Revolut democratizes bond investing across Europe💰🇪🇺; Shift4 expands reach in Europe with strategic acquisitions 🇪🇺; Visa doubles down on bolstering small business growth 📈

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Elon Musk’s 𝕏 unveils ambitions to dominate digital payments 📲💸 [a deeper dive into this Everything App, uncovering what Elon’s master plan is all about & what’s next for 𝕏 + lots of bonus reads and deep dives inside]

Apple shuts down Apple Pay Later 😳 [what it’s all about & what’s next + some bonus deep dives into Apple’s new BNPL strategy & how Apple Intelligence will change everything]

HUGE: Revolut aims for a $40 billion valuation in a share sale 😳📈 [what it’s all about & why it’s huge + unpacking the most important numbers and data so we could see the bigger picture here & some bonus reads on Revolut and its biggest competitors]

Wise's price-led growth strategy is all that matters 📉💸 [why their price-led growth strategy is all that matters + a bonus deep dive into Wise & why their current stock price could be an early gift for us]

BBVA set to launch digital bank in Germany to rival JPMorgan 😳🇩🇪

Consumers open to AI in Banking, but data privacy concerns persist 👀

As for today, here are the 3 brilliant FinTech stories that were changing the world of financial technology as we know it. This is one of the most thrilling and intense weeks this year thus far, so make sure to check all the above stories.

Revolut democratizes bond investing across Europe💰🇪🇺

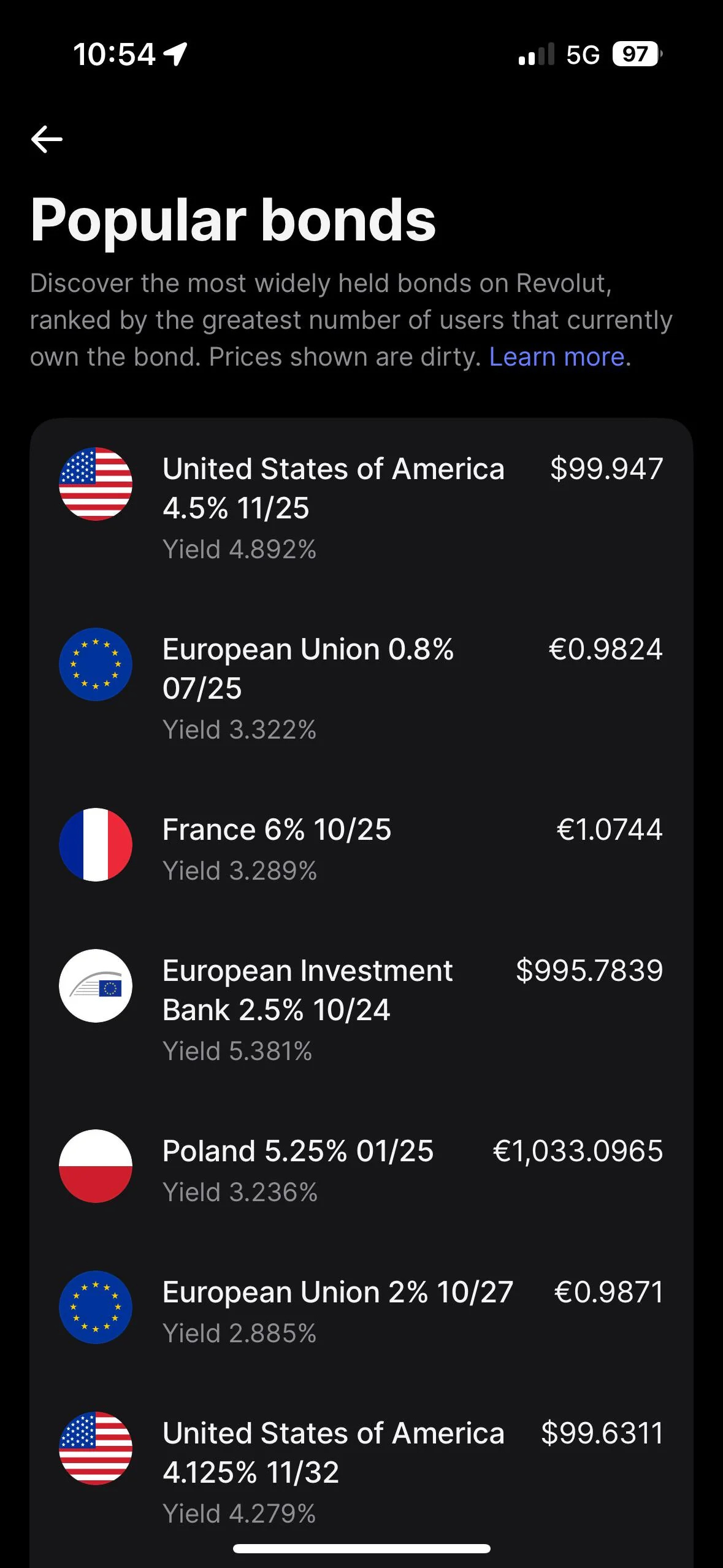

The news 🗞️ Financial technology giant Revolut has just made a significant move to expand its investment offerings by enabling customers across the European Economic Area (EEA) to trade corporate and government bonds directly through its app.

