Google’s universal payments standard for AI Agents 🤖💸🤖; Zelle owner prepares to enter the stablecoin arena 👀🪙; AI-powered financial command center for European startups from Stripe alumni 🇪🇺🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

280+ AI Tools You Should Know 📚🤖 [from automation to creativity - this is your toolkit for working smarter, not harder]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who's backing them, unlock their exclusive pitch decks, and learn from the best]

MoneyGram’s stablecoin wallet in Colombia 🪙🇨🇴 [what’s the USP here and how it fits into MoneyGram’s transformation + bonus dive into other firms launching stablecoins and the ultimate list of stablecoin resources inside]

Revolut’s $75 billion valuation amid 46% revenue surge and aggressive US expansion plans 😳📈 [what does it indicate & what’s next + bonus dives into Revolut inside]

FinTech giants Robinhood & Trade Republic are breaking down private market barriers 📈💸 [key details on their recent initiatives, why they matter & why it could change the FinTech game + bonus deep dive into Robinhood, changes in capital markets & the ultimate PE toolkit inside]

JPMorgan and Plaid strike data-sharing deal 📊🏦 [key details, why it matters & what’s next for the future of open banking + bonus dive into JPM]

Tether makes strategic push into US market with compliant stablecoin USAT 🪙🇺🇸 [what’s the USP here, what it means for Circle & what’s next + bonus list of ultimate stables resources & deep dive into Circle’s latest earnings]

UK's stablecoin ownership caps spark industry backlash 🪙🇬🇧 [what it’s all about & how I’m thinking about this + bonus list of ultimate stables resources & London’s challenges trying to stay relevant in the digital finance age]

3 Essential Templates Every AI Startup Needs 🚀🤖 [raise smarter, scale faster: the essential toolkit for today’s leading tech startups]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

Google’s universal payments standard for AI Agents 🤖💸🤖

The news 🗞️ $3 trillion tech & AI giant Google has just introduced the Agent Payments Protocol (AP2). This open-source framework enables artificial intelligence agents to conduct secure financial transactions on behalf of users.

At the core, this new protocol from Google is all about establishing trust and standardization in autonomous commerce.

Let’s take a look at this, see why it matters, and what’s next for payments.

