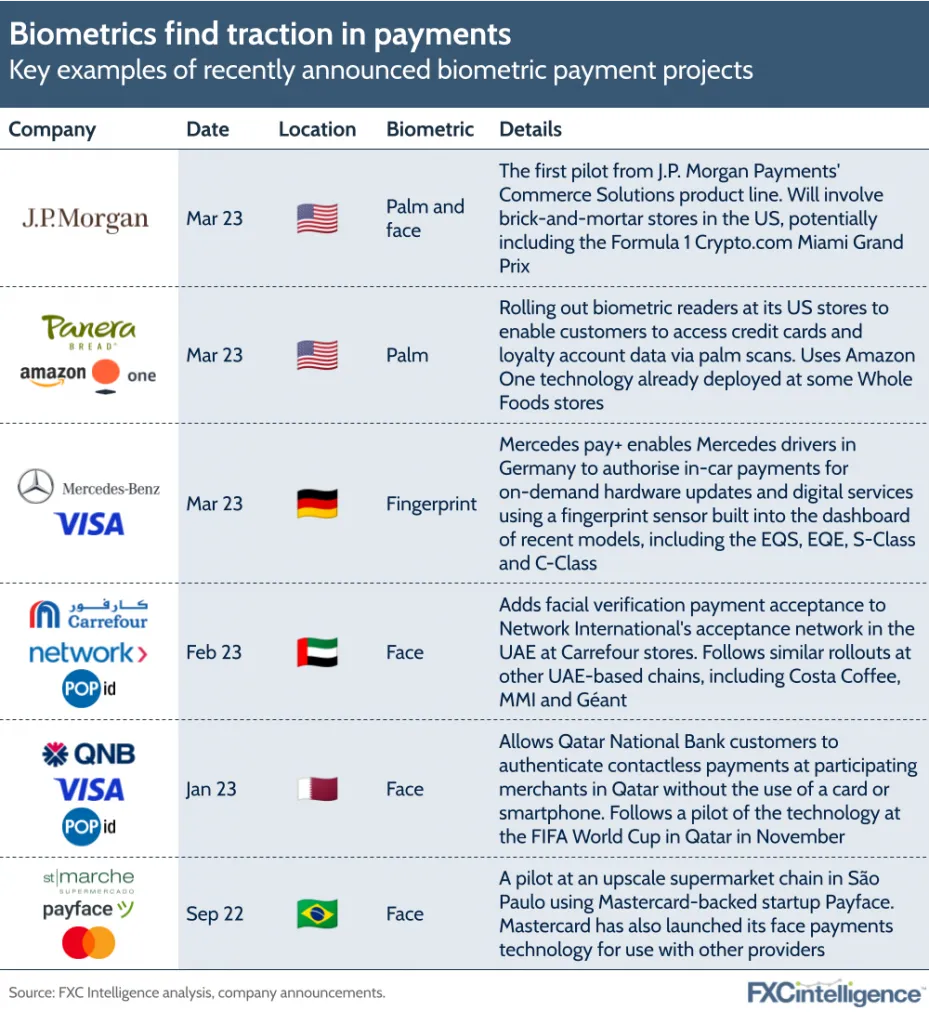

JPMorgan's move into biometric payments is part of a broader trend, with companies like Amazon AMZN 0.00%↑, Toshiba, Visa V 0.00%↑, and Mastercard MA 0.00%↑ also exploring this technology. Although there may be competition among providers, we can see more opportunities for collaboration, particularly in establishing industry standards crucial for widespread adoption.

✈️ THE TAKEAWAY

Why it matters? 🤔 As JPMorgan continues to invest in and refine its biometric checkout service, the bank is well-positioned to continue dominating the payments landscape. With its extensive merchant relationships and the launch of Commerce Solutions, a suite of cloud-based payments infrastructure and applications, JPMorgan is poised to offer a comprehensive, cutting-edge payment experience for both consumers and businesses. Looking ahead, the successful implementation of biometric payments could pave the way for even more innovative solutions, such as integrating loyalty programs, personalized promotions, and seamless returns and refunds. As consumer trust in biometrics grows and the technology becomes more sophisticated, JPMorgan's early adoption and ongoing investment in this space could cement its position as a leader in the digital payments revolution.

