Banking meets FinTech: Standard Chartered inks a major deal with Wise 🏦🤝📱; FIS’s Q3 2024: core banking dominance and digital transformation power growth 🏦📈

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Payoneer: a hidden FinTech giant accelerating B2B cross-border payments growth 😤🚀 [breaking down their latest Q3 2024 financials, what they mean, why I’m bullish & why you should be too]

FinTech giant Wise is a trillion-dollar money mover in the making 😳💸 [unpacking the most important H1 FY25 numbers, what they mean & what’s next for Wise]

Adyen’s Q3 2024: premium payments player hits growth speed bump, but long-term thesis remains intact 🫡📈 [see how premium payments player hits growth speed bump and why long-term thesis remains intact + more bonus reads inside]

Mercado Libre’s Q3 2024: Latin America's e-commerce giant is trading growth for margins 📈🛍️ [breaking down their Q3 2024 financials, what they mean, why I’m bullish on MELI 0.00%↑ & why you should be too]

Block's digital payments empire continues to show strong fundamentals and execution excellence 😤📱[deep dive into their Q3 2024 results, unpacking the most important numbers & whether Block is worth your time and money in 2024 and beyond]

MoneyLion is a FinTech dark horse that’s emerging as the "Amazon of Financial Services" 😳🚀 [breaking down their latest numbers, what they mean and what’s next & whether MoneyLion is worth your time and money in 2024 and beyond]

Affirm: Buy Now, Profit Later? Growing scale masks path to sustainable profitability 🤔💳 [Buy Now, Profit Later, or the breakdown of Affirm’s latest financials, what they mean & what’s next]

FinTech disruptor Marqeta is poised for continued growth 👏💳 [unpacking Marqeta's Q3 2024 financials, what they tell us & what’s next]

As for today, here are the 2 awesome FinTech stories that were changing the world of financial technology as we know it. This was yet another good week in the financial technology space so make sure to check all the above stories.

Banking meets FinTech: Standard Chartered inks a major deal with Wise 🏦🤝📱

The news 🗞️ In yet another signal of growing cooperation between traditional banking and FinTech, Standard Chartered has announced a strategic partnership with cross-border payments giant Wise.

The deal will enable Standard Chartered to offer enhanced multi-currency money transfers across Asia and the Middle East, leveraging Wise's established payments infrastructure.

Let’s take a look at this and see why it matters.

More on this 👉 The partnership will integrate Wise's technology into Standard Chartered's SC Remit service, allowing customers to transfer money in 21 currencies, including major ones such as USD, EUR, GBP, SGD, HKD, and JPY. A key feature of this integration is the promise of mid-market exchange rates without markups, combined with near-instantaneous transfer speeds. Stables, anyone? 👀

ICYMI:

This deal represents an expansion of an existing relationship between the two companies, following their earlier partnership in March 2024 through Standard Chartered's Hong Kong-based digital bank, Mox. The announcement had an immediate positive impact on Wise's market performance, with its shares rising 8.5% in London trading.

Zoom out 🔎 The partnership's significance is underscored by Wise's impressive operational metrics. The company currently holds over 65 licenses globally and maintains six direct connections to payment systems, enabling 63% of its cross-border transfers to be completed within 20 seconds.

In the quarter ending September 2024, Wise processed £35.2 billion ($45.7 billion) in cross-border payments, marking a 20% year-over-year increase. Solid! 👏

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this partnership could mark a turning point in how traditional banks approach FinTech collaboration. Rather than developing competing solutions internally, as some banks like HSBC HSBC 0.00%↑ have attempted, Standard Chartered's approach suggests a pragmatic shift toward leveraging existing FinTech infrastructure. For Wise, this partnership could catalyze similar deals with other major banks. Having a Tier 1 global bank like Standard Chartered as a partner significantly enhances Wise's credibility in the institutional banking sector. This is particularly noteworthy given Wise's historical stance of criticizing traditional banks' transfer fees and services. Looking ahead, the next steps for banks will be to embrace crypto innovation, the first of which will be leveraging stablecoins as both an asset and another rail.

ICYMI: FinTech giant Wise is a trillion-dollar money mover in the making 😳💸 [unpacking the most important H1 FY25 numbers, what they mean & what’s next for Wise]

FIS’s Q3 2024: core banking dominance and digital transformation power growth 🏦📈

Earnings time 🤑 In the third quarter of 2024, Fidelity National Information Services aka FIS FIS 0.00%↑ delivered robust financial performance beating analyst estimates.

Let’s look at the key numbers, what they mean, and whether FIS is worth your time and money in 2024.

