Nubank partners with Wise to launch a global account & tap into travel banking 🌍💳; Robinhood unveils new media arm Sherwood News to expand beyond trading 📰; Most active Q1 VCs 💸

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Making Siri Great Again: Apple's ReALM aims to revolutionize voice assistants for smarter finance and beyond 🎙️🤖 [how it aims to revolutionize voice assistants for smarter finance + some deep dives into Apple’s advancements in AI & how it can transform FinServ]

BlackRock's assets soar to a record $10.5T. Thanks to Bitcoin 😳 [a quick recap of BlackRock’s Q1 2024 + some more bonus reads]

Deepfakes: the next frontier of financial fraud 🦹♂️ [a holistic view of the current status quo & some wild examples + what’s next]

Turning point for DeFi regulation? Uniswap faces potential SEC lawsuit 😳 [what it’s all about & why it could be a turning point for DeFi]

Revolut secures RBI approval for prepaid payment instruments in India 🇮🇳 [why this matters + a view of the Indian payments market & why Revolut hasn’t conquered it]

SVB 2.0? California banks face huge risks just one year after the biggest bank collapse in America since 2008 🫣 [is it Silicon Valley Bank 2.0? + a bonus read breaking down SVB’s collapse]

Klarna launches 'Wikipink' to promote transparency and challenge traditional credit models 📊💵 [what it’s all about & why it makes sense + some solid deep dives into Klarna and their possible 2024 IPO]

Coinbase's Layer 2 network Base thrives as interest in crypto surges 🚀 [looking at the latest numbers, what’s driving the crazy growth & why it matters + a bonus deep dive into Coinbase & why it’s still underrated]

As for today, here are the 3 brilliant FinTech stories that were changing the world of financial technology as we know it. This is one of the most intense and thrilling weeks this year thus far, so make sure to check all the above stories.

Nubank partners with Wise to launch a global account and tap into travel banking 🌍💳

The news 🗞️ Nubank, Brazil’s FinTech gem and one of the world’s largest digital banks with over 90 million customers, has partnered with Wise Platform to launch a new global account and international debit card for its premium Ultravioleta customers.

This marks an important step for Nubank into the travel segment and further strengthens Wise’s international growth ambitions.

Let’s take a quick look at the match that has been made in heaven.

More on this 👉 The Global Account will allow Ultravioleta users to instantly convert their balance from Brazilian Real to US Dollars and Euros directly in the Nubank app. It offers an exclusive conversion rate of 0.9%, the lowest in the segment, using commercial exchange rates and a reduced IOF tax of 1.1%. Nice!

This makes it up to 9% cheaper than using traditional credit cards abroad. More importantly, the associated debit card can be used in over 200 countries with no issuance or maintenance fees.

Additional perks include two free foreign ATM withdrawals per month, free international travel insurance, and 10GB of free roaming data valid for 30 days in over 40 countries. A similar service was recently launched by both Revolut and Western Union (more on this - below).

ICYMI: Western Union copies Revolut as it unveils global eSIM service 😳 [the USP & where’s the money + some more reads on Revolut]

This comprehensive offering aims to provide a seamless, cost-effective solution for Nubank's frequent traveler customer base.

✈️ THE TAKEAWAY

Why it matters? 🤔 First and foremost, the partnership is a massive win-win for both FinTech giants. For Nubank, it enables rapid entry into the lucrative travel financial services market, allowing them to monetize their substantial customer base of over 90 million users across Latin America and further grow revenue diversification. Meanwhile, for Wise, it represents another major partnership as they expand their presence in LatAm, solidifying Wise Platform's position as a preferred choice for banks and businesses globally. Looking ahead, we must note that the travel account has significant growth potential as Nubank's premium customer base expands. If successful, expect Nubank to extend similar offerings to its mass market. And this could be highly disruptive in Brazil where travel financial services are dominated by incumbent banks.

