Brazil’s Nubank is leveraging OpenAI to transform customer experience 🤖🇧🇷; European tech leaders launch €10M fund to cultivate next generation of startup founders 😤🚀; BBVA goes crypto 😳🇪🇸

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

10 FinTech and Finance stocks to include in your portfolio for 2025 💼 | Part II [seize the Future: ride the wave of innovation reshaping Finance & FinTech]

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

AI 100: Top Artificial Intelligence Startups of 2024 🤖💸 [these companies raised $28B already. Find whose backing them, unlock their exclusive pitch decks & learn from the best]

The Ultimate Toolkit for Cashflow Forecasting & Financial Health Monitoring 📈 [navigate your financial journey with precision, clarity, and confidence]

Visa's moat keeps deepening: network effect dominance, payment digitization, & value-added services create unstoppable growth engine for the finance giant 😤💳 [how network effect dominance, payment digitization, and value-added services create unstoppable growth engine for the finance giant + bonus deep dives into Visa’s & Mastercard’s latest financials]

Block makes bold dual moves: banking capabilities meet AI dominance 🤖💸 [what it’s all about and why it matters + bonus deep dive into Block and their latest financials & priceless resources on AI Agents]

Varo Bank bets on AI to drive profitability 🤖💸 [quick recap of Varo’s strategy and what it indicates us + more bonus reads & resources on AI inside]

US Senate advances stablecoin regulatory framework 🏦🪙 [why it matters & what it means for the future of finance + lots of bonus deep dives inside]

Green Dot explores sale 😳🏦 [what it’s all about & what it tells us about the future of BaaS]

Coinbase gets green light for India return🚦🇮🇳 [why it matters & what’s next + bonus deep dive into Coinbase and their latest financials]

Gemini files confidentially for US IPO 😳🔔 [what this indicates & why it matters, and what can we expect next]

Global 6,200+ Investor Database to Fast-Track Your Funding in 2025 💸 [shorten your fundraising time, find your perfect investors, and close rounds faster]

As for today, here are the 3 fascinating FinTech stories that were changing the world of financial technology as we know it. This was yet another wild week in the financial technology space so make sure to check all the above stories.

Brazil’s Nubank is leveraging OpenAI to transform customer experience 🤖🇧🇷

The news 🗞️ Brazil's digital banking powerhouse Nubank NU 0.00%↑ has formed a strategic partnership with OpenAI to enhance both customer experiences and internal operations across its 114 million customer base.

The recent announcement detailed multiple AI initiatives that are already showing significant operational improvements.

Let’s take a quick look at this, see why it matters, and what’s next.

More on this 👉 The partnership began with a custom enterprise search tool powered by GPT-4o and GPT-4o mini. This system employs Retrieval-Augmented Generation (RAG) techniques to provide Nubank's 7,000+ employees with instant access to internal information like FAQs, brand guidelines, and company policies.

The chat-based interface, now used by over 5,000 employees monthly, has streamlined workflows by eliminating the need to navigate fragmented information repositories.

