Claude for Financial Services, or AI to redefine how finance works, analyzes, & scales 🤖; Congress passes landmark stables legislation 🪙; JPMorgan's yet another revenue stream - your bank data 👀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Beginners Guide to AI 📚🤖 [5,500+ pages of knowledge to transform your understanding from beginner to AI authority]

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

AI Agents & MCPs Starter Pack: 10 Curated Repos to Learn, Build, & Scale Autonomous Agents 🤖 [from zero to builder - this toolkit has everything you need to master the agentic future of AI]

Citi's solid Q2 2025 earnings & digital asset strategy: a bid to lead the stablecoin revolution 🪙🏦 [breaking down the most important financial facts and figures, what’s next, and uncovering Citi’s brilliant stables strategy + the ultimate list of stablecoin resources inside]

Adyen’s stablecoin strategy: Wait, Watch, and Win? 🤔🪙 [what it’s all about & why it makes sense, whether Adyen is missing out or not & what’s next + bonus deep dives into Adyen and the ultimate resource list on stablecoins]

Wise delivers strong volume growth despite market disappointment 👀📈 [quick dive into their latest financials & why you should still be bullish + a bonus dive into Wise]

Standard Chartered becomes the first major global bank to launch institutional crypto trading 😳📈 [why it’s a pivotal moment in finance & what to expect next + more bonus reads inside]

N26 launches travel eSIM service 🏦📞 [why it’s a good move, what trends it justifies and what to expect next]

Starling Bank weighs NYSE listing 👀🇺🇸 [another major blow for London and why it makes sense + bonus deep dive into Starling]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another solid week in the financial technology space, so make sure to check all the above stories.

Claude for Financial Services, or AI to redefine how finance works, analyzes, and scales 😳🤖

The BIG News 🔥 AI giant Anthropic has just unveiled Claude for Financial Services, a comprehensive artificial intelligence solution designed specifically for financial professionals.

This new platform represents the company's most significant industry-focused product launch, targeting investment analysts, portfolio managers, and research teams across Wall Street.

Let’s take a look at this, understand why it’s huge, and what’s next for Wall St. 2.0.

More on this 👉 The Financial Analysis Solution integrates multiple data sources into a unified interface, combining market feeds with internal enterprise data from platforms including Databricks and Snowflake.

Financial professionals can now access real-time information from major data providers such as FactSet, PitchBook, Morningstar, S&P Global, and Daloopa through pre-built connectors, enabling comprehensive analysis across previously siloed systems.

According to Anthropic's performance benchmarks, Claude 4 models demonstrate superior capabilities compared to competing AI systems on financial tasks. When tested by FundamentalLabs, Claude Opus 4 successfully completed 5 of 7 levels in the Financial Modeling World Cup competition, achieving 83% accuracy on complex Excel-based financial tasks. Let that sink in… 👀

