“You either die a FinTech or live long enough to see yourself selling ads” - Revolut 📢💸; Monzo Flex captures 20% of UK's BNPL market 😳; Klarna sells Hero in a strategic shift 💸🤝

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Towards AI-driven Finance: Apple acquires another AI startup to boost on-device LLM processing 🍎🤖 [what this is, why it’s significant + a deeper dive into how it can power Apple’s lead in building AI-driven finance & more bonus reads]

Fiserv: a FinTech Powerhouse poised for sustained growth 📈🚀 [a closer look at the FinTech powerhouse that’s poised for sustained growth & whether it’s worth your time and money in 2024]

Adyen's resilient growth crowned with market selloff: a brilliant buying opportunity for long-term investors? 🤔 [why the current market selloff is a brilliant opportunity for long-term investors + some bonus deep dives into Europan FinTech superstar]

Visa's strong Q2 2024 results demonstrate resilience and growth potential 🚀 [analyzing the most important numbers, seeing what they mean, & what’s next for Visa + some bonus deep dives to learn more]

Stripe brings back crypto payments with USDC stablecoin 😳 [what it’s all about & why it matters + more bonus reads on Stripe & why we might not see them IPOing anytime soon]

AI-powered marketing - the future of consumer engagement in banking? 🤔 [could it be the future of consumer engagement in banking + some bonus dives into JPMorgan, one of the leading banks in all things AI]

Franklin Templeton enables peer-to-peer transfers for tokenized treasury fund 💸

As for today, here are the 3 brilliant FinTech stories that were changing the world of financial technology as we know it. This is one of the most intense and exciting weeks this year thus far, so make sure to check all the above stories.

“You either die a FinTech or live long enough to see yourself selling ads” - Revolut 📢💸

The news 🗞️ FinTech giant Revolut is embarking on a new strategic endeavor to diversify its revenue streams by monetizing customer data through targeted advertising partnerships.

Let’s take a quick look at this.

More on this 👉 The company has recently hired Inam Mahmood, former head of e-commerce partnerships at TikTok UK, to spearhead a dedicated sales team of approximately 30 individuals for this so-called media strategy.

According to Antoine Le Nel, Revolut's Head of Growth, the FinTech firm aims to capitalize on its vast user base and the data insights gleaned from their in-app behavior, FT reported.

By understanding users' interests and navigation patterns within the app, Revolut seeks to create a media business where it can monetize its audience through targeted advertising.

The company has reportedly set an ambitious internal target of generating around £300 million in advertising revenue by 2026, a significant portion of its total revenue. Revolut has reportedly already garnered interest from advertisers and distributors keen on partnering with the FinTech giant.

✈️ THE TAKEAWAY

Looking ahead 👀 First and foremost, it must be noted that Revolut's foray into the media business comes at a time when the private FinTech sector isn’t living its best days. We can once again remember that despite securing a $33 billion valuation in a SoftBank-led funding round in 2021, Revolut's implied valuation by investors like Schroders has fluctuated, dropping to $18 billion in 2022 before rebounding to circa $26 billion by the end of 2023. That probably coincided with the fact that the fintech posted a £25 million pre-tax loss in 2022, a stark contrast to the £40 million pre-tax profit it achieved in 2021, primarily driven by a surge in cryptocurrency trading. Ups.

ICYMI: Is Revolut now worth 45% more?! 🤔 [latest revaluation & why it means so little + some bonus reads]

To achieve sustainable profitability, Revolut is therefore exploring various avenues to diversify its revenue streams beyond traditional banking services. In addition to its new media strategy, we can remember that the company has recently launched a mobile phone e-SIM, enabling customers to access mobile data while traveling (though this is more of a cross-sell and bundle package to incentivize users to subscribe to premium plans).

ICYMI: Revolut takes on telecoms with eSIM launch 😮📱[why this makes sense + some bonus deep dives into a FinTech giant]

As for ads, well it’s a very good business. In fact, many people don’t realize how much ad revenue big tech & marketplaces are pulling in:

Amazon AMZN 0.00%↑: $46.9 billion (2023)

Uber UBER 0.00%↑: $1 billion (projected in 2024)

Instacart CART 0.00%↑ : $870 million (2023)

Advertising is essentially turning tech into free cash flow machines, and that’s exactly why JPMorgan JPM 0.00%↑ recently made a similar move into this as well. I guess you either die a FinTech or live long enough to see yourself selling ads.

