Robinhood’s S&P 500 entry, or the transformation from trading app to financial Super App 📲📈; Cloudflare's stablecoin NET Dollar to power AI-driven commerce 🤖🪙; Ebury's 2026 London IPO 👀🇬🇧

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

280+ AI Tools You Should Know 📚🤖 [from automation to creativity - this is your toolkit for working smarter, not harder]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

Coinbase and Cloudflare launch x402 foundation to transform web-native payments for AI era 💸🤖 [what it’s all about & why it could be huge, how it compares to Google’s AP2 + bonus deep dives into Coinbase, AP2 & more inside]

Wall Street’s new arms race: HSBC’s quantum computer just beat every trading algorithm on the planet by 34% 😳📈 [what this means & why it’s the Wall Street’s new arms race + bonus dive into other quantum breakthroughs & more reads on AI + Finance]

Stablecoin giant Tether eyes $500 billion valuation in massive fundraising round 😳💰 [is it justified, what does it tell us & what can we expect next + bonus dive into Tether’s new USAT stable & the ultimate list of stablecoin resources inside]

$19.2M-backed protocol to unlock autonomous AI commerce 🤖💳 [what it’s all about, why it could be huge and what’s next in the agentic AI era for finance + bonus dives into Coinbase’s x402 protocol & more resources inside]

New AI system predicts financial market stress 3 months in advance 😳📈 [why it matters & what this means for the future of finance + top AI agents startups of 2025 inside]

From FinTech giant to AI powerhouse: SoftBank Vision Fund’s $100 billion pivot is reshaping investment future 😳🤖 [quick look at Vision Fund’s $100B pivot, how it’s reshaping VC future, what this means for FinTech startups going forward + a solid collection of AI resources inside]

The Customer Intelligence Template Every FinTech Leader Needs 🚀 [master growth by knowing your customers better than anyone else]

3 Essential Templates Every AI Startup Needs 🚀🤖 [raise smarter, scale faster: the essential toolkit for today’s leading tech startups]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

Robinhood’s S&P 500 entry marks transformation from trading app to financial Super App 📲📈

