OpenAI wants to replace investment bankers with AI 💸🤖; Second-biggest Series A in startup history goes to stablecoins 😳🪙; Coinbase spent $375M to replace your investment bank 📊🏦

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

280+ AI Tools You Should Know 📚🤖 [from automation to creativity - this is your toolkit for working smarter, not harder]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

OpenAI’s integrated AI ecosystem: Browser, Payments, and Finance all converge in Agentic Commerce push 🤖🛍️ [how browser, payments & finance plays all tie perferctly together, what does this indicate & what it means for the future of payments & finance + bonus deep dives into each of them, the agentic AI survival guide & top AI agent startups of 2025 inside]

Citi believes bank tokens will beat stablecoins by 2030 despite $4 trillion crypto surge 😳🏦 [key takeaways from Citi’s new research, unpacking the key details & future implications + the ultimate list of stablecoin resources inside]

DraftKings’ strategic pivot, or why prediction markets have arrived 📊💰 [what happened & why it matters + bonus reads on prediction markets inside]

Stablecoin infrastructure consolidation signals new era for digital finance 💸📈 [quick look at the most interesting M&As that just happened, what they tell us & what to expect next + bonus list of the ultimate stables resources inside & M&A templates that could save you a lot of $$$]

JPMorgan’s Q3 2025: premium quality at premium prices demands patience 📊🏦 [breaking down their latest numbers, what they mean & whether JPM is worth your time & money + bonus reads on the banking titan inside]

Citi’s Q3 2025: why the banking giant at $100 is a value trap, not a value play 📊🏦 [breaking down the latest numbers, what they mean & why the banking giant at $100 is a value trap, not a value play + a bonus deep dive into JPMorgan’s Q3 2025 inside]

This AI startup simulated human behavior better than Claude and ChatGPT, then raised $5.35 million 🤖🧠 [inside Artificial Societies’ masterclass in conviction-driven fundraising & how to sell an impossible future]

The Pitch Deck That Won $16M in the AI Agent Gold Rush 🤖💸 [how StackAI positioned itself as the bridge between cutting-edge AI and non-technical enterprises]

3 Essential Templates Every AI Startup Needs 🚀🤖 [raise smarter, scale faster: the essential toolkit for today’s leading tech startups]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

OpenAI now wants to replace investment bankers with AI 😳🤖

The news 🗞️ AI giant OpenAI has recently launched Project Mercury, a strategic initiative that employs over one hundred former investment bankers from elite firms, including Goldman Sachs, JPMorgan, and Morgan Stanley, to train artificial intelligence models on complex financial tasks.

These contractors, compensated at approximately $150 per hour, develop sophisticated Excel-based financial models covering initial public offerings, mergers and acquisitions, restructurings, and leveraged buyouts. The engagement process itself demonstrates automation’s reach, with candidates navigating AI-driven interviews and technical assessments without human interaction.

Let’s take a quick look at this.

More on this 👉 At the core, this project represents a calculated transition from consumer-oriented AI applications to enterprise-grade, domain-specific intelligence.

By encoding institutional knowledge accumulated over decades, OpenAI aims to automate the repetitive analytical work that currently consumes substantial time for junior analysts. The initiative also addresses a critical challenge for OpenAI: converting its substantial valuation into sustainable revenue streams through lucrative enterprise applications. Something that its rival Anthropic does very, very well right now.

Zoom out 🔎 We must note that the implications here extend beyond mere efficiency gains.

Project Mercury fundamentally challenges the traditional apprenticeship model that has long defined career progression in investment banking, where entry-level professionals develop expertise through intensive foundational work.

This disruption thus raises important questions about talent development pipelines and the future structure of financial careers.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Project Mercury clearly signals an inflection point where artificial intelligence transitions from augmenting to potentially replacing specialized white-collar work. For OpenAI, success in finance could establish a template for penetrating other knowledge-intensive sectors, including consulting, legal services, and accounting. The broader financial services industry therefore faces a transformative period requiring strategic decisions about developing proprietary AI capabilities versus partnering with technology providers. Looking ahead, regulatory frameworks will definitely need substantial evolution to address questions surrounding model transparency, algorithmic bias, and systemic risk as AI assumes greater responsibility for high-stakes financial decisions. Additionally, the competitive landscape will likely bifurcate between institutions that successfully integrate AI to enhance productivity and those that struggle to adapt their traditional operating models. Ultimately, the financial sector may witness a redefinition of value creation, where human expertise focuses increasingly on judgment-intensive advisory work while AI handles standardized analytical processes. AI is inevitable.

