Nubank hits historic 100M customer milestone in Brazil 🟣🇧🇷; Revolut expands crypto exchange to 30 European Markets 🫡🇪🇺; Swedish FinTech giant Klarna files confidentially for a US IPO 🔔🇺🇸

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

AI 100: Top Artificial Intelligence Startups of 2024 🤖💸 [these companies raised $28B already. Find whose backing them, unlock their exclusive pitch decks & learn from the best 🚀]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Latin America's digital banking dragon Nubank breathes fire with 30% ROE 😤🇧🇷 [breaking down their latest impressive Q3 2024 financials, what they mean & what’s ahead for NU + some bonus reads inside]

Digital remittance pioneer Remitly achieves profitability inflection point 👏🤑 [breaking down their key Q3 2024 numbers, what they mean & what’s next for Remitly + bonus deep dives into two of its biggest competitors]

Emerging markets payments pioneer dLocal shows resilience amid growing pains 💪💳 [unpacking the most important numbers, what they mean & what’s next for dLocal]

Shopify’s Q3 2024: the commerce giant is hitting its stride with expanding margins and enterprise momentum 😳🛍️ [unpacking their latest financial results, why they matter & why you should be bullish on Shopify + some bonus reads inside]

Shift4's payment processing empire continues to expand globally 📈🌎 [dicing into their Q3 2024 financials, breaking them down to see whether Shift4 is worth your time & money in 2024 and beyond]

B2B payments giant AvidXchange shows improving fundamentals 📈💸 [unpacking their latest financials, what they mean & whether AvidXchange is worth your time and money in 2024 & beyond]

Nuvei posts revenue growth ahead of $6.3B private transition 📈🤝 [looking into their latest Q3 2024 financials & what they mean, what’s next for Nuvei + some bonus reads inside]

As for today, here are the 3 incredible FinTech stories that were transforming the world of financial technology as we know it. This was yet another huge week in the Finance 2.0 space so make sure to check all the above stories.

Digital banking giant Nubank hits historic 100 million customer milestone in Brazil 🟣🇧🇷

The news 🗞️ FinTech giant Nubank NU 0.00%↑ has just announced reaching 100 million customers in Brazil, representing 57% of the country's adult population.

This milestone was achieved just eleven years after launching with a single credit card product, demonstrating the extraordinary pace of digital banking adoption in Latin America's largest economy.

Let’s take a quick look at this.

More on this 👉 The achievement follows Nubank's earlier announcement in May 2024 of reaching 100 million customers across its Latin American operations, including Mexico and Colombia.

The company's rapid expansion in Brazil alone, adding over one million new customers monthly, showcases the successful execution of its digital-first banking strategy. Wild 😳

Zoom out 🔎 This growth trajectory is particularly impressive considering Nubank's humble beginnings. The company exceeded one million customers within two years of launch, significantly outpacing initial forecasts.

The introduction of a savings account in 2017 proved to be a pivotal moment, enabling the company to expand its product portfolio to include personal loans, SME solutions, investments, cryptocurrency services, insurance, and marketplace offerings.

The company's success is backed by strong financial performance, with 2023 seeing over $1 billion in net profit and more than $8 billion in revenues.

Since its NYSE listing in late 2021, which valued the company at over $40 billion, Nubank has continued to demonstrate the viability of digital-first banking models.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, NU’s success demonstrates a fundamental shift in consumer banking preferences, particularly among younger generations. According to recent studies, Generation Z is leading the abandonment of traditional banking services, with many never having used conventional ATM services. More importantly, Nubank's transition from a digital bank to a "complete digital services platform" suggests a broader trend where fintech companies are evolving beyond pure banking services. The integration of shopping, travel services, and telecommunications (NuCel) indicates that successful fintech platforms may become comprehensive digital service ecosystems. Lastly, the company's growth patterns in Mexico and Colombia, which are outpacing its initial Brazilian growth rates, suggest significant untapped potential in other Latin American markets. This could herald a new era of regional financial integration and digital banking adoption. Bullish.

ICYMI: Latin America's digital banking dragon Nubank breathes fire with 30% ROE 😤🇧🇷 [breaking down their latest impressive Q3 2024 financials, what they mean & what’s ahead for NU + some bonus reads inside]

Revolut expands crypto exchange to 30 European Markets 🫡🇪🇺

The launch 🚀 London-based FinTech giant Revolut has just announced the rollout of its Revolut X crypto exchange across all 30 European Economic Area (EEA) countries.

This strategic move follows the platform's successful launch in the United Kingdom earlier this year and positions Revolut as a major player in the European cryptocurrency trading landscape.

Let’s take a look at this.

