Your identity is now the new security frontier and your most valuable currency 🛡️🪪; Stripe continues M&A spree with Orum acquisition 😤💰; BNY & Goldman launch blockchain-based MMF platform 😳⛓

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Beginners Guide to AI 📚🤖 [5,500+ pages of knowledge to transform your understanding from beginner to AI authority]

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

AI Agents & MCPs Starter Pack: 10 Curated Repos to Learn, Build, & Scale Autonomous Agents 🤖 [from zero to builder - this toolkit has everything you need to master the agentic future of AI]

Fiserv’s Q2 2025: an undervalued FinTech infrastructure fortress built for the digital payments revolution 🤑📈 [breaking down key financial facts & figures, what they mean, what’s next and why Fiserv represents one of the most compelling opportunities available in public markets today]

JPMorgan Chase’s Q2 2025: a capital fortress poised for digital assets & stablecoins (r)evolution 😤🪙 [unpacking the key financial facts & figures, what they mean, breaking down JPM’s stables & digital asset strategy, and what to expect next from the banking heavyweight + bonus deep dives into Citi, the ultimate stablecoin resource list & more reads inside]

Jack Dorsey Block's S&P 500 debut 🥳📈 [why it matters for Block & what to expect next + bonus dives into Block inside]

PayPal wants to be the Everything Payments App 👀💳 [what it’s all about & why it makes sense for PayPal + deep dive into the most compelling FinTech stock available today]

The perfect partnership: PNC Bank teams up with Coinbase 🤝💸 [why it’s a perfect partnership for both companies & what does it indicate about the future of FinTech & FinServ+ bonus deep dives into Coinbase]

Estonian FinTech Lightyear secures $23 million to challenge Robinhood 😤💸 [what it’s all about & why you should be excited about Lightyear + bonus dives into Robinhood inside]

The Only Capital Investment Template You’ll Ever Need 💸 [turn raw numbers into smart investment decisions - in minutes]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

Your identity is now the new security frontier and your most valuable currency 🛡️🪪

Following the trends 🤖 OpenAI CEO Sam Altman just delivered a stark warning to financial regulators, declaring that AI has fully defeated voice-based authentication systems still used by major banks.

Speaking at a Federal Reserve conference in Washington, Altman specifically targeted institutions that "will accept a voice print to move a lot of money," calling such practices a crazy thing to still be doing. And he’s right.

Let’s take a look at this, understand why it’s a huge problem (& an opportunity), and what should banks and FinTechs do to prepare for the AI-first age.

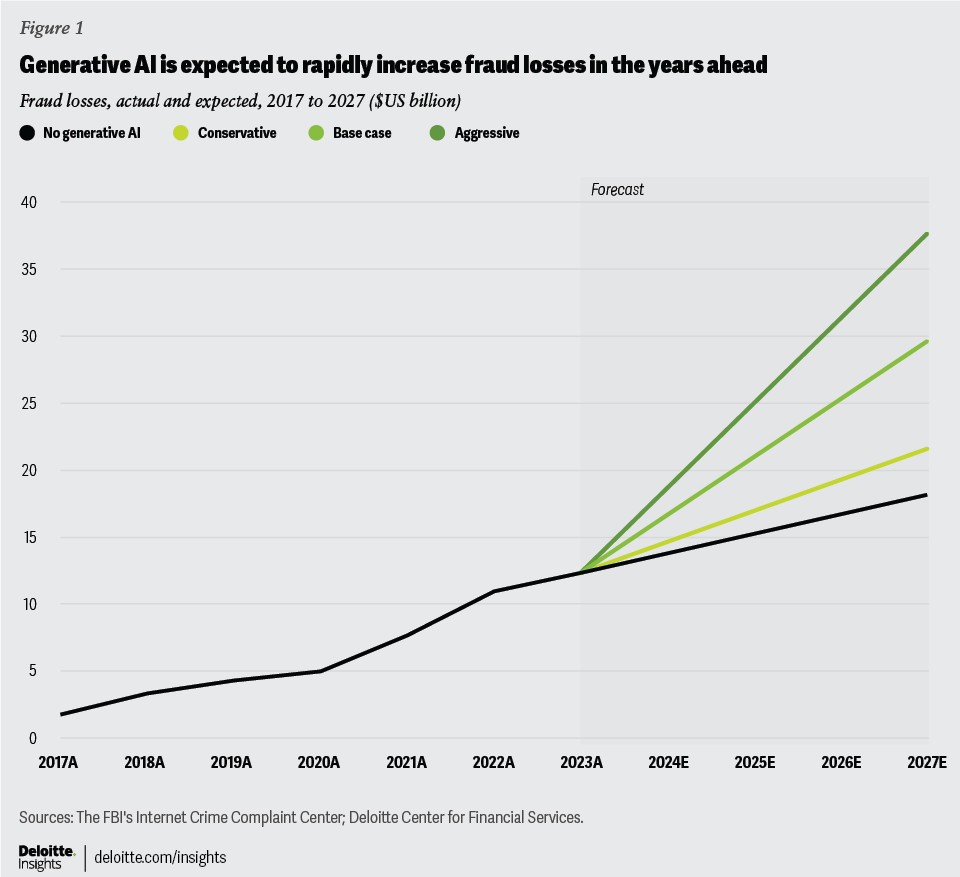

More on this 👉 Altman's comments underscore a critical authentication crisis facing financial services as AI-powered fraud losses are projected to surge from $12.3 billion in 2023 to a whopping $40 billion by 2027, according to Deloitte research.

This 32% compound annual growth rate reflects the devastating effectiveness of AI voice cloning technology, which can now replicate human voices using just three seconds of audio. Let that sink in.

(this is from 2024 and needs 10s but you get the idea; h/t @emollick via X)

The warning carries particular weight given recent high-profile cases. A Hong Kong engineering firm lost $25.6 million in January 2024 when employees were deceived by a multi-person deepfake video conference featuring AI-generated versions of company executives.

Similar attacks have targeted major corporations, with cybercriminals successfully impersonating CEOs of Ferrari, WPP, and other firms using AI voice cloning.

These will only get worse.

Zoom out 🔎 The good thing is that the banking industry is already responding to these threats. 91% of U.S. banks are reconsidering voice verification due to AI cloning risks, according to BioCatch research. Major institutions, including JPMorgan Chase, Bank of America, and Wells Fargo currently employ voice authentication for account access and telephone banking, though most require additional verification for high-value transactions.

ICYMI:

Industry experts advocate replacing vulnerable biometric systems with multi-layered authentication approaches. The U.S. Treasury Department's 2024 AI cybersecurity report recommends FIDO2-compliant hardware tokens, behavioral biometrics analyzing typing patterns and device interactions, and phishing-resistant multi-factor authentication. Leading banks like JPMorgan Chase have already achieved an estimated 50% fraud reduction using proprietary AI detection models. But we need more!

Regulatory momentum is also building rapidly. FinCEN issued a November 2024 alert specifically warning financial institutions about deepfake fraud, while the Federal Reserve explores partnerships with AI companies for enhanced verification methods. Lastly, the EU AI Act and emerging U.S. frameworks signal coordinated efforts to mandate stronger authentication standards.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must realize that digital trust is melting down, and we need to rebuild identity from the ground up. Out with voiceprints. Out with passwords. Out with naive biometrics. But as always, this crisis presents both challenge and opportunity. While traditional banks struggle with legacy authentication systems, agile FinTech companies can pioneer next-generation solutions including self-sovereign identity frameworks, blockchain-based credentials, and continuous behavioral authentication. The institutions that adapt fastest to AI-resistant verification will capture competitive advantages as customers demand both convenience and security. Looking ahead, it’s clear that the authentication arms race has begun. Financial institutions thus must act decisively to implement AI-resistant security measures, or risk becoming casualties in what Altman warned could be an "impending, significant fraud crisis" that threatens the entire banking ecosystem. The age of trusting what you see or hear at face value is over, and we’re entering a post-truth digital world. Your identity is now the new security frontier and your most valuable currency.

ICYMI:

Stripe continues M&A spree with Orum acquisition 😤💰

The news 🗞️ Payment processing giant Stripe has made another acquisition this year by acquiring payment orchestration startup Orum. This move significantly enhances its real-time payment capabilities and advances its non-card payment infrastructure strategy.

While financial terms remain undisclosed, the transaction represents a pivotal step in Stripe's broader initiative to dominate the evolving digital payments landscape.

Let’s take a quick look at this.

More on this 👉 Founded in 2019, Orum has established itself as a specialized provider of payment orchestration technology, offering businesses streamlined access to multiple US payment rails, including the Real-Time Payments network, FedNow, Same Day ACH, traditional ACH, wire transfers, and Visa Direct. The company's sophisticated API platform eliminates the complexity typically associated with bank integrations and compliance requirements while utilizing artificial intelligence to predict fund availability and pre-authorize transactions.

The acquisition brings significant technological assets to Stripe's portfolio. Orum's platform provides comprehensive bank account verification with claimed full US coverage, processing account validation within seconds rather than the days traditionally required through legacy methods like micro-deposits. This capability addresses a persistent bottleneck in digital finance where slow or unreliable account confirmation can delay fund availability and increase fraud risks.

Zoom out 🔎 This acquisition follows Stripe's recent string of strategic purchases, including the $1.1 billion acquisition of stablecoin platform Bridge and the purchase of user data API company Privy. These transactions collectively demonstrate Stripe's commitment to building a comprehensive payment infrastructure that extends far beyond traditional card processing.

On top of that, the timing of this acquisition aligns with significant momentum in real-time payment adoption across the United States. The Federal Reserve's launch of FedNow in 2023 has catalyzed industry-wide investment in instant settlement capabilities, while growing interest in stablecoins and digital assets has further accelerated demand for real-time money movement solutions.

For Stripe, which processed over $1.4 trillion in payment volume during 2024, the Orum acquisition strengthens its position in serving businesses with time-sensitive transfer requirements. This includes payroll providers, marketplace platforms, and companies offering instant payouts to users.

The integration is expected to reduce Stripe's reliance on third-party services while simplifying implementation for enterprise clients seeking end-to-end bank payment solutions.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, integrating Orum's capabilities should enable Stripe to offer more comprehensive payment orchestration services, potentially reducing customer acquisition costs and increasing retention rates. The ability to provide instant bank account verification and intelligent payment routing through a single API could significantly differentiate Stripe's offerings in an increasingly competitive market. Zooming out, the broader fintech landscape appears poised for continued consolidation, particularly among infrastructure providers specializing in payment speed, transparency, and reliability. As large platforms like Stripe integrate real-time capabilities, smaller technology companies with specialized expertise become attractive acquisition targets. This trend suggests we may see additional strategic acquisitions as major payment processors seek to build comprehensive, end-to-end solutions. Looking ahead, it’s clear that Stripe is doubling down to diversify their offering beyond cards. In the last 6 months alone, they : (1) acquired Bridge to scale a stablecoin offering; (2) acquired Privvy to scale crypto on/off offering; (3) acquired Orum to scale money movement offering. I sense this might not be the end…

ICYMI:

Wall Street giants BNY & Goldman Sachs launch blockchain-based money market fund platform 😳⛓

The news 🗞️ Wall Street giants Goldman Sachs and Bank of New York Mellon have announced a collaboration to bring blockchain technology to the $7.1 trillion money market fund industry through the launch of tokenized fund offerings for institutional investors.

Let’s take a look at this.

More on this 👉 The partnership leverages BNY's position as the world's largest custody bank and Goldman's blockchain expertise to create a new digital infrastructure for money market fund transactions. Under this arrangement, BNY will facilitate fund subscriptions through its LiquidityDirect platform while Goldman's private blockchain system, known as GS DAP, will maintain digital ownership records of the tokenized fund shares.

The initiative has attracted participation from industry heavyweights, including BlackRock, Fidelity Investments, and Federated Hermes, alongside the asset management divisions of both partnering institutions. This broad industry support yet again signals significant momentum behind the tokenization movement within traditional finance.

The timing of this announcement follows the recent passage of the GENIUS Act, which established a comprehensive regulatory framework for digital assets in the United States. This legislation has provided the regulatory clarity that financial institutions needed to confidently pursue tokenization initiatives without fear of unexpected regulatory intervention.

Zoom out 🔎 The tokenization approach offers several operational advantages over traditional money market fund structures. Digital tokens enable round-the-clock trading capabilities, instantaneous settlement processes, and enhanced liquidity management. Most significantly, tokenized funds can serve as more efficient collateral instruments, allowing investors to pledge their holdings without the need to liquidate positions into cash first.

This therefore represents a fundamental shift in how institutional investors can interact with money market funds. Traditional money market transactions are constrained by business hours and require settlement periods of one to two days. The tokenized alternative eliminates these temporal restrictions while reducing operational friction and associated costs.

The collaboration also demonstrates how established financial institutions are positioning themselves to bridge TradFi & DeFi. Rather than viewing blockchain technology as disruptive competition, these firms are integrating it to enhance existing services and create new value propositions for their clients.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this partnership between Goldman and BNY represents a pivotal moment in the evolution of institutional finance toward blockchain-based infrastructure. The successful implementation of tokenized money market funds will likely accelerate adoption across other asset classes and financial products. More importantly, this is a win-win for both finance giants as it positions them as leaders in the digital transformation of capital markets. BNY's role as the primary administrator for money market funds combined with Goldman's blockchain technology creates a formidable competitive advantage in the emerging tokenization marketplace. This partnership could thus establish new industry standards and attract additional asset managers seeking to digitize their offerings. Looking at the bigger picture, it’s clear that traditional asset managers will face increasing pressure to offer tokenized alternatives to remain competitive, particularly as institutional clients recognize the operational efficiencies and enhanced functionality of blockchain-based products. We can anticipate similar tokenization initiatives expanding to include corporate bonds, government securities, and eventually more complex financial instruments. The financial industry finally appears to be entering a new phase where blockchain technology transitions from experimental and/or marginal applications to core operational infrastructure. Slowly, then suddenly.

🔎 What else I’m watching

Bitget Wallet & MoonPay Partner for Fiat Withdrawals 💱 Bitget Wallet has teamed up with MoonPay to introduce a fiat withdrawal feature, enabling users to convert stablecoins like USDT and USDC directly into cash. This service supports over 25 fiat currencies, including USD, EUR, and GBP, without requiring centralized exchanges. Users can access this feature via Bitget Wallet's "Sell Crypto" page, complete identity verification, and choose their preferred withdrawal method, such as Apple Pay or debit/credit cards. This partnership aims to simplify crypto transactions and enhance user control over their assets. ICYMI:

Financial Firms Adopt Agentic AI for Compliance 🤖 A recent study by Fenergo reveals that 93% of financial institutions plan to implement agentic AI within the next two years, with 6% already using the technology. Firms are focusing on high-value, high-risk use cases such as fraud detection (34%), KYC maintenance (19%), and transaction monitoring (16%). Agentic AI is expected to deliver significant cost savings, with 26% of firms anticipating annual savings of over $4 million. However, data privacy (44%) and regulatory concerns (36%) remain top challenges. Keith Redmond of Fenergo emphasizes that early adopters of agentic AI will lead the future of financial crime prevention and gain a competitive edge. ICYMI:

Nasdaq Verafin Launches AI AML Workers 🤖 Nasdaq's Verafin unit has introduced agentic AI digital workers to assist banks with anti-money laundering (AML) compliance. These AI workers automate low-value, high-volume processes, enabling banks to reallocate resources to more complex investigations. Currently in beta, the first AI workers focus on sanctions screening and enhanced due diligence reviews. The sanctions screening agent handles false positive alerts, while the enhanced due diligence analyst automates periodic reviews. This innovation aims to address the resource and technology gaps reported by 75% of industry professionals, enhancing efficiency and allowing teams to focus on serious financial crimes. ICYMI:

💸 Following the Money

Digital investor communications platform Proxymity closed a Series C round of $36M, including new investment from Mitsubishi UFJ.

Xelix secures $160M Series B to advance agentic AI innovation in accounts payable.

Corporate payments outfit Corpay has agreed to buy British peer Alpha Group for $2.2 billion in cash.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is brilliant - appreciate your consistent work

If you check the crypto project world coin in which Sam Altman is cofounder, you’ll see how the future might look like. Proof of personhood via iris scans, although utopian, could be the way forward.