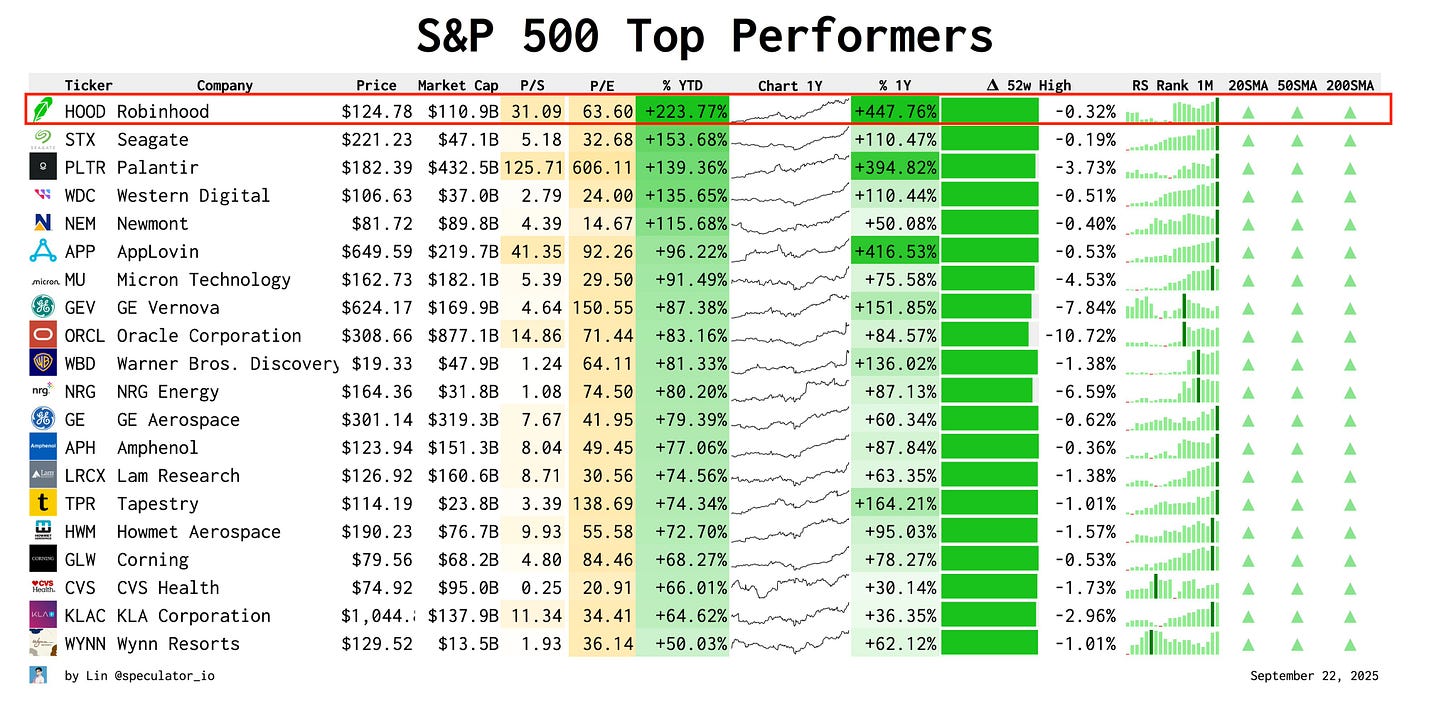

The news 🗞️ Robinhood Markets HOOD 0.00%↑ has achieved a significant milestone yesterday, joining the S&P 500 index and cementing its evolution from a controversial trading platform to an established financial powerhouse.

The company’s stock has surged a whopping 235% year-to-date (at the point of writing), climbing from $37.26 to $124.89, making it one of the index’s strongest performers. Let that sink in 👀

Let’s take a closer look at this, understand why it matters, and what’s next for HOOD 0.00%↑.

More on this 👉 The inclusion brings substantial benefits, including automatic institutional buying pressure from index-tracking funds managing trillions in assets, enhanced market credibility, and improved liquidity through tighter bid-ask spreads. So basically, this development validates Robinhood’s business model transformation and provides access to a broader, more stable investor base that should reduce the stock’s historical volatility.

The company’s financial performance justifies this recognition. Second quarter 2025 results showed revenues climbing 45% to $989 million while net income doubled to $386 million. The platform now serves 27.4 million funded customers managing $279 billion in assets, representing nearly 100% growth in platform assets year-over-year. Transaction-based revenues jumped 65% to $539 million, demonstrating strong engagement despite market normalization. Nice!

ICYMI: Robinhood’s Q2 2025: The Great FinTech Transformation 👏📈 [deep dive into their latest financials, unpacking the most important facts & figures, whether Robinhood is worth your time & money this year, and what’s next for the FinTech giant]

Zoom out 🔎 We must also remember that Robinhood has aggressively expanded beyond its core trading services. The company acquired Bitstamp for $200 million to access international crypto licenses, launched tokenized stock trading in Europe, enabling 24/7 market access, and is developing proprietary Layer 2 blockchain infrastructure. New AI-powered tools through Robinhood Cortex, social trading features, and expansion into futures and short selling demonstrate the company’s commitment to becoming a comprehensive financial services platform. In other words, a Super App for all things money 🤑

ICYMI: FinTech giants Robinhood & Trade Republic are breaking down private market barriers 📈💸 [key details on their recent initiatives, why they matter & why it could change the FinTech game + bonus deep dive into Robinhood, changes in capital markets & the ultimate PE toolkit inside]

