The world’s first fully AI-powered digital bank 🏦🤖; NU eyes bank acquisition as Brazilian regulators tighten FinTech rules 🏦🇧🇷; Gemini's new XRP credit card with Ripple 🪙💳

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who's backing them, unlock their exclusive pitch decks, and learn from the best]

The Ultimate Financial Plan for SaaS & AI Startups 🤖🚀 [In 2025, every company is a SaaS company, and every SaaS company is becoming an AI company]

JPMorgan claims its first major Open Banking victim: payments giant Visa 😳🏦 [what it’s all about, what it means for Visa & what to expect next + bonus deep dive into Visa’s latest Q3 2025 financials & more reads inside]

LendingClub's banking transformation finally reaches an inflection point 🏦📈 [a deep dive into their latest Q2 2025 earnings, unpacking the most important numbers, what they mean, and if LC 0.00%↑ is worth your time and money in 2025 & beyond + a bonus deep dive into SoFi inside]

Klarna targets September IPO at $14 billion valuation 🤑📈 [the key details, why now it’s the perfect time to go public, bonus deep dive into Klarna’s latest financials, IPO filing + Circle’s first earnings as a public company & a deep dive into Klarna’s biggest competitor Affirm]

SoFi, the FinTech flywheel that finally achieves escape velocity 😤📈 [deep dive into their Q2 2025 financials, unpacking the most important facts & figures to see why you should be bullish on SoFi for the years to come]

FinTech giants battle for young savers: Revolut challenges Monzo with premium youth savings rates 👶🏦 [what it’s all about, what it means & what to expect next + bonus deep dives into Revolut & Monzo inside]

The AI Code has been cracked: welcome to new, AI-first reality 🤖 [AI's experimental phase just ended. This new report reveals the hard data behind a new economic reality, and why most are already playing catch-up]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another awesome week in the financial technology space, so make sure to check all the above stories.

The world’s first fully AI-powered digital bank 🏦🤖

The news 🗞️ Malaysia has just made headlines with the launch of Ryt Bank, marketed as the world's first artificial intelligence-powered digital bank.

This venture, developed through a partnership between YTL Digital Capital and Singapore-based Sea Limited, represents a transformative approach to banking that integrates advanced AI capabilities with deep cultural understanding.

Let’s take a look at this.

