Paradigm shift: Revolut receives its UK banking license paving the way for the new era 🏦; HUGE: Ether ETFs are finally making waves on Wall St. 🌊; Capital One-Discover merger's legal challenge 🤕

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Despite the pullback, Visa continuous digital dominance in Q3 2024 😤💸 [deep dive and breakdown of the most important numbers, what they mean & what’s next for Visa + some bonus dives into key competitors]

Nasdaq's diversification pays dividends, but valuation demands caution 👀💸 [breaking down their latest Q2 2024 financials, what they mean & whether Nasdaq is worth your time & money in 2024 + a bonus deep dive into this financial powerhouse]

Despite huge profit jump in Q2, Discover Financial is balancing between digital ambitions & M&A potential 👀⚖️ [breaking down the most important numbers, what they mean, & whether DFS 0.00%↑ is worth your time & money in 2024 + a bonus deep dive into one of their biggest competitors]

Fiserv’s Q2 2024: a FinTech fortress still poised for sustained growth 🏦🚀 [analyzing their latest numbers, what they mean & why the FinTech giant is still poised for sustained growth]

Revolut faces scrutiny as UK fraud complaints soar 😳📈 [what’s happening & why it matters + bonus deep dive into Revolut’s latest financials]

Why bank marketers are still nervous about AI? 🤔🤖 [recaping the latest data, what it means & what’s next + some bonus reads on AI + Banking & Finance]

The litmus test for UK FinTech & capital markets as Ebury eyes $2.5B London IPO 😳🇬🇧 [what it’s all about & why it matters for UK, FinTech, and everyone else]

Stripe bolsters merchant of record capabilities with Lemon Squeezy acquisition 🤝💰

As for today, here are the 3 incredible FinTech stories that were transforming the world of financial technology as we know it. This is one of the most interesting and thrilling weeks this year so far, so make sure to check all the above stories.

Paradigm shift: Revolut finally receives its long-awaited UK banking license paving the way for the new era 😳🏦

The BIG news 🗞️ After a three-year journey, London-based FinTech giant Revolut has finally secured a UK banking license from the Prudential Regulation Authority (PRA).

This milestone marks a significant step in the company's evolution and its ability to compete with traditional banks in its home market.

Let’s take a quick look at this and see why it matters.