However, concerns persist about the company’s premium valuation. Trading at a forward price-to-earnings ratio of 69.9x and price-to-sales of 31.9x, the stock commands multiples significantly above sector averages. Some analysts worry these valuations leave little room for disappointment, particularly given the company’s dependence on volatile trading revenues and regulatory uncertainties surrounding crypto operations.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Robinhood’s S&P 500 inclusion represents a watershed moment for the broader fintech sector, signaling institutional acceptance of digital-first financial platforms. This development will likely only accelerate consolidation as traditional financial institutions recognize the need to compete with technology-native challengers. The immediate future will test Robinhood’s execution capabilities across multiple fronts. Success in international expansion, particularly through tokenized trading and 24/7 market access, could establish the company as a global financial infrastructure provider rather than merely a US brokerage. The integration of banking services, wealth management capabilities, and institutional-grade crypto offerings positions Robinhood to capture increasing wallet share from traditional financial institutions. Looking ahead, expect Robinhood to leverage its technological advantages and younger customer base to pioneer new financial products. The development of prediction markets, event-based contracts, and democratized private market access through its proposed Robinhood Ventures Fund could reshape retail investing. Additionally, the company’s focus on AI-driven personalization and social trading features may define the next generation of financial services, where community engagement and algorithmic intelligence converge. Are you bullish enough on HOOD 0.00%↑ ? 🤔

Cloudflare enters stablecoin arena with NET Dollar to power AI-driven commerce 🤖🪙

The BIG News 🗞️ Cloudflare NET 0.00%↑, the $76 billion cloud infrastructure giant that powers significant portions of internet traffic, just announced its entry into the digital assets market with NET Dollar, a fully collateralized U.S. dollar-backed stablecoin designed specifically for the emerging AI agent economy.

At the core, this move represents a significant convergence of web infrastructure, artificial intelligence, and digital finance.

Let’s take a look at this, understand why it could be huge, and what’s next.

