How Stripe built AI but for payments 🤖💳; Robinhood expands North with $179M WonderFi acquisition 💸🇨🇦; Klarna reverses AI-first strategy, returns to human CS 😳🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Beginners Guide to AI 📚🤖 [5,500+ pages of knowledge to transform your understanding from beginner to AI authority]

The Ultimate List of Stablecoin Use Cases 🪙 [discover how stablecoins are quietly revolutionizing finance, business, and daily life across industries]

The AI Strategy Playbook that Builds Billion‑Dollar Moats 💸🤖 [Uncover playbooks and best practices from leading organisations and turn AI hype into bottom‑line dominance]

Latin America's digital banking giant Nubank is poised for profit explosion despite margin pressures 😤🏦 [deep dive into NU’s Q1 2025 financials, unpacking the most important numbers, what they mean & why you should be bullish on LatAm’s FinTech gem + bonus deep dive into its closest competitor Revolut]

Revolut tests mortgages in Lithuania, signaling broader European ambitions 🏦🇱🇹 [why it matters & why it could be huge + bonus deep dive into Revolut’s latest financials]

Coinbase’s Q1 2025: revenue diversification shows promise, but regulatory & security headwinds demand caution 📊👀 [deep dive into their latest financials, unpacking key numbers, what they mean & what’s next for Coinbase + bonus deep dive into its biggest competitor Robinhood]

Monzo finally prepares for £6 billion IPO 🥳🔔 [why it matters & what to expect next + bonus deep dives into Monzo, JPMorgan and eToro’s IPO]

PayPal and Perplexity join forces to pioneer AI-powered shopping 🤖🛍️ [what it’s all about & why it could be huge + bonus dives into Agentic Commerce & FinTech plays and more AI reads inside]

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

KPI Dashboards That Supercharge Your Decision Making 📊✨ [unlock 3 easy-to-use templates to convert complex data into strategic insights - perfect for leaders, entrepreneurs, and finance pros 🧠]

As for today, here are the 3 fascinating FinTech stories that are transforming the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

How Stripe built AI but for payments 🤖💳

Following the data 📊 Payments giant Stripe has recently unveiled a groundbreaking development: a transformer-based payments foundation model, akin to a "GPT for payments." In simple terms, they built an AI but for payments.

This new AI moves far beyond their traditional machine learning models, which, while effective (+15% conversion, -30% fraud), relied on manually selected discrete features (like BIN or zip codes) and required task-specific training.

Let’s take a quick look at this, understand why it matters, and what’s next.

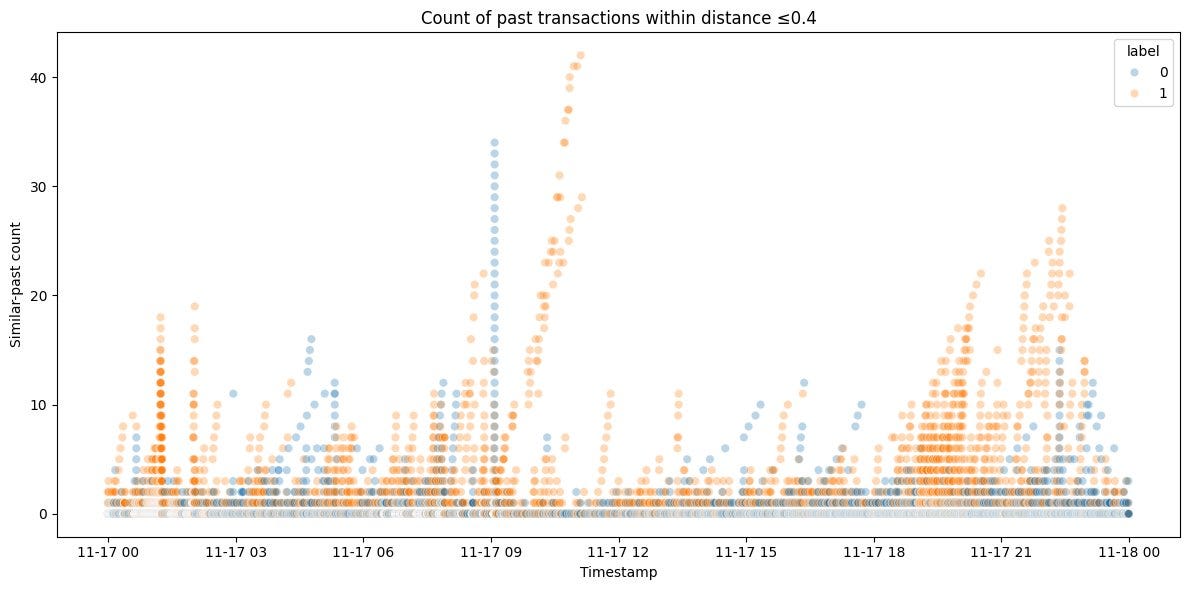

More on this 👉 The new model, trained on tens of billions of transactions, learns the "language" of payments. It processes transactions as sequences of tokens - much like words in a sentence - and creates dense, general-purpose vector embeddings for each.