ICYMI: OpenAI’s integrated AI ecosystem: Browser, Payments, and Finance all converge in Agentic Commerce push 🤖🛍️ [how browser, payments & finance plays all tie perferctly together, what does this indicate & what it means for the future of payments & finance + bonus deep dives into each of them, the agentic AI survival guide & top AI agent startups of 2025 inside]

Second-biggest Series A in startup history goes to stablecoins, and Wall Street VCs are all in 😳🪙

The BIG News 🗞️ Tempo, a blockchain infrastructure platform developed through a partnership between FinTech giant Stripe and crypto venture firm Paradigm, has just raised $500 million in Series A funding at a whopping $5 billion valuation. The round was co-led by Thrive Capital and Greenoaks, with participation from Sequoia Capital, Ribbit Capital, and SV Angel, marking one of the largest venture rounds in blockchain history.

To put this into perspective, this is actually the second-largest Series A round in the history of tech startups 🤯 It falls short only of the record set by Transmit Security’s $543M Series A in 2021, which remains the highest to date based on publicly reported deals.

Let’s take a closer look at this, understand why it matters, and what to expect next.

More on this 👉 We can remember that Tempo launched publicly in early September 2025, so securing this substantial investment just 6 weeks later is quite impressive 👏

Under the leadership of Paradigm co-founder Matt Huang, who also serves on Stripe’s board, Tempo positions itself as a payments-oriented Layer 1 blockchain specifically engineered for stablecoin transactions and real-world financial applications.

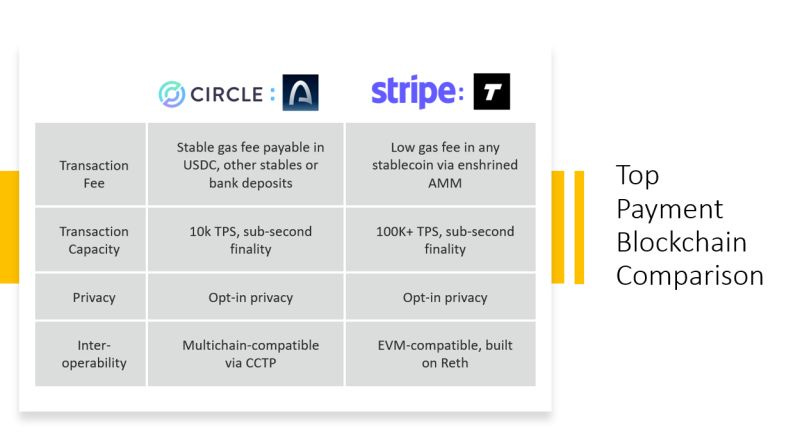

The platform’s technical architecture addresses critical limitations in existing blockchain networks. Tempo delivers over 100,000 transactions per second with sub-second finality, substantially exceeding the throughput of established networks like Ethereum. Its stablecoin-native design incorporates an enshrined automated market maker that enables users to pay transaction fees in any stablecoin, eliminating the need for volatile native tokens.

Zoom out 🔎 Tempo has assembled an impressive roster of design partners spanning traditional finance and technology sectors, including Visa, Deutsche Bank, Standard Chartered, OpenAI, Anthropic, Shopify, and DoorDash. The platform recently strengthened its technical capabilities by recruiting Dankrad Feist, a prominent Ethereum Foundation researcher, as a senior engineer.

At the core, this funding round reflects Stripe’s comprehensive strategy to control the entire payments technology stack, complementing its earlier acquisitions of Bridge for stablecoin infrastructure and Privy for digital wallet capabilities.

ICYMI: Stablecoin companies are becoming banks 🪙🏦 [why Stripe’s stablecoin startup is pursuing a national charter, what it means for the sector & what’s likely to happen next + bonus list of the ultimate stables resources inside]

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this could be a transformative moment for stablecoin infrastructure and enterprise blockchain adoption. Tempo’s phenomenal funding & valuation demonstrates that institutional capital increasingly views payment-focused blockchains as critical infrastructure rather than speculative ventures. The participation of traditionally mainstream VC firms like Thrive Capital and Greenoaks, which typically focus on AI and enterprise software, confirms that stables tech has crossed into mainstream financial technology investment. Zooming out, Tempo’s emergence presents both opportunities and competitive pressures. Traditional stablecoin issuers like Circle and Tether may face increased competition as Stripe channels its substantial payment volume through proprietary infrastructure. Financial institutions collaborating as design partners gain early positioning in blockchain-based settlement systems that could eventually supplant legacy payment rails like SWIFT and traditional card networks. On top of that, the stablecoin market, currently exceeding $300 billion, appears poised for further acceleration. Tempo’s stablecoin-agnostic approach could reduce market fragmentation by creating a neutral settlement layer supporting multiple currencies. This neutrality may thus prove essential for regulatory acceptance, particularly following recent United States legislation establishing frameworks for stablecoin issuers. Looking forward, we can expect Tempo to likely announce tokenomics within the next year to incentivize network validators and potentially distribute governance rights. The platform’s mainnet launch, expected in 2026, will test whether its technical capabilities translate into actual enterprise adoption. Strategic partnerships with major payment networks like Visa suggest tokenized deposit products and institutional settlement applications will emerge as early use cases.

