Revolut just let an AI touch money 🤖💸; Mesh is the newest stablecoin unicorn 🪙🦄; Yahoo’s AI Search play is smarter than it looks 🤖🌐

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

AI Just Killed the User Interface 🧠🖥️ [Anthropic AI launched an app layer inside Claude, & it changed the role of SaaS entirely]

The Agentic Singularity 🤖🌀 [Deconstructing OpenAI’s operating system strategy and the eclipse of the application era]

The Stock Picks That Quietly Beat the Market (Again) 📈💸 [My 2025 portfolio outperformed the S&P 500 by 2× and surpassed most top hedge funds. Here’s how each company actually performed & what it means for investing in 2026]

The Institutionalization of FinTech 💳🏦 [Capital One bought Brex for $5B. Ramp is worth $32B. What happened? 🤔]

Rockets, AI, and rails: the closed-loop economy no bank can touch 🚀🔒 [deep dive into SpaceX & xAI [& X Money] merger, what everyone’s missing about the biggest IPO of all time + bonus deep dive into Elon’s Super App ambitions]

Nubank’s US charter is a stress test for every neobank’s unit economics 🏦🇺🇸 [why it’s huge & who has to worry + bonus deep dive into NU’s latest financials inside]

Google’s Universal Commerce Protocol: the new default for how AI buys things 🤖🛍️ [2,000+ words dive into Universal Commerce Protocol (UCP), why it’s huge, how it changes everything, and how each player needs to adapt to the new AI-first economy + bonus list of top 10 AI startups to watch in 2026 & AI leader playbook inside]

Brazil’s digital payments darling comes of age, but can PicPay escape the shadow of its controllers? 🤔🇧🇷 [unpacking their strategy, financials, and challenging governance to see whether this new Latin American stock is worth your time and money in the years to come + inside you’ll also find deep dives into other LatAm gems Nubank & MercadoLibre, and why I’m super bullish on both]

Affirm’s Bank charter bid is really a 300 basis point bet 😎🏦 [what’s the real strategy here & how it stacks against the competition + bonus deep dives into the latest financials of Affirm, Klarna & PayPal Bank]

Top 10 AI Startups to Watch in 2026 🤖🦄 [Strategies, stories, and GTM blueprints from the fastest-growing AI companies that have collectively raised $500M+]

120+ AI Use Cases From Leading Startups & Internet Companies 🚀🧠 [Learn how real companies are using AI to ship products, cut costs, and change entire industries]

The AI Leader Playbook 📚🧠 [A First-Principles Guide to Building AI-Powered Engineering Teams and Products]

As for today, here are the 3 amazing FinTech stories that are transforming the world of financial technology as we know it. This was yet another incredible week in the financial technology space, so make sure to check all the above stories.

Revolut just let an AI touch money 🤖💸

The news 🗞️ Most banks deploy AI to keep you away from humans. Revolut just deployed it to replace them.

The $75 billion fintech rolled out ElevenLabs voice agents to 4 million UK and European users, and the scope goes beyond the usual FAQ-reading chatbot.

Let’s unpack this.

More on this 👉 These agents execute transactions. They process chargebacks. They handle dispute resolution end-to-end. They block and unblock cards. They switch between 30+ languages mid-conversation 😳

Revolut reports 8x faster resolution times and a 99.7% call success rate.

The numbers matter less than what they imply: Revolut has given an AI system permission to move customer money without human intervention. That’s a different category of trust than letting it answer “what’s my balance.”

Interestingly, the partnership extends to Formula 1, where ElevenLabs will dub driver interviews and team content into 30+ languages for Revolut’s Audi F1 sponsorship.

Smart marketing, but the operational bet is the real story. Revolut isn’t trimming support costs at the margins. It’s rebuilding the customer service function around the assumption that AI handles resolution, not deflection.

Zoom out 🔎 There’s a European angle worth noting here as well: a UK-headquartered fintech choosing a Polish-founded AI company over OpenAI or Google. Whether that’s GDPR calculus, better performance, or relationship-driven matters less than the signal. The “build on US infrastructure” default is now weakening.

THE TAKEAWAY ✈️

What’s next? 🤔 Looking ahead, two questions will determine whether this becomes a template or a cautionary tale. First: what happens when the AI gets it wrong on a high-stakes dispute? Revolut’s error rate looks good until a single viral complaint changes the narrative. Second: how long before regulators want to know exactly when AI-executed financial actions require human review? The fintechs watching should be asking a harder question: if this works, what does a support org even look like in 3 years? AI-first is no longer optional.

ICYMI: Revolut’s bet that AI would kill the checkout page 🤖🛍️ [why they are the first in Europe to support Google’s AP2 & how they are seeing the bigger picture here + bonus deep dive into Google’s UCP, and how it changes everything]

Mesh is the newest stablecoin unicorn 🪙🦄

Following the money 💸 The third stablecoin infrastructure unicorn in 4 months just dropped, and the pattern is now undeniable: capital is flooding into the plumbing, not the coins.

Mesh just closed a $75 million Series C at a $1 billion valuation, doubling its price tag from March 2025. Dragonfly led; Paradigm, Coinbase Ventures, and the usual suspects followed. The company processes nearly $10 billion in monthly volume through integrations with 300+ wallets and exchanges, enabling what it calls “any-to-any” payments: consumers spend Bitcoin, merchants receive USDC, and Mesh handles the mess in between.

Let’s take a quick look at this and see what it’s all about.

More on this 👉 Despite the flashy $1 billion price tag, the real story here isn’t another unicorn minting. It’s what Mesh is actually selling: a bet that stablecoin fragmentation is permanent.

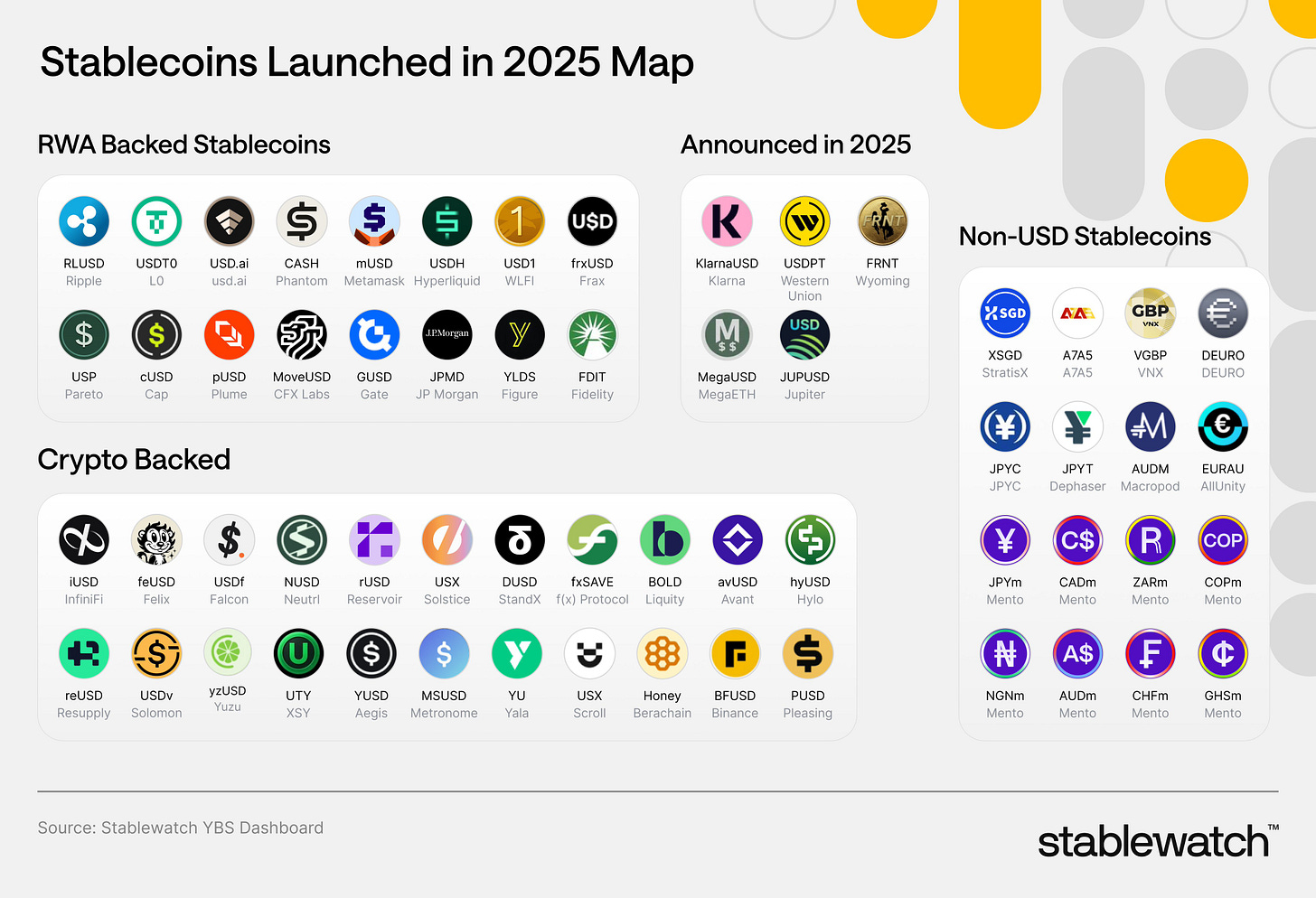

Right now, 200+ stablecoins are scattered across dozens of chains with siloed liquidity, incompatible standards, and varying regulatory status. The conventional wisdom says this consolidates over time - a few winners emerge, standards coalesce, complexity falls.

Mesh is betting the opposite. Every new stablecoin, every regional variant optimized for local compliance, every chain-specific deployment widens their moat (in essence, something similar to local currencies & local payment rails). So they’re not solving fragmentation. They’re monetizing it.

Case in point: there have been 59 new major Stablecoins launched in 2025.

Zoom out 🔎 This explains the company’s neutrality play. Unlike Stripe (which acquired Bridge and backed Tempo to own the stack end-to-end) or PayPal (issuing PYUSD while using Mesh for distribution), Mesh stays agnostic - supporting USDC, USDT, PYUSD, and whatever comes next.

In a market consolidating toward two or three dominant stablecoins, that neutrality becomes a liability. In a market that stays fragmented by regulatory arbitrage and ecosystem specialization, it’s structural advantage. And that’s exactly what Mesh is betting big here on.

THE TAKEAWAY ✈️

What’s next? 🤔 Looking ahead, the key question to watch now is this: does the GENIUS Act’s regulatory clarity accelerate consolidation or entrench regional divergence? Early signs point toward the latter. MiCA-compliant euro stablecoins, GENIUS Act-compliant dollar variants, and Asian alternatives are all proliferating, not converging. That said, if fragmentation persists, the orchestration layer captures disproportionate value - basis points on trillions in flow. If it doesn’t, Mesh becomes middleware competing on price. The billion-dollar valuation prices in the chaos thesis. Now they have to be right.

ICYMI:

Yahoo’s AI Search play is smarter than it looks 🤖🌐

The news 🗞️ Yahoo just made the most strategic move a legacy internet company can make in 2026: it stopped trying to win.

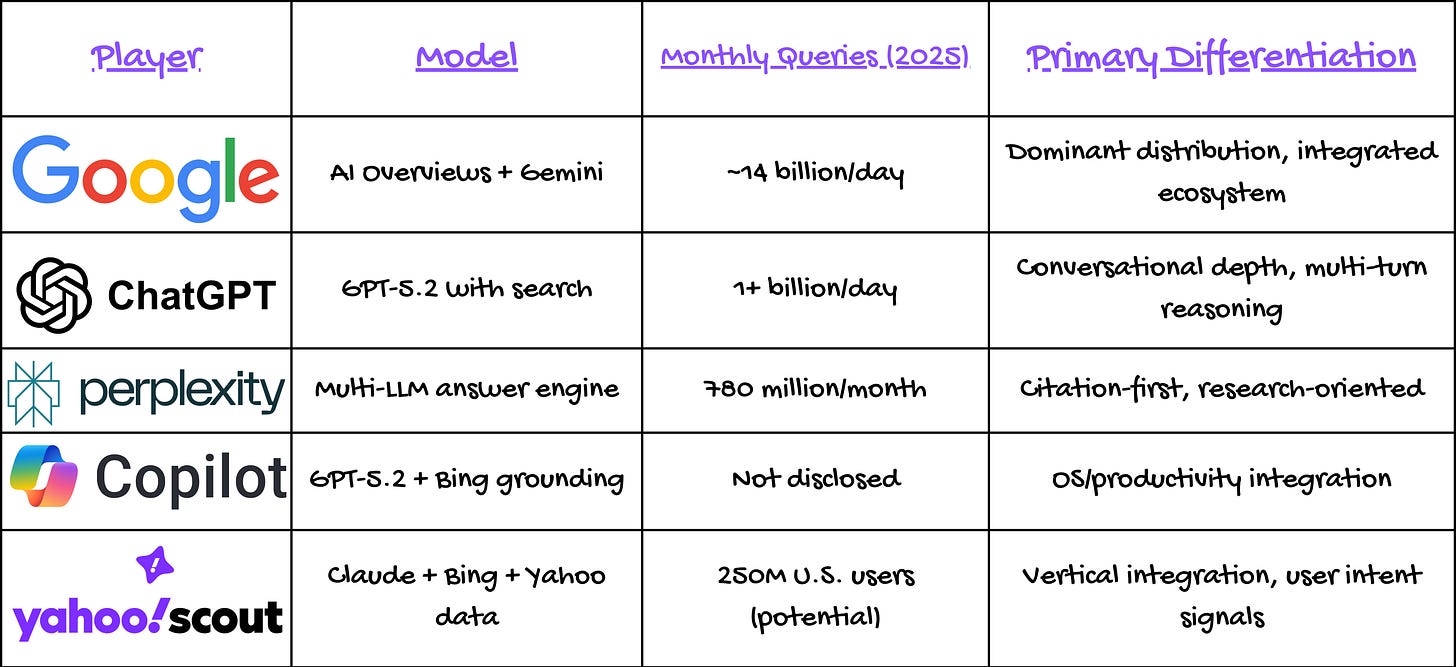

Yesterday, Yahoo launched Scout, an AI answer engine built on Anthropic’s Claude and grounded by Microsoft Bing’s search API. The product itself is competent but unremarkable - conversational interface, inline citations, the usual AI search features. What’s interesting is the strategy underneath it.

Let’s unpack it.

More on this 👉 Yahoo isn’t chasing Google’s 90% market share or ChatGPT’s cultural mindshare. Instead, it’s exploiting 3 structural advantages nobody else has in combination:

→ 250 million monthly U.S. users already habituated to Yahoo properties

→ 30 years of behavioral data across finance, sports, email, and news (18 trillion annual consumer signals, 500 million user profiles), and

→ A mature ad infrastructure that lets it monetize from day one, while OpenAI is still figuring out its business model.

The publisher angle matters more than it appears. Scout prominently features source attribution and “Read More” buttons - a deliberate contrast to Google’s AI Overviews, which publishers blame for a 33% traffic decline over the past year. Yahoo joined Microsoft’s Publisher Content Marketplace pilot, positioning itself as the AI search engine that actually sends traffic back to the open web.

If publishers start seeing better click-through rates from Scout, some may begin blocking Google and OpenAI crawlers while allowing Yahoo. That’s a wedge.

Zoom out 🔎 CEO Jim Lanzone called it an opportunity “we didn’t think would come around again.” He’s right about the timing.

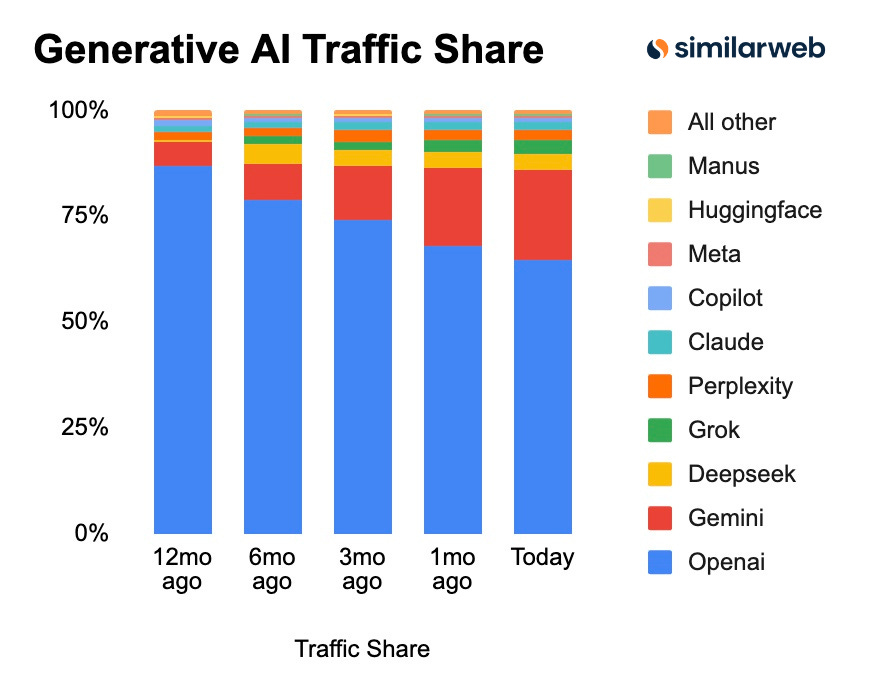

The AI search market is fragmenting faster than expected - ChatGPT’s search interest share dropped from 92% to 59% in the past year as users develop specialized preferences. And that could be a gap Scout could fill.

THE TAKEAWAY ✈️

What’s next? 🤔 One thing is clear - Scout won’t kill Google. But it doesn’t have to. Yahoo’s bet is much narrower: capture the casual user who checks Yahoo Finance daily and never signed up for ChatGPT, then use proprietary data to make switching costly. Looking ahead, watch cross-property engagement metrics over the next two quarters. If Yahoo Mail users start asking Scout about their portfolio holdings, the flywheel thesis is working. If not, this is just another portal company adding AI features to arrest decline. Nevertheless, it’s definitely an interesting bet.

ICYMI:

What else I’m watching

eBay Bans AI Agents 🤖 eBay is banning independent AI agents from shopping on its site, creating a closed-loop ecosystem that allows only approved partners like OpenAI. The ban, effective next month, targets bots that can search for items, negotiate prices, and complete transactions. The aim is to prevent bots from outpacing human buyers and engaging in manipulative practices like scalping. eBay was a launch partner of OpenAI’s ‘Operator’ in early 2025. ICYMI:

UAE’s First Stablecoin 🇦🇪 Universal Digital has launched USDU, the UAE’s first central bank-approved USD-backed stablecoin. Registered as a Foreign Payment Token, USDU is backed 1:1 by reserves at Emirates NBD and Mashreq. This launch aims to provide institutions with confidence in digital-asset markets and supports the maturation of the market. ICYMI:

Revolut Expands Mortgages 🇱🇹 Revolut is expanding its mortgage product in Lithuania to include home buying, offering competitive rates, flexible repayment options, and discounts for energy-efficient homes. The fully digital process provides real-time updates and local support. Customers can receive a pre-approved offer in minutes, with loan amounts ranging from €35,000 to €1,000,000. The product is currently available to a limited group, with others able to join a waitlist. Revolut’s refinancing has already saved customers over 14,000 euros on average.

💸 Following the Money

Vennre, a wealth creation platform enabling HENRYs (High Earners, Not Rich Yet) to access private market opportunities, closed its Pre-Series A funding round, raising $9.6M through a hybrid equity and debt structure.

JPMorgan Chase has acquired UK-based pensions and wealth management technology platform WealthOS.

Checkout.com, has acquired Blue EMI, a Lithuanian-licenced issuer of euro stablecoins.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

What a week... I think stables are going to become even more mainstream in 2026. Probably they already are...

Good read. Revolut to go to $100B soon?