ICYMI: Nubank delivers strong growth & profitability, and is positioned to unlock substantial value for investors 🟣🚀 [going in deep to analyze NU’s latest performance, the most important numbers, uncover what they mean, & see how NU is perfectly positioned to unlock substantial value for investors + more reads and bonus dives]

Wise continues strong growth with upgraded 2024 guidance 🚀 [a look at their solid numbers & what they mean + what’s next & some bonus reads]

Robinhood unveils new media arm Sherwood News to expand beyond trading 📰

The launch 🚀 Stock trading platform Robinhood has officially launched its new media outlet Sherwood News as an independent subsidiary. The move marks a further expansion for Robinhood into the financial news and content space.

Let’s take a look.

More on this 👉 Sherwood News is led by editor-in-chief Joshua Topolsky, who began hiring a team of nearly two dozen veteran journalists last year from outlets like Bloomberg, The New York Times, and CoinDesk. The site features original reporting across the business, markets, tech, crypto, personal finance, and other topics.

It also incorporates Robinhood's existing Snacks newsletter, which is being rebranded and expanded with interactive elements like quizzes.

The USP 🥊 While Sherwood News is editorially independent and journalists can cover Robinhood with proper disclosures, the media arm aims to be a revenue-generating business for its parent company. It will start with an advertising-based model before potentially expanding to events and other revenue streams.

Topolsky sees an opportunity to cover business news in a voice and format tailored to younger investors.

Zooming out, we must note that the launch comes as Robinhood looks to grow its business after turbulent times. The retail trading company was fined $70 million in 2021 for systemwide outages and misleading communications that left clients unable to trade during key periods.

We can also remember that Robinhood has faced scrutiny over its practice of selling user transaction data to hedge funds and other third parties, which at one point accounted for the majority of its revenue.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, by expanding into financial media, Robinhood is clearly seeking to diversify its business, engage users, and bolster its brand. The move follows a pattern of media companies combining news and trading platforms, such as Yahoo Finance's acquisition of retail investor site CommonStock last year. However, in-house media outlets of larger companies have a mixed track record of financial success. Both Bloomberg Media and Barstool Sports, which was briefly owned by casino company Penn National, have struggled to turn profits. Now speaking about Robinhood, owning a media subsidiary is obviously both an opportunity and a risk. If successful, Sherwood News could drive user engagement, advertising revenue, and eventually subscription revenue if integrated as an investor tool. It could also repair Robinhood's reputation through high-quality, informative content. But if the media arm fails to resonate with audiences or runs into conflicts of interest, it could become a costly distraction and a huge flop. Execution is all that matters.

ICYMI: Robinhood posts surprise profit in Q4 2023, eyes return to growth 😳📈 [a closer look to see whether Robinhood is worth your time and money in 2024]

If you’re in FinTech, you’re in Media: Robinhood acquires Chartr 📊

Not just for degenerates: Robinhood is now luring wealthier investors 💸

Yahoo is moving into FinTech as Yahoo Finance acquires social investing platform Commonstock 🤑 [what’s the catch + why social investing could be a big thing]