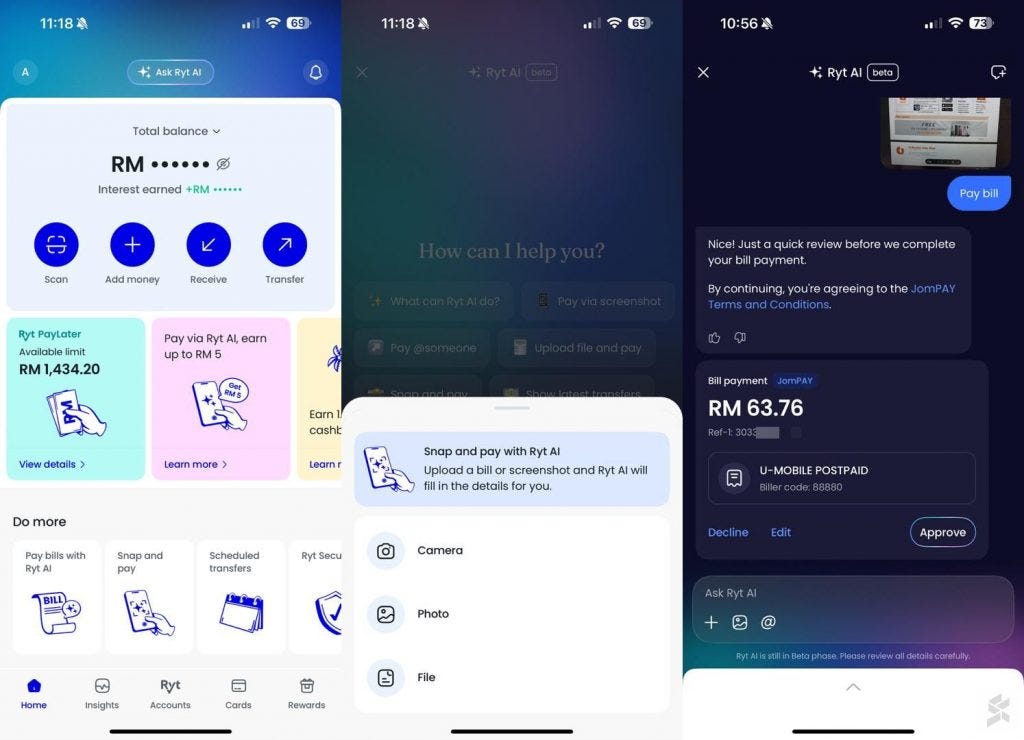

More on this 👉 At the core of Ryt Bank's innovation is Ryt AI, an intelligent banking assistant powered by ILMU, Malaysia's first domestically developed large language model created by YTL AI Cloud. This technology enables users to conduct banking transactions through natural conversation in Bahasa Malaysia, English, and soon Mandarin, with the system understanding even mixed-language interactions commonly used in Malaysia.

Users can perform complex tasks simply by uploading photos of bills or receipts, with the AI automatically processing payments through the extensive JomPAY network covering over 20,000 billers.

In addition to that, the bank also offers compelling financial products, including savings accounts with promotional rates reaching 4% annually credited daily, instant credit facilities up to RM1,499 with no documentation requirements, and a versatile debit-credit card with competitive cashback programs.

Despite all the tech, security still remains paramount, with Bank Negara Malaysia licensing and PIDM protection covering deposits up to RM250,000, alongside advanced biometric authentication and real-time fraud monitoring systems.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, the launch of Ryt Bank could signal a watershed moment in Southeast Asian banking, demonstrating how artificial intelligence can fundamentally reshape financial services delivery. More importantly, the integration of locally developed LLMs represents a strategic shift toward technological sovereignty, reducing dependence on foreign AI systems while ensuring cultural and linguistic authenticity. This approach could inspire similar initiatives across the region (maybe China, India?), as financial institutions recognize the competitive advantage of AI systems that truly understand local contexts. When it comes to Ryt Bank itself, its success will hinge on rapid feature expansion and ecosystem integration. The planned Mandarin language support will be critical for capturing Malaysia's significant Chinese-speaking population, while deeper integration with Sea Limited's e-commerce platform could create powerful synergies between shopping and financial services. The bank will likely expand into more sophisticated AI-driven services, including predictive financial planning, automated investment advisory, and real-time credit risk assessment based on behavioral patterns. Looking ahead, we can expect increased investment in conversational AI capabilities, with banks racing to deploy virtual assistants that match or exceed Ryt AI's capabilities. Of course, regulatory frameworks will need rapid evolution to address AI-specific risks, including algorithmic bias, data privacy, and the potential for AI-driven financial exclusion of certain demographics. This aside, if all goes well, Ryt Bank’s success could establish Malaysia as Southeast Asia's FinTech innovation hub, attracting talent and investments while setting new standards for AI-powered banking globally. Watch this space!

ICYMI:

FinTech's Maturation Moment: how AI and sustainable growth are reshaping financial services 🤖📈 [breaking down the new FinTech report with key trends, latest developments & massive untapped opportunities + bonus deep dives into top challenger banks, top AI startups & their pitch decks, Agentic AI survival guide & more!]

NU eyes bank acquisition as Brazilian regulators tighten FinTech rules 🏦🇧🇷

The news 🗞️ Brazilian digital banking powerhouse Nubank NU 0.00%↑ is reportedly considering the acquisition of a traditional bank to secure a full banking license, marking a significant strategic shift for Latin America's most valuable FinTech company.