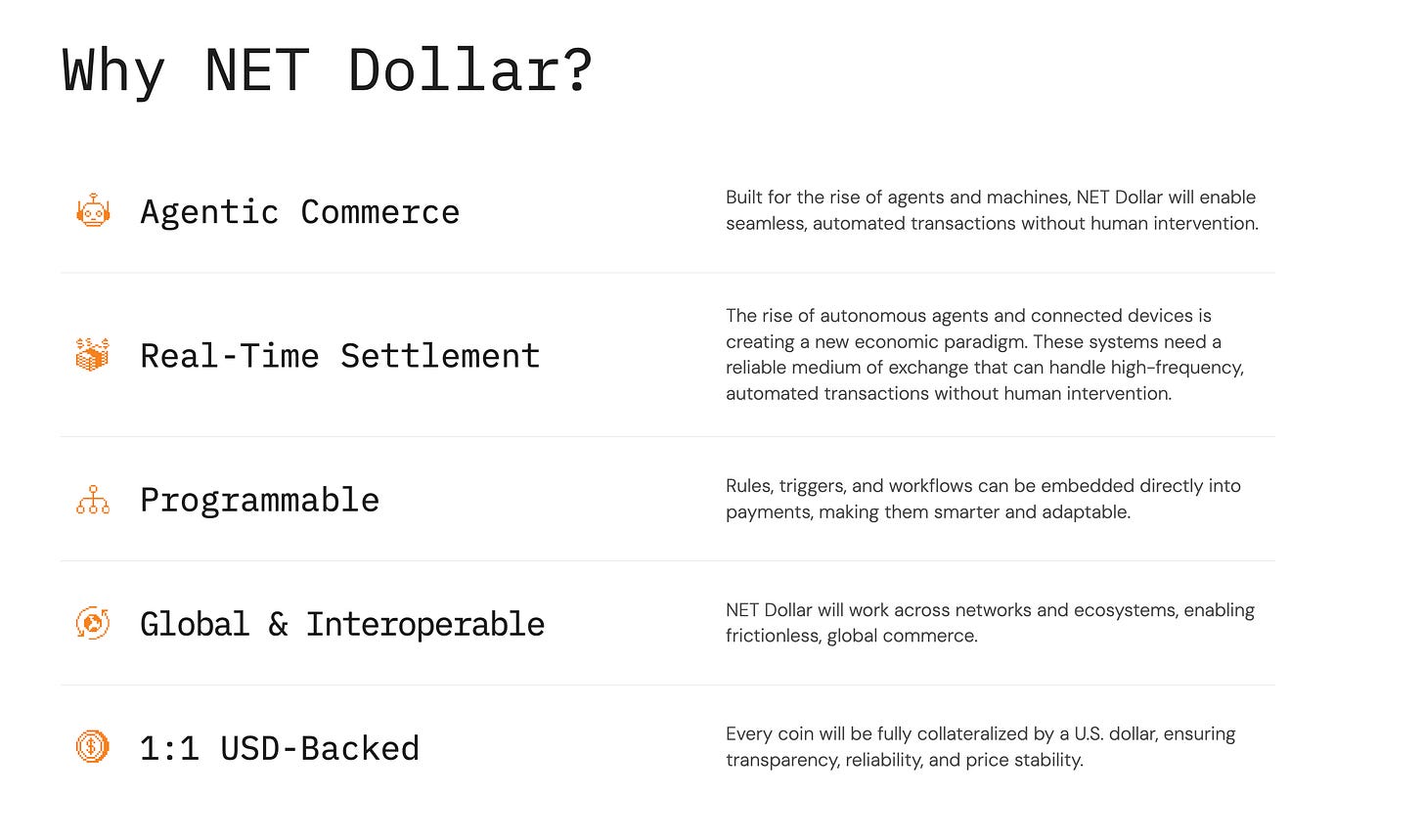

More on this 👉 The NET Dollar distinguishes itself through its focus on “agentic commerce,” enabling autonomous AI agents to conduct transactions without human intervention. These capabilities extend from personal AI assistants booking flights and ordering supplies to business agents executing instant supplier payments upon delivery confirmation.

The stablecoin supports programmable payments with embedded rules and conditions, real-time global settlement leveraging Cloudflare’s edge network, and seamless interoperability across different platforms.

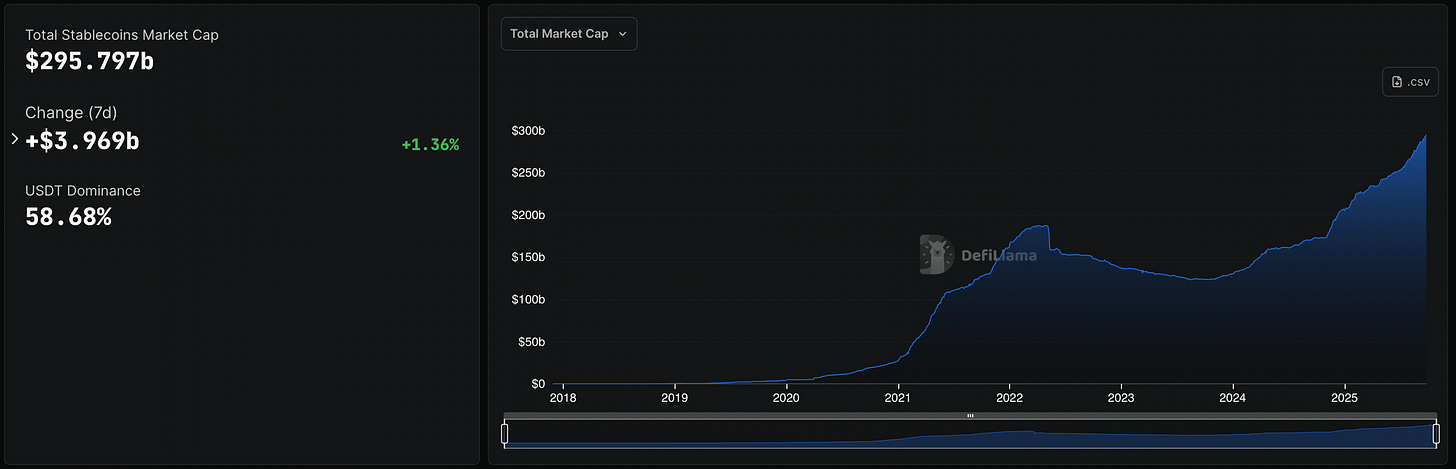

Zoom out 🔎 Cloudflare’s initiative comes at a pivotal moment for the stablecoin market, which has expanded by nearly $90 billion in 2025 alone to reach nearly $300 billion in total market capitalization.