ICYMI: JPMorgan launches Ad Platform & enters the media business 🎬 [why their ad platform is brilliant, their Super App ambitions + a deep dive into JPM & how FinTechs are media companies too]

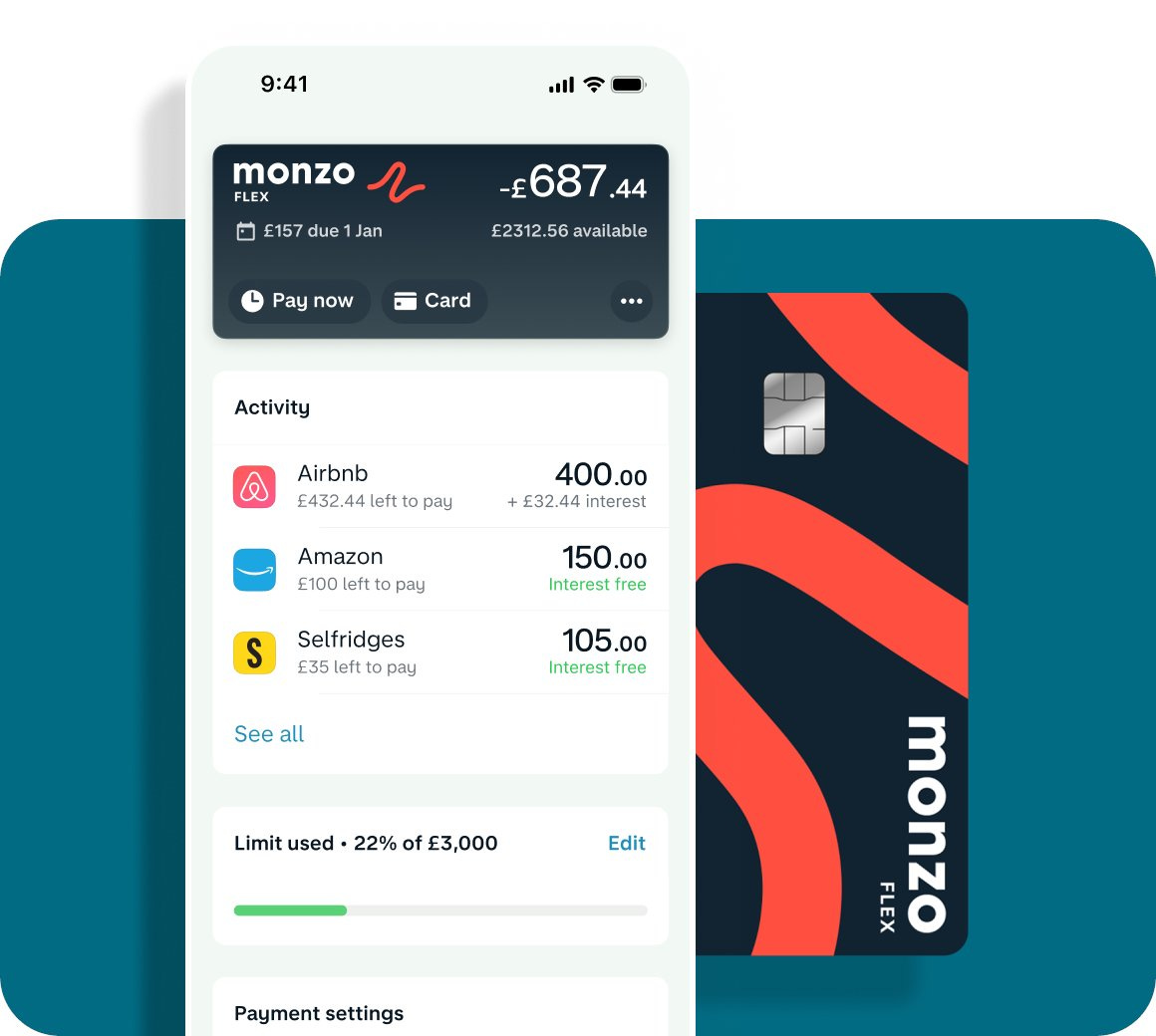

Monzo Flex captures 20% of the UK's BNPL market 😳

The news 🗞️ London-based FinTech gem Monzo has made significant strides in the UK's Buy Now, Pay Later (BNPL) market with its Flex credit card. Launched in late 2021, the card allows customers to spread the cost of purchases over three months interest-free.

According to research by credit technology company Render, Monzo's Flex card has helped the company capture a 20% stake in the BNPL market in just one year. That’s solid! 👏

Let’s take a quick look at this and see why it matters.

