Elon Musk sold 𝕏 to… Elon Musk 🤷♂️🤑; Chime unveils Premium Membership ahead of its IPO 💸🔔; Stablecoin regulation advances in Congress 🪙🇺🇸

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

10 FinTech and Finance stocks to include in your portfolio for 2025 💼 | Part II [seize the Future: ride the wave of innovation reshaping Finance & FinTech]

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

AI Must-Reads: The Essential Guide to Winning in the Age of Intelligent Transformation 📚🤖 [360+ pages of must-read AI reports transforming today's leaders into tomorrow's visionaries]

The Ultimate List of Stablecoin Use Cases 🪙 [discover how stablecoins are quietly revolutionizing finance, business, and daily life across industries]

Circle's IPO orbit: profitable stablecoin leader tethered to interest rates and stables regulation 🪙🏦 [unpacking their S-1, breaking down the latest financials, strategy & what’s next for Circle + bonus deep dives into Klarna & eToro IPOs AND a bunch of other extra reads & resources inside]

Battle for the Apple Card heats up as Visa offers $100 million to unseat Mastercard 💳🍎 [what’s happening & why it matters + bonus deep dives into Apple Card & more inside]

Stablecoins surge: market reaches $225 billion as DeFi & institutional adoption transform digital finance 📈🪙 [how DeFi & institutional adoption is transforming digital finance + the ultimate list of real-world use cases of stables & more reads inside]

PayPal expands its advertising platform to the UK 🇬🇧🛍️ [why it matters & what to expect next + bonus deep dive into PayPal]

JPMorgan's $175 million lesson: Frank founder convicted in landmark FinTech fraud case 🦹♀️🏦 [how Frank founder was just convicted in landmark FinTech fraud case, why it matters & what to expect next + some priceless M&A resources inside to save you billions]

The Ultimate Africa & MENA Investor Directory 💰🌍 [Discover the leading VCs, PE Firms, and Angel Investors powering growth in MENA & Africa 💸]

Global 6,200+ Investor Database to Fast-Track Your Funding in 2025 💸 [shorten your fundraising time, find your perfect investors, and close rounds faster]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

Elon Musk sold 𝕏 to… Elon Musk 🤷♂️🤑

The news 🗞️ Elon Musk has just orchestrated a major consolidation of his tech empire by having his artificial intelligence startup xAI acquire 𝕏 (formerly Twitter) in an all-stock transaction valued at a whopping $113 billion 😳

The deal, announced just a few days ago, values xAI at $80 billion and 𝕏 at $33 billion, with xAI shareholders receiving approximately 70% of the combined entity called XAI Holdings. Not too shabby!

Let’s take a deeper dive into this, understand why it could change the game of social + AI, and see what’s next.

More on this 👉 The merger formalizes an already close relationship between the two Musk-controlled companies. xAI's Grok chatbot has been available through 𝕏's premium subscription for over a year, while xAI has been utilizing 𝕏's vast user-generated content for AI training.

As Musk explained in his announcement: "XAI and X's futures are intertwined. Today, we officially take the step to combine the data, models, compute, distribution and talent."

For 𝕏 investors, who have endured significant uncertainty since Musk's $44 billion acquisition in 2022, the merger represents a potential lifeline. Many financial institutions, including Fidelity, had previously marked down their 𝕏 equity stakes by 60-70% as advertisers fled and revenue declined.