The company is collaborating with major financial institutions, including Mastercard, American Express, and PayPal, to develop open standards like the Agent Payments Protocol, while partnering with Coinbase to establish the x402 Foundation for digital payment infrastructure.

ICYMI: Coinbase and Cloudflare launch x402 foundation to transform web-native payments for AI era 💸🤖 [what it’s all about & why it could be huge, how it compares to Google’s AP2 + bonus deep dives into Coinbase, AP2 & more inside]

The stablecoin addresses critical limitations in current payment systems, particularly for micropayments and machine-to-machine transactions that traditional credit card networks cannot efficiently handle. By enabling direct monetization models, NET Dollar could fundamentally shift internet economics away from advertising-dependent revenue streams toward pay-per-use frameworks that fairly compensate content creators and API developers.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, Cloudflare’s entrance into stablecoins signals a broader transformation in digital finance that extends way beyond just crypto markets. As Citi analysts project the stablecoin market reaching $1.9 trillion by 2030, with potential bull case scenarios of $4 trillion, NET Dollar could capture significant market share by addressing the specific needs of AI-driven commerce that current stablecoins like Tether and Circle’s USDC have not fully exploited. In the short term, expect intensified competition among stablecoin issuers, thus forcing incumbents to innovate their offerings to maintain market position. Traditional financial institutions will likely also accelerate their own digital currency initiatives, particularly as regulatory frameworks like the GENIUS Act provide clearer guidelines for stablecoin operations in the United States. Speaking of Cloudflare specifically, this move positions the company at the intersection of three transformative technologies: cloud infrastructure, artificial intelligence, and blockchain-based finance. Success with NET Dollar could establish Cloudflare as a critical infrastructure provider not just for web services but for the entire digital economy, potentially driving significant revenue growth beyond its core business. And that’s exactly why they are doing this in the first place, so well played 👏 Zooming out, the broader finance industry should prepare for a fundamental restructuring of payment rails that accommodate autonomous AI agents conducting billions of daily transactions. This shift will require new risk management frameworks, compliance protocols, and technological infrastructure capable of handling programmable money at internet scale. Financial institutions that fail to adapt to this machine-to-machine economy risk obsolescence as AI agents increasingly dominate commercial transactions over the next decade.

ICYMI:

Ebury eyes spring 2026 for London IPO 👀🇬🇧

The news 🗞️ Cross-border payments giant Ebury is reviving its initial public offering plans, targeting a spring 2026 debut on the London Stock Exchange with an ambitious valuation goal of £2 billion ($2.7 billion).

The company’s board and banking advisors are reportedly discussing a launch in the second quarter of 2026, marking a strategic reset after market volatility forced the postponement of earlier IPO ambitions.

Let’s take a look at this.

More on this 👉 The fintech firm, which provides international payment and currency risk management solutions to small and medium-sized enterprises, had originally planned to go public earlier this year. However, those plans were derailed by market turbulence attributed to new U.S. tariff policies that created uncertainty in global markets. The delay reflects the challenging environment that has faced many companies seeking public listings in recent years.

Santander, which acquired a 50.1% majority stake in Ebury for £350 million in 2019 and integrated it into its PagoNxt payments platform, appears to be taking a firm stance on valuation expectations. Reports indicate the Spanish banking giant will only proceed with the offering if the targeted £2 billion valuation can be achieved, signaling confidence in Ebury’s growth trajectory despite market headwinds.

