Global venture funding shows signs of cautious recovery in Q1 2024 😌📈; The Billion-Dollar (FinTech) Marketer: lessons from Ryan Reynolds💡

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

HUGE: PayPal enables PYUSD for international payments 💸 [a closer look at what it’s all about & why it’s a massive move]

Apple Card Savings account rate dips for first time since launch 😳 [what it means for Apple & why it’s brilliant news for Robinhood + a deeper dive into the stock trading FinTech giant & a holistic look at the Apple Card over the last 5 years]

Coinbase is first licensed crypto exchange in Canada 🍁 [why it’s BIG news & what’s next + a deep dive into the crypto giant]

JPMorgan launches Ad Platform & enters the media business 🎬 [why their ad platform is brilliant, their Super App ambitions + a deep dive into JPM & how FinTechs are media companies too]

ClearBank hits profitability amid rising interest rates & expanding customer base 📈

Nuvei to go private in $6.3B acquisition by Advent International 😲

Ripple joins stablecoin rush with plans for USD-pegged token 😲💸

As for today, here are the 2 fascinating FinTech stories that were reshaping the world of financial technology as we know it. This is one of the most interesting and rewarding weeks this year thus far, so make sure to check all the above stories.

Global venture funding shows signs of cautious recovery in Q1 2024 😌📈

Following the money 💸 After a challenging year for startups in 2023, the first quarter of 2024 showed some signs of improvement in the venture capital market, although investors still remain cautious.

I’ve read through the latest reports from CB Insights and Crunchbase (222+ pages) so you don’t have to.

Let’s take a look at the key findings.

More on this 👉 According to data from Crunchbase and CB Insights, global venture funding reached $66 billion in Q1 2024, a 6% increase from the previous quarter but still 20% lower than the same period last year. Progress, but could be better.

The largest rounds of the quarter went to AI and healthcare companies, with Anthropic, a leading AI startup, raising a whopping $3.55 billion across two rounds, and several biotech firms securing funding in the hundreds of millions.

The AI sector accounted for 17% of all global funding, while healthcare and biotech companies raised 24% of the total.

Early-stage funding saw a slight uptick, with $29.5 billion invested, a 6% year-over-year increase. However, late-stage funding took the biggest hit, dropping 36% compared to Q1 2023.

This indicates that investors are still hesitant to make large bets on more mature companies in the current economic climate.

The FinTech sector also showed resilience, with companies raising $7.3 billion in Q1 2024. While this represents a decrease from the record-breaking funding levels seen in 2021, it demonstrates the continued importance of financial technology in the startup ecosystem.

Notable FinTech deals included Monzo's $431 million Series I round and Bilt Rewards' $200 million Series C. As consumers and businesses increasingly adopt digital financial solutions, FinTech startups are well-positioned to capture growth opportunities in the coming quarters. Bullish!

ICYMI: Monzo's fresh $5 billion valuation and ambitious yet questionable US expansion plans 💰🇺🇸 [a recap of the current status, future plans + a deep dive into why Monzo is unlikely to succeed in the US]

On a positive note, the IPO market showed signs of life near the end of the quarter, with the successful public debuts of semiconductor company Astera Labs and social news site Reddit. Both companies saw their stock prices surge on the first day of trading, providing a glimmer of hope for startups looking to exit. Will we see more FinTech IPOs this year though?

ICYMI: Klarna's Resurrection: narrowing losses and preparing for the biggest IPO of 2024 🤑🔔 [a deep dive into their latest numbers to see what they mean & what’s next for Klarna + some solid bonus reads & further dives inside]

Geographically, the United States continues to dominate the venture capital scene, accounting for 39% of all deals in Q1 2024. Asia followed with 31% of deals, while Europe captured 24%. Latin America, Canada, Africa, and Oceania combined represented less than 6% of global deals.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, the venture capital market's recovery will likely be gradual and uneven. While the successful IPOs and large funding rounds in AI, healthcare, and FinTech are encouraging, many investors are still grappling with the liquidity challenges from 2022. As a result, founders will need to focus on efficient growth, profitability, and demonstrating clear value to secure funding in the coming quarters. Unsurprisingly, the increased interest in AI, healthcare, and FinTech startups yet again highlights the growing importance of these sectors in the post-pandemic world. As companies and consumers alike seek innovative solutions to address health concerns, leverage the power of artificial intelligence, and adopt digital financial tools, startups in these fields may find more opportunities to secure funding and scale their businesses. Q2 should be stronger.

P.S. to make the most out of Q2, use this:

The Billion-Dollar (FinTech) Marketer: lessons from Ryan Reynolds💡

Ryan Reynolds-backed FinTech giant Nuvei just got sold to Advent International for a whopping $6.3 billion 😳

This makes it the second-largest private equity deal in FinTech in recent memory. The biggest one is GTCR acquiring Worldpay for $11.4B.