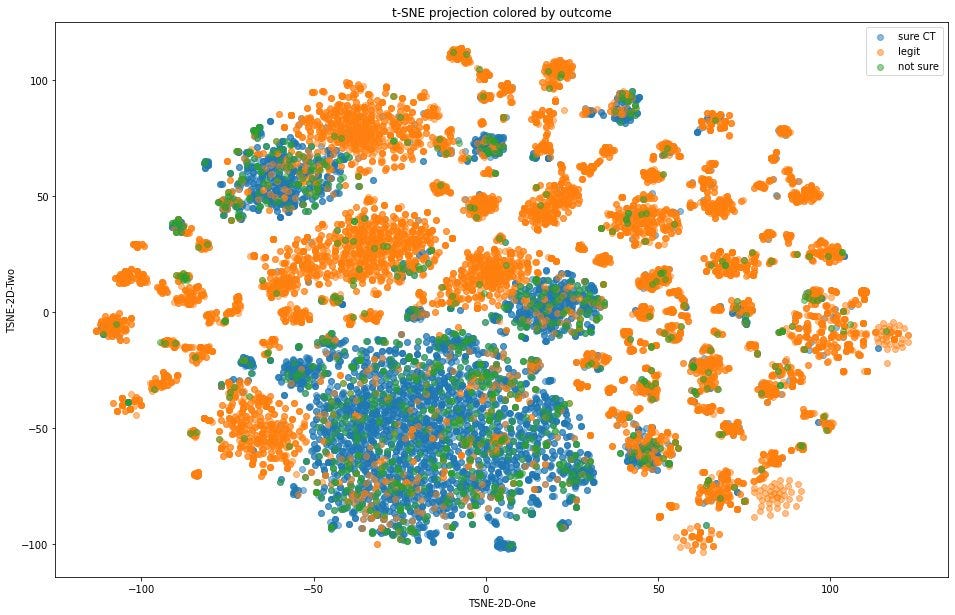

This then allows the AI to understand the underlying structure, behavior, and contextual relationships within payment data. Transactions with similarities, such as those from the same card issuer or sharing an email address, naturally cluster together in this high-dimensional space.

This deep, semantic understanding means the model isn't just crunching numbers; it's grasping the nuanced patterns and "grammatical rules" inherent in financial flows.

The most striking demonstration of its power came in tackling sophisticated card-testing attacks. Where traditional ML methods achieved a 59% detection rate for these attacks on large users, Stripe’s new transformer-based classifier, leveraging these rich embeddings, boosted this to an astounding 97% overnight.

This single, versatile foundation model can now be applied across various tasks, including disputes and authorizations, without needing constant, specific retraining.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this development by Stripe isn't just an incremental improvement - it's a significant indicator of the future trajectory for FinTech and the broader financial industry. Here’s what we should be thinking about right now:

The New Standard for Financial AI: Stripe has thrown down the gauntlet. This level of sophisticated, self-supervised learning on transactional data will likely become the benchmark. Other payment processors and financial institutions will be compelled to explore similar transformer-based architectures to remain competitive in fraud detection, risk assessment, and operational efficiency. This aligns with Andrej Karpathy’s 2024 insight that LLMs are general-purpose token stream modelers, and Stripe has powerfully validated this for the financial domain.

Rise of Domain-Specific Foundation Models: We're witnessing the dawn of highly specialized foundation models. Just as Stripe has built one for payments, we can expect similar AI engines to be developed for other complex data ecosystems like supply chains, healthcare records, energy grids, and legal data. The focus will shift from merely labeling problems to achieving a structural and contextual understanding at scale.

Beyond Fraud – Towards Proactive Finance: While the immediate impact is on fraud, the ability to understand the "semantic meaning" of transactions opens doors to hyper-personalized financial services, predictive analytics for cash flow, more nuanced credit scoring, and even automated compliance. For Stripe, this could mean an entirely new suite of AI-driven products and services for their merchants.

Ethical and Interpretability Challenges: As these powerful models become more embedded, the "black box" problem will intensify. The concern raised about "opaque rejections" is now valid more than ever. The industry, including Stripe, will need to invest heavily in explainable AI (XAI) to ensure transparency, fairness, and to meet evolving regulatory demands. We may see a push for open research or shared methodologies, as suggested by Clement Delangue, to foster trust and broader innovation.

In essence, Stripe has demonstrated that "attention" might indeed be all payments needed (referring to the famous Google paper). More importantly, this isn't just about better fraud detection - it's about unlocking a deeper intelligence from financial data. The next few years will therefore likely see an explosion of AI applications that fundamentally understand and reshape how money moves, how risk is managed, and how financial services are delivered. This probably marks the beginning of a new financial infrastructure powered by deep, contextual AI.

ICYMI:

Robinhood expands North: acquires Canadian crypto firm WonderFi in $179 million deal 💸🇨🇦

The news 🗞️ Robinhood Markets Inc. HOOD 0.00%↑ has agreed to acquire Canadian cryptocurrency platform operator WonderFi Technologies Inc. for approximately C$250 million ($179M) in an all-cash deal, marking a significant milestone in the FinTech company's international expansion strategy.

Let’s take a quick look at this and see why it matters.

More on this 👉 The transaction values WonderFi at C$0.36 per share, representing a 41% premium over its previous closing price on the Toronto Stock Exchange. WonderFi operates two regulated cryptocurrency platforms, Bitbuy and Coinsquare, which collectively manage over C$2.1 billion in assets under custody.

This acquisition follows Robinhood's $200 million purchase of European crypto exchange Bitstamp last year, underlining the company's commitment to global expansion beyond its US home market. The deal is expected to close in the second half of 2025, subject to regulatory and shareholder approvals.

Upon completion, WonderFi employees, including CEO Dean Skurka, will join Robinhood Crypto, adding to the approximately 140 staff already working at the company's Toronto headquarters, which was established in 2024.

Market reaction to the announcement was positive, with Robinhood shares rising more than 4% while WonderFi stock surged 35%.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this acquisition represents another strategic pivot for Robinhood as it evolves beyond its origins as a stock-trading app into a comprehensive financial services platform with significant cryptocurrency capabilities. The move into Canada's regulated crypto market could thus serve as a template for further international expansion. Looking at the bigger picture, Robinhood's aggressive expansion signals increasing consolidation in the cryptocurrency sector, following other significant deals this year, including Coinbase's COIN 0.00%↑ $2.9 billion purchase of Deribit and Ripple's $1.25 billion acquisition of Hidden Road. The timing is particularly noteworthy as the cryptocurrency market experiences renewed growth under the business-friendly Trump administration. Robinhood's first-quarter results revealed its crypto arm generated a whopping $253 million in transaction-based revenue, doubling year-over-year. Looking ahead, Robinhood could leverage WonderFi's established regulatory framework to introduce additional financial products to Canadian consumers. If Robinhood successfully establishes a foothold beyond crypto in Canada, the region could potentially generate $250 million in annual revenue for the company long-term. Not too shabby!

ICYMI: The Renaissance Platform: Robinhood's transformation from meme stock enabler to financial services powerhouse 😤📱[unpacking the most important numbers, what they mean, see how the FinTech giant transformed from meme stock enabler to financial services powerhouse & what’s next for Robinhood]

Coinbase’s Q1 2025: revenue diversification shows promise, but regulatory & security headwinds demand caution 📊👀 [deep dive into their latest financials, unpacking key numbers, what they mean & what’s next for Coinbase + bonus deep dive into its biggest competitor Robinhood]

Klarna reverses AI-first strategy, returns to human customer service 😳🤖

The news 🗞️ Klarna, the IPO-ready $14.6 billion Buy Now, Pay Later (BNPL) FinTech giant, is walking back aspects of its aggressive AI-first strategy in a notable shift for a company that once positioned itself at the forefront of workplace automation.

The development highlights the challenges of balancing technological efficiency with customer experience quality.

Let’s take a quick look at this, understand what it tells us, and what’s next.

More on this 👉 CEO Sebastian Siemiatkowski, who previously positioned Klarna as OpenAI's "favorite guinea pig," is now orchestrating a recruitment drive for human customer service representatives. This partial reversal comes after the company found that its AI-powered customer service, while cost-effective, delivered insufficient quality.

"As cost unfortunately seems to have been a too predominant evaluation factor when organizing this, what you end up having is lower quality," Siemiatkowski told Bloomberg. "Really investing in the quality of the human support is the way of the future for us."

The reversal is particularly significant given Klarna's previous public stance. We can remember that just last year, the company boasted that its AI systems were doing the work of 700 customer service agents and handling 75% of customer interactions.

During this period, the company implemented a year-long hiring freeze and saw its headcount drop by 22% to 3,500 employees through attrition.