This new feature, powered by GTN's instant click-to-trade functionality, allows users to invest in bonds with a minimum amount of just €100 (or $100), at a fixed fee of 0.25% per trade.

Let’s take a quick look at this and see why it matters.

More on this 👉 This is a big and very positive piece of news as the introduction of bond trading on Revolut's platform is a major step towards democratizing access to fixed-income assets for retail investors.

The thing is that traditionally, investing in bonds has been challenging for individuals with smaller capital due to high minimum investments and complexities associated with accessing a broader range of assets.

By offering fractional bonds and a user-friendly UI, Revolut and GTN are thus breaking down these barriers, enabling more people to diversify their portfolios and potentially benefit from the stability and returns that bonds can offer.

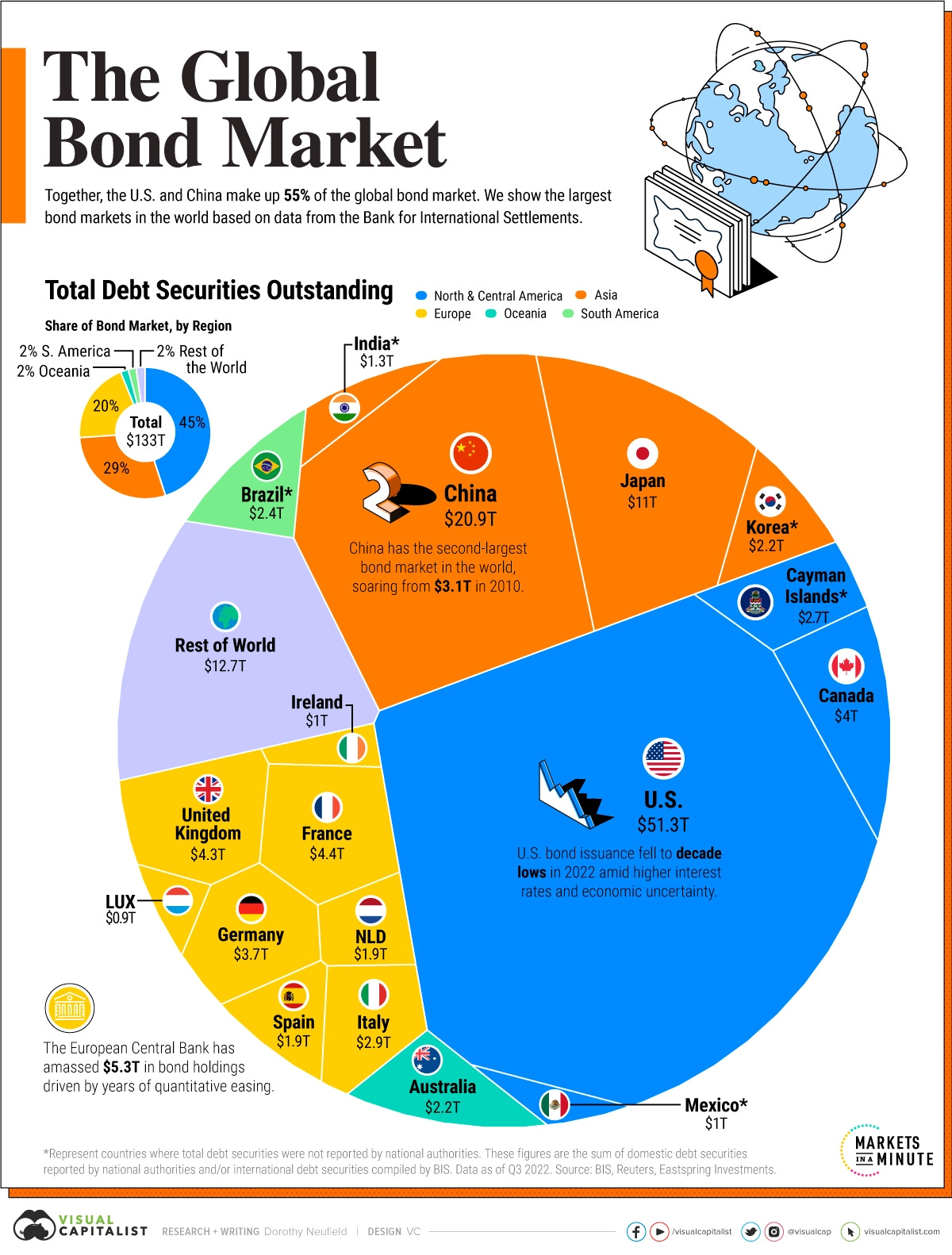

Zoom out 🔎 Revolut's bond trading feature comes at a time when the global bond market stands at an impressive $100 trillion, and bond investing is gaining popularity among investors seeking to hedge against economic uncertainty.

The platform currently offers close to 40 corporate and government bonds, with plans to expand the list in the coming months. This initiative aligns with Revolut's mission to build a comprehensive, multi-asset investment platform that caters to both beginner and advanced users across EEA markets.

Looking at the big picture, the collaboration between Revolut and GTN yet again signifies a growing trend in the FinTech industry, where companies are striving to make a wide range of investment opportunities more accessible to the masses (remember the most recent example of Apple AAPL 0.00%↑ + Affirm AFRM 0.00%↑).

ICYMI: Deal of the year: Affirm partners with Apple Pay to expand BNPL reach 👏😎 [why it’s a deal of the year, what it means for both giants + a bonus deep dive into Affirm and why it’s about time to be very bullish on them]

As Revolut continues to expand its investment offerings, including the recent removal of custody fees for UK and EEA customers, it is clear that the company is very much committed to being the single point of contact of its users for all things finance aka to become to ultimate Super App.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that the introduction of bond trading on Revolut's platform is a good and very positive piece of news for everyone. As more retail investors gain access to fixed-income assets, we can expect increased market participation and liquidity. This, in turn, may lead to greater competition among FinTech platforms, driving innovation and further democratization of investment opportunities. As a result, traditional financial institutions may need to adapt and innovate to remain competitive in the face of growing FinTech disruption. Looking at the big picture, Revolut's introduction of bond trading for its EEA customers is yet another crucial development in the company's journey towards becoming a global financial super app. By expanding its investment offerings to include fixed-income assets, Revolut is taking a significant step in providing a comprehensive, all-in-one financial platform that caters to the diverse needs of its growing user base. As the FinTech giant continues to prioritize customer needs and push the boundaries of what's possible in the world of digital finance, it is well on its way to realizing its vision of becoming the world's go-to platform for all things money.

ICYMI: HUGE: Revolut aims for a $40 billion valuation in a share sale 😳📈 [what it’s all about & why it’s huge + unpacking the most important numbers and data so we could see the bigger picture here & some bonus reads on Revolut and its biggest competitors]

Shift4 expands reach in Europe with strategic acquisitions 🇪🇺

The news 🗞️ Payments FinTch Shift4 FOUR 0.00%↑ has just made some significant strides in expanding its global presence through two key acquisitions.

The company recently acquired a majority stake in German point-of-sale (POS) system supplier Vectron Systems and completed its purchase of US-based Revel Systems.

Let’s take a quick look at this, see why it matters, and what’s next for Shift4.

More on this 👉 Vectron, with approximately 65,000 POS locations across Europe representing €25 billion in volume opportunity, provides Shift4 with a substantial customer footprint in the region. The acquisition also includes Vectron's distribution network of around 300 POS resellers. Shift4 plans to integrate its payment services into Vectron's current offerings, providing a comprehensive POS and payments solution to the European market. Big win 👏

Simultaneously, the completion of the Revel Systems acquisition I discussed earlier grants Shift4 access to over 18,000 merchant locations in the US and internationally, translating to a $17 billion payment opportunity. More importantly, Revel's direct sales and dealer distribution network is expected to accelerate the distribution of Shift4's SkyTab solution both domestically and abroad.

ICYMI: Shift4 to acquire rival POS firm Revel further strengthening market position 💸

These strategic moves position Shift4 at the forefront of the convergence between software and payments in the restaurant and hospitality sectors. By unlocking synergies, expanding distribution, and monetizing payments for large existing install bases, Shift4 is poised to redefine commerce and simplify complex payment ecosystems worldwide.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Shift4's acquisitions of Vectron and Revel mark a significant milestone in the company's growth and expansion plans. By strengthening its presence in Europe and the US, Shift4 is well-positioned to capitalize on the increasing demand for integrated payment solutions in the restaurant and hospitality industries. More importantly, the company's ability to leverage local expertise, infrastructure, and distribution networks in Europe and beyond may give it a competitive edge over other players in the industry (i.e. Toast, Square, etc.). Looking at the big picture, as businesses increasingly seek integrated, all-in-one solutions for their payment needs, Shift4's expanded global presence and comprehensive offerings is setting a new standard in the market. And this is yet another reason to be bullish on this underrated FinTech giant 😎

ICYMI: Shift4: poised for stellar growth despite recent selloff 🚀 [breaking down their latest numbers & why it’s one of the most undervalued FinTechs on the market right now]

Visa doubles down on bolstering small business growth 📈

The news 🗞️ Global payments giant Visa V 0.00%↑ has revamped its SavingsEdge program to better support small businesses in the United States and Canada.

The program, which has been providing eligible Visa Business cardholders with savings, tools, and resources for over a decade, now boasts a range of new features designed to encourage smarter spending and increased savings.

Let’s take a quick look at this and see why it matters.

More on this 👉 The enhanced SavingsEdge platform includes an upgraded website with improved functionality, a wider variety of merchant offers through Instant Coupons and Cashback Offers, real-time notifications for cashback earnings, and a savings tracker.

These updates aim to attract more small businesses to Visa-branded payment products, potentially boosting the company's revenues.

The timing of these enhancements aligns with the findings of the recent Visa Small Business Pulse survey, which indicates a positive outlook for small businesses in the U.S. The survey reveals that 77% of businesses expect revenue growth in 2024, 59% are optimistic about the economy (up from 47% in 2023), and 64% are interested in investing in cost-saving technology.

Zooming out, the revamped SavingsEdge program is a significant move for Visa, as it demonstrates the company's commitment to supporting the growth and success of small businesses. This initiative not only benefits Visa by potentially increasing the adoption of its payment products but also contributes to the overall health of the small business ecosystem.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Visa's decision to enhance its SavingsEdge program is a strategic move that could yield two key benefits for the company:

Increased adoption of Visa-branded payment products: by offering a more attractive and comprehensive savings program, Visa aims to encourage more small businesses to use its payment products. As more businesses opt for Visa Business cards, the company's TPV and revenues are likely to grow.

Stronger relationships with small business customers: the revamped SavingsEdge program demonstrates Visa's commitment to supporting small businesses, which could lead to increased loyalty and trust among this important customer segment. By providing valuable tools and resources, Visa can position itself as a preferred partner for small businesses, fostering long-term relationships and reducing the likelihood of customers switching to competitors.

Looking at the big picture, Visa's SavingsEdge program also serves as a prime example of how financial institutions can play a vital role in supporting their growth and success. The future of small business finance looks promising, with the potential for more targeted, tech-driven solutions that can help these businesses thrive in an increasingly competitive landscape. Another well-timed move from Visa 👏

ICYMI: Visa's strong Q2 2024 results demonstrate resilience and growth potential 🚀 [analyzing the most important numbers, seeing what they mean, & what’s next for Visa + some bonus deep dives to learn more]

🔎 What else I’m watching

Brex Transitions to Single-CEO Model 👨💼 Spend management FinTech Brex is shifting to a single-CEO model, with co-founder Pedro Franceschi becoming the sole CEO and fellow co-founder Henrique Dubugras moving to board chair. The change aims to improve decision-making and support the company's goal of going public in 2025. Dubugras will remain committed to Brex and keep many external responsibilities. Brex recently cut 20% of its workforce and reduced cash burn, putting it on track for profitability. The co-founders remain close friends and look forward to continuing their partnership.

Unit Finance Cuts 15% of Staff ✂️👩💼 Embedded finance FinTech Unit has laid off 15% of its workforce, approximately 25 employees, due to slower revenue growth and plans to become profitable without additional funding. Co-founders Itai Damti and Doron Somech announced the decision in a blog post, emphasizing the need for efficiency and long-term thinking. Unit, founded in 2019, serves 1.38 million end customers and has an annualized transaction volume of $28.7 billion. The company aims to become profitable independently and maintain a strong balance sheet. Unit joins other FinTech firms like Treasury Prime and Paxos in laying off employees this year. Ouch.

Vipps MobilePay Enables P2P Payments Across Denmark, Norway, & Finland📱💰Vipps MobilePay has launched a person-to-person (P2P) payment service between Denmark, Norway, and Finland, allowing users to send money using just a phone number. The new feature eliminates the need for IBANs for cross-border transfers, which cost 4% of the transaction amount for senders while receiving payments is free. The service will soon expand to include payments to 325,000 merchants and organizations using Vipps MobilePay in the three countries, with Sweden joining later this year. The merger of Danske Bank-owned MobilePay and Vipps in 2021 created a Nordic mobile payments leader with over 11 million customers.

💸 Following the Money

Prosper, the UK WealthTech founded by Tandem and Nutmeg alumni has hit its £800,000 Crowdcube target before launching to the public.

Warsaw-based Wealthon, which provides financial support to SMEs and entrepreneurs, raised PLN 50M (~€11.5M) in debt funding from CVI Dom Maklerski.

Citi has made a strategic investment in Numerated as part of a wider partnership with the AI-powered modular commercial lending platform.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Thanks for another great read! Really enjoyed it.