More on this 👉 While Monzo conducts affordability checks and offers credit limits of up to £3,000 when users sign up for Flex, the study also found that BNPL transactions do not consistently appear on credit histories. Over half of the customers analyzed who were known to use BNPL did not have it reported on their credit reports. This raises concerns about the accuracy of customer indebtedness assessments and the potential for debt accumulation.

The Render Report also revealed that the average BNPL transaction count has increased across all age groups, indicating a shift towards funding more routine expenses rather than large single-ticket items.

Monzo maintains the stance that Flex is a fully regulated credit card product, with customers undergoing comprehensive credit and affordability checks that are reported to credit providers. The company also highlights the transparency and flexibility it offers customers regarding repayments, without charging late or hidden fees.

✈️ THE TAKEAWAY

What’s next? 🤔 First, let’s zoom out. The popularity of BNPL products has surged since the start of the pandemic, with an estimated 14 million adults in the UK using these products in 2023. That’s huge! The Financial Conduct Authority (FCA) research found that regular BNPL users were more likely to have missed payments on bills or credit commitments and to have increased their debt on credit products over the past year. Having said that, as BNPL continues to grow, it is crucial to strike a balance between providing valuable benefits to consumers and ensuring adequate protections, especially for vulnerable individuals. Regulators and industry stakeholders must thus collaborate to establish clear guidelines and standards for BNPL products. This may include mandating the reporting of BNPL transactions to credit agencies, enhancing affordability assessments, and promoting financial education to help consumers make informed decisions. Because BNPL is here to stay.

ICYMI: Monzo's fresh $5 billion valuation and ambitious yet questionable US expansion plans 💰🇺🇸 [a recap of the current status, future plans + a deep dive into why Monzo is unlikely to succeed in the US]

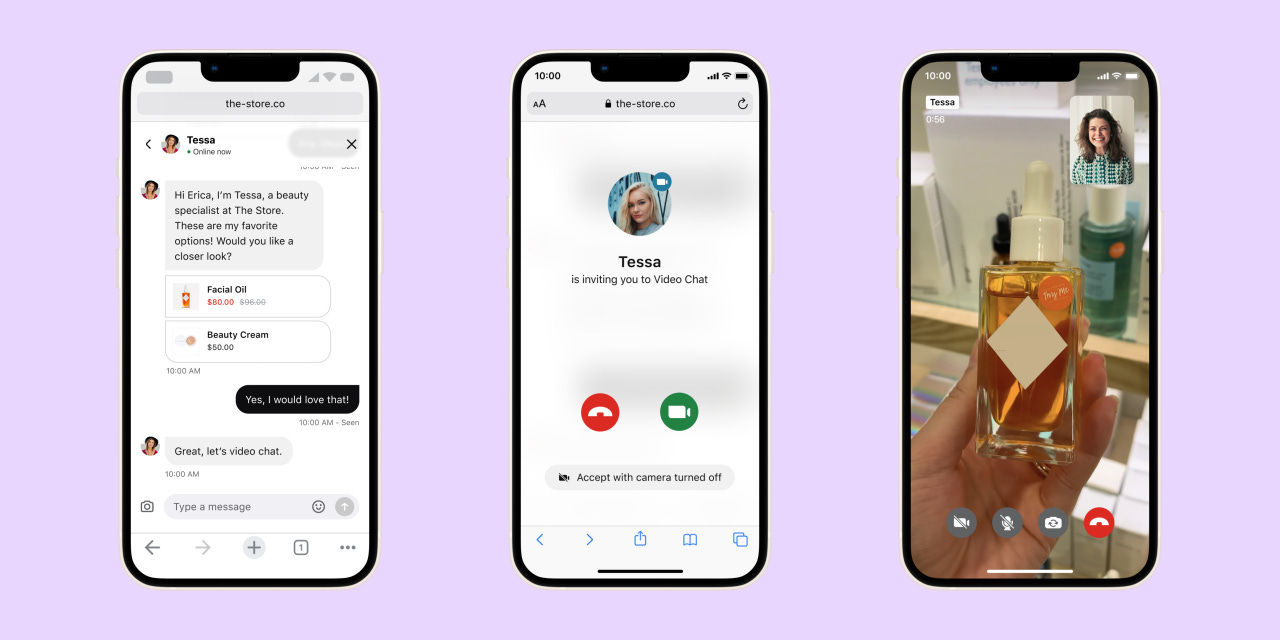

Klarna sells Hero's assets to Bambuser in a strategic shift 💸🤝

The news 🗞️ Swedish buy-now-pay-later (BNPL) giant Klarna has sold the assets of Hero, a virtual shopping platform it acquired in 2021, to Stockholm-based video commerce company Bambuser.