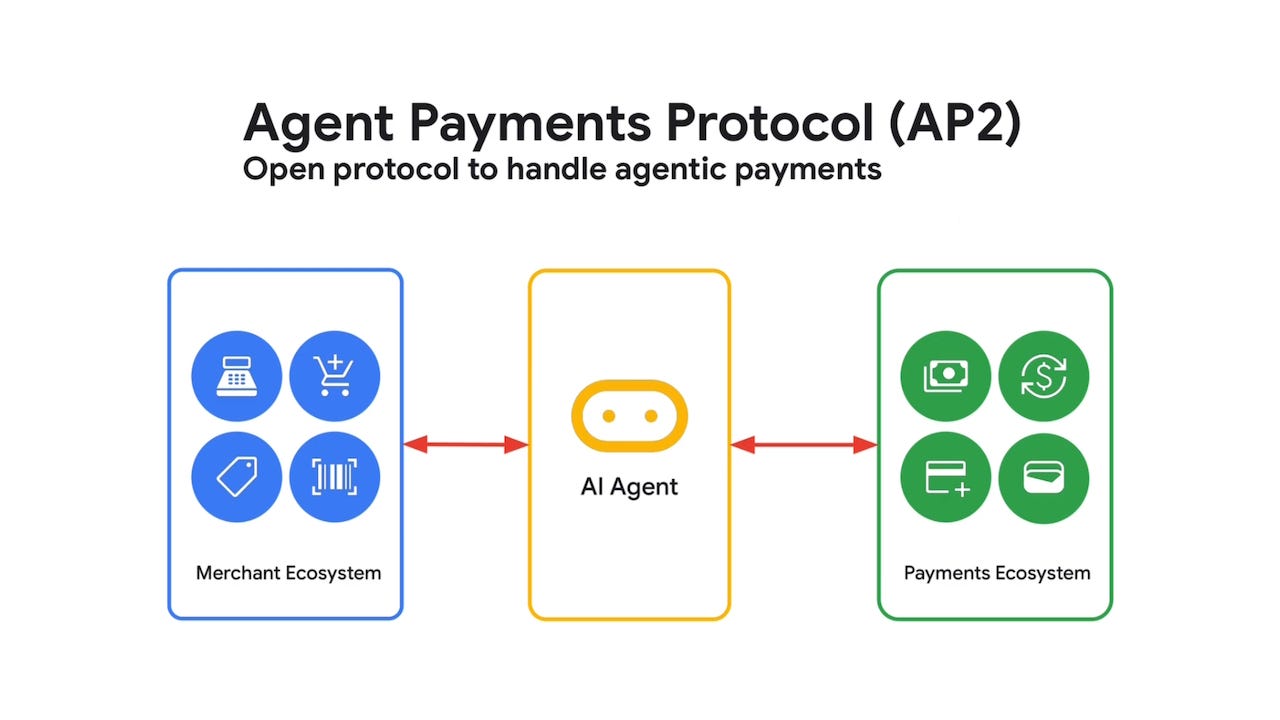

More on this 👉 The protocol addresses fundamental challenges that arise when AI systems, rather than humans, initiate payments. Traditional e-commerce assumes direct human interaction with trusted interfaces, but autonomous agents break this assumption, creating critical questions about authorization, authenticity, and accountability.

AP2 resolves these concerns through cryptographically signed digital contracts called Mandates, which create tamper-proof records of user intent and transaction authorization.

Developed in collaboration with over sixty organizations spanning traditional finance and emerging technologies, AP2 supports diverse payment methods including credit cards, bank transfers, stablecoins, and cryptocurrencies. Notable partners include American Express, Mastercard, PayPal, Coinbase, Ethereum Foundation, and MetaMask.

The protocol's x402 extension, created specifically for cryptocurrency transactions, demonstrates its commitment to bridging traditional and decentralized financial systems.

The framework distinguishes between two primary transaction modes. In real-time purchases where users remain present, they approve specific Cart Mandates after agents present options. For delegated tasks where users are absent, detailed Intent Mandates establish pre-authorized parameters within which agents can operate autonomously.

This dual approach creates comprehensive audit trails while maintaining user control and security.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this protocol positions Google as a foundational infrastructure provider for the emerging agent economy, potentially worth trillions by decade's end. Additionally, AP2 strengthens Google’s ecosystem advantage by ensuring AI agents using its platforms can seamlessly transact across merchants globally, creating network effects that could rival current payment processors. Zooming out, first and foremost, the transition to agent-initiated payments introduces unprecedented risk management complexities that traditional financial infrastructure cannot adequately address. When AI systems execute transactions autonomously, institutions face novel fraud patterns, accountability questions, and regulatory compliance challenges that legacy risk systems were never designed to handle. Financial institutions will therefore require sophisticated AI-powered risk decisioning platforms capable of evaluating agent behavior patterns, verifying mandate authenticity, and detecting anomalous transaction sequences in real time. Companies like Oscilar*, which specialize in unified risk management platforms that integrate fraud detection, compliance monitoring, and behavioral analytics, become essential infrastructure providers in this new ecosystem. Second, the protocol's native cryptocurrency support could mainstream stablecoin usage for everyday commerce, particularly in cross-border transactions where agents can optimize for speed and cost across multiple payment rails. Looking ahead, expect rapid evolution in three areas. First, competitive protocols from major technology companies seeking to establish their own standards, though Google's open-source approach and broad coalition provide significant momentum. Second, regulatory & risk frameworks will need updating to address liability and consumer protection when autonomous agents make financial decisions. Third, entirely new business models will emerge around agent-to-agent commerce, where AI systems negotiate, purchase services from each other, and create self-sustaining economic ecosystems. Agentic is the future 🤖

ICYMI:

*Disclaimer: I’m part of Oscilar.

Zelle owner prepares to enter the stablecoin arena 👀🪙

The news 🗞️ Early Warning Services (EWS), the bank-owned company operating the Zelle payment network, is preparing to investigate the creation of a dollar-backed stablecoin specifically designed for retail banking customers.