ICYMI: JPMorgan doubles down on growing the old-fashioned way: branches 🏦 [why it makes sense + a deep dive into JPM and how it recently made history]

Robinhood's third attempt to conquer the UK: will persistence pay off? 🤔

The launch 🚀 Robinhood HOOD 0.00%↑, the Silicon Valley-based commission-free trading app, has finally launched in the UK. Again and after two previous failed attempts 😬

But the company's timing seems to be spot-on, as the UK market is ripe for disruption, with a growing interest in retail investing and a desire for more accessible, low-cost trading options.

Let’s take a closer look at this.

More on this 👉 Robinhood's UK offering includes commission-free trading, zero foreign exchange fees, and an attractive 5% AER on uninvested cash and $2.25M FDIC protection. For the perspective, Revolut currently offers 5.10% APY in flexible accounts while Lightyear (a more direct competitor) has 4.5% APY on your GBP.

The company also provides access to over 6,000 US-listed stocks and plans to introduce local stocks and tax wrappers in the future.

However, its margin lending feature is currently on hold pending discussions with regulators.

Why UK? 🤔 The UK market presents unique challenges for US-based trading apps like Robinhood. European investors prefer localized offerings, including access to domestic stocks, local currencies, and tax-efficient investing vehicles.

Additionally, the UK has a well-established set of homegrown WealthTech startups, such as Freetrade or Lightyear, which have already captured a significant share of the market. Then there’s Public and WeBull which have recently entered the UK as well.

Despite these obstacles, Robinhood's persistence and strong brand recognition could work in its favor. The company's US success story and its ability to attract younger investors through user-friendly features and low costs may resonate with UK consumers looking for alternatives to traditional brokers. And once attracted, Robinhood’s gamified experience might keep them hooked and stay in the game for quite some time.

It won’t be easy… 👀 Even with all the potential upside and clear advantages, Robinhood's launch comes during a challenging economic environment in the UK, with a recent recession and increased tax burdens limiting individuals' investing capacity.

The company will also need to contend with changing attitudes towards investing, as many Britons prefer lower-risk options like cash savings accounts, especially in the current high-interest environment.

Finally, the tract record is against Robinhood’s favor - we still have very few examples of companies from the US making it huge in the UK/Europe in finance.

✈️ THE TAKEAWAY

What’s next? 🤔 Robinhood's success in the UK will essentially depend on its ability to adapt to local market conditions, offer competitive features, and effectively engage with potential customers. If leveraging its brand recognition and user-friendly platform, the company can navigate the regulatory landscape, introduce localized offerings, and capitalize on the growing interest in retail investing, it may finally gain a foothold in the UK market and disrupt the WealthTech landscape. Looking at the big picture, a successful UK launch could serve as a stepping stone for Robinhood's broader European expansion plans. By establishing a strong presence in the UK, the company can gain valuable insights and experience that will help it tailor its offerings to other European markets.

P.S. It seems like Robinhood is planning to run its European operations out of Lithuania 🇱🇹:

ICYMI: Robinhood posts surprise profit in Q4 2023, eyes return to growth 😳📈 [a closer look to see whether Robinhood is worth your time and money in 2024]

If you’re in FinTech, you’re in Media: Robinhood acquires Chartr 📊

Not just for degenerates: Robinhood is now luring wealthier investors 💸

ChatGPT buzz raises the bar for banking chatbot capabilities 🤖

Zoom out 🔎 In recent years, banking chatbots and virtual assistants have seen a significant uptick in usage, with consumers increasingly interacting with these AI-powered tools for their financial needs.

As generative AI (genAI) technologies like ChatGPT and Google Gemini gain prominence, customer expectations for these banking assistants are evolving, pushing banks to enhance their digital offerings.

Let’s take a look.

More on this 👉 A 2023 Corporate Insight survey revealed that 24% of credit card app users had engaged with a virtual assistant in the past six months, a substantial increase from just 4% in 2019. Bank of America's BAC 0.00%↑ virtual assistant, Erica, has experienced steady growth, boasting 18.5 million active users by Q4 2023.

This surge in adoption is attributed to enhanced in-app capabilities and the growing buzz surrounding gen AI. And to meet shifting consumer expectations, banks are redesigning their chatbot interfaces to resemble gen AI-powered search tools.

Bank of America's Erica now features a search bar instead of the traditional chat bubble, allowing users to interact more intuitively. While Erica has not yet incorporated genAI, its knowledge base and personalization have improved.