More on this 👉 Key facts & figures:

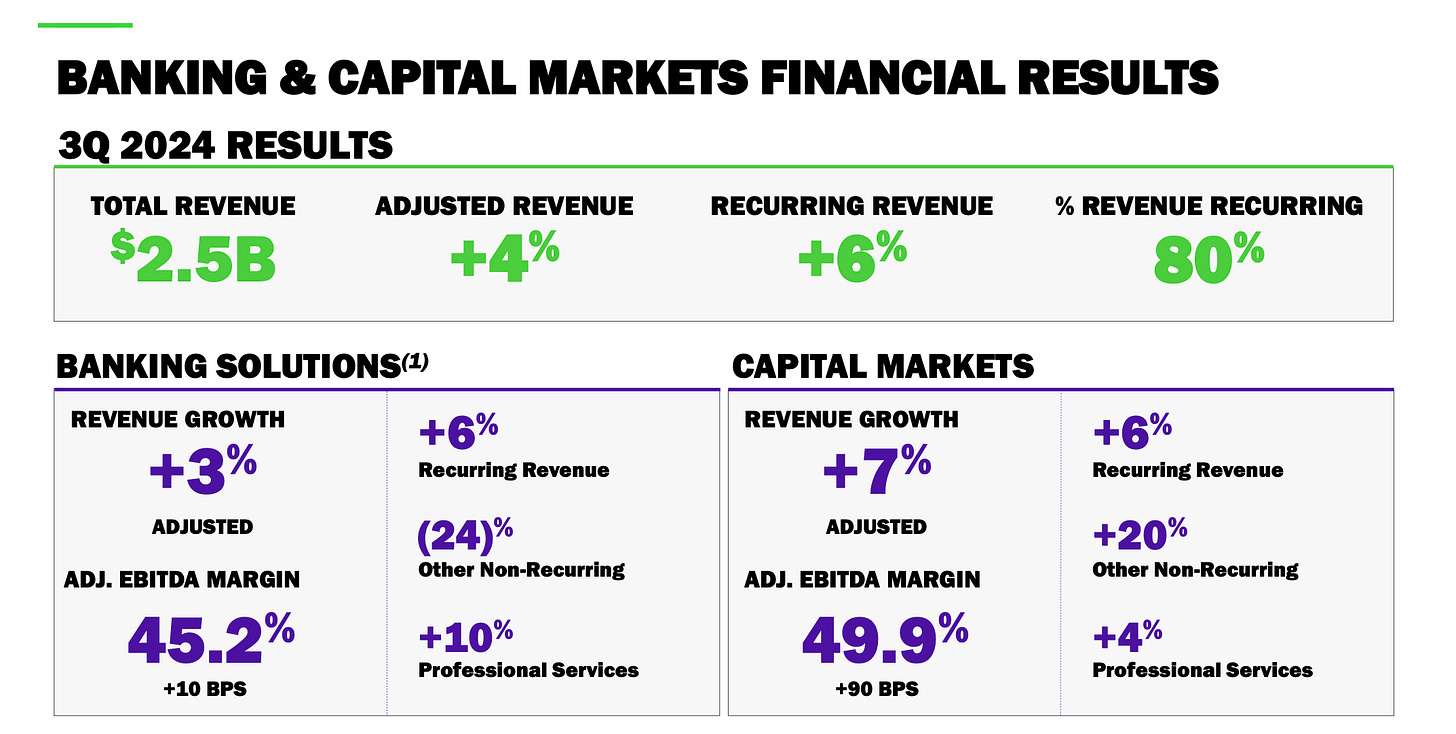

Revenue grew 4% YoY on an adjusted basis to $2.57B, with recurring revenue accelerating to 6% growth

Adjusted EBITDA margin of 41.3% contracted 140bps YoY but showed segment-level expansion

Banking Solutions (69% of revenue) grew 3% with 45.2% margins (+10bps)

Capital Market Solutions (29% of revenue) grew 7% with 49.9% margins (+90bps)

Adjusted EPS of $1.40 increased 49% YoY (13% normalized)

Leverage ratio of 2.6x with $10.9B total debt

Free cash flow of $530M with 85% conversion rate

Zoom out 🔎 FIS continues to show market leadership and scale. One of the key things here is the dominant position in core banking technology with high barriers to entry. Mission-critical systems thus create sticky, long-term customer relationships. Additionally, a broad product suite across the money lifecycle enables powerful cross-selling, and strong recent wins across core banking platforms illustrate that well (IBS, Horizon, MBP).

Another noteworthy thing is revenue quality. 80% recurring revenue provides stability and visibility while accelerating recurring revenue growth shows fundamental strength. Furthermore, the premium Payback loyalty solution is gaining significant traction while international expansion opportunities, particularly in APAC look promising for future growth.

Finally, we have to speak about capital returns. FIS is now on track for a $4B share repurchase in 2024, which is very solid. Additionally, giving the company $700M returned to shareholders in Q3 alone while having a 35% dividend payout target demonstrates a commitment to shareholders.