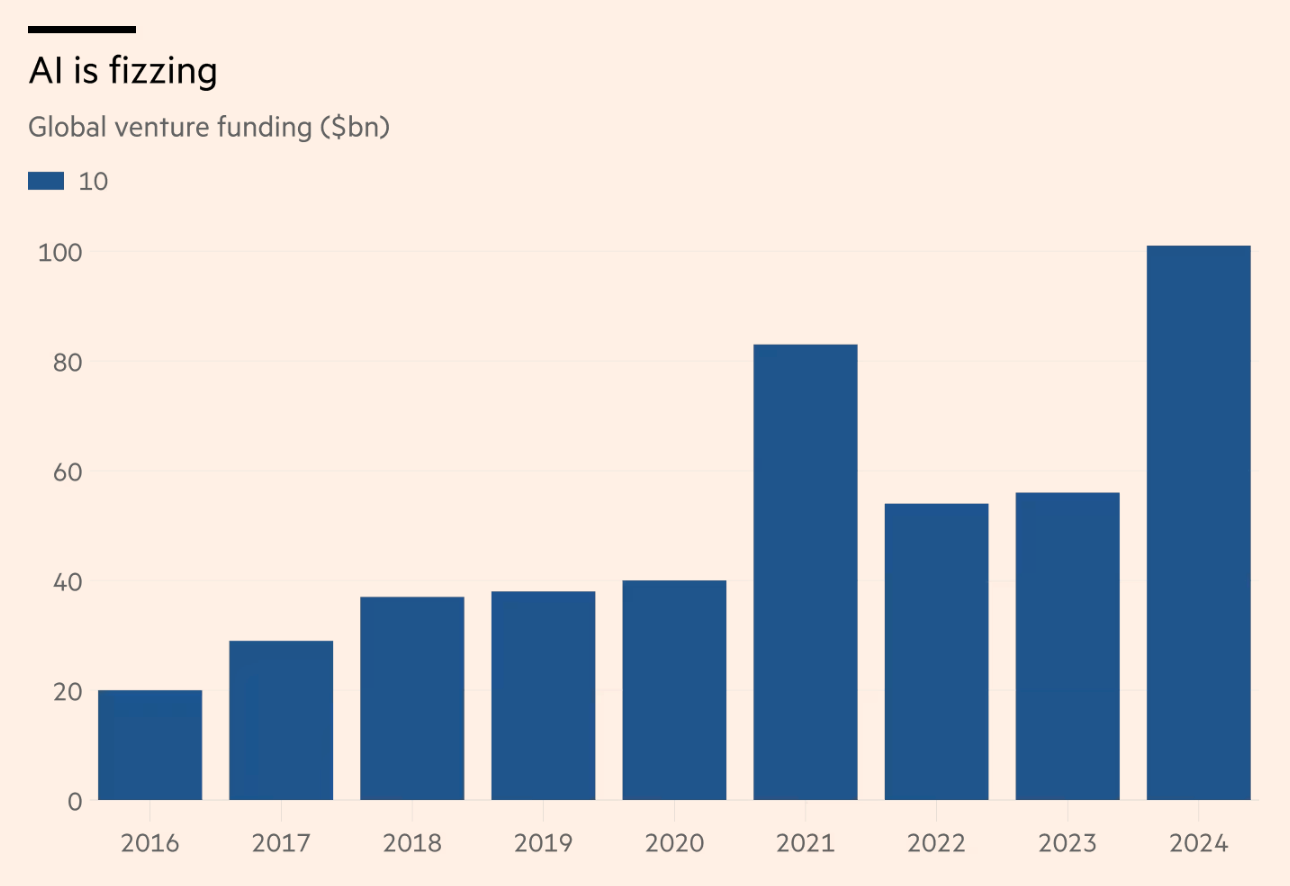

Now, they own shares in a high-growth AI venture at a time when AI valuations are soaring.

Zoom out 🔎 The transaction comes after 𝕏 recently raised approximately $900 million at a valuation close to its 2022 takeover price and as some advertisers begin returning to the platform. Meanwhile, xAI's valuation has jumped significantly from around $50 billion in late 2024 to the current $80 billion, reflecting the intense investor enthusiasm for AI companies.

Critics question the necessity of the formal merger, given the existing close integration between the companies. Questions remain about the management structure of XAI Holdings, though Musk is expected to lead the combined entity.

