Bank of America signals readiness for cryptocurrency integration 😳🏦; RIP Zing: HSBC shutters Wise & Revolut competitor after just one year 🪦🏦

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The ultimate list of resources for building and scaling billion-dollar companies 🦄 [1,500+ pages of knowledge, data, and advice to launch & scale your next unicorn startup in 2025]

AI 100: Top Artificial Intelligence Startups of 2024 🤖💸 [these companies raised $28B already. Find whose backing them, unlock their exclusive pitch decks & learn from the best]

Agentic AI set to transform financial services in 2025 and beyond 🤖💸 [unpacking Citi’s latest report, why it matters & what’s next + bonus deep dives into Citi, Goldman Sachs & more Finance + AI stuff]

Goldman Sachs’ new AI Assistant, or a bid to hire a veteran banker who never sleeps 🤖💸 [what it’s all about, why it makes sense & what it means for the future of banking + bonus deep dive into Goldman & their latest financials]

Get Funded Fast: Pitch Deck Templates from Top Startup Accelerators & Investors💰 [leverage proven decks and best practices to secure your next round faster]

Discover Financial’s Q4 2024: strong core metrics & Capital One merger create a compelling risk-reward proposition 👀📈 [breaking down their latest numbers, what they tell us & whether Discover is worth your time in 2025 & beyond]

Bank of America’s Q4: strong deposit franchise and rising NII signal compelling value despite near-term headwinds 👀🏦 [unpacking their latest Q4 2024 numbers what they mean, what’s next & whether BoA is worth your time and money in 2025 + bonus deep dives into other banking giants]

Charles Schwab: strong Q4 showcases resilient business model, but valuation warrants caution 🤔📈 [unpacking their latest financials, what they mean & whether Charles Schwab is worth your time and money in 2025]

Morgan Stanley’s record earnings mask deeper strategic evolution 📈💸 [breaking down the key numbers, what they mean & what’s next for Morgan Stanley]

Global 6,200+ Investor Database to Fast-Track Your Funding in 2025 💸 [shorten your fundraising time, find your perfect investors, and close rounds faster]

As for today, here are the 2 fascinating FinTech stories that were changing the world of financial technology as we know it. This was yet another insane week in the financial technology space space so make sure to check all the above stories.

Bank of America signals readiness for crypto integration 😳🏦

The news 🗞️ Bank of America BAC 0.00%↑ CEO Brian Moynihan has indicated that the US banking industry stands prepared to embrace crypto payments, contingent upon regulatory approval.

Speaking at the World Economic Forum in Davos, Switzerland, Moynihan articulated a clear position on cryptocurrency integration while emphasizing the need for regulatory framework clarity.

Let’s take a quick look at this and see why it matters.

More on this 👉 The statement from America's second-largest bank by assets represents a notable shift in the traditional banking sector's stance toward digital currencies. Moynihan envisions cryptocurrency becoming another payment option alongside established methods like Visa V 0.00%↑, Mastercard MA 0.00%↑, and Apple Pay for everyday transactions. And he’s not wrong here 😉

Notably, we must remember that Bank of America has already secured hundreds of blockchain-related patents, suggesting substantial preparation for potential cryptocurrency integration.

Zoom out 🔎 This position contrasts with more skeptical views from other banking leaders, such as JPMorgan Chase JPM 0.00%↑ CEO Jamie Dimon, who has expressed concerns about Bitcoin while acknowledging the potential utility of blockchain technology.

Meanwhile, Moynihan's comments specifically emphasized the transactional aspects of cryptocurrency rather than its investment potential. He expressed particular interest in stablecoin applications, suggesting that dollar-backed digital currencies could provide practical value for consumer transactions.

The divergence in perspectives well highlights the evolving nature of traditional banking's relationship with digital assets.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this marks yet another sign of the convergence of traditional banking and cryptocurrency. For Bank of America, early positioning through blockchain patents and public openness to crypto integration could provide a competitive advantage once regulatory frameworks are established. Looking at the bigger picture, this also (again) signals a shift from cryptocurrency being viewed as primarily an investment vehicle to becoming an integrated part of the mainstream payment infrastructure. This transition should thus accelerate the development of hybrid financial products that bridge traditional and digital finance. Looking ahead, this development extends way beyond immediate business implications. It clearly suggests a future where digital and traditional financial systems become increasingly integrated, potentially leading to more efficient, accessible, and diverse payment options for consumers while maintaining the stability and security of traditional banking infrastructure. Bullish.