Most active Q1 VCs 💸

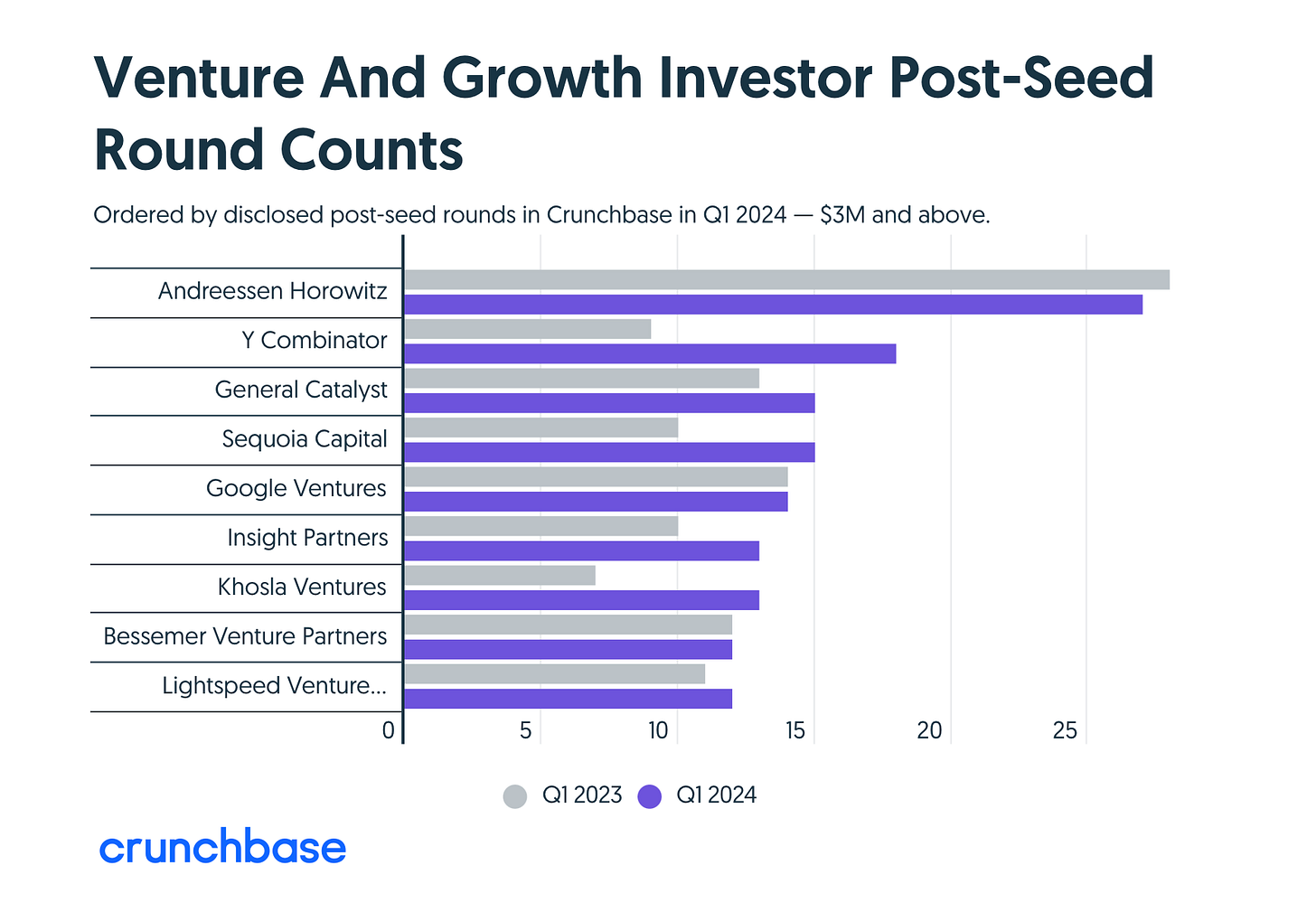

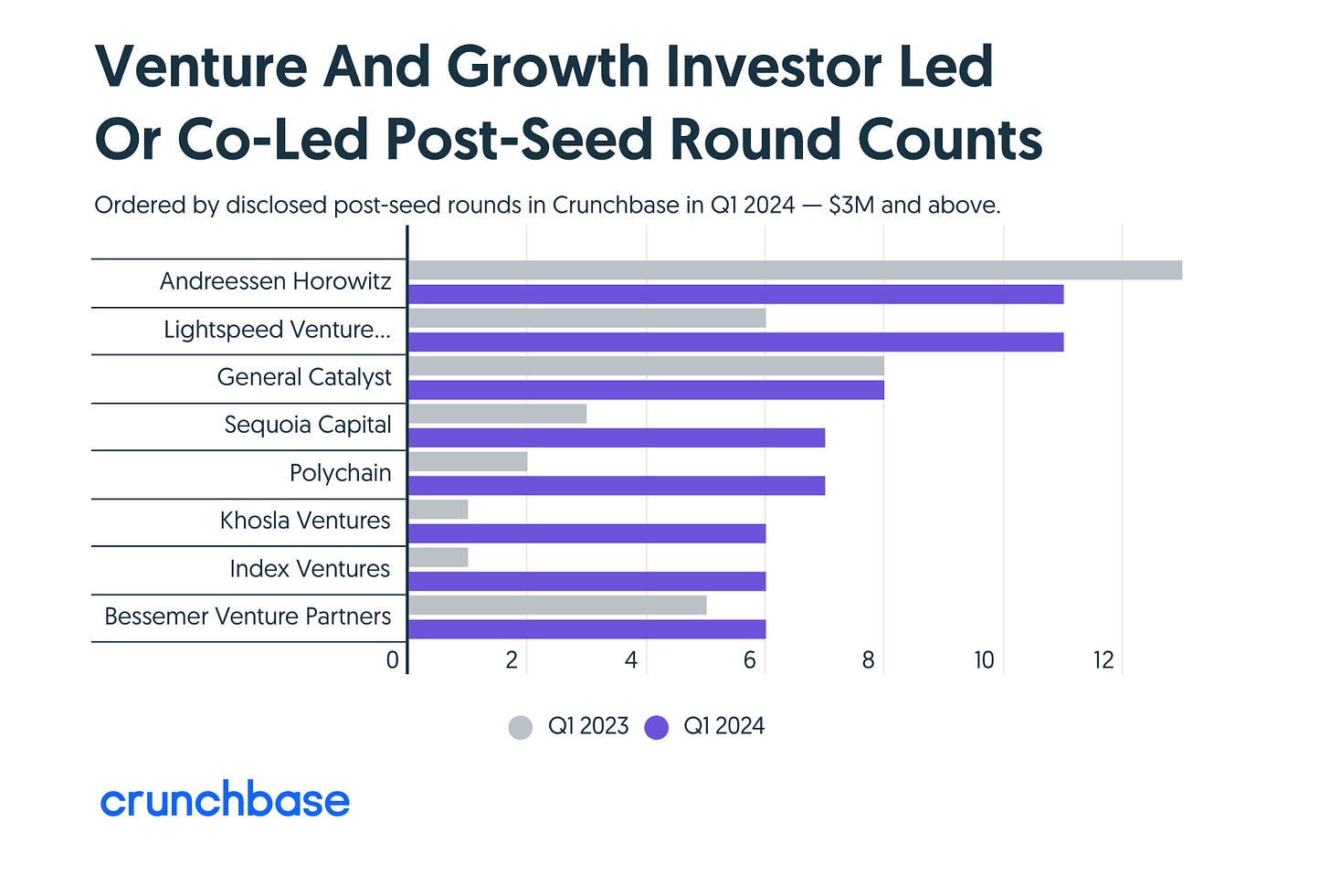

New data in 📊 Crunchbase’s latest data reveals that the firms once known for their prolific dealmaking have drastically reduced their activity in 1Q 2024, particularly in large late-stage deals.

However, amidst this shift, Andreessen Horowitz (a16z) and Y Combinator have emerged as the most active investors in the post-peak era.

Let’s take a quick look.

More on this 👉 In the first quarter of 2024, a16z participated in 27 post-seed rounds, outpacing all other venture investors. Y Combinator followed closely with 18 post-seed deals, while General Catalyst secured the third spot with 15 rounds. Notably, U.S.-based investors dominated the list of most active post-seed investors, although many of their investments were made in startups outside the country.

When considering lead investors, Andreessen Horowitz and Lightspeed Venture Partners tied for the top position, each leading or co-leading 11 rounds in Q1 2024. Once again, U.S.-headquartered firms dominated this category, with Index Ventures being a partial exception due to its dual headquarters in San Francisco and London.

Despite their continued activity, the most active investors are now financing smaller sums compared to the market peak in 2021. The number of venture and growth rounds exceeding $300 million has significantly decreased, with only 20 such deals in Q1 2024, compared to over 100 in Q4 2021.

In the seed funding arena, Y Combinator, Techstars, and Antler topped the charts in Q1 2024. Although seed funding has experienced a decline, with global seed companies raising just over $7 billion in Q1 (down by more than $1 billion year-over-year), the seed funding environment remains relatively robust.