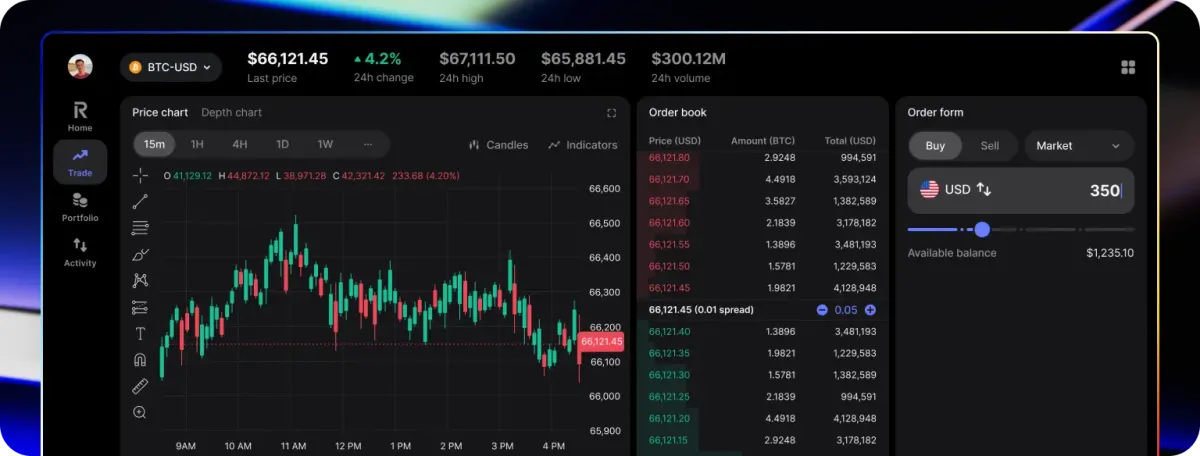

More on this 👉 The expansion allows EEA-based customers with Revolut accounts to trade over 200 digital tokens through a desktop-based platform designed for both experienced traders and retail customers.

The service features competitive pricing with zero fees for limit (maker) orders and a modest 0.09% fee for market (taker) orders, regardless of trading volume.

The table above shows a comprehensive comparison of trading fees across various crypto exchanges as per Perplexity. Looking at the data, Revolut X stands out with the most competitive fee structure among all listed exchanges:

It offers the lowest maker fee at 0.00% (completely free for limit orders)

Its taker fee of 0.09% is among the lowest, only matched or beaten by a few exchanges like Crypto.com (0.075%) and KuCoin/Binance (0.10%)

On top of that, Revolut X distinguishes itself through several key features, including:

Advanced trading analytics and real-time monitoring tools integrated with TradingView

24/7 customer support

Enhanced security measures with the majority of funds stored in cold storage

Seamless integration with existing Revolut accounts

Zoom out 🔎 The timing of this expansion is particularly noteworthy as it aligns with the European Union's Markets in Crypto-Assets (MiCA) legislation, which provides a comprehensive regulatory framework for digital assets across Europe.

This regulatory clarity has created a favorable environment for Revolut's expansion strategy.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Revolut's move clearly suggests again a trend toward traditional financial institutions integrating cryptocurrency services into their core offerings. This will inevitably lead to increased competition with established crypto exchanges and potentially drive consolidation in the market. Additionally, the alignment with MiCA legislation demonstrates how regulatory clarity can enable traditional financial institutions to confidently enter the crypto space. This could set a precedent for similar expansions in other regions as regulatory frameworks mature. Hopefully, Europe can establish itself as a solid hub for all things digital assets. Zooming out and given Revolut's reported plans to launch its own stablecoin and its recent introduction of crypto payment cards, this expansion appears to be part of a broader strategy to create a comprehensive crypto ecosystem. This could include:

Further integration of crypto services with traditional banking functions

Development of institutional trading services

Expansion of crypto payment solutions for everyday transactions

Potential partnerships with traditional financial institutions

Lastly, Revolut's zero-fee model for limit orders could pressure other platforms to reduce their fees, potentially reshaping the competitive landscape of crypto trading in Europe. This could lead to increased adoption of cryptocurrency trading among retail investors and drive innovation in service offerings across the industry.

ICYMI:

Swedish FinTech giant Klarna files confidentially for a US IPO 🔔🇺🇸

The news 🗞️ In a move that signals growing confidence in the FinTech IPO market, Swedish Buy Now, Pay Later (BNPL) pioneer Klarna has confidentially submitted draft registration documents to the US Securities and Exchange Commission (SEC) for an initial public offering.

The anticipated valuation ranges between $15 billion and $20 billion, marking a substantial recovery from its 2022 valuation of $6.7 billion, though still well below its pandemic-era peak of $46 billion.

Let’s take a quick look at this.