This move represents another shift as traditional banking institutions position themselves to compete in the rapidly evolving digital payments landscape.

Let’s take a look at this.

More on this 👉 The initiative emerges from a consortium of major financial institutions, including JPMorgan Chase, Bank of America, Wells Fargo, Capital One, and PNC, which collectively control EWS.

With Zelle already commanding an impressive market presence - processing more than $1 trillion annually and reaching a monthly record of $108 billion - the company possesses substantial infrastructure to support a stablecoin venture. The network currently serves 151 million enrolled accounts through partnerships with over 2,500 financial institutions.

The exploration focuses on developing infrastructure for a retail-oriented stablecoin, distinguishing it from wholesale or institutional applications. This approach would enable seamless integration within existing bank applications, potentially displaying stablecoin balances as a new account type alongside traditional checking and savings accounts.

The timing aligns strategically with recent regulatory developments, particularly the GENIUS Act signed in July, which establishes a framework for bank-issued stablecoins.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this is another moment in the convergence of traditional banking and digital assets. Banks are positioning themselves to recapture market share from fintech competitors while addressing inefficiencies in cross-border payments and settlement systems. The integration of stablecoin technology with Zelle's established network could dramatically accelerate mainstream adoption by eliminating the friction points typically associated with cryptocurrency usage. Looking ahead, first expect intensified competition among banking consortiums to establish dominant stablecoin platforms, potentially leading to consolidation or strategic partnerships between traditional financial institutions and existing stablecoin issuers. Second, regulatory frameworks will likely accelerate as banks' involvement legitimizes the stablecoin market, prompting clearer guidance from federal banking regulators. Looking at the bigger picture, the success of this initiative could fundamentally reshape payment infrastructure within the next 3-5 years. If EWS successfully launches a bank-backed stablecoin, it would likely trigger similar initiatives from other banking groups, creating a new competitive dynamic where traditional institutions leverage their regulatory compliance expertise and customer trust against the innovation speed of fintech companies. Furthermore, this development may reduce the perceived need for a central bank digital currency, as private bank-issued stablecoins could effectively serve similar functions while maintaining the existing banking system's structure.

ICYMI: Tether makes strategic push into US market with compliant stablecoin USAT 🪙🇺🇸 [what’s the USP here, what it means for Circle & what’s next + bonus list of ultimate stables resources & deep dive into Circle’s latest earnings]