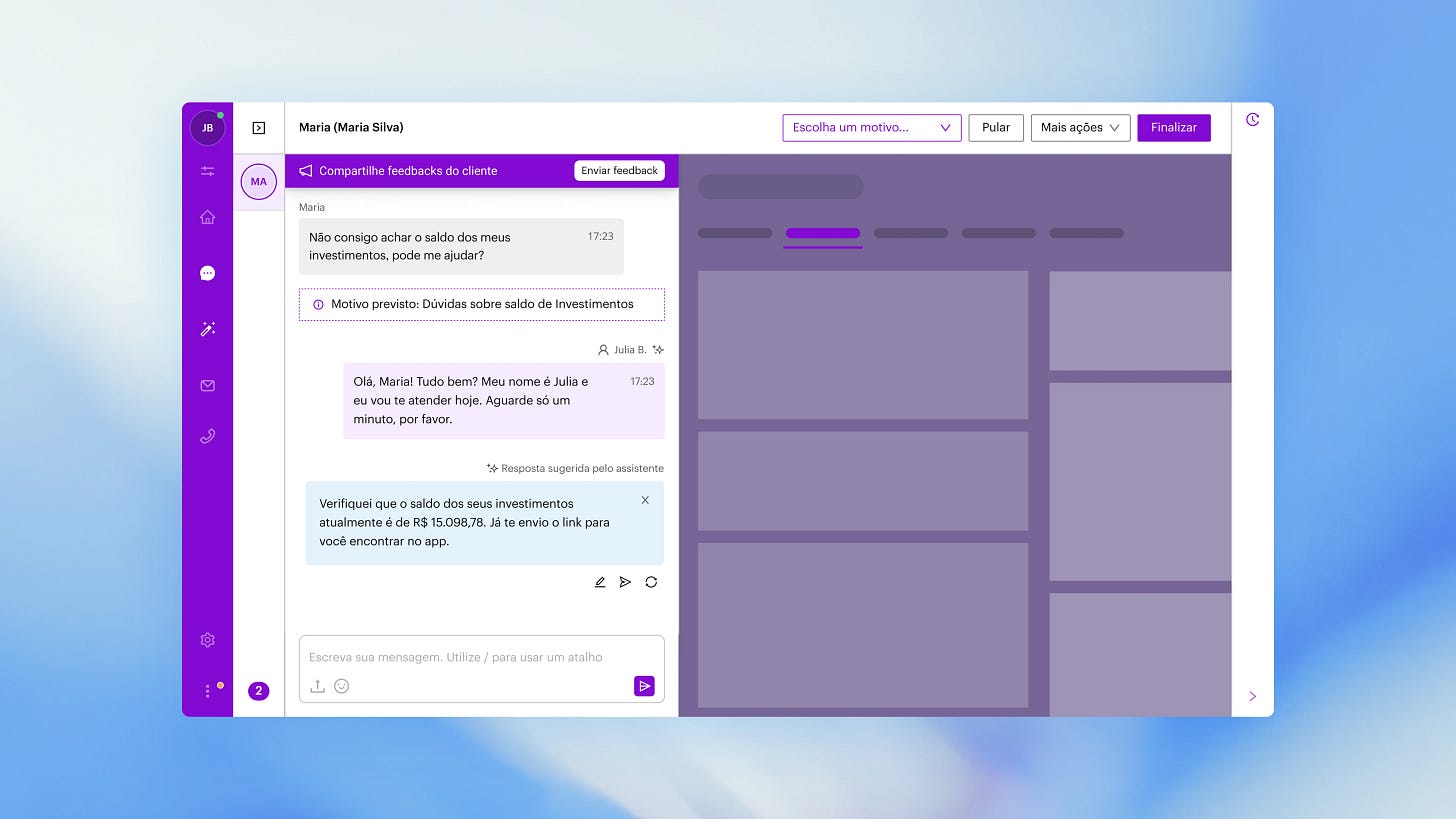

Building on this foundation, Nubank implemented a Call Center Copilot that assists human agents in real-time conversations. This tool integrates the bank's knowledge base with chat history to offer agents next-reply suggestions, conversation summaries, and step-by-step technical guidance. Currently, more than 45% of agents utilize these features to provide more consistent and empathetic customer support. Nice!

Perhaps most impactful is Nubank's customer-facing AI Assistant, also powered by GPT-4o. This system handles up to five automated interactions before escalation and manages over two million chats monthly. The assistant has proven capable of resolving up to 50% of tier 1 inquiries without human intervention, reducing response times by 70%. AI revolution at its finest 👏

The bank is also piloting an advanced fraud detection system that uses GPT-4o vision to analyze transaction records, customer communications, and submitted documents, identifying patterns that may indicate fraudulent activity.