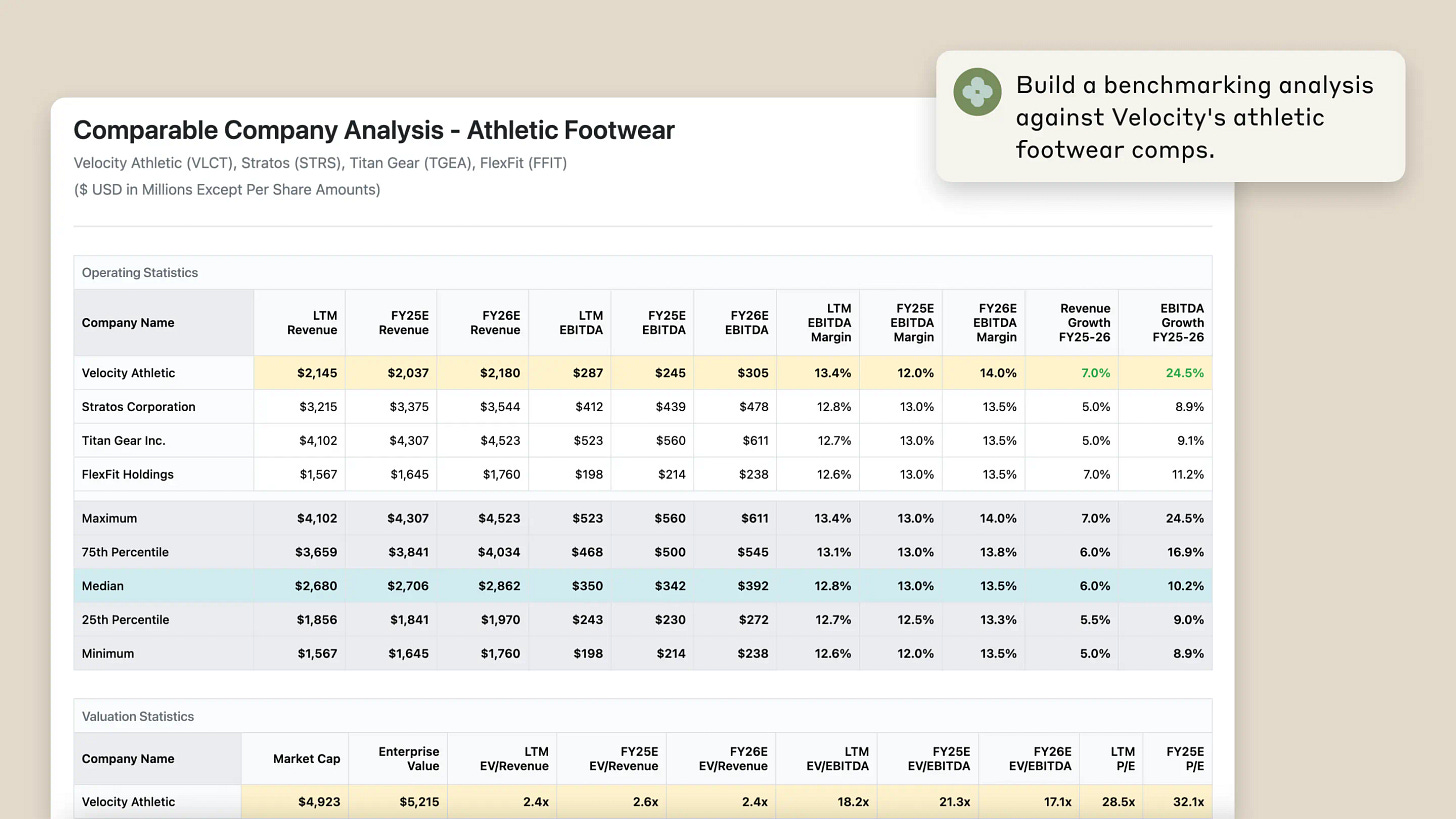

The platform addresses critical workflows including due diligence processes, market research, competitive benchmarking, and investment memorandum generation. Leading financial institutions have already reported substantial productivity gains, with Norway's sovereign wealth fund NBIM estimating 20% efficiency improvements equivalent to 213,000 hours of analyst work. Not too shabby!

Major financial firms, including Bridgewater Associates, American International Group, and Commonwealth Bank of Australia have become early adopters. These organizations highlight Claude's particular strength in generating Python code for financial analysis and creating sophisticated data visualizations that previously required extensive manual effort.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this launch positions Anthropic as a formidable competitor to OpenAI in the lucrative enterprise AI market, particularly within financial services, where data sensitivity and regulatory compliance create significant barriers to entry. The company's revenue growth from $3 billion to $4 billion annually within just 1 month demonstrates the substantial market demand for specialized AI solutions.

Looking at the bigger picture, we must understand this - finance runs on structured data and speed, and Claude can now turn weeks of work into minutes. More importantly, it is building the foundation of AI-first investment teams. And this could mark by far the biggest reshape of finance we’ve seen to date. From compliance to capital markets. From asset managers to AI-native banks. This could be the vertical AI moment finance has been waiting for. The entire financial stack will be rewritten with AI. Paradigm shift.

ICYMI:

US Congress passes landmark stablecoin legislation 😳🪙

The BIG News 🔥 The United States House of Representatives just achieved a watershed moment for the digital asset industry, passing the first federal legislation to regulate stablecoins by a decisive 308-122 margin.

The Guiding and Establishing National Innovation for US Stablecoins Act, known as the GENIUS Act, now awaits President Donald Trump's signature after clearing both chambers of Congress.

Let’s take a quick look at this, understand why it’s huge, and what to expect next.