ICYMI: Bank of America’s Q4: strong deposit franchise and rising NII signal compelling value despite near-term headwinds 👀🏦 [unpacking their latest Q4 2024 numbers what they mean, what’s next & whether BoA is worth your time and money in 2025 + bonus deep dives into other banking giants]

RIP Zing: HSBC shutters Wise competitor after just one year 🪦🏦

The (BIG?) news 🗞️ HSBC HSBC 0.00%↑ just announced the closure of Zing, its international payments application, merely a year after its launch. Ouch 🤕

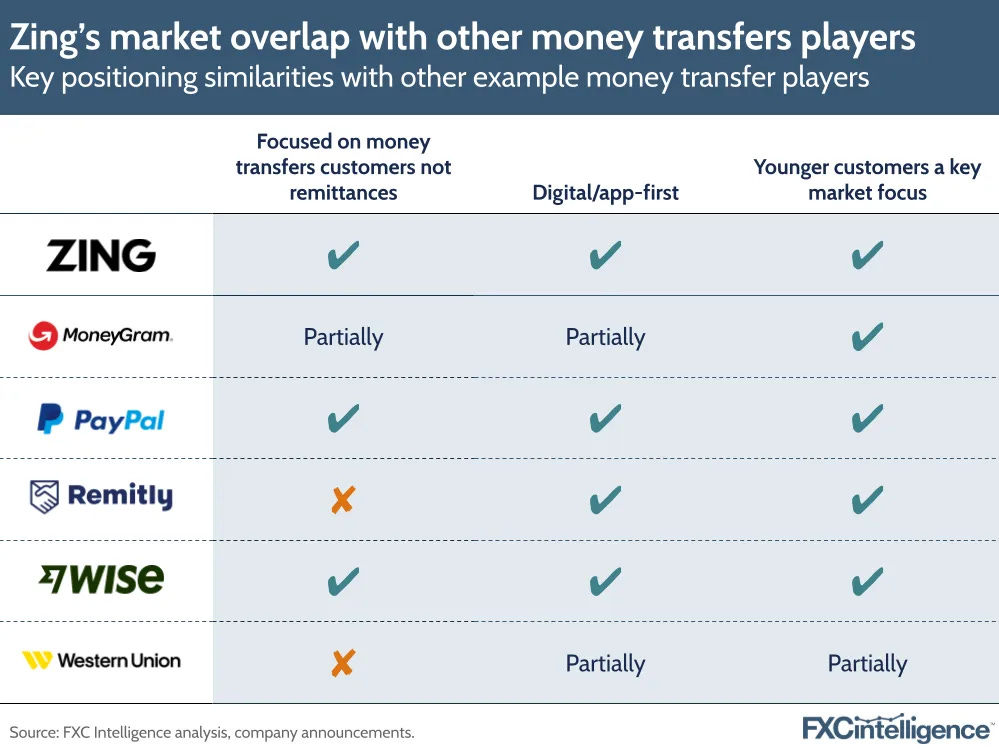

The shutdown of this digital payments venture, which was designed to compete with established FinTech players like Wise and Revolut, brilliantly underscores the significant challenges traditional banks face when attempting to innovate in the FinTech space.

Let’s take a quick look at this and see what lessons banks should learn here.

More on this 👉 The decision to discontinue Zing came amid struggles to restructure its compliance functions through an initiative called Project Green.

Despite HSBC's considerable resources and global presence, Zing managed to attract only approximately 30,000 customers by mid-2024, falling short of expectations for a bank of HSBC's scale. Ups 😬

For context:

Revolut

Reached 50M customers by November 2024

Growing at a rate of 1M new users every three weeks

UK remains its largest market with 9.5M users

Wise

Reached 12.8M active customers by March 2024

Experienced 29% year-over-year growth

About two-thirds of new customers join through word-of-mouth referrals

In retrospect, Zing had no chance… 🤷♂️

The app, which offered multi-currency holdings and competitive conversion fees as low as 0.2%, operated under a separate UK e-money institution license as MP Payments.