More on this 👉 The decision to list in New York rather than London or Stockholm represents a strategic choice that aligns with Klarna's expanding US presence, where it generates approximately 29% of its group revenue.

This move follows in the footsteps of other European tech companies like Spotify SPOT 0.00%↑, highlighting an ongoing trend of European tech firms preferring US markets for their public debuts.

Zoom out 🔎 We can remember that founded in 2005, Klarna has evolved from a Swedish BNPL provider into a global FinTech powerhouse, offering various financial services including instant payments, banking services, and a comprehensive retail app. The company has recently embraced AI technology to streamline operations and reduce costs, while also striking strategic deals such as offloading £30 billion of UK loans to hedge fund Elliott to strengthen its capital position.

The timing of the IPO filing comes as Klarna has shown improved financial performance, narrowing its losses and appearing to be on track for annual profitability. The company's leadership, including CEO Sebastian Siemiatkowski, has been preparing for this moment, implementing various measures such as a hiring freeze and workforce optimization through AI integration.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, a successful IPO could validate the BNPL business model and potentially trigger a wave of public listings from other FinTech companies waiting on the sidelines. The performance of Klarna's stock will likely serve as a benchmark for the sector's valuation metrics as right now we only have Affirm AFRM 0.00%↑… Additionally, as a public company, Klarna will have access to new capital for expansion and innovation, potentially accelerating the adoption of new technologies like AI or launching new products and/or new markets. This could in turn force traditional banks and payment providers to step up their game. Zooming out, the choice of a US listing venue may prompt other European tech companies to follow suit, potentially leading to policy changes in European markets as they compete to retain their most promising tech companies. Let’s be clear, there’s very little incentive for firms with global ambitions to list in Europe vs. the US… Looking ahead, Klarna's public debut will likely set important precedents for valuation metrics applied to FinTech companies in a high-interest-rate environment and how one should integrate oAI and traditional financial services. Can’t wait 🍿

ICYMI:

Affirm: Buy Now, Profit Later? Growing scale masks path to sustainable profitability 🤔💳 [Buy Now, Profit Later, or the breakdown of Affirm’s latest financials, what they mean & what’s next]

🔎 What else I’m watching

Visa and Affirm Launch Card with Toggle Between Debit and BNPL 💳 Visa V 0.00%↑ has partnered with Affirm AFRM 0.00%↑ to introduce a card in the US that allows shoppers to toggle between debit and Buy Now, Pay Later (BNPL) payment options. The Visa Flexible Credential (VFC) technology enables users to pay from different funding sources with a single card. The Affirm card lets users pay in full or request to pay over time via the Affirm app. Also, Emirates NBD's digital offshoot Liv uses VFC to offer multi-currency access from a single card. The US and UAE rollouts follow the successful launch of VFC in Japan with Sumitomo Mitsui Card Company. ICYMI: Affirm: Buy Now, Profit Later? Growing scale masks path to sustainable profitability 🤔💳 [Buy Now, Profit Later, or the breakdown of Affirm’s latest financials, what they mean & what’s next]

Adyen and Zalando Partner for Seamless European Payments 💳 Adyen and Zalando have partnered to optimize payment methods for European clients. Adyen will be Zalando's exclusive partner for selected local payments, including Cartes Bancaires in France and Bancontact in Belgium. The collaboration aims to enhance security and convenience, focusing on 3D Secure transactions under PSD2. Network Token Optimization will reduce cancellations and improve authorization rates, ensuring a frictionless payment experience. Adyen's solutions will integrate payments, avoiding third-party redirections. ICYMI: Adyen’s Q3 2024: premium payments player hits growth speed bump, but long-term thesis remains intact 🫡📈 [see how premium payments player hits growth speed bump and why long-term thesis remains intact + more bonus reads inside]

PayPal Launches Money Pooling Tool for Group Purchases 💸 PayPal PYPL 0.00%↑ has introduced a money pooling feature for group purchases, rolling out globally in the US, Germany, Italy, and Spain. The tool allows users to set up a pool in the PayPal app or online, invite friends and family to contribute, track contributions, and transfer funds to their PayPal balance. A 2024 PayPal survey found that US consumers pooled money for group purchases approximately 86 million times last year. ICYMI: PayPal’s Q3 2024: profitable evolution from growth story to value play 💰📊 [breaking down the most important Q3 2024 numbers, what they mean & what’s next + bonus reads on PayPal & co]

💸 Following the Money

Argentinian FinTech Ualá hits $2.75B valuation on $300M funding round.

Italian unicorn Satispay has raised €60M, surpassing the milestone of five million users.

Saudi Arabia-based FinTech infrastructure platform Lean Technologies has raised $67.5M in a Series B funding round to scale its Pay-by-Bank and Open Banking offerings.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is brilliant! Thank you for sharing this here.