More on this 👉 This landmark legislation establishes a comprehensive regulatory framework requiring stablecoin issuers to maintain dollar-for-dollar reserves in short-term government debt or similar products under federal or state oversight. The measure represents the culmination of years of industry lobbying efforts, including hundreds of millions in campaign contributions during the 2024 elections to support pro-cryptocurrency candidates.

The legislation's passage followed several days of procedural drama, as conservative Republicans initially blocked votes over concerns about central bank digital currencies. The impasse was resolved only after House leadership agreed to incorporate a separate bill banning Federal Reserve-issued digital currencies into annual defense spending legislation, and President Trump personally lobbied reluctant lawmakers.

Zoom out 🔎 Major financial institutions have already signaled their readiness to enter the stablecoin market. JPMorgan Chase CEO Jamie Dimon confirmed his bank will participate in both deposit coins and stablecoins, while Citigroup's Jane Fraser expressed enthusiasm about the regulatory clarity. Bank of America's Brian Moynihan similarly indicated an appetite for stablecoin payment services, though he cautioned about uncertain market demand.

The House also advanced the Digital Asset Market Clarity Act by a 294-134 vote, sending comprehensive cryptocurrency market structure legislation to the Senate. This broader bill would establish regulatory jurisdiction between the Securities and Exchange Commission and the Commodity Futures Trading Commission while requiring enhanced consumer disclosures from digital asset firms.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the GENIUS Act's passage signals a fundamental shift in how traditional financial institutions will approach digital payments infrastructure. As stablecoins become legitimized through federal oversight, we can expect accelerated adoption across corporate treasury functions, cross-border payments, and retail banking services. The legislation effectively removes regulatory uncertainty that previously deterred institutional participation. One must note that the prohibition on stablecoin yield offerings will likely reshape competitive dynamics, forcing issuers to differentiate through transaction efficiency and integration capabilities rather than investment returns. This regulatory constraint may paradoxically benefit traditional banks, whose existing deposit relationships and payment networks could provide natural advantages in a yield-restricted environment. Looking ahead, the real test lies in Senate consideration of the broader Clarity Act, where bipartisan support appears less certain. The cryptocurrency industry's political influence, as demonstrated by the successful passage of the House bill despite initial resistance, suggests continued legislative momentum. However, concerns about conflicts of interest given Trump's substantial cryptocurrency investments may complicate Democratic support in the upper chamber. Most importantly, the successful passage of stablecoin regulation likely represents the beginning rather than the conclusion of comprehensive cryptocurrency legislation. As digital assets become increasingly integrated into mainstream financial infrastructure, we can anticipate additional regulatory frameworks addressing decentralized finance protocols, central bank digital currencies, and international coordination mechanisms. Slowly, then suddenly.

ICYMI: Citi's solid Q2 2025 earnings & digital asset strategy: a bid to lead the stablecoin revolution 🪙🏦 [breaking down the most important financial facts and figures, what’s next, and uncovering Citi’s brilliant stables strategy + the ultimate list of stablecoin resources inside]

JPMorgan found yet another revenue stream - your bank data 👀📈

The news 🗞️ Banking giant JPMorgan Chase JPM 0.00%↑ just shook the entire financial technology landscape by implementing fees for FinTech companies seeking access to customer bank account data.

This marks the end of an era where such access has traditionally been provided at no cost, fundamentally altering the economic foundation upon which many FinTech services operate.

Let’s take a look at this.

More on this 👉 The nation's largest bank has distributed pricing sheets to data aggregators such as Plaid and MX, which serve as intermediaries between banks and FinTech applications. These new charges, expected to generate hundreds of millions of dollars annually across the industry, vary based on usage patterns, with payment-focused companies facing substantially higher fees.

In some cases, these costs could exceed the revenue that certain open banking FinTech firms generate from individual transactions by as much as 1000%. Ouch 🤕

The announcement triggered immediate market reactions, with FinTech stocks experiencing notable declines. PayPal Holdings dropped 6.5%, while other payment platforms and financial technology companies also saw their valuations decrease as investors assessed the potential impact on profit margins and business sustainability.

JPMorgan justifies this decision by highlighting its substantial investments in cybersecurity infrastructure and fraud prevention systems that protect consumer data. The bank argues that fintech companies have benefited from these security measures without contributing to their costs.

