Revolut takes on trading giants Robinhood & eToro with its new retail wealth app 😳📈; PayPal goes all-in: crypto now open for business 😤💸; Mercado Libre aims to revolutionize Mexican banking 🏦🇲🇽

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Justice Department sues Visa over alleged debit card monopoly 👀💳 [why it matters & what’s next + bonus deep dives both into Visa & Mastercard]

Bitcoin soars past $66,000 as ETFs attract significant inflows 🤑📈 [what does this tell us & what can we expect next + bonus reads on finance giants that are now doubling down on crypto]

Visa is acquiring Featurespace to bolster AI-driven fraud prevention 🤖💸 [why it matters & what’s next + bonus deep dives into both Visa & Mastercard]

AI chatbot gets the green light for stock-picking advice 🤖✅ [what it’s all about & why it matters + bonus reads on other FinTech giant crushing it in AI]

Amazon and PayPal join forces for Buy with Prime 🤝💳 [what’s the value add here, why it matters + bonus reads on PayPal & Adyen]

Klarna and Adyen join forces to revolutionize in-store payments 💳🛍️ [what does it tell us & what can we expect next + bonus dive into both Klarna & Adyen]

Walmart's bold move: partnering with Fiserv for real-time payments 👀🏦 [why it makes sense & what it tells us about the future + a bonus deep dive into Fiserv and whether it’s worth your time and money in 2024]

Stripe is showing signs of IPO 🤫 [a look into their latest developments & why Stripe IPO matters + more bonus dives into the FinTech giant]

BNY Mellon to offer crypto ETF custody 😳🏦 [why it matters & what’s next + a bonus deep dive into Coinbase that might soon get more competition]

Chime taps Morgan Stanley for 2025 IPO 😳🔔 [why it matters + some bonus reads on Chime & its biggest competitor]

As for today, here are the 3 increcible FinTech stories that were changing the world of financial technology as we know it. This was one of the most intense and interesting weeks in 2024 so far, so make sure to check all the above stories.