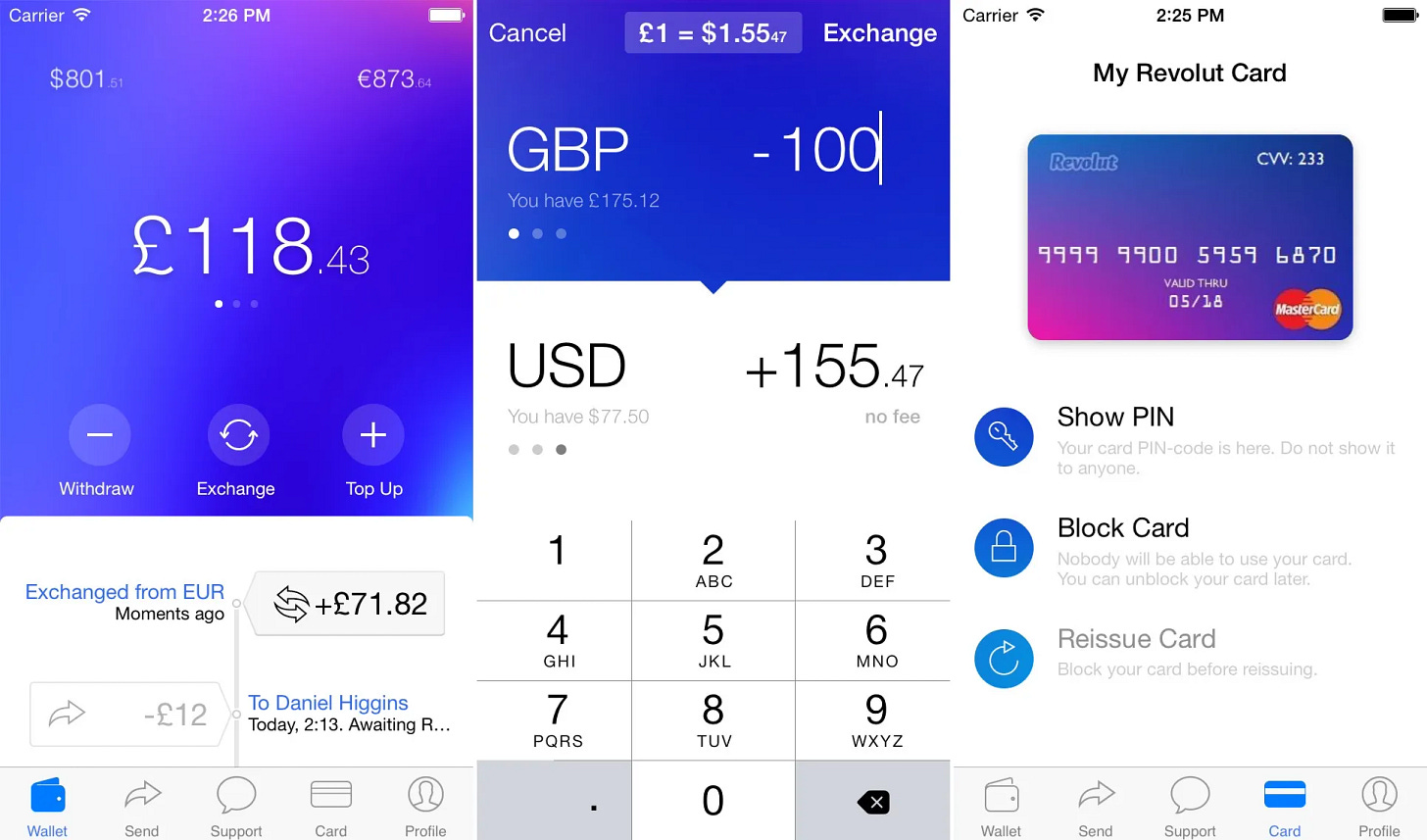

More on this 👉 We can remember that founded in 2015, Revolut has rapidly grown to serve 45 million customers globally, with 9 million in the UK alone.

The company, which started as an e-money institution offering services like checking accounts and foreign currency exchange, can now expand into traditional banking services such as lending and savings products.

The license comes with initial restrictions, a common practice for new banks in the UK. Revolut will thus enter a mobilization phase, allowing it to build out its banking infrastructure before fully launching these new services. This process could take up to a year and means the following:

Revolut can hold only £50,000 of total customer deposits.

Customers will remain with its Financial Conduct Authority-approved e-money entity until a full UK bank launches.

But more importantly, this means that the neobank last valued at $33 billion can now offer overdrafts, loans, and savings products to more than 9 million of their consumers in the United Kingdom.

For the perspective, the biggest competitor Monzo has $9.7M while Starling Bank counts ~4M customers in the UK.

ICYMI: Starling Bank’s latest financials: soaring profits, but gathering clouds 🌤️ [breaking down their latest annual report, uncovering the most important numbers & what’s next for Starling + a bonus deep dive into Monzo & why it’s super exciting]

Monzo’s first profitable year and high-growth opportunities ahead 🚀 [breaking down the key numbers & what they mean, looking at what’s ahead + a few bonus dives into Monzo]

JPMorgan Investor Day 2024: positioning for strength, & roadmap for dominance in the digital age 🚀 [breaking down the key takeaways from the massive event & how the firm's strategic vision positions it for unparalleled success in the future + some bonus deep dives into JPM]

The approval follows a period of scrutiny and challenges, including concerns about the company's share structure and a warning from auditors about revenue verification in its 2021 accounts.

Revolut has since addressed these issues, restructuring its ownership and improving its financial reporting.

ICYMI: Revolut’s 2023 financials: a FinTech rocket with astronomical growth, but regulatory asteroids loom 🚀☄️ [breaking down the key facts & figures, uncovering the most important numbers & what’s next for Revolut + bonus deep dives into Starling Bank, Monzo and JPMorgan]

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Revolut can now more directly challenge traditional banks, potentially forcing them to innovate and improve their services to retain customers. Again. On top of that, with the ability to offer a full range of banking services, Revolut may introduce new products tailored to the UK market, such as mortgages and personal loans. Furthermore, the UK banking license brings Revolut under the Financial Services Compensation Scheme, potentially boosting customer confidence in the platform and bringing in another lever for growth. But most importantly, the success in obtaining a UK license may help Revolut in its efforts to secure banking licenses in other key markets, such as the United States (they have huge ambitions there). The next phase in Revolut’s journey begins today 🚀

ICYMI: HUGE: Revolut aims for a $40 billion valuation in a share sale 😳📈 [what it’s all about & why it’s huge + unpacking the most important numbers and data so we could see the bigger picture here & some bonus reads on Revolut and its biggest competitors]

HUGE: Ethereum ETFs are finally making waves on Wall Street 💸🌊

The BIG news 🗞️ Ethereum exchange-traded funds (ETFs) have officially launched in the United States, marking a significant milestone for the world's second-largest cryptocurrency.

Eight issuers debuted their ether ETFs on Tuesday allowing both institutional and retail investors easier access to Ethereum exposure through traditional financial instruments.

Let’s take a quick look at this, see why it matters, and what’s next.

More on this 👉 The launch saw impressive first-day trading volumes, with over $1 billion in shares changing hands across the various funds.

Grayscale's Ethereum Trust led the pack with $469 million in volume, followed by BlackRock's BLK 0.00%↑ Shares Ether Trust at $258 million.

Despite the strong trading activity, the price of Ethereum (ETH) remained relatively stable, trading around $3,479 with minimal movement over the past 24 hours and week.

Zoom out 🔎 Analysts have varying expectations for the ETFs' performance. Some predict inflows of $750 million to $1 billion per month for the first five to six months, while others estimate total inflows of $4.7 billion to $5.4 billion over the initial six-month period.

These projections are more conservative compared to the bitcoin ETFs, which have amassed more than $76 billion in combined market cap since their January launch.

The introduction of Ethereum ETFs is seen as another step towards the mainstream adoption of cryptocurrencies. It allows for easier integration of crypto exposure into retirement accounts like 401(k)s and IRAs.

However, some experts note that the lack of staking options in these ETFs may deter certain investors looking for additional returns.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, the launch of Ethereum ETFs represents a significant development for both Ethereum and the broader cryptocurrency industry. As these products gain traction, they should lead to increased institutional investment in Ethereum, potentially driving up demand and price in the long term. That said, the success of these ETFs may pave the way for similar products based on other cryptocurrencies, such as Solana, or even diversified crypto funds. This trend could further legitimize the crypto asset class in the eyes of traditional finance and regulators. However, the immediate price stability of ETH following the ETF launch suggests that much of the anticipation may have already been priced in. Moving forward, the true test will be sustained inflows and the ETFs' ability to attract a diverse investor base beyond existing crypto enthusiasts. Zooming out, this is also a bullish thing on Coinbase COIN 0.00%↑ given the role they’re playing in shaping crypto. So watch this closely!

ICYMI: HUGE: Coinbase teams up with Stripe to revolutionize crypto payments 😳🪙 [what it’s all about & why it’s huge + bonus deep dives both in Coinbase & Stripe]

Capital One-Discover merger faces legal challenge 🤕🔎

The news 🗞️ Capital One's COF 0.00%↑ proposed $35 billion acquisition of Discover Financial DFS 0.00%↑ is facing legal opposition from customers concerned about potential anticompetitive effects.

The merger, announced in February 2024, would create the largest U.S. credit card issuer by balance and the sixth-largest U.S. bank by assets.

Let’s take a quick look at this.

More on this 👉 Two Capital One customers from Vermont and New Jersey have filed a proposed class action lawsuit in federal court in Alexandria, Virginia. The plaintiffs argue that the merger would violate U.S. antitrust law, potentially reducing competition and driving up prices for consumers.

They are seeking either to prevent the merger entirely or to require measures such as asset divestment to address anti-competitive concerns.

The lawsuit contends that the existence of Discover and American Express AXP 0.00%↑ as independent entities currently pressure competitors to offer rewards to customers. The plaintiffs fear this competitive force would diminish significantly post-merger.

Capital One has defended the merger, stating that it would actually drive competition in credit card and payment processing markets. The company argues that even after the merger, the combined entity would only account for about 13% of credit card purchasing volume, suggesting limited market dominance.