Zoom out 🔎 The company has demonstrated robust expansion through strategic acquisitions, recently completing the purchase of Lithuania-based ArcaPay in September 2024, adding to earlier acquisitions of South Africa’s Prime Financial Markets and Brazil’s Bexs.

This geographic diversification has expanded Ebury’s footprint to over 16,700 customers across more than 40 offices in 29 countries, positioning it as a significant player in the global B2B payments space.

Investment banks, including Barclays, Goldman Sachs, and Peel Hun,t have been engaged to facilitate the potential offering.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, by targeting spring 2026, the company allows sufficient runway for market conditions to potentially stabilize following recent volatility, while also benefiting from continued business growth and integration of recent acquisitions. More importantly, the success or failure of this IPO will serve as a crucial litmus test for the London Stock Exchange’s ability to attract major fintech listings, particularly as it competes with U.S. markets for technology company debuts. Looking ahead, the cross-border payments sector specifically stands to benefit from continued globalization and SME digitalization trends. If Ebury successfully achieves its targeted valuation, it could trigger renewed interest in B2B payment companies and encourage other players in the space to accelerate their own public listing plans.

🔎 What else I’m watching

Mukuru and MoneyGram Boost Cross-Border Payments 🌍 Mukuru, a leading African fintech platform, has partnered with MoneyGram to enhance cross-border payment services across Africa, Asia, and beyond. By combining Mukuru’s technology-led infrastructure in Southern Africa with MoneyGram’s global reach, the partnership aims to deliver faster, more affordable, and inclusive remittance services. Customers benefit from expanded access to MoneyGram’s network and Mukuru’s extensive local outlets, with options for cash and digital transactions. The collaboration features real-time settlement, mobile-first access, and top-notch security. ICYMI: MoneyGram’s stablecoin wallet in Colombia 🪙🇨🇴 [what’s the USP here and how it fits into MoneyGram’s transformation + bonus dive into other firms launching stablecoins and the ultimate list of stablecoin resources inside]

Coinbase Introduces SGD Stablecoin 💱 Coinbase is introducing the Singapore dollar stablecoin, XSGD, to its platform through a partnership with StraitsX. This addition aims to facilitate easier local and cross-border payments for Singaporeans and allow users to convert SGD to XSGD at a 1:1 ratio. XSGD will be issued on Base, Coinbase’s low-cost Ethereum Layer 2 Chain, and an XSGD/USDC pool will be launched on Aerodrome to drive adoption. XSGD on Base will enable new use cases such as AI agents interacting on the blockchain, purchasing digital art, acquiring tokenized assets, and powering on-chain FX transactions. ICYMI: Coinbase and Cloudflare launch x402 foundation to transform web-native payments for AI era 💸🤖 [what it’s all about & why it could be huge, how it compares to Google’s AP2 + bonus deep dives into Coinbase, AP2 & more inside]

Klarna Reaches 1M US Debit Card Sign-Ups 💳 Klarna has achieved over 1M sign-ups for its debit card in the US within just 11 weeks of its launch on July 4. The Klarna Card offers consumers the flexibility to pay upfront or by installments, both in-store and online. Americans are signing up at a rate of 13,000 a day, with a peak of 50,000 sign-ups on September 23. The successful US launch has prompted Klarna to begin issuing cards in other markets, with plans to expand to more countries. ICYMI: Klarna’s $15B IPO, or a 26x oversubscribed feeding frenzy on Wall St. for Europe’s biggest FinTech comeback 👏🤑 [what it’s all about, why it matters & what to expect next + bonus deep dive into Klarna’s IPO filing & why you should be bullish on them]

💸 Following the Money

Light, the AI-native finance platform that processes 280M records in under a second, announced $30M in Series A funding led by Balderton Capital.

Tipalti, the AI-powered platform for finance automation, has secured $200M in growth financing from long-time partner Hercules Capital.

Shield, a neobank startup using stablecoin payments to make life easier for global trade businesses, has raised $5M in seed funding.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Wow, this one is 10x packed... insane!