PayPal expands in China 🇨🇳🚀; FinTech startup which aims to revolutionize Wall Street with AI Analyst 🤖📊; Worldpay dives deep into blockchain 👀⛓️

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

European banks launch Wero to challenge Visa and Mastercard's dominance 😳💳 [why & if it matters, what’s next in the future of payments + lots of bonus reads on Visa, Mastercard & co]

Mastercard doesn’t stop: acquires subscription management FinTech 😤💳 [why it matters & what’s next + bonus deep dives into Mastercard & Visa]

Visa unveils platform for tokenized asset management 😲⛓️ [what’s the USP here, why it’s brilliant & what it means for the future + lots of bonus deep dives inside]

HSBC launches Embedded Finance venture 😳💳 [what it’s all about & why it’s a great move + a bonus deep dive into HSBC & why the future of finance is embedded]

SWIFT doubles down on and dives into digital assets 🤑🪙 [what’s the latest move all about, why it matters & what’s next + bonus reads on other financial giants going all into crypto]

PayPal pioneers business payments with its proprietary stablecoin 😳🪙 [why it matters & what’s next + bonus dives into PayPal & SWIFT]

JPMorgan is banking on low-income communities 👨👩👧🏦 [why it’s a good move & why it matters + bonus dives into JPM & how they are crushing it in all things AI]

Starling Bank’s £29 million fine 🤯🏦 [what it’s all about, what it means for the future of FinTech & challenger banks + bonus deep dive into Starling’s latest financials]

Lightspeed is exploring sale amid FinTech market shifts 😳🏷️ [a holistic recap of the situation, what it means for Lightspeed & what’s next + bonus deep dive into Nuvei]

As for today, here are the 3 amazing FinTech stories that were transforming the world of financial technology as we know it. This was one of the most intense and interesting weeks in 2024 so far, so make sure to check all the above stories.

PayPal expands in China 🇨🇳🚀

The news 🗞️ Online payments giant PayPal PYPL 0.00%↑ has just made a significant move in the Chinese market by launching its Complete Payments platform.

This expansion marks a crucial step in PayPal's global strategy and could reshape the landscape of cross-border e-commerce and digital payments in China.

Let’s take a quick look at this.

More on this 👉 The Complete Payments platform is an all-in-one solution designed to streamline payment and receivables processes for businesses of all sizes. It offers a range of customized products and solutions to support Chinese merchants in selling globally.

Key features include:

Access to PayPal's vast network, reaching over 400 million active users worldwide

Quick fund settlements for faster access to earnings

Custom products like RMB Transfer and Vendor Payouts for secure global fund transfers

AI-powered tools for risk assessment and fraud management

Zoom out 🔎 This launch comes at a time when China's cross-border e-commerce sector is experiencing rapid growth. Despite global economic challenges, PayPal's China business has recorded double-digit growth in the past year.

The platform aims to capitalize on China's booming export market, which saw exports grow by 8.7% year-on-year in August 2024, reaching $308.65 billion.

Of course, PayPal's expansion in China is not without challenges. The company faces competition from local payment giants and must navigate complex regulatory environments.

However, as the first foreign company to fully own a payments platform in China (following its acquisition of GoPay in 2020), PayPal is well-positioned to bridge Chinese businesses with global consumers.

✈️ THE TAKEAWAY

What’s next? 🤔 The launch of PayPal Complete Payments in China is all about market expansion. This move opens up a significant new market for PayPal, potentially driving substantial growth in transaction volumes and revenue. In relation to that, by simplifying international transactions, PayPal could play a crucial role in further boosting China's already thriving cross-border e-commerce sector. Looking at the big picture, PayPal's entry may spur local payment providers to innovate and improve their cross-border offerings, benefiting Chinese merchants and global consumers alike. Also, in an era of increasing economic tensions between China and the West, PayPal's success in China could serve as a model for other Western tech companies seeking to operate in the Chinese market. Looking ahead, we may see PayPal further expanding its services in China, potentially partnering with more local e-commerce platforms and financial institutions. The company might also introduce more localized features to cater to the specific needs of Chinese merchants and consumers. Great job and yet another bullish signal from PayPal 👏