The move comes in response to evolving regulatory requirements from Brazil's Central Bank that could fundamentally alter how FinTech companies operate and market themselves in the region's largest economy.

Let’s take a quick look at this.

More on this 👉 Currently operating as a payment institution and direct credit company rather than a fully licensed bank, Nubank serves over 100 million customers across Brazil, Mexico, and Colombia. Despite its massive scale and valuation exceeding $50 billion, the company faces operational constraints that limit its service offerings compared to traditional financial institutions.

The proposed regulatory changes, introduced through Public Consultation 117/2025 earlier this year, would restrict the use of banking terminology exclusively to institutions holding full banking licenses. This development could force Nubank to undergo significant rebranding efforts or face operational restrictions that might hamper its competitive position.

Zoom out 🔎 The potential acquisition thus represents more than a regulatory compliance maneuver. It signals a broader transformation in Latin America's FinTech landscape, where the lines between digital disruptors and traditional institutions are increasingly blurring.

Nubank's consideration of this strategy follows its successful securing of a full banking license in Mexico in April 2025, demonstrating a pattern of pursuing regulatory legitimacy to enable service expansion across international markets.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, we could be witnessing a fundamental restructuring of the Latin American FinTech sector over the next several years. As regulatory frameworks mature to address the rapid growth of digital financial services, we can expect to see accelerated consolidation between FinTech companies and traditional banks. This trend will likely manifest through two primary channels: acquisitions of smaller traditional banks by well-capitalized FinTech seeking licenses like NU, and strategic partnerships that combine digital innovation with regulatory compliance infrastructure. When it comes to Nubank specifically, successfully acquiring a licensed bank would position the company to expand its product portfolio significantly, potentially introducing more sophisticated lending products, more international transfer capabilities, and investment services that require full banking authorization. This would thus strengthen its competitive position against both traditional incumbents like Itaú and Banco do Brasil, and other regional FinTech players such as Mercado Pago and PagSeguro. Zooming out, we must note that the era of pure-play FinTech disruption may be evolving toward a hybrid model where digital innovation operates within traditional regulatory frameworks. This convergence could ultimately benefit consumers through more robust consumer protections while maintaining the technological advantages that made FinTechs attractive in the first place. Yet, increased compliance costs and operational complexity may also lead to some inevitable consolidation in the sector.

ICYMI: Nubank’s Q2 2025, or why Latin America's digital banking emperor is the FinTech investment steal of the decade 😤📈 [deep dive into NU’s financials, what they mean, what’s next & why you just can’t be not bullish on Nubank]

Gemini launches XRP credit card with Ripple 🪙💳

The news 🗞️ Crypto exchange Gemini has just launched a limited-edition XRP credit card in partnership with Ripple, marking an expansion of their collaboration as the exchange prepares for its public listing.

The card, issued by WebBank on the Mastercard network, offers competitive crypto rewards without annual fees, positioning itself as an accessible entry point for mainstream consumers into digital assets.

Let’s take a quick look at this.

More on this 👉 The reward structure delivers up to 4% back in XRP on fuel, electric vehicle charging, and rideshare purchases, 3% on dining, 2% on groceries, and 1% on other spending. New cardholders receive a $200 XRP bonus after spending $3,000 within their first 90 days. Select merchant partnerships provide opportunities for up to 10% rewards on qualifying purchases.

The timing appears strategic despite XRP's recent volatility. The token declined 3.2% to $2.91 during the August 25-26 trading window, primarily due to institutional liquidation pressures.

However, historical performance data reveals the potential value proposition: Gemini reports that cardholders who selected XRP rewards between October 2021 and July 2025 and held their tokens for at least one year experienced returns exceeding 450%. Not too shabby!

Zoom out 🔎 Market response has been notable. Following the announcement, Gemini surpassed Coinbase in the US Apple App Store's finance category rankings, climbing to 16th place despite maintaining significantly lower trading volumes than its competitor. This surge suggests strong consumer interest in XRP-focused products.