ICYMI: Stripe’s killing SWIFT? Their new L1 blockchain Tempo unites OpenAI, Visa, Shopify, and Deutsche Bank to make stablecoins the default global payment rail 😳⛓ [key details we know so far, why it matters, could it kill SWIFT + the ultimate list of stables resources, deep dive into Circle’s latest earnings & more inside!]

Stripe launches comprehensive stablecoin suite, positioning itself as a full-stack digital asset infrastructure provider 💳 🪙 [what it’s all about & why it could be huge + bonus dives into Agentic Commerce Protocol launched with OpenAI, recap of their L1 Tempo & the ultimate list of stablecoin resources inside]

Coinbase just spent $375 million to replace your investment bank 😳🏦

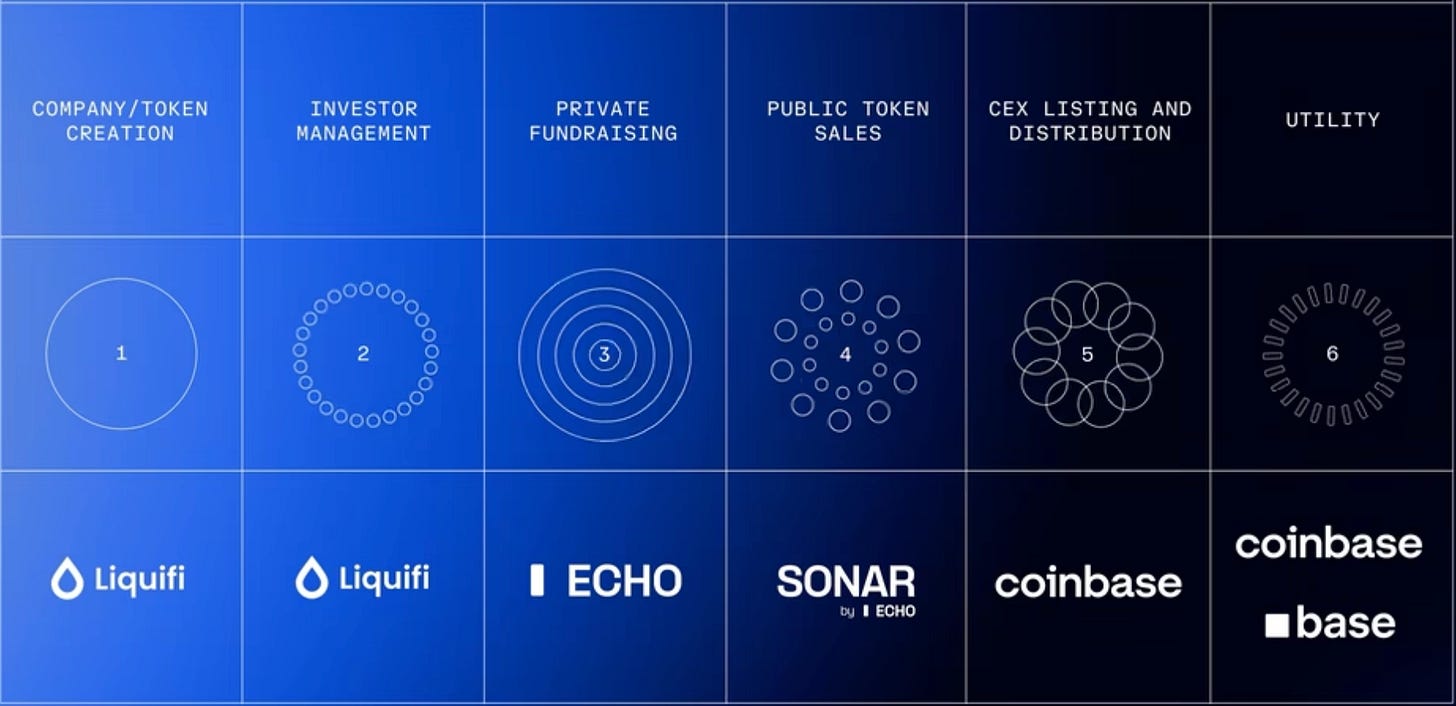

The news 🗞️ Digital assets giant Coinbase has just acquired Echo, an onchain fundraising platform, for approximately $375 million in a combination of cash and stock.

This transaction represents Coinbase’s 8th acquisition of the year and marks a significant expansion of the exchange’s capabilities beyond traditional cryptocurrency trading.

Let’s take a closer look at this, understand why it matters, and what’s next for Coinbase.

More on this 👉 Echo, founded by prominent crypto trader Jordan Fish (known as “Cobie”), has established itself as a blockchain-based platform that enables both private and public token sales. Since its launch in April 2024, Echo has facilitated over $200 million in capital raises across roughly 300 deals.

The platform’s Sonar product allows founders to host public token sales with built-in compliance and jurisdictional controls, addressing longstanding challenges in crypto fundraising around transparency and accessibility.

Zoom out 🔎 The acquisition strategy positions Coinbase to support projects across their entire lifecycle, from initial token creation through fundraising and eventual listing on secondary markets. This deal complements Coinbase’s July acquisition of token management platform Liquifi, creating an integrated suite of services for crypto founders and investors.

Echo will initially operate as a standalone brand while its core technology is integrated into Coinbase’s ecosystem, with Fish and his forty-person team joining the company.

The transaction also reflects broader momentum in crypto industry consolidation, driven by increasingly favorable regulatory conditions under the current administration.

Coinbase joins competitors, including Kraken, Ripple, and Robinhood in executing significant acquisitions throughout 2025 as companies seek to expand their capabilities and market position.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this M&A positions Coinbase to fundamentally reshape how capital formation occurs in digital asset markets. By controlling the entire value chain from project inception to trading, Coinbase creates substantial competitive moats that extend well beyond its traditional exchange business. The integration of Echo’s fundraising capabilities addresses a critical gap in the crypto ecosystem, where individual investors have historically been excluded from early-stage opportunities while founders struggled with opaque, venture capital-dominated fundraising processes. More importantly, Coinbase appears to be positioning itself for the eventual tokenization of traditional securities and real-world assets, a market opportunity that could dwarf the current crypto economy. As regulatory frameworks continue to evolve, particularly around tokenized securities, Coinbase’s compliance-first approach and end-to-end platform capabilities could prove decisive advantages. The company is essentially building infrastructure for a future where capital markets operate primarily onchain, with 24/7 accessibility and unprecedented transparency. Looking at the bigger picture, this could signal an acceleration toward disintermediation of traditional financial gatekeepers. If Coinbase successfully executes this vision, it could pressure traditional investment banks, venture capital firms, and equity exchanges to fundamentally rethink their business models. Could onchain be the future? We are yet to find out, but Coinbase clearly wants to own it.

ICYMI:

🔎 What else I’m watching

PayRetailers Launches EON AI Platform 🤖 PayRetailers has launched EON, an in-house enterprise AI platform designed to enhance internal operations and customer experience in the payment sector. The initial launch is with a selected group of merchants through the Merchant Portal, offering features like natural language searches and customised reporting at no additional cost. EON is also used internally for ticket management and workflows, aiming to improve efficiency and response times. The platform ensures security and compliance, with data remaining within PayRetailers’ ecosystem and adhering to standards like PCI DSS and GDPR. ICYMI:

Revolut Nears $3B Funding 🤑 UK-based Revolut is close to finalizing a $3 billion fundraising round, valuing the company at approximately $75 billion. The round includes new funding and a secondary share sale, providing liquidity to early backers and employees. Revolut has grown significantly since 2015, offering a range of financial services to 65 million users. The company aims to enter 30 additional markets and invest USD 13 billion to reach 100 million customers. Revolut is also focused on obtaining full banking licenses and recently acquired Swifty, an AI-enabled travel agent startup. ICYMI: Revolut navigates regulatory roadblocks while betting big on AI travel integration ✈️🏦 [recap of the latest UK bank licencing challenges & why the M&A of AI travel agent startup is a brilliant play + bonus dives into Revolut’s other strategic moves & the list of top AI agent startups of 2025 and their pitch decks inside]

Japanese Banks Launch Stablecoin 🇯🇵🪙 Three of Japan’s largest banks - MUFG Bank, Sumitomo Mitsuio Banking Corp, and Mizuho Bank - are launching a unified stablecoin pegged to the Japanese yen. The launch is set for March, with Mitsubishi as the first major user. The banks aim to improve efficiency and reduce costs in cross-border payments. Progmat will provide the infrastructure, and JPYC plans to issue 1 trillion yen’s worth of the stablecoin over three years. Meanwhile, nine European banks are working on a euro-denominated stablecoin. ICYMI:

💸 Following the Money

Online lender Upgrade has announced that it has secured $165M in a new funding round, bringing its valuation to $7.3B.

London-based payments network TrueLayer is set to expand its presence in Europe after striking an agreement to buy Nordic competitor Zimpler.

Bluwhale, the decentralized AI network powering agents on blockchains, closed $10 million Series A funding round.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

What a week... thanks for another great read!