A company spokesperson emphasized their commitment to working with the ecosystem while ensuring necessary investments in customer protection infrastructure.

Zoom out 🔎 The timing of this announcement coincides with significant regulatory uncertainty surrounding open banking in the United States. The Consumer Financial Protection Bureau finalized regulations in October 2024 requiring banks to share customer data without charge, but these rules face legal challenges from the banking industry.

Under the current administration, there are indications that these regulations might be modified or withdrawn, potentially providing banks with greater leverage to implement such fees.

Industry critics have thus characterized JPMorgan's move as exploiting regulatory ambiguity to impose what they describe as an arbitrary tax on competitive financial services. They argue this represents a deliberate effort to curtail innovation and weaken the competitive landscape that has benefited consumers.

But the implications extend beyond immediate cost considerations to broader questions about financial access and inclusion.

Lower-income consumers who rely on free budgeting applications and payment services may now face reduced access to these tools if costs are passed through to end users. This could thus exacerbate existing financial inequalities and limit the democratizing effects that FinTech innovations have achieved.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, JPMorgan's decision could establish a precedent that other major financial institutions may follow, hence creating industry-wide changes in how customer data is monetized and accessed. As a result, this shift threatens to compress margins and force strategic reassessments. Smaller FinTech companies may face particular challenges in absorbing these costs, potentially accelerating industry consolidation as firms seek economies of scale or exit the market entirely. Meanwhile, larger players with stronger balance sheets may gain competitive advantages, fundamentally altering the landscape that has fostered innovation and competition. Zooming out, the regulatory environment remains a critical variable in determining the ultimate outcome here. If the CFPB's open banking rules are maintained or strengthened, banks may be compelled to reverse course and provide free data access. Conversely, regulatory rollbacks could empower additional banks to implement similar fee structures, creating a more restrictive environment for fintech innovation. Will be watching this one out!

ICYMI:

🔎 What else I’m watching

Ramp Launches AI Agents 🤖 Ramp has introduced AI agents to automate finance tasks, reducing manual work and increasing productivity. These agents, built on Ramp Intelligence and powered by OpenAI, handle expense approvals, policy enforcement, and real-time spending analysis with 99% accuracy. They autonomously review expenses, flag issues, and provide auditable decisions, allowing finance teams to focus on strategic work. Early adopters like Quora report fewer errors and faster reviews. Ramp's AI agents adapt to company policies, detect fraud, and suggest policy improvements, offering a significant advantage for finance teams of all sizes. ICYMI:

Lloyds' GenAI Hub Boosts Efficiency 🏦 Lloyds Banking Group has launched Athena, a GenAI-powered knowledge hub that significantly reduces query response times for customer-facing employees. Athena scans 13,000 internal articles, cutting average search time from 59 to 20 seconds - a 66% improvement. This innovation is expected to save 4,000 hours annually for telephone banking teams alone. Since early 2025, 21,000 employees have used Athena for 2.1 million searches, with plans to reach 40 million searches by year-end. Lloyds aims to enhance customer experience and free up staff for complex needs, projecting £50 million in revenue growth and productivity gains for 2025. ICYMI:

Barclays Fined £42M for AML Failures 💰 Barclays Bank has been fined £42M by the FCA for inadequate money laundering risk management. The bank failed to properly vet two clients: WealthTek, a collapsed wealth management firm, and Stunt & Co, a gold bullion business. Barclays did not gather sufficient information or conduct proper ongoing monitoring of Stunt & Co, which received £46.8M from a jeweler linked to money laundering. Additionally, Barclays opened an account for WealthTek without verifying its FCA authorization, leading to £34M in client deposits. Barclays will voluntarily pay £6.3M to affected clients. ICYMI: Monzo’s £21 million AML fine 🤕💰 [what it’s all about & why it matters for the broader FinTech industry + bonus deep dive into Monzo and their latest financial results]

💸 Following the Money

Neighbourhood loyalty platform Bilt has raised $250M in primary funding, sending its valuation soaring to $10.75B.

Crypto-integrated business banking platform Dakota has obtained $12.5M in a Series A funding round led by CoinFund.

Yasmina, an embedded insurance platform based in Riyadh, has secured $2M in seed funding to expand InsurTech across the MENA region.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Another banger - thank you sir