The shift in the venture capital landscape is not only evident in the most active investors but also in the absence of certain prominent players. Tiger Global Management and SoftBank Vision Fund, known for their substantial late-stage investments during the market peak, have significantly curtailed their activity. Meanwhile, established firms such as Andreessen Horowitz, Sequoia Capital, Lightspeed, and Insight Partners continue to lead the pack.

✈️ THE TAKEAWAY

What’s next? 🤔 One thing is clear - the startup ecosystem continues to evolve, but the prominence of Andreessen Horowitz and Y Combinator as the most active investors in Q1 2024 proves their ability to adapt and maintain a strong presence amidst challenging market conditions. That said, with a focus on smaller deals and a more cautious approach to late-stage funding, entrepreneurs may need to adjust their fundraising strategies and expectations.

P.S. to make the most out of Q2, use this:

🔎 What else I’m watching

Coinbase + Apple Pay 🇬🇧 Coinbase has enabled UK users to buy digital assets using Apple Pay, aiming to expand crypto adoption amidst a market slowdown and low retail interest. This integration is part of Coinbase's efforts to increase the number of crypto holders in the United Kingdom. With Apple Pay, users can now purchase Bitcoin, Ether, and other digital assets using their iPhone's Apple Pay feature. Coinbase believes this integration offers a more secure and private way to buy crypto, as card numbers are not stored on the device or Apple servers. Instead, a unique device account number is assigned, encrypted, and stored in an industry-standard chip for storing payment information. More than 6 million adults in the UK are cryptocurrency owners, and the Apple Pay integration aims to raise this figure by reducing entry barriers to digital assets. ICYMI: Coinbase's Layer 2 network Base thrives as interest in crypto surges 🚀 [looking at the latest numbers, what’s driving the crazy growth & why it matters + a bonus deep dive into Coinbase & why it’s still underrated]

Bullish on crypto 😤 In an interview with CNBC on Sunday, Ripple CEO Brad Garlinghouse predicted the cryptocurrency market cap will likely double by the end of 2024 to surpass $5 trillion, driven by macroeconomic trends, The Block reported. Garlinghouse is bullish on the emergence of the U.S. spot Bitcoin ETFs and the upcoming Bitcoin halving event as key drivers for this growth. The Ripple CEO added that he expects more regulatory clarity on crypto in the U.S. should a new administration take office in the country following this year's election. We can remember that Ripple recently announced it is jumping into the USDT and USDC-dominated stablecoin market, with its U.S. dollar-pegged stablecoin expected to be launched on the XRP Ledger and Ethereum later this year. ICYMI: Ripple joins stablecoin rush with plans for USD-pegged token 😲💸

Nuvei Launches Invoice Financing Services 🇨🇦 Canada-based FinTech giant Nuvei has introduced new Invoice Financing services integrated into enterprise resource planning (ERP) platforms. This service allows merchants direct access to Nuvei's Invoice Financing solutions within their ERP systems, enabling optimized cash flow and more efficient unlocking of working capital. Nuvei's Invoice Financing solution enables businesses to expedite payments from any customer invoiced through their ERP with a single click. This service ensures prompt access to needed cash and offers favorable rates based on existing payment transaction data. ICYMI: Nuvei to go private in $6.3B acquisition by Advent International 😳 [why it makes sense & what can we expect next]

💸 Following the Money

Blockchain scaling infrastructure project Lumoz has raised $6M in a pre-Series A funding round, reaching a $120M token valuation.

TransferGo, the UK/Lithuania-based fintech best known as a consumer platform for global remittances, has raised a $10M growth funding round from Taiwan-based investor Taiwania Capital, to expand in the Asia-Pacific region. It last raised a $50M Series C funding round in 2021.

Revolut and Spotify-backer Lakestar has closed $600M (€552M) to invest in European companies in DeepTech, AI, healthcare, digitalization, and FinTech.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

can't wait to go into this - thanks

a16z isn's sleeping