The deal, valued at around $1.3 million, will see Bambuser gain Hero's technology which enables brands to connect online shoppers with product experts via text, chat, and video.

Let’s take a quick look at this.

More on this 👉 When Klarna bought Hero for $160 million three years ago, it planned to offer a virtual shopping solution to its 250,000 retail partners to enhance the online customer experience. However, Klarna is now offloading the business while retaining the Hero brand and over 100 employees.

The most expensive part? Klarna basically spent $158M for a branding exercise 🤷♂️

Nevertheless, looking at the big picture, this sale comes as Klarna looks to streamline operations and focus on its core offerings as it prepares for a potential IPO. This follows a trend of companies divesting acquisitions made during the era of ultra-low interest rates aka the ZIRP.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, selling Hero's assets allows Klarna to refocus on its core payments and BNPL business while still offering virtual shopping capabilities through its partnership with Bambuser. The move may impact the range of services Klarna can provide to its retail partners in the short term though… Looking ahead, Klarna will likely continue optimizing its operations and product offerings to position itself for long-term profitability and growth. This could involve further strategic partnerships, a greater emphasis on its banking services, and expansion into new markets as it aims to become a more comprehensive financial and retail ecosystem beyond just payments. And go public, of course 😎

ICYMI: Klarna doubles down on the US with a credit card launch 💳🇺🇸 [why it makes sense & what’s Klarna’s unfair advantage + a solid deep dive into the BNPL giant]

🔎 What else I’m watching

EU to Approve Apple's NFC Access Offer 📱 EU antitrust regulators are poised to approve Apple's AAPL 0.00%↑ proposal to open up NFC chip technology for third-party payment providers on iPhones. The agreement, expected as early as May, will resolve a 2022 antitrust case and help Apple avoid potential billion-dollar fines. The 10-year deal covers all third-party mobile wallet app developers in the EEA and allows defaulting of preferred payment apps, access to authentication features, and a suppression mechanism. Despite progress in Europe, Apple faces similar issues in the US. The key question now is this - will this move pave the way for increased competition in mobile payments? ICYMI: Towards AI-driven Finance: Apple acquires another AI startup to boost on-device LLM processing 🍎🤖 [what this is, why it’s significant + a deeper dive into how it can power Apple’s lead in building AI-driven finance & more bonus reads]

Visa Launches Stablecoin Analytics Dashboard 📊 Visa V 0.00%↑ has partnered with Allium Labs to create the Visa Onchain Analytics Dashboard, offering clear insights into stablecoin activity using aggregated blockchain data. The dashboard provides information on active users, volumes by coin and blockchain, transaction sizes, and an evolving set of metrics. While a popular social media chart suggests stablecoin volumes are approaching Visa's levels, Visa's dashboard reveals a more complex picture, adjusting for bot-driven transactions and showing a significant discrepancy between total and bot-adjusted transfer volumes. ICYMI: Visa's strong Q2 2024 results demonstrate resilience and growth potential 🚀 [analyzing the most important numbers, seeing what they mean, & what’s next for Visa + some bonus deep dives to learn more]

Klarna and Uber Join Forces for Global Payments 🚗 Klarna has partnered with Uber UBER 0.00%↑, offering users immediate or deferred payment options for taxi and food delivery services. Currently live in the US, Germany, and Sweden, Klarna's Pay Now feature enables one-click, full payments. Users in Sweden and Germany can also bundle purchases into a single monthly payment aligned with their salary cycle. This collaboration aims to enhance Uber's localized payment experience. ICYMI: Klarna doubles down on the US with a credit card launch 💳🇺🇸 [why it makes sense & what’s Klarna’s unfair advantage + a solid deep dive into the BNPL giant]

💸 Following the Money

Money moving platform TabaPay is to acquire the rival assets of bankrupt Banking-as-a-Service platform Synapse.

Only1 has announced the closure of a strategic investment round of $1.3M, led by Newman Group, bringing its total funds raised to $4.8M to build an adult content platform on Solana.

Insurtech PeppercornAI has raised £3.25M in its latest funding round. The funding, of which Wealth Club raised £1.9M, included high net worth investors, existing investors EHE Capital and Angels Invest Wales.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Everything is an Ad Network a you said on LinkedIn.