Risks & Challenges🛡️ Obviously, all of this isn’t without the risks. Here’s what we should be thinking about in the years to come:

Margin Pressures

Corporate expenses creating near-term headwinds

Rising technology supplier costs (50-70% increases) impacting CapEx

Higher investments needed for digital transformation

Integration costs from acquisitions like Dragonfly

Competitive Threats

Fintech disruption in the banking technology space

Need for continued heavy investment in innovation

Risk of market share erosion in core banking

Execution Risk

Complex technology implementations can face delays

Some core conversions shifting to 2025

M&A integration challenges

Future outlook 🔮 Given the company's strong market position, accelerating recurring revenue growth, and robust capital return program, FIS presents a compelling risk/reward at current levels.

The company's adjusted revenue growth guidance of 4.1-4.4% and EPS growth of 16-17% (normalized) demonstrate solid execution of its strategy.

✈️ THE TAKEAWAY

What’s next? 🤔 All in all, while margin pressures and rising costs are concerning, these appear largely temporal rather than structural. FIS’s ability to expand segment-level margins while investing in growth initiatives is encouraging. Looking ahead, FIS appears well-positioned for sustained growth over the medium term, driven by:

Digital banking transformation tailwinds

International expansion opportunities

Cross-sell momentum across the product suite

Margin expansion potential as investments mature

Strategic M&A in high-growth verticals

Target 5-7% organic revenue growth and 100-150bps annual margin expansion by 2026, suggesting potential for 12-15% annual EPS growth. Key monitoring points include recurring revenue growth sustainability, margin progression, and competitive positioning in core banking modernization. More importantly, the transformation to a focused banking and capital markets technology provider following the Worldpay separation should drive multiple expansion as execution continues to improve.

Disclaimer: this isn’t investment advice and you should always do your own research.

ICYMI: Global Payments is set for margin expansion, but near-term growth headwinds warrant caution 👀📈 [breaking down their latest financials, what they mean, and whether Global Payments is worth your time and money in the years to come + more bonus reads inside]

Payoneer: a hidden FinTech giant accelerating B2B cross-border payments growth 😤🚀 [breaking down their latest Q3 2024 financials, what they mean, why I’m bullish & why you should be too]

Adyen’s Q3 2024: premium payments player hits growth speed bump, but long-term thesis remains intact 🫡📈 [see how premium payments player hits growth speed bump and why long-term thesis remains intact + more bonus reads inside]

🔎 What else I’m watching

Mastercard Launches Pay Local for Seamless Digital Wallet Payments 💳Mastercard MA 0.00%↑ has introduced Mastercard Pay Local, a service that simplifies card payments using local digital wallets. Initially rolling out in the Asia Pacific, with partners like DANA, Touch ‘n Go, Bakong, and LankaPay, the service allows cardholders to link their cards to digital wallets for quick transactions at over 35 million merchants. The platform will also expand to Latin America, Eastern Europe, the Middle East, and Africa. Pay Local benefits consumers, merchants, wallet providers, and card issuers by increasing payment options and accessibility. ICYMI: Mastercard’s Q3 2024: digital payments giant shows resilience amid rising competition 😤💳 [uncovering the most important Q3 2024 numbers, what they mean, and what’s next + bonus dives on Visa, Mastercard & more]

Wolt Partners with Revolut to Offer Wolt+ Membership 🍴💳 Wolt has partnered with Revolut to offer Wolt+ membership to Revolut's Premium, Metal, and Ultra paid plan subscribers across 17 European markets. Revolut users will enjoy free access to Wolt+, including unlimited free deliveries, no delivery fees, and exclusive discounts. The partnership aims to provide convenience, savings, and an optimized experience for customers, while both companies focus on regulatory compliance and meeting user demands.

Affirm Launches in the UK 🇬🇧 Affirm AFRM 0.76%↑, a major North American Buy Now, Pay Later (BNPL) platform, has launched in the UK, offering interest-free and interest-bearing monthly payment options. The FCA-regulated lender, which has processed over $75 billion in transactions in the US and Canada, emphasizes no late fees or hidden charges. Initial partners include Alternative Airlines and Fexco. CEO Max Levchin highlights Affirm's commitment to responsible credit options. The launch follows Affirm's exit from Australia and comes ahead of new UK regulations for the BNPL sector. ICYMI: Affirm: Buy Now, Profit Later? Growing scale masks path to sustainable profitability 🤔💳 [Buy Now, Profit Later, or the breakdown of Affirm’s latest financials, what they mean & what’s next]

💸 Following the Money

Kalshi secures tens of millions in loans from VCs, eyes $50M+ round amid election betting boom, source says

Neem has announced the rise of a $4M credit facility from DNI Group to scale its earned wage access solution across the region of Pakistan.

Mumbai-based supply chain fintech startup Veefin has announced its decision to acquire a stake in a Singapore-based genAI startup Walnut.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is a present for Sunday - thank you!