ICYMI: Amazon and PayPal join forces for Buy with Prime 🤝💳 [what’s the value add here, why it matters + bonus reads on PayPal & Adyen]

PayPal pioneers business payments with its proprietary stablecoin 😳🪙 [why it matters & what’s next + bonus dives into PayPal & SWIFT]

FinTech startup which aims to revolutionize Wall Street with AI Analyst 🤖📊

The news 🗞️ Rogo, a startup developing an AI-powered platform for the finance industry, has raised $18.5 million in a Series A funding round led by Khosla Ventures.

The company aims to create Wall Street's first trusted AI analyst by leveraging advanced language models and a vast knowledge graph of financial data.

Let’s take a quick look at this.

More on this 👉 Founded in 2022 by former Lazard investment banker Gabe Stengel and co-founders John Willett and Tumas Rackaitis, Rogo has quickly gained traction in the financial sector.

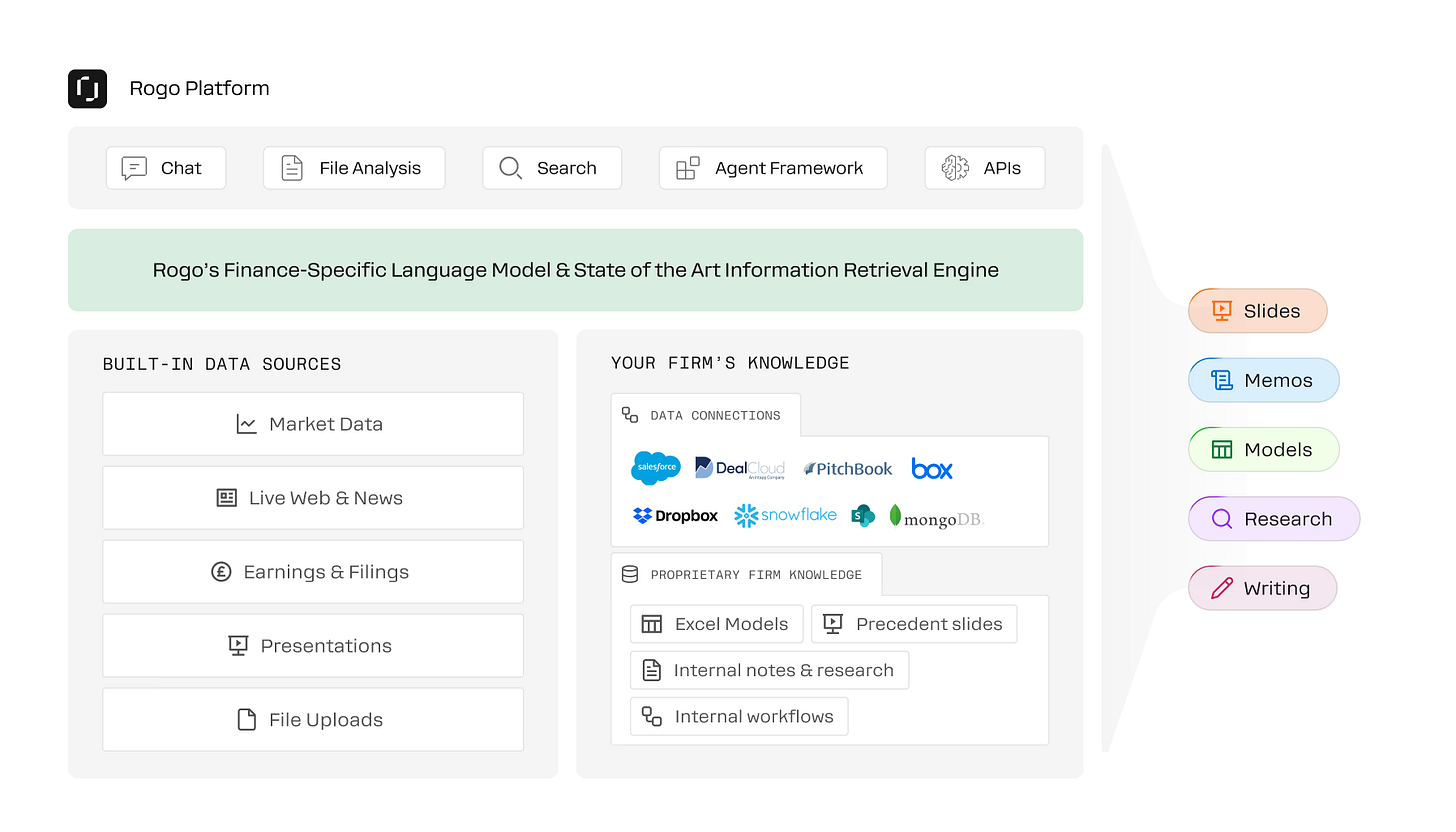

The platform offers three key products: (1) an AI Analyst for answering complex financial queries, (2) an Agent Framework for automating various financial workflows, and (3) the Rogo Platform for developing custom AI solutions.

Rogo's rapid growth is evidenced by its partnerships with 25 firms nationwide, including leading investment banks, private equity firms, and hedge funds. The company claims its AI is 2.42 times more accurate than ChatGPT for finance-related tasks and saves users an average of 400 hours per year on core analyst work. Big if true 👀

The funding round, which brings Rogo's total capital raised to $26 million, included participation from notable investors such as AlleyCorp, BoxGroup, Eric Schmidt, and Jack Altman.

Stengel emphasizes that Rogo's mission is to make financial firms and professionals smarter, not to replace human analysts. By automating rote tasks, the platform aims to free up junior bankers to focus on more intellectually stimulating and relationship-driven aspects of their work.

✈️ THE TAKEAWAY