We must note that the partnership extends beyond just the credit card.

Ripple has provided Gemini with a $75 million credit facility that could expand to $150 million, supporting the exchange's planned Nasdaq listing under ticker "GEMI."

Additionally, Gemini now offers Ripple's RLUSD stablecoin for US spot trading, which has achieved over $640 million in market capitalization since launch.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this development represents a calculated move toward mainstream crypto adoption through traditional financial instruments. The integration of cryptocurrency rewards into everyday spending patterns could accelerate consumer familiarity and comfort with digital assets, particularly among the 55 million Americans who already own cryptocurrency. For Gemini specifically, the partnership provides critical differentiation as it approaches its IPO amid challenging financials, including a $282.5 million net loss in the first half of 2025. The XRP card could potentially drive user acquisition and engagement metrics that appeal to public market investors, particularly given the immediate app store ranking improvement. Zooming out, we are starting to notice an emerging trend where cryptocurrency exchanges leverage strategic partnerships and product innovations to compete beyond pure trading services. As regulatory clarity improves and institutional infrastructure matures, expect to see more traditional financial products incorporating crypto elements (i.e. Coinbase’s BTC reward card).

ICYMI: Gemini IPO: not convincing enough 🤷♂️🔔 [deep dive into their S-1 filing, uncovering the most important facts & figures, what they mean and what’s next for the Winklevoss twins’ crypto platform]

🔎 What else I’m watching

Stablecoins go mainstream in EEMEA 🌍 Mastercard and Circle are expanding their partnership to enable USDC and EURC settlement for acquirers in Eastern Europe, the Middle East, and Africa (EEMEA), marking the region’s first stablecoin-based transaction settlements. Arab Financial Services and Eazy Financial Services will pioneer the initiative, allowing merchants to receive payments in fully reserved, regulated stablecoins -reducing friction in high-volume settlements while improving liquidity and efficiency. This builds on existing crypto card collaborations like Bybit and S1LKPAY and aligns with Mastercard’s broader push to integrate stablecoins into traditional finance, leveraging its security and compliance expertise. ICYMI:

Zopa’s £1.8B GenAI Upskill Drive 🤖 Zopa is launching a five-year campaign to reskill 100,000 UK banking workers in AI, starting with internal modules for engineers, analysts, and ops teams. The push includes a GenAI Engineering Programme, a Coding Academy, and enterprise-wide OpenAI training - already deploying custom GPTs for customer queries, vulnerability detection, and autonomous coding. With £1.8B earmarked for GenAI by 2030, Zopa forecasts 187M labor hours saved (mostly in back-office tasks) but warns 27,000 UK banking jobs (10% of the sector) could be disrupted. Zopa wants to build the next-gen intelligence layers while legacy banks chase 100% ROI on early adoption. ICYMI:

SCB & Ant International Launch AI FX Solution 🌍 Standard Chartered and Ant International have teamed up to roll out an AI-powered treasury and FX management tool, merging Ant’s Falcon TST model (90%+ forecast accuracy) with SCB’s SCALE liquidity engine. The solution delivers real-time, 24/7 FX forecasting, cutting hedging costs by up to 60% and liquidity expenses by 50% for Ant’s cross-border transactions. Part of Singapore’s PathFin.ai initiative, the collaboration builds on their blockchain work, targeting volatile FX markets with automated, multi-currency settlements. Both firms vow to expand AI-driven innovations, aiming to redefine global liquidity and risk management for corporates. ICYMI:

💸 Following the Money

AI hedge fund Numerai has secured up to $500M from JPMorgan Asset Management, significantly increasing its access to investment capital. Numerai said over the past 3 years it's grown from managing $60M to $450M.

Canada's Wealthsimple has acquired investment research platform Fey. Financial terms of the deal were not disclosed.

IVIX, an AI-powered platform that helps governments around the world combat financial crime, had closed its $60M Series B funding round.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is gold as always - thank you!