Collectively, these AI implementations have enabled Nubank to resolve customer queries 2.3x faster while maintaining high accuracy and strong customer satisfaction scores.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must stress that Nubank's comprehensive AI strategy signals a fundamental shift in how financial institutions will compete in the coming years. As one of Latin America's most innovative financial companies joins global institutions like BNY, BBVA, and Klarna in leveraging OpenAI's capabilities, we're witnessing the early stages of an industry-wide transformation. The most significant long-term impact may thus be on workforce dynamics in financial services. Rather than replacing human employees, Nubank's approach augments them with AI tools that handle routine tasks while enabling staff to focus on complex issues requiring human judgment. This hybrid model likely represents the future of customer service across the industry. Meanwhile, for consumers, the barrier between digital and traditional banking experiences will continue to erode as AI-enabled services provide increasingly personalized interactions at scale. Financial institutions that fail to adopt similar technologies risk falling behind in both operational efficiency and customer experience. Looking ahead, we can expect Nubank to expand its AI capabilities into more sophisticated financial advisory services, personalized product recommendations, and predictive financial planning tools. The real competitive advantage will therefore come not just from implementing AI, but from thoughtfully integrating it throughout the customer journey in ways that genuinely improve financial outcomes.

ICYMI: Latin America's digital banking juggernaut Nubank combines explosive growth with industry-leading profitability 😤🚀 [breaking down their Q4 2024 financials, what they tell us & why you should be really bullish on NU 0.00%↑]

stuff 🌶️

European tech leaders launch €10M fund to cultivate next generation of startup founders 😤🚀

The news 🗞️ A coalition of over 150 prominent European tech entrepreneurs has launched Project Europe, a €10 million initiative designed to nurture young tech talent and create the continent's next wave of major technology companies.

The fund will invest €200,000 in 10-20 entrepreneurs under the age of 25 annually, taking a 6.66% equity stake in exchange.

Let’s take a quick look at this and see why it matters.

More on this 👉 Led by British podcaster-turned-venture capitalist Harry Stebbings of 20VC, Project Europe brings together founders from some of Europe's most successful tech companies, including Klarna, Mistral, Delivery Hero, and Shopify. The initiative is backed by three venture capital firms: 20VC, Berlin-based Point Nine, and New York-based Adjacent.

The program will pair each young entrepreneur with an established European founder who will provide mentorship focused on "solving hard problems with technical solutions." Stebbings describes the initiative as what would result "if the Thiel fellowship and YC had a baby," referring to Peter Thiel's grant program for young entrepreneurs and Y Combinator, the renowned Silicon Valley accelerator.

Unlike the Thiel Fellowship, which provides grants, Project Europe takes an equity stake, with Stebbings noting that "investments are treated with much more respect, accountability and consciousness than grants."

Zoom out 🔎 The initiative comes amid concerns about Europe's competitive position in the global tech landscape. Stebbings characterizes the current situation as a "doom loop" causing a "brain drain" of top talent to the United States, emphasizing that "the world thinks that we can't build great companies anymore."

Project Europe doesn't require participants to have fully formed startups or co-founders to apply. The program will identify talent through both network outreach and direct applications. Kitty Mayo, who previously ran programs at Entrepreneur First, has been appointed CEO.

✈️ THE TAKEAWAY

What’s next? 🤔 Project Europe represents a significant shift in Europe's approach to tech entrepreneurship, potentially addressing several critical challenges facing the ecosystem. The initiative's focus on youth could help counter the talent exodus to Silicon Valley by cultivating a stronger sense of possibility among Europe's next generation of founders. The program arrives at a pivotal moment, as regulatory tensions between Europe and American tech giants intensify and concerns about the region's innovation capacity grow. By focusing on early-stage technical talent, Project Europe may help address the pipeline problem that has historically limited Europe's ability to produce trillion-dollar tech companies. Looking ahead, the initiative's success will likely depend on its ability to not just provide funding but build a truly supportive ecosystem. The involvement of so many successful founders signals a meaningful commitment to mentorship that could prove transformative. If Project Europe can establish a pattern of successful homegrown companies that remain in Europe through their growth stages, it could fundamentally alter the continent's tech trajectory. Let’s make Europe Great Again! 🇪🇺🚀

ICYMI:

Spanish banking giant BBVA secures historic crypto trading license bringing Bitcoin to millions 😳🇪🇸

The BIG news 🗞️ Spain's second-largest bank, Banco Bilbao Vizcaya Argentaria (BBVA) BBVA 0.00%↑, has received regulatory approval from Spain's securities regulator (CNMV) to offer cryptocurrency trading services to its clients.

This landmark decision will enable BBVA customers to buy, sell, and manage Bitcoin and Ethereum directly through the bank's mobile application.