What’s next? 🤔 Rogo's success and the significant investment it has attracted signal a growing trend in the FinTech and Finance space: the integration of AI to enhance productivity and decision-making. This development could thus lead to some notable changes in the industry:

Transformation of junior roles: as AI takes over more routine tasks, entry-level positions in finance may evolve to focus more on strategic thinking, client relationships, and creative problem-solving. This could hence lead to a shift in the skills and training required for aspiring finance professionals.

Increased efficiency and accuracy: with AI handling time-consuming analytical tasks, financial firms may be able to process larger volumes of data and generate insights more quickly and accurately. This could thus lead to faster deal-making and more informed investment decisions.

Competitive advantage: firms that successfully integrate AI tools like Rogo may gain a significant edge over competitors, potentially reshaping the competitive landscape in finance.

Of course, it wouldn’t be without ethical considerations: as AI becomes more prevalent in financial decision-making, there will likely be increased scrutiny on the algorithms' fairness, transparency, and potential biases. Regulators may need to develop new frameworks to oversee AI use in finance.

Looking ahead, it’s getting more and more clear that collaboration between humans and AI is the way to go. The future of finance will likely involve a symbiotic relationship between human professionals and AI tools. Developing effective ways for humans to work alongside and leverage AI capabilities will therefore be crucial for success in the industry.

ICYMI: AI chatbot gets the green light for stock-picking advice 🤖✅ [what it’s all about & why it matters + bonus reads on other FinTech giant crushing it in AI]

Worldpay dives deep into blockchain 👀⛓️

The news 🗞️ Global payments giant Worldpay is taking a bold step into the world of blockchain technology. The company plans to become a validator on select blockchain networks, marking its first direct involvement in verifying blockchain transactions.

Let’s take a quick look at this.

More on this 👉 This move is part of a strategy to gain deeper insights into the mechanics of digital ledgers. By participating "right at the base" of the ecosystem, Worldpay aims to better understand how funds flow across these innovative financial rails.

The role of a validator is crucial in maintaining the integrity of blockchain networks. Validators stake native cryptocurrencies as collateral and earn fees for their work in monitoring and verifying transactions. This hands-on approach could provide Worldpay with valuable firsthand experience in blockchain operations.

Zoom out 🔎 While Worldpay's blockchain ambitions are noteworthy, it's important to contextualize them within the company's overall business.

In 2024, Worldpay has processed $1.3 billion in stablecoin payments, up from under $1 billion in 2023. However, this figure pales in comparison to the company's annual payment volume of over $2.3 trillion across all channels.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, Worldpay's move into blockchain validation signals a growing recognition of the technology's potential in the payments industry. By actively participating in blockchain networks, Worldpay positions itself to adapt quickly to shifts in the financial landscape. Having said that, direct involvement in blockchain operations will provide Worldpay with invaluable insights into the strengths and limitations of the technology. On top of that, the knowledge gained could inform the creation of new blockchain-based payment solutions or the integration of existing ones into Worldpay's offerings. Lastly, as more financial activity moves to blockchain networks, Worldpay's early experience could give it an edge over competitors. Looking ahead, as the lines between traditional finance and blockchain technology continue to blur, Worldpay's proactive approach may well position it as a leader in the next generation of global payment systems. The coming years will reveal whether this bold move into blockchain validation will indeed be a game-changer for Worldpay or just a good learning exercise. Either way, the bet is worthwhile 👏

ICYMI: Visa unveils platform for tokenized asset management 😲⛓️ [what’s the USP here, why it’s brilliant & what it means for the future + lots of bonus deep dives inside]

SWIFT doubles down on and dives into digital assets 🤑🪙 [what’s the latest move all about, why it matters & what’s next + bonus reads on other financial giants going all into crypto]

🔎 What else I’m watching

AI to Transform Wealth Management 🤖💼 A global survey by the London Stock Exchange Group and ThoughtLab reveals that 90% of investors believe AI can effectively research financial products and services. Sixty-two percent of wealth management firms expect AI to significantly transform their operations, offering benefits like automation, speed, reduced errors, and cost-effectiveness. However, investors still value human advisors for trusted advice, holistic financial planning, and support in difficult situations. A hybrid model combining AI and human expertise is thus expected to become the standard.

HSBC Writes Off Monese Stake 💰 HSBC HSBC 0.00%↑ has written off its $5.86M stake in mobile banking fintech Monese, just two years after investing $35M. Monese, founded in 2015, reported a £30.5M loss in 2022 and faced uncertainty despite securing additional funds. Another major backer, Kinnevik, also wrote off its investment, citing Monese's uncertain future. ICYMI: HSBC launches Embedded Finance venture 😳💳 [what it’s all about & why it’s a great move + a bonus deep dive into HSBC & why the future of finance is embedded]

Qonto Expands into Four European Markets 🌍 French neobank Qonto, founded in 2016, is opening offices in Austria, Belgium, Portugal, and the Netherlands to strengthen its European presence. Targeting SMEs and freelancers, Qonto offers online banking, invoicing, and bookkeeping services. CEO Alexander Prot expresses confidence in this expansion, following success in Germany, Italy, and Spain. The move aims to solidify Qonto's position in Europe, where SMEs and freelancers constitute 99% of businesses.

💸 Following the Money

Former Revolut product lead Bogdan Uzbekov has raised $30M in Series B funding for his new startup Apron, which is aiming to become the financial super app for small and medium businesses (SMBs).

BMLL, a firm specializing in data and analytics for global equity and futures markets, has secured a £16M strategic investment.

UK-based Nationwide has announced that it completed the acquisition of Virgin Money, with the move allowing the financial institution to augment its offering.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

My favourite Sunday read - thank you for putting this together. Again!