The transaction was advised by Morgan Stanley, the same bank that supported Musk's acquisition of Twitter, highlighting the interconnected nature of Musk's business dealings.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this merger signals a fundamental shift in how AI and social media companies will operate going forward. By controlling both the data source (𝕏) and the AI development (xAI), Musk has created a vertically integrated AI powerhouse that few competitors can match. More importantly, for 𝕏, the merger provides a clearer strategic direction as an AI-driven platform rather than just a social network. Users can expect more AI features integrated throughout the 𝕏 experience, from content recommendation to advanced personalization and potentially sophisticated financial services built on AI technologies. Looking at the bigger picture, this consolidation may accelerate the integration of AI with financial services. As social media platforms increasingly serve as venues for financial discussions, market sentiment analysis, and even transaction platforms, AI-powered insights derived from real-time social data could become valuable tools for financial decision-making and automated trading systems. On the other hand, the regulatory implications are significant, too. Antitrust authorities, particularly in Europe, will likely scrutinize the merger closely, examining concerns about data monopolization and privacy. Financial regulators may also take interest in how AI models trained on social media data could influence markets or be used for financial services. On top of that, competitors like OpenAI, Google DeepMind, and Anthropic will likely only accelerate their pursuit of proprietary data sources, potentially through similar acquisitions or strategic partnerships with content platforms. Meanwhile, financial institutions may increasingly look to partner with AI companies that have access to real-time social data for market intelligence and customer insights. And this makes 𝕏 very unique. Let that sink in.

ICYMI: 𝕏 marks the spot: how Musk's platform rebounded to $44 billion valuation 😳📈 [quick recap of the latest developments at 𝕏, why it matters + bonus deep dive into the vision behind the Everything App]

Chime unveils Premium Membership ahead of its anticipated IPO 💸🔔

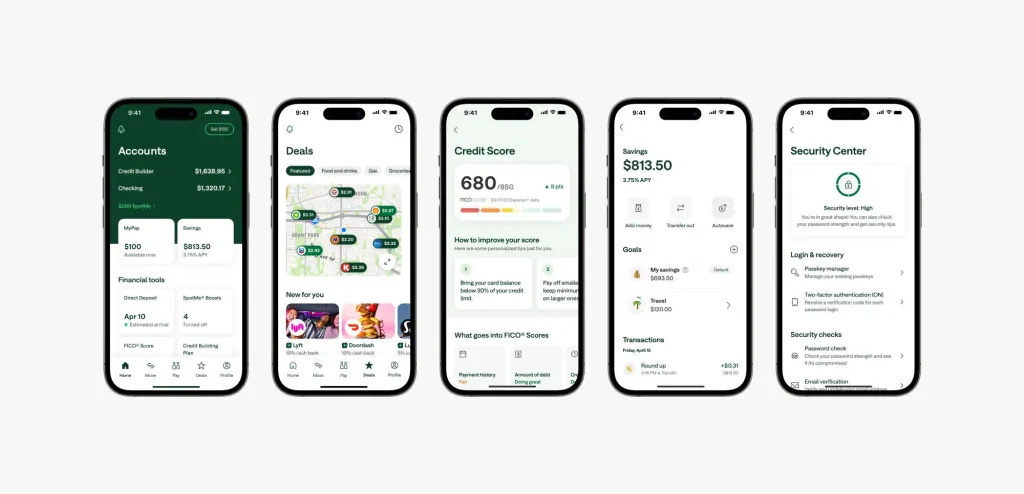

The news 🗞️ US Mobile banking giant Chime has launched a comprehensive suite of new features, headlined by a premium membership tier called Chime+, signaling an aggressive growth strategy as the company prepares for its public market debut.

Let’s take a quick look at this and see why it matters.

More on this 👉 Chime+ is available exclusively to members who set up direct deposit through the platform. The premium tier comes with several notable benefits, including a competitive 3.75% APY savings rate - significantly higher than the national average of 0.61%. Even non-direct deposit customers will receive a respectable 2% APY.

Additional Chime+ perks include exclusive merchant deals, cashback offers from top retailers, and priority customer support.

Alongside the premium tier, Chime has rolled out a redesigned app with enhanced functionality for all users. Key improvements include:

Credit building features available from day one, removing the previous direct deposit requirement for accessing Chime's Credit Builder Visa card

Personalized credit insights with FICO score tracking and improvement recommendations

New savings goals tools to help users track financial milestones

Enhanced security center with passkeys and multi-factor authentication

Streamlined interface with popular features accessible from the home screen

The fintech company has also launched Chime Workplace, a suite of financial wellness services for employers, and recently introduced Instant Loans - offering pre-approved members access to three-month installment loans up to $500.

Zoom out 🔎 According to TechCrunch reporting, Chime filed confidential paperwork with the SEC in December to go public.

The company was last valued at $25 billion during a funding round in 2021 and has raised approximately $2.65 billion to date from investors including SoftBank, Tiger Global, and Sequoia.

Recent figures showed Chime with 7 million customers and $1.5 billion in annualized revenue as of mid-2024. Not bad!

✈️ THE TAKEAWAY

What’s next? 🤔 Chime's strategic expansion of premium features appears calculated to strengthen its position ahead of its IPO. By offering high-yield savings accounts and removing barriers to credit-building services, the company is clearly focused on both customer acquisition and deepening relationships with existing users. This move represents a growing trend in the fintech space where companies are moving beyond basic no-fee banking toward more comprehensive financial service ecosystems. Competitors like Robinhood HOOD 0.00%↑ are following similar strategies, recently announcing wealth management services with comparable high-yield savings rates. Looking at the bigger picture, Chime's approach highlights how digital-first platforms continue to challenge traditional banks by leveraging technology to offer premium services without premium fees. The integration of AI for customer support -with Chime reporting that AI handled nearly 70% of customer interactions last year -signals that automation will play an increasingly important role in scaling customer service while maintaining cost efficiency. As Chime approaches its public offering, we can expect further enhancements to its revenue-generating capabilities, likely including expanded lending products and possibly wealth management features to compete more directly with both neobanks and established financial institutions. Can’t wait to dive into their IPO filing 🤓

ICYMI: Robinhood unleashes AI-powered banking revolution: from doorstep cash to digital financial advisors 🤖🏦 [why their latest announcements could change the finance game & should worry traditional banks, what’s next for Robinhood + bonus deep dive into HOOD 0.00%↑ & SoFi’s SOFI 0.00%↑ latest financials AND some must-read AI resources inside]

Beyond Banking: Revolut is set to disrupt global employment in 2025 with GlobalHire 😳🏦 [what it’s all about, why it matters, and what we can expect next]

Stablecoin regulation advances in Congress 🪙🇺🇸

The news 🗞️ The U.S. House Financial Services Committee has passed the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act with a 32-17 vote, moving forward the first comprehensive regulatory framework for dollar-pegged digital tokens.

The bill, which now heads to a full House vote, has become embroiled in partisan debate following the Trump family's entry into the stablecoin market.

Let’s take a quick look at this.

More on this 👉 Democrats on the committee attempted to add amendments that would prevent the president and other government officials from having financial interests in stablecoins. This push came in direct response to World Liberty Financial, a Trump-affiliated venture that recently launched its own stablecoin called USD1.

Rep. Maxine Waters, the committee's ranking Democrat, expressed strong opposition, warning that the bill could enable the Trump family to use its stablecoin for government payments, creating significant conflicts of interest. Democratic Representatives Stephen Lynch and Brad Sherman raised additional concerns about potential government bailouts if the Trump-affiliated stablecoin were to fail.

Republicans, led by Committee Chair French Hill and Digital Assets Subcommittee Chair Bryan Steil, have resisted these amendments, arguing that the legislation establishes universal requirements for all issuers. According to Rep. Tom Emmer, President Trump has directed Congress to pass this legislation before the August recess.