AI-powered financial command center for European startups from Stripe alumni 🇪🇺🤖

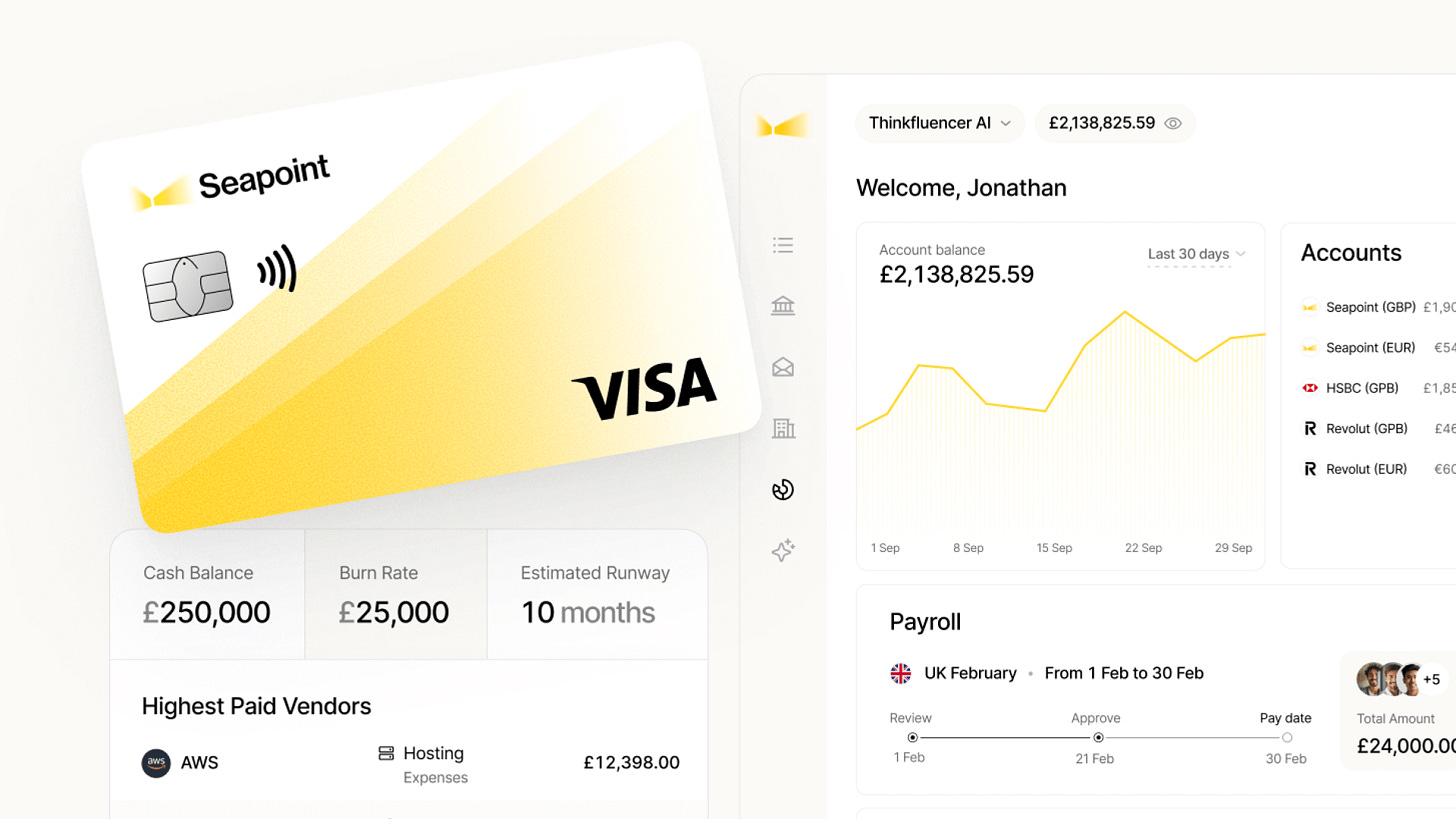

The news 🗞️ Dublin-based financial technology company Seapoint has announced its emergence from stealth mode with $3 million in pre-seed funding to revolutionize how European startups manage their finances.

The platform, founded by former Stripe European CIO Sean Mullaney, addresses a critical gap in the market by serving venture-backed companies that have outgrown consumer-focused neobanks but remain underserved by traditional corporate banking.

Let’s take a look at this.

More on this 👉 The company's platform consolidates fragmented financial tools into a unified system powered by artificial intelligence. Rather than forcing founders to juggle multiple applications for banking, accounting, and expense management, Seapoint creates a single dashboard that connects existing bank accounts, email systems, accounting software, and customer relationship management tools.

The platform's AI capabilities automate routine but time-consuming tasks such as processing invoices directly from email, managing bulk payroll operations, categorizing expenses, and calculating value-added tax obligations.

What distinguishes Seapoint from existing solutions is its combination of sophisticated automation with personalized service. Each client receives a dedicated relationship manager who understands the unique challenges facing growing startups, from Delaware C-Corporation compliance to venture capital fund transfers. This hybrid approach targets companies with 10 to 250 employees, organizations that require more sophisticated financial infrastructure than basic banking applications provide, yet do not need the complexity of enterprise-level solutions.

Zoom out 🔎 The funding round, led by Frontline Ventures with participation from multiple venture capital firms and prominent angel investors, including former executives from Stripe, Revolut, and Tide, validates the market opportunity.

Currently serving dozens of startups in private beta across the United Kingdom and Europe, Seapoint reports that early users experience an 80% reduction in invoice processing time while potentially reducing overall financial management costs by 20 to 30 percent.