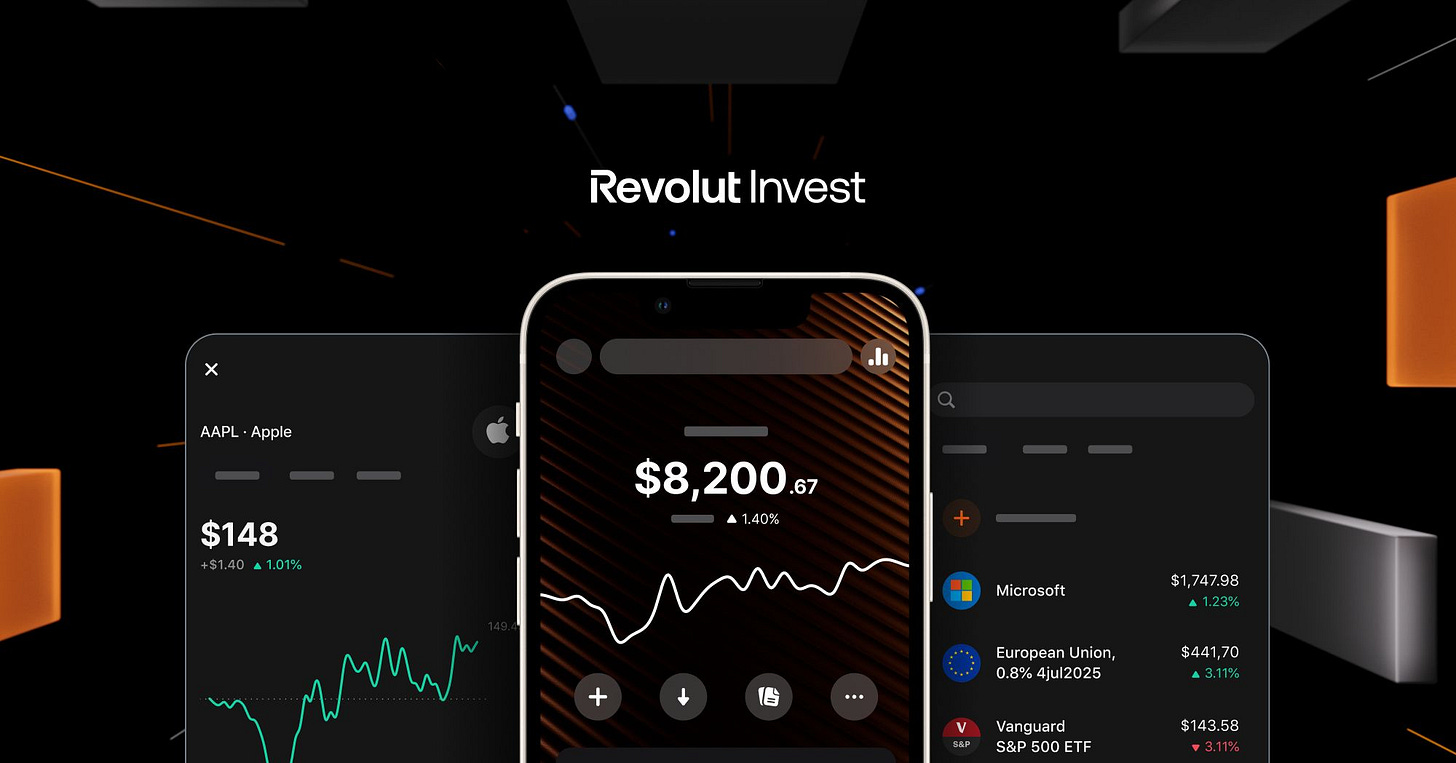

Revolut is taking on trading giants Robinhood & eToro with its standalone retail wealth app 😳📈

The BIG news 🗞️ In a bold move to capture a larger share of the retail investor market, Europe's most valuable FinTech Revolut is launching a standalone wealth management app called Revolut Invest.

This strategic spin-off of its €8.5 billion ($9.5 billion) wealth management offering aims to compete directly with established industry players like Robinhood HOOD 0.00%↑ and eToro.

Let’s take a quick look at this and see why it matters.

More on this 👉 Upon debut, Revolut Invest will:

Offer nearly ~5,000 assets on the launch, including US and European stocks, ETFs, commodities, bonds, and new products such as CFDs.

Equity and bond investments will face a flat fee of either 0.25% or €1 while charges for CFDs may vary.

Currently undergoing testing in Greece, Denmark, and the Czech Republic, the app will be introduced in other European Economic Area countries by the end of the year, as per Revolut.

This move is part of CEO Nik Storonsky's vision to transform Revolut into a "truly global bank" rivaling industry giants like JPMorgan Chase JPM 0.00%↑ and Barclays.

ICYMI: JPMorgan expands small-town presence, bucking branch closure trend 🏠👋 [what it’s all about and why it matters + a bonus deep dive into JPM & how it’s crushing it in AI + Finance]

By creating a standalone app, Revolut thus aims to attract new customers beyond its existing banking user base, potentially opening up a vast new market of retail investors.

✈️ THE TAKEAWAY

What’s next? 🤔 Valued at $45 billion, Revolut aims to be the Global Super App but having a separate WealtTech offering makes a lot of sense: (1) It can tap into the wave of retail investors returning to the markets as central banks around the world start to cut interest rates; (2) Revolut will be able to target new customers who aren’t already using its banking services thus leveraging this as a customer acquisition funnel for the main app while at the same time offering premium services & new subscription tiers (which would bring extra revenue, grow ARPU & potentially even bump their valuation further). Impressively, assets under management in Revolut's wealth offering have almost tripled to €8.5 billion, from €3 billion at the end of 2023 🤯 For the perspective, Robinhood currently holds more than $140B in AUC. Yet, Revolut's size and valuation could give it a significant advantage in this crowded field. The company was recently valued at $45B, more than double the market capitalization of Robinhood. This financial strength, combined with Revolut's existing customer base of 45M users (over 3M already use its investment services), positions the company well for this new venture. Retail trading space is about to get super interesting 🍿