But more importantly, this makes Reynolds the greatest marketer alive today. Here’s how he does it👇

But first...

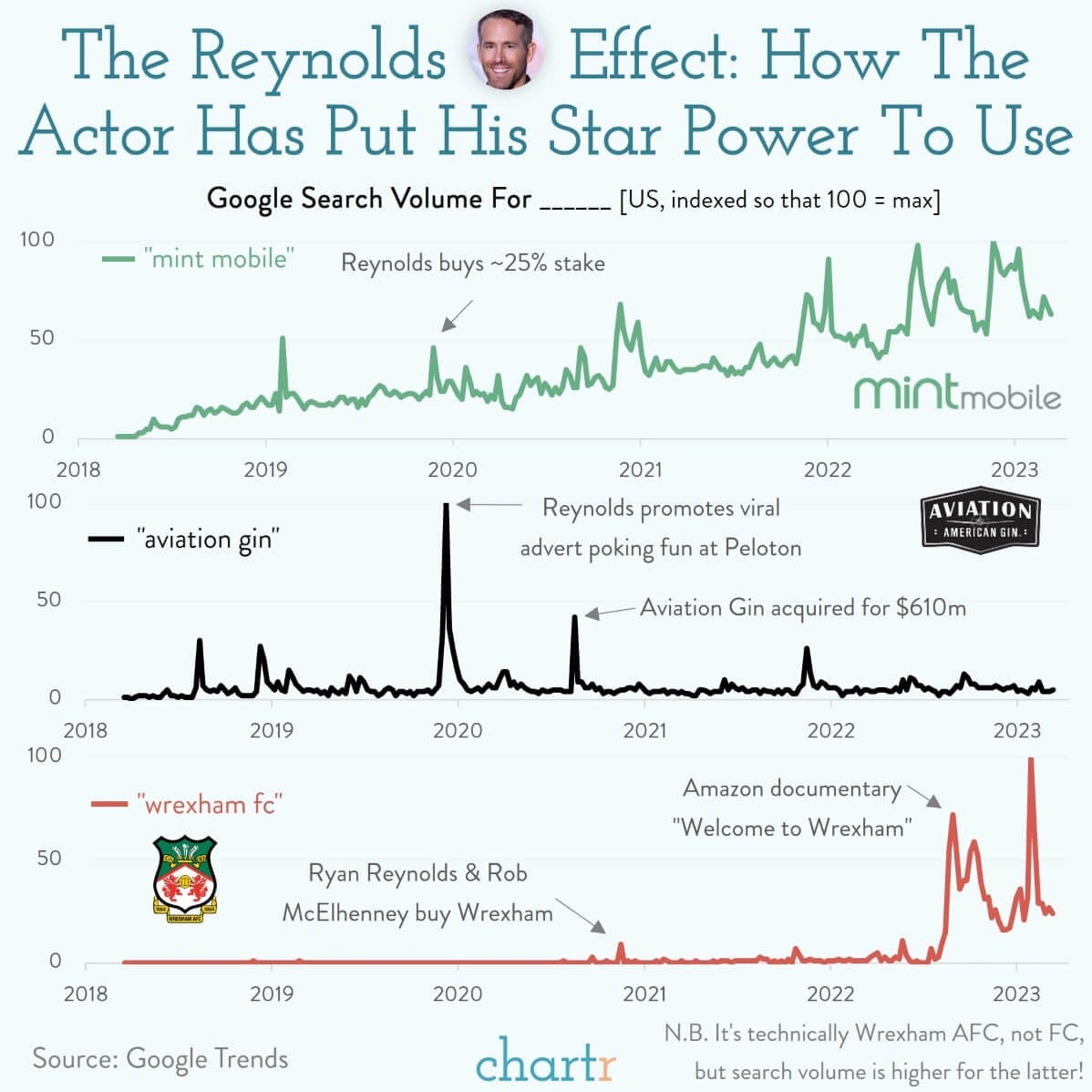

What do a Canadian payments processor, a struggling gin brand, a budget mobile carrier, and a small Welsh soccer club have in common? 🤔

That's right, they've all been touched by the marketing magic of Ryan Reynolds, propelling them to billion-dollar valuations.

The crazy part? Companies he co-owns or has sold are valued at more than $20 billion 🤯

So how does he do it?

Of course, at the core of it all is the Ryan Reynolds brand that took decades to build. But you can have a brand, be famous, and still fail or achieve only a fraction of what he managed to achieve.

Hence, leveraging your brand and executing on it is the key, and Ryan is a true master of it.

So what’s the secret then? It all boils down to Reynolds' unconventional approach.

He doesn't just invest money and sit back - he becomes the face and driving force behind the brands he believes in. With his signature wit and charm, Reynolds creates ads that are instant viral sensations, seamlessly injecting himself into the cultural narrative.

From capitalizing on the buzz around Taylor Swift's music re-recordings to turning around a hilarious Aviation Gin ad in just 36 hours featuring the actress from Peloton's controversial commercial, Reynolds has mastered the art of "fast-vertising."

He brilliantly rides the waves of trending topics, ensuring his brands are always at the center of the conversation.

But it's not just about speed.

Reynolds understands the power of equity. His biggest successes, like Aviation Gin and Mint Mobile, are companies where he owns a stake.

He's therefore not afraid to get personally involved, whether it's staging a fake feud with Hugh Jackman or becoming the voice of Mint Mobile's customer voicemails.

Perhaps most importantly, Reynolds reminds us that marketing doesn't have to be expensive or serious.

Some of his most effective ads are simple, low-budget productions that rely on great writing and comedic timing. In a world of stuffy corporate campaigns, Reynolds' approach is like a breath of fresh air.

So what can we learn from the billion-dollar marketer?

Be authentic, move fast, and don't be afraid to have fun.

Or as Reynolds himself might say, "In a world full of bland brands, be the gin that gives back."

ICYMI: Nuvei to go private in $6.3B acquisition by Advent International 😳 [why it makes sense & what can we expect next]

🔎 What else I’m watching

Soaring Bitcoin ETF volume 🚀 Cumulative monthly trading volume for spot bitcoin ETFs nearly tripled in March, reaching $111 billion compared to February's total of $42 billion. This significant increase highlights the growing interest in these new crypto-based financial instruments. Bloomberg Senior ETF Analyst Eric Balchunas noted the importance of last month's trading volume, stating that bitcoin ETFs traded $111 billion in March, nearly triple the volume of February and January. The spot ETFs issued by Grayscale, BlackRock, and Fidelity continue to dominate trading volume. However, Grayscale's GBTC fund surpassed $15 billion in total outflows since trading began in January, dropping 46% in bitcoin terms. In terms of assets under management, BlackRock and Fidelity's spot bitcoin ETFs hit about 18 billion and 10 billion, respectively, in March. Their products have also been the most successful in terms of inflows. ICYMI: Bitcoin breaks records again: the relentless rally fueled by institutional demand 📈💸 [analyzing the latest data, thinking about what’s next + two investment thesis for Bitcoin]

Amazon Ditches Just Walk Out Tech 🛒 Amazon is removing its cashierless "Just Walk Out" technology from its Fresh grocery stores in the US as part of a remodel. The technology, launched in 2018, uses sensors, cameras, and AI to track items customers take from shelves and charges them automatically through an app. Tony Hoggett, Amazon's SVP of grocery stores, told The Information that the company will now use smart shopping carts that let customers scan items as they go and take an automatic payment. The Just Walk Out system will still be available in Amazon Go stores and licensed to other retailers.

Embedded Finance market to reach $228B by 2028💰 The embedded finance market is set to grow by 148% over the next five years, according to a recent study by Juniper Research. The report predicts that revenue will exceed $228 billion by 2028, driven by advances in technology and specific use cases. Key use cases include multi-rail payments and the aggregation of open banking APIs. The B2B market is also highlighted for its growth prospects, with comprehensive product suites being deployed due to newly developed technologies. Embedded insurance is expected to grow by 125% over the next five years, driven by the prevalence of insurance offers on e-commerce platforms. The Asia-Pacific region is set to see significant growth, thanks to government promotion of digital insurance in countries like Singapore and Malaysia. However, the report suggests that embedded insurance remains an "uncommon offering" from many leading vendors, despite its significant growth potential. ICYMI: Here’s your gentle reminder that the Future of Finance is Embedded 🔗 [recap of why, what’s driving this + who’s doing this well right now]

💸 Following the Money

The web3 artificial intelligence firm Raiinmaker raised $7.5M in seed funding, bringing the firm's total funding to $10M.

Swedish startup Scayl, a debt financing platform based in Stockholm, has raised €100M to address a lending gap in the fintech sector. According to Scayl, which describes itself as a “fintech for fintech lenders”, the money will be immediately made available to fintech lenders.

The Bristol-based deep science VC firm Empirical Ventures has announced a first close of £8.25M for its first fund, which is targeting £10m. It’ll back pre-seed and seed-stage startups working on deeptech and techbio across the UK.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

thanks

VC recap was brilliant - thanks for sharing this.