Zoom out 🔎 Meanwhile, cryptocurrency executives are lobbying to allow stablecoins to pay interest, a feature currently prohibited in the House version of the bill. Coinbase COIN 0.00%↑ CEO Brian Armstrong has advocated for this capability, arguing that "the government shouldn't put its thumb on the scale to benefit one industry over another."

Banking industry representatives have pushed back, with the American Bankers Association warning that interest-bearing stablecoins could threaten banks' fundamental role in credit intermediation by shifting deposits away from the regulated banking system.

A companion bill in the Senate, the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins), has already advanced through the Senate Banking Committee with an 18-6 vote. Reports suggest lawmakers may work to align the two bills to avoid the need for a conference committee.

✈️ THE TAKEAWAY

What’s next? 🤔 The advancing stablecoin legislation represents a pivotal moment for the cryptocurrency industry and traditional finance. As the first comprehensive regulatory framework for a major crypto asset class, the final legislation will likely set precedents for how digital assets integrate with the existing financial system. The controversy over interest-bearing stablecoins highlights the fundamental tension between innovation and stability. If stablecoins are allowed to pay interest, they could accelerate the migration of capital from traditional banking to decentralized finance. This would potentially democratize access to yields currently captured by financial institutions, but might also increase systemic risks if significant capital flows out of insured deposit accounts. The Trump administration's dual role as both regulator and market participant through family connections creates an unprecedented regulatory challenge. How this conflict is resolved could establish important guardrails for future administrations' involvement in emerging financial technologies. Looking ahead, as these bills progress toward potential reconciliation and passage, we can expect intensified lobbying from both traditional finance and crypto interests. The final legislation will likely define stablecoins' role in the U.S. financial system for years to come, potentially accelerating or constraining the growth of dollar-based digital payments infrastructure. Will be following this closely 🍿

ICYMI:

🔎 What else I’m watching

Ziglu Introduces Crypto on Card 💳 Ziglu launched Crypto on Card, allowing users to spend cryptocurrency in real-world transactions using their Ziglu debit card. The feature converts crypto to GBP at the time of purchase, with users setting the order of currencies to spend from. If the primary account lacks sufficient funds, Ziglu automatically pulls from additional accounts. The service offers transparent rates, no hidden fees, and compatibility with Apple Pay and Google Pay.

Amazon Introduces AI Shopping Agent 🛍️ Amazon AMZN 0.00%↑ launched an AI agent capable of shopping online independently. The Nova Act SDK, now in research preview, allows developers to create agents for various tasks, from submitting out-of-office requests to playing video games. The SDK breaks down complex workflows into reliable commands, enabling true automation without constant supervision. Amazon envisions these agents handling intricate tasks like organizing weddings or managing IT processes to boost productivity. ICYMI:

Greek Church Plans to Launch Digital Bank 🏛️ The Church of Greece is preparing to apply for a banking license to launch its own digital bank, similar to Revolut. The initiative, developed over three years, aims to create a fully digital financial institution with no physical branches. The necessary legal documentation is expected to be submitted to the Bank of Greece by May or June. The bank will not use church assets as collateral, and the project has sparked internal debate among clergy. If approved, the bank plans to expand operations to serve Greek diaspora communities worldwide.

💸 Following the Money

Halal vehicle finance FinTech Ayan Capital has secured a significant £25M in Sharia-compliant financing from institutional debt provider Partners for Growth (PFG).

Axyon AI, a leading tech provider of Predictive AI-powered solutions for the investment management sector, has secured a further €4.3M funding round led by CDP Venture Capital.

Latin American enterprise spend management platform Mendel has raised $35M in a Series B funding round led by Base10 Partners and joined by PayPal Ventures.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is one of your best weekly issues this year. Thank you - really enjoyed it.