ICYMI:

Robinhood's profitable growth trajectory: a diamond in the rough or fool's gold? 🤔💳 [a deeper dive into their Q2 2024 numbers, what they mean & whether you should be bullish on HOOD 0.00%↑ in 2024 + some bonus reads inside]

PayPal goes all-in: crypto now open for business 😤💸

The news 🗞️ In a move that further solidifies its position in the cryptocurrency space, payments giant PayPal PYPL 0.00%↑ has announced the expansion of its digital asset capabilities for US merchants.

As of September 2024, US-based businesses can now buy, hold, and sell cryptocurrency directly through their PayPal business accounts, mirroring the functionality already available to individual users since 2020.

Let’s take a quick look at this, see why it matters, and what’s next.

More on this 👉 This expansion allows merchants to engage more deeply with digital currencies, potentially opening up new avenues for commerce and investment. PayPal is also enabling US merchants to transfer cryptocurrencies to third-party eligible wallets, facilitating greater flexibility in managing their digital assets. Nice! 👏

The decision comes as a response to increasing demand from business owners for crypto functionalities similar to those offered to consumers. However, this new feature will not be immediately available to businesses in New York State, likely due to regulatory considerations.

Zoom out 🔎 This expansion builds upon PayPal's ongoing efforts to integrate cryptocurrencies into its ecosystem. In 2023, the company launched its own US dollar-backed stablecoin, PayPal USD (PYUSD), which has since reached a market cap of $1 billion.

PYUSD has been integrated into PayPal's Xoom platform for international transfers and is now available on the Solana blockchain, offering users more options for transactions.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, PayPal's latest move yet again signals a growing mainstream acceptance of cryptocurrencies in the business world. By enabling merchants to directly engage with digital assets, PayPal is thus positioning itself as a bridge between traditional finance and the crypto economy. That said, this development should have some significant implications. First and foremost, we must think about increased adoption. As more businesses gain easy access to cryptocurrencies (and PayPal has over 36M merchants), we may see accelerated adoption of digital assets for both investment and transactions. Second, this should spur more competition in the crypto space. PayPal’s move may prompt other payment processors and FinTech companies to expand their crypto offerings, potentially leading to more innovation and competition in the sector. Looking ahead, we might expect PayPal to continue expanding its crypto capabilities, possibly including more cryptocurrencies, offering crypto-based lending or yield-generating products, or integrating with decentralized finance (DeFi) platforms. The company's moves in this space could also influence regulatory discussions, potentially shaping the future legal landscape for cryptocurrencies in commerce. Once again, Alex Chriss is delivering 👏😎

ICYMI: Amazon and PayPal join forces for Buy with Prime 🤝💳 [what’s the value add here, why it matters + bonus reads on PayPal & Adyen]

Mercado Libre aims to revolutionize Mexican banking landscape 🏦🇲🇽

The news 🗞️ Latin American e-commerce giant Mercado Libre MELI 0.00%↑ is making some bold moves to expand its financial services offerings in Mexico.

The company's FinTech arm, Mercado Pago, has recently applied for a banking license in the country, signaling its ambition to become a major player in the Mexican financial sector.

Let’s take a quick look at this.

More on this 👉 Mercado Pago submitted its banking license application to Mexico's National Banking and Securities Commission (CNBV) in September 2024. The company aims to become the largest digital bank in Mexico, leveraging its existing position as the second-largest digital wallet in the country.

A banking license would allow Mercado Pago to offer a wider range of services, including savings and checking accounts, certificates of deposit, commercial loans, and mortgages. The licensing process is expected to take 12 to 24 months.