Zooming out, we must note that consumers value the proactive insights provided by gen AI and machine learning, such as personalized spending trackers and subscription monitoring. However, lingering negative perceptions from early, less sophisticated chatbots may hinder adoption.

To overcome this, gen AI-powered virtual assistants must deliver human-like responses and live up to the high expectations set by consumers' other AI interactions.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, the integration of gen AI in banking chatbots is expected only to accelerate, with a majority of financial services executives planning to leverage the technology for customer service and personalization. As these tools become more sophisticated, they have the potential to revolutionize the way consumers manage their finances and interact with their banks. Zooming out, it’s clear that the future of banking is increasingly digital, and genAI-powered chatbots will play a crucial role in shaping this landscape. Banks that successfully harness this technology to provide seamless, personalized experiences will likely gain a competitive edge. However, they must also navigate the challenges of data privacy, security, and ethical AI deployment to maintain customer trust. As the technology evolves, we can expect to see even more innovative applications of genAI in banking, ultimately transforming the industry and redefining the customer experience.

ICYMI: Klarna replaces 700 human agents with ChatGPT as it prepares for a $20 billion IPO in 2024 😳 [the time has come & how leveraging AI the BNPL giant has done one of the greatest comebacks in FinTech + more deep dives & reads on AI + Finance]

🔎 What else I’m watching

Monzo stake at sale 💸🏦 Monzo, a digital bank, is in advanced talks to sell a $50M stake to Singapore's Government Investment Corporation (GIC). The potential investment from GIC would broaden Monzo's spectrum of shareholders and could be announced in the coming weeks. Monzo has secured a valuation exceeding $5B and has amassed over nine million customers, diversifying its offerings to include investments and instant access savings accounts. The latest fundraising round is anticipated to be Monzo's final one before its planned initial public offering (IPO). Monzo recently restructured its corporate setup to establish Monzo Bank Holding Group, aiming to avoid regulatory issues in new overseas markets as part of its international expansion strategy preceding the IPO. Among Monzo's existing investors are Tencent, Passion Capital, Accel, and General Catalyst. ICYMI: Monzo's fresh $5 billion valuation and ambitious yet questionable US expansion plans 💰🇺🇸 [a recap of the current status, future plans + a deep dive into why Monzo is unlikely to succeed in the US]

dLocal-Ebury Partnership 🤝️ dLocal and Ebury have joined forces to offer enhanced payment solutions across Africa's major markets. This collaboration aims to provide cost-effective, reliable, and diverse payment methods to clients. dLocal's One dLocal service will enable Ebury to accept payments, send payouts, and settle funds globally without managing separate processors. Ebury, a global financial services company, will benefit from secure and efficient pay-in and pay-out management, improved costs, and delivery times. The partnership also allows Ebury to support merchants in accessing complex emerging markets and gain access to over 41 regions in Africa. ICYMI: Inside dLocal’s 2023 financials: emerging markets FinTech trailblazer poised for sustainable growth 🚀 [diving into their key numbers, uncovering what they mean & why this emerging markets FinTech might be worth your time and money in 2024]

N26 Launches N26 Crypto 🇫🇷💳 Banking challenger N26 has announced the launch of its new cryptocurrency trading product, N26 Crypto, in France. The new product will enable N26 customers and clients based in France to invest in crypto assets directly in their N26 application by leveraging the N26 Crypto service. The launch will also enable the company to offer users the ability to trade over 200 cryptocurrencies in a secure and efficient manner. N26 Crypto is expected to be a part of N26's strategy to optimize the way customers manage more aspects of their finances and meet their needs, preferences, and demands in an ever-evolving market. The new product was developed and launched in partnership with Bitpanda GmbH, which will manage the execution of trades and custody of coins. N26 also plans to launch more solutions across the investment space in the future. ICYMI: N26 turbocharges European expansion with high-yield savings accounts 💸 [what it’s all about & why it makes sense + bonus dives into N26 and their strategy]

💸 Following the Money

Zero-knowledge proofs startup Succinct Labs announced it has raised $55M in Seed and Series A financing round led by Paradigm.

Blockchain project Espresso Systems closed a $28M Series B funding round led by a16z crypto.

Morph, an Ethereum Layer 2 network developer, has raised $20M in seed and angel funding rounds.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Robinhood is the most interesting US startup coming to Europe

JPM is always one step ahead...