✈️ THE TAKEAWAY

What’s next? 🤔 Seapoint's emergence yet again signals a fundamental shift in financial technology toward what we could call autonomous finance - systems where artificial intelligence handles end-to-end workflows rather than merely assisting with discrete tasks. This development carries significant implications for both the startup ecosystem and the broader financial services industry. For Seapoint specifically, success will mainly depend on execution during its transition from private beta to full market rollout in early 2026. The company appears well-positioned to capture market share, given the European startup ecosystem's rapid growth and the increasing complexity of financial regulatory requirements such as PSD3 and MiCA. The platform could potentially evolve to incorporate multimodal AI capabilities, enabling it to process voice notes, images, and other unstructured data formats for even more comprehensive automation. Zooming out, we should expect increased competitive pressure as Seapoint's model demonstrates the viability of AI-first financial platforms for the mid-market segment. Traditional banks may need to accelerate their digital transformation efforts or risk losing 10-15% of their small and medium enterprise market share by 2027. Meanwhile, established neobanks might need to develop more sophisticated offerings for growing businesses or face being relegated to serving only consumer and micro-business segments. Looking ahead, it’s getting more and more clear that the integration of generative AI and predictive analytics into financial management platforms will likely become table stakes rather than differentiators. The winners in this space will be those who can combine technological sophistication with a deep understanding of their target market's specific needs, a balance Seapoint appears to have achieved through its founder-focused approach and team composition of former entrepreneurs. As artificial intelligence capabilities continue to advance, expect to see financial management platforms evolve from reactive tools to proactive advisors, fundamentally changing how startups allocate resources and make strategic financial decisions. AI-first is the way 🤖

ICYMI:

🔎 What else I’m watching

Auquan Introduces AI Credit Agent 💡Auquan introduces its AI Credit Agent, designed to autonomously handle credit analysis and monitoring workflows. This tool independently executes tasks from data gathering to reporting, allowing professionals to focus on high-value work. It addresses the challenges of evaluating more deals in less time and managing inconsistent data formats. Key features include deal screening, borrower assessment, market intelligence, structure analysis, credit memo generation, portfolio monitoring, and regulatory reporting. The Credit Agent integrates both internal and public data, providing comprehensive insights. ICYMI:

LSEG Debuts Blockchain Platform 🏦 The London Stock Exchange (LSEG) has launched a blockchain-based Digital Markets Infrastructure (DMI) platform for private funds, powered by Microsoft Azure. DMI offers efficiencies across the asset lifecycle, including issuance, tokenization, and post-trade settlement. As the first asset class on the platform, private funds will be discoverable via LSEG's Workspace platform, facilitating interactions between General Partners and investors. MembersCap and Archax are the first clients, with MembersCap executing a primary fundraise in the inaugural transaction. ICYMI: FinTech giants Robinhood & Trade Republic are breaking down private market barriers 📈💸 [key details on their recent initiatives, why they matter & why it could change the FinTech game + bonus deep dive into Robinhood, changes in capital markets & the ultimate PE toolkit inside]

Klarna Integrates with Apple Pay 🛒 Klarna has integrated with Apple Pay to offer Buy Now, Pay Later (BNPL) options at in-store checkouts in the UK and US, following its online and in-app rollout last year. Customers can select Klarna at checkout to access various installment plans. In the US, these include four interest-free installments for purchases over $35, paying later within 30 days interest-free, and monthly financing for larger payments. UK shoppers can choose to pay in full, in three installments, or later. Competitor Affirm offers a similar service in the US with biweekly or monthly payment options and interest rates ranging from 0% to 36% APR. ICYMI: Klarna’s $15B IPO, or a 26x oversubscribed feeding frenzy on Wall St. for Europe's biggest FinTech comeback 👏🤑 [what it’s all about, why it matters & what to expect next + bonus deep dive into Klarna’s IPO filing & why you should be bullish on them]

💸 Following the Money

Hala, a Saudi Arabian FinTech that provides embedded financial services to micro, small, and medium enterprises, has raised $157M in a Series B funding round.

Clarity, an AI-powered customer-experience and voice-of-customer (VoC) platform for highly regulated industries, has raised $12M in new funding.

PayNearMe, a fintech targeting non-commerce businesses and their customers, has secured $50M in Series E funding from Atlantic Vantage Point.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Very good read - thank you so much for doing this.