MercadoLibre plans to invest $2.5 billion in its Mexican operations and create 8,200 new jobs in the country in 2024.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that MercadoLibre's pursuit of a banking license in Mexico represents a significant shift in the Latin American FinTech landscape. With less than half of Mexico's population having bank accounts, the potential for growth in financial services is enormous. The move mirrors the rapid advancement in banking accessibility, electronic payments, and credit use observed in Brazil over the past decade (hint: Nubank NU 0.00%↑ 😎). MercadoLibre now aims to be at the forefront of this transformation in Mexico. Looking ahead, we can expect increased competition in the Mexican banking sector, potentially leading to more innovative products and services for consumers. As an effect, there should be a push towards greater financial inclusion, as MercadoLibre leverages its e-commerce platform to offer banking services to underserved populations. Finally, we can expect a possible expansion of similar models to other Latin American countries, as MercadoLibre tests and refines its banking services in Mexico. Bullish.

ICYMI: Latin America's e-commerce giant MercadoLibre is uniquely poised for continued dominance 😤🚀 [breaking down their key numbers, understanding what they mean so you can see why you just can’t ignore this FinTech giant in 2024]

🔎 What else I’m watching

Nasdaq Expands Presence in LatAm Through NU Agreement 🌎 US-based financial technology system Nasdaq NDAQ 0.00%↑ has expanded its digital bank fintech presence in Latin America by agreeing to offer its AxiomSL solution to Nubank NU 0.00%↑. This extension of their existing collaboration will help Nubank meet regulatory reporting requirements in Colombia. The move underscores the growing demand for third-party financial technology solutions in Latin America, driven by the rapid development of digital banking in the region. ICYMI: Nasdaq's diversification pays dividends, but valuation demands caution 👀💸 [breaking down their latest Q2 2024 financials, what they mean & whether Nasdaq is worth your time & money in 2024 + a bonus deep dive into this financial powerhouse]

Bank of England to Form AI Consortium 🤖 The Bank of England (BoE) is inviting financial services firms to join its artificial intelligence (AI) consortium, designed to oversee the use of AI within the sector. The public-private industry group will be chaired by Sarah Breeden, deputy governor for financial stability at the central bank. The group's primary focus will be identifying current and potential future uses of AI, assessing the benefits and risks, and informing the BoE's policies on AI use within financial services. The bank aims to recruit about 30 members based on their expertise in both AI and financial services. Meetings will be held four times a year, with minutes published on the BoE's website. Additionally, workshops will be held throughout the year to delve into complex issues. The deadline for applications is November 8.

HSBC & JPMorgan Processed Payments for Wagner Head 💸 Reports have surfaced that JPMorgan Chase JPM 0.00%↑ and HSBC HSBC 0.00%↑ inadvertently processed payments for companies associated with Yevgeny Prigozhin, the former leader of the Wagner Group. Prigozhin, who played a key role in the Wagner Group’s extensive operations in Africa, died in August under unclear circumstances when his private jet crashed near Moscow. The Wagner Group has been active across Africa, providing military and paramilitary services in exchange for significant financial compensation, primarily through deals in the mining and raw materials sectors. Documents obtained by the Centre for Advanced Defence Studies (C4ADS) revealed that transactions connected to Wagner’s operations passed through major banks, including JPMorgan and HSBC.

💸 Following the Money

PayPal PYPL 0.00%↑ has used its stablecoin to make an additional investment in blockchain risk management specialist Chaos Labs. Founded in 2021, New York-based Chaos Labs offers a suite of on-chain risk management tools for decentralized finance (DeFi). ICYMI: PayPal and Adyen join forces for the first time to change the game in payments 🤝💳 [what it’s all about & why it’s huge + bonus deep dives both into Adyen & PayPal and an extra one into Shopify]

Madrid-based Tuio, an insurtech platform, raised €15M in funding from investors including MassMutual Ventures, BlackRock, Bamcap Ventures, and Extension Fund.

The European Investment Bank (EIB) is lending Italian PayTech giant Nexi Group €220M to support digital payment innovation. ICYMI: Nexi: underrated European payments powerhouse poised for growth 🇮🇹📈 [breaking down the most important numbers, uncovering what they mean & whether Nexi is worth your time and money in 2024 + a bonus deep dive into another European PayTech giant]

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Sundays are worth it because of this - thank you!