Let’s take a quick look at this and see why it matters.

More on this 👉 The service will initially be available to a select group of users before expanding to all private banking customers across Spain in the coming months. BBVA plans to use its own cryptographic key custody platform, maintaining full control of customer holdings without relying on third-party providers, though the bank has stated it will not offer advisory services related to these digital assets.

This approval marks a significant milestone in BBVA's cryptocurrency journey, which began in Switzerland in June 2021 when the bank first offered Bitcoin custody and trading services to private banking clients. The Swiss branch has since expanded its offerings to include Ethereum and the USDC stablecoin. In January 2025, BBVA further extended its crypto services through its Turkish subsidiary, Garanti BBVA Kripto.

The bank's expansion into cryptocurrencies comes as the European Union's Markets in Crypto-Assets Regulation (MiCA) reaches full implementation. While the framework is now in effect, cryptocurrency companies have until July 2026 to fully comply with its requirements under an 18-month transitional phase.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, BBVA's entry into Spain's cryptocurrency market clearly signals a growing trend of traditional financial institutions embracing digital assets across Europe. Several major banks have already begun integrating crypto services, including Deutsche Bank DB 0.00%↑ developing an Ethereum rollup with ZKsync, Société Générale launching a euro stablecoin, and Italy's Intesa Sanpaolo making a €1 million Bitcoin purchase for its treasury in January. This move by BBVA therefore represents a significant shift in mainstream banking's approach to cryptocurrencies, potentially accelerating adoption among retail customers who may be more comfortable accessing digital assets through established financial institutions rather than specialized crypto exchanges. Looking ahead, we can expect more European banks to follow suit as MiCA provides regulatory clarity across the EU. The combination of Trump's election in the US and Europe's evolving regulatory framework appears to be creating a favorable environment for traditional finance to expand into digital assets. Slowly, then suddenly.

ICYMI: Regulatory U-Turn: Trump administration clears path for crypto and tech in finance 👀💸 [what’s been happening & what can we expect next + bonus deep dives into Robinhood & Coinbase]

🔎 What else I’m watching

Zero Hash Integrates PayPal USD 💵 Zero Hash has integrated PayPal USD (PYUSD), a regulated stablecoin issued by Paxos Trust Company, into its platform. This addition allows Zero Hash customers to access PYUSD on both Ethereum and Solana networks, enhancing their stablecoin offerings, which already include USDC, USDT, DAI, EURC, RLUSD, and USDP. PYUSD is backed one-to-one by US dollar deposits and Treasuries, ensuring stability and security for cross-border payments and remittances. Disclaimer: I’m part of Zero Hash.

North Korean Hackers Cash Out $300 Million from ByBit Heist 💸 North Korean hackers have successfully cashed out $300M from the record-breaking $1.5B crypto heist of ByBit Exchange. The hackers, part of the Lazarus Group, worked tirelessly to launder the stolen funds, distributing them across 50 wallets within hours and systematically emptying them over nine days. North Korea, known for its sophisticated crypto laundering techniques, has stolen over $6B in crypto assets since 2017, reportedly funding its ballistic missile program. The ByBit hack is the largest crypto heist in history, surpassing the $611M stolen from Poly Network in 2021.

UK Government to Scrap Payment Systems Regulator 🏦 The UK Government plans to abolish the Payment Systems Regulator (PSR) to streamline regulation and boost economic growth. The PSR's responsibilities will be consolidated into the Financial Conduct Authority (FCA), reducing the regulatory burden on payment firms, particularly small and medium-sized enterprises (SMEs). The move aims to simplify compliance and promote innovation and competition in the payments sector. The PSR will continue to operate until legislation is passed, ensuring a smooth transition of its statutory powers to the FCA.

💸 Following the Money

Finory, a personal finance management app that simplifies how Malaysians track their finances, has secured investment from 1337 Ventures.

Worth, a fintech platform for onboarding and underwriting workflow automation, just secured a $25M investment led by TTV Capital.

Less than two years after launching, Mexican digital bank Plata has joined the unicorn club off the back of a $160M Series A funding round.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Love it! Can't believe this is free - thank you.