The case has drawn attention from regulators and lawmakers. Some members of Congress have called for U.S. regulators to block the deal, while the Federal Reserve and Office of the Comptroller of the Currency recently held a public meeting to address the acquisition plan.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the legal challenge to the Capital One-Discover merger highlights the growing scrutiny of consolidation in the financial services sector. If successful, this lawsuit could significantly impact both companies' strategic plans and potentially reshape the competitive landscape of the U.S. credit card market. For Capital One and Discover, the immediate future likely involves a protracted legal and regulatory battle. They will need to convince both the court and regulatory bodies that the merger will not harm competition. This process could delay the deal's completion and might require the companies to make concessions or structural changes to gain approval. Zooming out, the outcome of this case could set a precedent for future mergers in the financial industry. If the court blocks the merger or requires significant divestitures, it may deter similar large-scale consolidations in the sector. Conversely, if the deal proceeds with minimal changes, it could encourage further consolidation among financial institutions. So watch this out!

ICYMI: Despite a huge profit jump in Q2, Discover Financial is balancing between digital ambitions and merger potential 👀⚖️ [breaking down the most important numbers, what they mean, & whether DFS 0.00%↑ is worth your time & money in 2024 + a bonus deep dive into one of their biggest competitors]

🔎 What else I’m watching

Green Dot Fined $44M💰📉 The US Federal Reserve has fined Green Dot, a US-based FinTech and bank company, $44M for several 'unfair and deceptive practices' and deficient risk management. Green Dot, headquartered in Texas, allegedly violated consumer law in marketing its prepaid debit cards and tax return preparation payment services. The Central Bank also claimed that the company improperly blocked accounts of legitimate customers who received unemployment benefits and lacked the necessary policies to address these errors. In response, Green Dot's CEO, George Gresham, stated that the issues related to practices from several years ago have been addressed, and the company is committed to further mitigating these shortcomings while working with relevant regulators.

Klarna Enhances Security with New Payment Service Integration 🔒💳 Swedish payments giant Klarna has integrated a new payment service into Klarna Payments to improve checkout security. The integration follows Klarna's acquisition of German-based company Sofort in 2014, which marked its entry into the Open Banking sector. Sofortüberweisung will now be available as part of Klarna's 'Pay Now' options. Earlier this year, Klarna extended the Sofortüberweisung service to additional markets, including the UK. The integration allows users to manage Sofortüberweisung payments within the Klarna app, offering greater convenience and increased security through Klarna's two-factor authentication system. Customers must create a Klarna account to use these features, and 95% of Sofort users have already made the transition. The name 'Sofortüberweisung' will continue to appear in the payment process for German users. In February, Klarna introduced 'Sign in with Klarna,' a new service that expedites online purchases by automatically filling in user details.

HSBC Australia Blocks Payments to Crypto Exchanges 🚫💸 HSBC's HSBC 0.00%↑ Australian branch has notified customers that it will block payments to cryptocurrency exchanges, citing concerns over scams. This action aligns HSBC with other major banks that have taken similar measures to protect customer funds. In a communication to customers on July 24, HSBC Australia stated that it would block transactions to cryptocurrency exchanges deemed potentially fraudulent, referencing data from Australia's competition and consumer regulator that indicated Australians lost up to $171M in investment scams in 2023. The bank acknowledged the inconvenience but emphasized its commitment to protecting customer assets. HSBC's decision follows actions taken by Australia's major banks, including Commonwealth Bank, National Australia Bank (NAB), Westpac, and Australia and New Zealand Banking Group (ANZ), which implemented similar restrictions over the past year.

💸 Following the Money

Fragment, which offers a ledger API that makes real-time, double-entry accounting accessible to engineers without having to learn a whole new accounting vocabulary, raised $9M from Stripe, Jack Altman, BoxGroup, and others.

Igloo, the parent company of the popular NFT brand Pudgy Penguins, has raised over $11M in a strategic funding round led by Peter Thiel's Founders Fund to develop a new Layer 2 blockchain Abstract.

Italy's UniCredit has entered into a binding agreement to acquire the entire share capital of European Banking-as-a-Service platform Vodeno and Belgian digital bank Aion.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Fabulous issue as always - thanks for doing this.