Future outlook 🔮 Siemiatkowski's new recruitment initiative aims to ensure customers "will always have the option of speaking to a real person." The company plans to structure these roles in "an Uber-type of setup" where representatives can work remotely, targeting students, rural populations, and even passionate Klarna users.

Despite this shift, Klarna maintains it remains enthusiastic about AI technology. The company continues to incorporate AI in its technology stack to improve efficiency and is developing a digital financial assistant that could eventually negotiate on customers' behalf for better interest rates and insurance premiums.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Klarna's adjustment may signal a broader recalibration in FinTech as companies refine their AI implementation strategies. Rather than wholesale replacement of human workers, a more nuanced approach is emerging: AI for repetitive, data-driven tasks while retaining human interaction for complex problem-solving and customer relationships. Looking at the bigger picture, these developments suggest customer-facing roles may prove more resistant to full automation than back-office operations. Companies that strike the right balance between technological efficiency and human connection will likely gain competitive advantages in customer retention and brand loyalty. Zooming out, we must note that Klarna's experience aligns with broader industry challenges. An IBM survey revealed that only one in four AI projects delivers promised returns, and just 16% successfully scale across organizations. This suggests that well-implemented AI should augment rather than replace human capabilities in many business contexts. As Klarna prepares for a potential IPO with a target valuation exceeding $15 billion, this strategic adjustment demonstrates that even AI pioneers must carefully calibrate automation initiatives against CX quality to maintain a competitive position in the rapidly evolving FinTech landscape.

ICYMI:

🔎 What else I’m watching

Monzo Introduces 'Undo Payments' Feature for Bank Transfers 🏦 Monzo has launched a new feature called 'Undo Payments,' allowing users to cancel a bank transfer within a configurable delay of 10 to 60 seconds after initiation. This feature addresses common payment errors, with research showing that 30% of UK adults have sent money to the wrong person or entered incorrect amounts in the past year. The default setting provides a 15-second window to reverse the transaction, helping to mitigate both human errors and potential fraud. Monzo's data indicates that simple mistakes, such as typing errors, account for 68% of misdirected payments. The feature is part of Monzo's efforts to incorporate real-time safeguards into digital banking. ICYMI: Monzo finally prepares for £6 billion IPO 🥳🔔 [why it matters & what to expect next + bonus deep dives into Monzo, JPMorgan and eToro’s IPO]

Modern Treasury Introduces Stablecoin Payment Accounts 💸 Modern Treasury has launched Stablecoin Payment Accounts (SPAs), USD-backed accounts that enable companies to send and receive payments via ACH, wire, RTP, and stablecoin rails through a single API. SPAs offer a faster and more flexible way to move money domestically and internationally with built-in compliance, eliminating the need for FBO accounts. Companies can start moving money programmatically in as little as two weeks, thanks to a partnership with Brale, a stablecoin infrastructure provider. SPAs are accessible to US and select international entities, supporting stablecoins issued by Circle, Paxos, and Brale. The accounts allow companies to send and receive USD over various payment rails and stablecoins globally, with automatic conversion between USD and stablecoins for seamless settlement. ICYMI:

BBVA Expands OpenAI Agreement to 11,000 ChatGPT Licenses 🏦 BBVA has significantly increased its ChatGPT Enterprise licenses from 3,300 to 11,000 after finding that the technology saves employees nearly three hours per week. The Spanish bank, which was the first European bank to partner with OpenAI, reports that 83% of licensed users utilize ChatGPT daily. The bank has created over 3,000 specialized AI assistants for tasks such as translations, document summaries, coding, financial analysis, and marketing. Employees receive training on data security and confidentiality, and BBVA has established a community for sharing best practices and tools. The expansion reflects high demand across various business areas for generative AI capabilities. ICYMI:

💸 Following the Money

Savings and investment app Acorns has acquired the assets of EarlyBird, a "family wealth and digital memory" platform for kids. Financial terms were not disclosed.

American investing app Stash has raised $146M in an oversubscribed Series H funding round led by Goodwater Capital.

American investing app Stash has raised $146M in an oversubscribed Series H funding round led by Goodwater Capital.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is gold. Thank you for this stuff!

While Stripe's Foundation Model is interesting work, the approach isn’t new. Several companies have built payments foundation models before. Featurespace (now part of Visa) announced the first one in 2023, published a paper, then used it in the 2024 PayUK APP PoC. Links below:

Peer-reviewed academic paper: https://arxiv.org/abs/2401.01641

Initial press release: https://www.featurespace.com/newsroom/featurespace-launches-tallierltm-for-the-financial-services-and-payments-industry

PayUK PoC results: https://www.featurespace.com/newsroom/featurespaces-pilot-with-pay-uk-again-demonstrates-the-potential-for-national-payments-systems-to-help-combat-fraud