However, recent developments, including the departure of key personnel and the reassignment of international expansion staff to compliance-related projects, signaled growing operational challenges.

Zoom out 🔎 This closure represents a broader (failing) pattern in HSBC's FinTech ventures, following the bank's write-off of its £35 million investment in Monese, a (failing) British neobank, just months earlier.

The series of setbacks well highlights the fundamental difficulties traditional banks face when attempting to compete in the digital-first financial services landscape.

Sometimes you win, sometimes you learn as they say…

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this development is a brilliant reminder that traditional banks must reconcile their established operational models, which prioritize regulatory compliance and risk management, with the need for rapid innovation and digital transformation. More importantly, the failure of Zing suggests that simply replicating existing FinTech offerings without providing distinctive value propositions is insufficient. What if a bank would do it is the new What if Google would do it. Looking ahead, it’s clear that the future may require traditional banks to adopt alternative approaches to digital innovation. Rather than developing standalone competitors to established FinTech players, banks might find more success in strategic partnerships, acquisitions, or focusing on integrating digital capabilities into their core services where they already have competitive advantages. When it comes to HSBC, this experience may lead to a strategic pivot in how it approaches digital transformation. Under CEO Georges Elhedery's leadership, the bank appears to be refocusing on core business lines and cost reduction rather than experimental digital ventures (remember that Goldman did that too and it worked out brilliantly). This could thus signal a broader industry trend where large banks become more selective and strategic in their FinTech investments, potentially leading to increased collaboration between traditional banking institutions and successful FinTech companies rather than direct competition.

ICYMI: HSBC’s Q2 2024: global banking giant navigates stormy waters with resilience, yet headwinds persist 👀🌊 [why the bank's latest financial reports reveal a mixed picture of resilience & challenges + LOTS of bonus deep dives into other banking behemoths]

FinTech giant Wise is a trillion-dollar money mover in the making 😳💸 [unpacking the most important H1 FY25 numbers, what they mean & what’s next for Wise]

🔎 What else I’m watching

Trump Meme Coin Crashes as Melania Enters Crypto Market 💥 The value of Donald Trump's newly launched meme coin, $Trump, briefly plummeted by more than 50% following the release of a similar crypto token by his wife, Melania. The price of $Trump had surged to over $70, valuing it at over $14 billion, but it crashed to $30 before recovering to around $64 after the launch of $Melania. Both tokens have entered the top 20 cryptocurrencies, leading to a sell-off of other meme coins. Market analysts are surprised by Trump's impact on the crypto market, which has pushed Bitcoin to a new high of $108,943. Trump is expected to issue an executive order designating cryptocurrency as a national priority, which could further disrupt the market.

Stripe Lays Off 300 Employees in Workforce Restructuring 🏢 Stripe has laid off approximately 300 employees, representing 3.5% of its workforce, according to Business Insider. The cuts primarily affect roles in product, engineering, and operations. Despite the layoffs, Stripe plans to increase its headcount by 17% to 10,000 employees by the end of the year. Chief People Officer Rob McIntosh cited the need for team-level changes to ensure the right people are in the right roles and locations to execute the company's plans.

KakaoPay and Apple Pay Fined $5.8 Million in South Korea for Data Breaches 🔒 South Korea's Personal Information Protection Commission (PIPC) has fined KakaoPay and Apple Pay a combined $5.8 million for violating the country's Personal Information Protection Act. The fines stem from unauthorized transfers of personal data involving approximately 40 million users to Alipay, a Chinese payment platform. Between April and July 2018, KakaoPay transferred sensitive user data, including phone numbers, email addresses, and account balances, to Alipay without proper consent. This data was used to calculate 'NSF scores' for Apple’s payment evaluation process. The transfers involved all KakaoPay users, regardless of whether they used Apple Pay.

💸 Following the Money

Amazon has agreed to acquire Indian buy now, pay later firm axio in a deal reported to be worth more than $150M.

Crypto firm Circle Internet Group has acquired Hashnote, the issuer of US Yield Coin (USYC), the world's largest tokenized treasury and money market fund.

Norwegian open banking firm Neonomics has acquired UK contemporary Ordo. Financial terms of the deal were not disclosed.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: