Revolut’s $75B valuation signals a new era for European FinTech 😤📈; Klarna launches KlarnaUSD stablecoin to reshape global payments 😳🪙; AI shopping tools & the future of agentic commerce 🤖🛍️

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

The Ultimate LLM Toolkit for Unleashing AI Innovation 🤖📚 [100+ battle‑tested tools and frameworks to accelerate your AI projects and stay ahead in the LLM race]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

𝕏’s Super App gambit: Elon Musk wants to be your bank 😳🏦 [what hiring at 𝕏 Money tells us & what to expect next + bonus dives into Elon’s Everything App ambitions & growing challenges from OpenAI]

Robinhood is building the Nasdaq of Reality, where every headline becomes a trade 🤑📈 [why the latest M&A of LedgerX is a masterstroke and how it ties into their bigger vision in the space + bonus deep dive into Robinhood’s latest financials, why I’m bullish & more reads on their biggest competitor Coinbase inside]

Klarna’s 3Q 2025: AI-powered BNPL leader trading at 50% discount to intrinsic value? 🤯📉 [unpacking the most important 3Q 2025 financial facts & figures, understanding what they mean, and why Klarna might be worth your time and money in the years to come]

Coinbase’s 9th M&A this year to advance the ‘Everything Exchange’ vision 🤑📲 [why it’s buying Vector.fun & how it ties to the rest of the ecosystem + bonus deep dive into Coinbase & their latest financials inside]

PayPal and Perplexity launch Instant Buy, or the new era of AI-powered commerce 🤖🛍️ [what it’s all about & why you should be paying attention + bonus deep dive into PayPal & more dives into Agentic Commerce and Agentic Finance inside]

The Honest Network effect, or why Affirm’s data moat is worth $50 billion 🤑📊 [breaking down BNPL leader’s latest financials, understanding what they mean & why you should be bullish on AFRM 0.00%↑ + bonus deep dive into their biggest competitor Klarna]

Coinbase’s AI-powered debate system 🤖💭 [how the FinTech giant implemented AI Agents to strengthen the company’s internal processes & what can we learn from this + bonus dive into Coinbase & the ultimate LLM toolkit inside]

Due diligence checklist for VCs and startup investors 📋💸 [Everyone’s funding AI. Almost no one is doing the DD properly]

How this AI startup sold compliance automation to VCs: the $14M pitch deck breakdown 💸🤖 [In the age of vibe coding, anyone can build an app. But can you keep it compliant with 50+ regulations without hiring an army of lawyers? Feroot bet $14M you can’t and won 👏]

The $400 billion problem nobody talks about: inside AI startup’s pitch to fix the internet 🤖🌐 [How Vibranium Labs is building the AI that prevents your 3 am wake-up calls 💤]

The 75% Problem, or How This AI Startup Raised $13M in One Week 💸🤖 [How ex-Monzo founders are automating the complex customer operations work financial services companies thought impossible 📈]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

Revolut’s $75 billion valuation signals a new era for European FinTech 😤📈

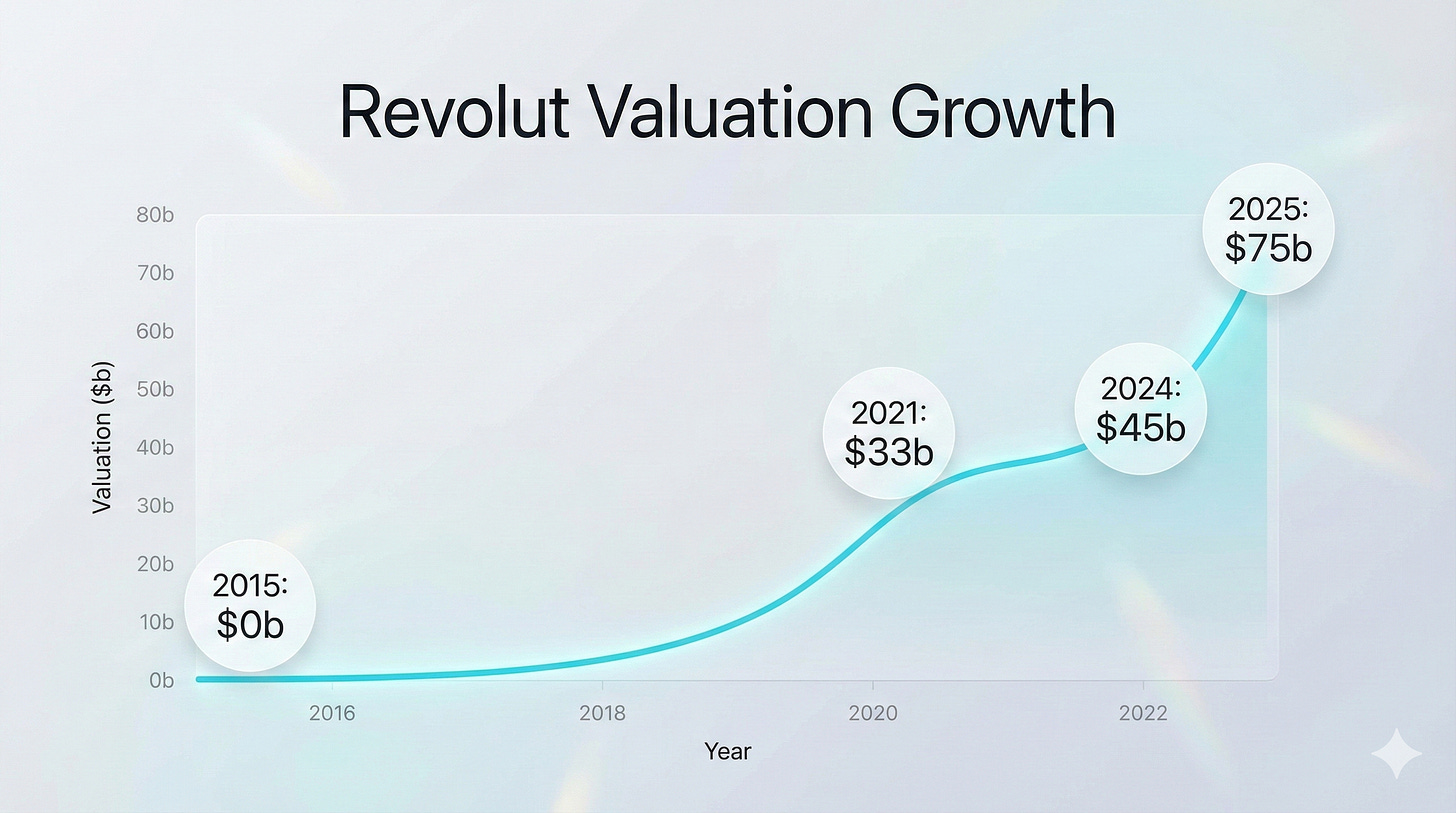

The BIG News 🗞️ FinTech giant Revolut has just secured a whopping $75 billion valuation following a secondary share sale, establishing itself as Europe’s most valuable private technology company and one of the top 10 private firms globally.

This represents a remarkable 67% increase from its $45 billion valuation in early 2024. Let that sink in… 🤯

Let’s take a quick look at this, understand why it matters, and what’s next for Revolut.

More on this 👉 The transaction, led by Coatue, Greenoaks, Dragoneer, and Fidelity, drew strategic participation even from Nvidia’s venture arm NVentures, signaling growing convergence between AI infrastructure and financial services.

The deal primarily provided liquidity to employees rather than raising operational capital, marking Revolut’s 5th such share sale program. Nice!

Zoom out 🔎 The valuation rests on exceptional fundamentals.

In 2024, revenue surged 72% to $4 billion while pre-tax profit jumped 149% to $1.4 billion, demonstrating that rapid growth and profitability can coexist in FinTech.

The company now serves over 65 million customers globally, with its business division alone crossing $1 billion in annualized revenue.

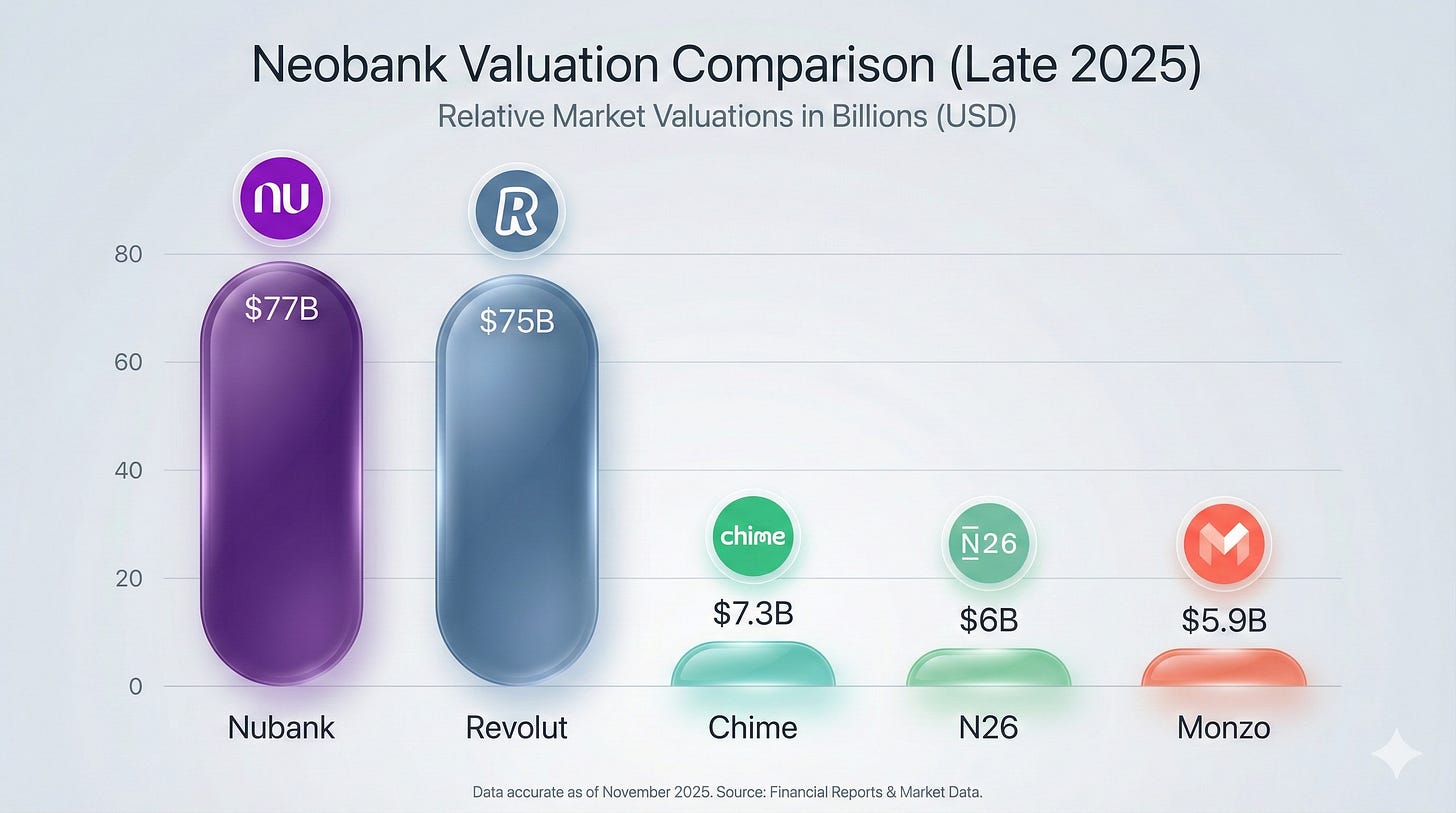

At $75B, Revolut is now more valuable than Coinbase and nearly as valuable as Nubank, while at the same time surpassing all of its other peers.

ICYMI: Purple Reign, or how Nubank built an AI moat competitors can’t touch 🤖💜🏦 [deep dive into NU’s 3Q 2025, breaking down the most important facts & figures, understanding what they mean, and why you should be bullish on NU]

Revolut’s trajectory suggests profound implications for global finance.

The company’s stated ambition to reach 100 million customers across 100 countries by 2030, combined with Nvidia’s involvement, points toward an AI-enhanced financial Super App capable of not only challenging but perhaps even surpassing traditional banking infrastructure worldwide.

THE TAKEAWAY ✈️

What’s next? 🤔 Looking ahead, Revolut appears to be well-positioned for an eventual public listing, likely awaiting full UK banking license approval and favorable market conditions. The participation of major institutional investors such as Andreessen Horowitz and Fidelity typically precedes IPO activity. Should Revolut successfully execute its expansion strategy while maintaining profitability, it could fundamentally reshape competitive dynamics in global retail banking, proving that digitally native platforms can outperform century-old institutions built on legacy infrastructure. The Apple of FinTech.

ICYMI:

Klarna launches KlarnaUSD stablecoin to reshape global payments 😳🪙

The news 🗞️ Swedish Buy-Now-Pay-Later (BNPL) pioneer Klarna just announced the launch of KlarnaUSD, a fully dollar-backed stablecoin designed to fundamentally reduce the cost and friction of cross-border payments.

The move positions Klarna as the first regulated bank to issue a stablecoin on Tempo, a payments-focused blockchain developed by Stripe and venture firm Paradigm.

Let’s take a look at this, understand why it matters, and see what’s next.

More on this 👉 KlarnaUSD is issued through Bridge, Stripe’s stablecoin infrastructure platform, which handles compliance, reserve management, and redemptions. The token is currently operating on Tempo’s testnet for internal testing, with a full public launch anticipated in 2026.

Klarna processes approximately $112 billion in annual gross merchandise volume across 114 million customers in 26 markets, thus providing substantial scale for potential adoption.

ICYMI: Stripe’s killing SWIFT? Their new L1 blockchain Tempo unites OpenAI, Visa, Shopify, and Deutsche Bank to make stablecoins the default global payment rail 😳⛓ [key details we know so far, why it matters, could it kill SWIFT + the ultimate list of stables resources, deep dive into Circle’s latest earnings & more inside!]

Stripe launches comprehensive stablecoin suite, positioning itself as a full-stack digital asset infrastructure provider 💳 🪙 [what it’s all about & why it could be huge + bonus dives into Agentic Commerce Protocol launched with OpenAI, recap of their L1 Tempo & the ultimate list of stablecoin resources inside]

Zoom out 🔎 The strategic rationale centers on dismantling the expensive legacy infrastructure underlying international payments. Cross-border payment fees total an estimated $120 billion annually, with value leaking to card networks, correspondent banks, and foreign exchange intermediaries. By shifting settlement to a low-cost, high-throughput stablecoin rail, Klarna aims to compress per-transaction costs while achieving near-instant settlement speeds.

The company hence expects the initiative to benefit both merchants through faster payouts and lower fees, and consumers through improved transaction experiences.

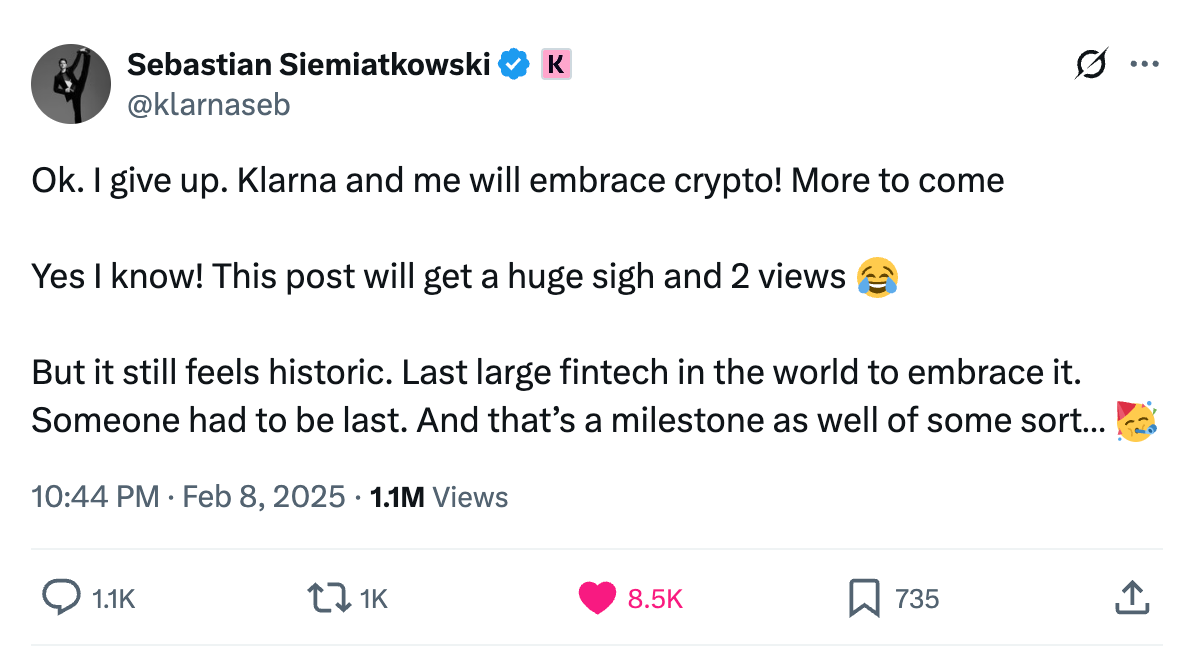

This announcement reflects a notable pivot for CEO Sebastian Siemiatkowski, who previously opposed cryptocurrency. The executive has since acknowledged that blockchain technology has reached the maturity necessary for scaled payment applications, describing this as “the start of Klarna’s crypto journey.”

Looking at the bigger picture, we must note that Klarna’s move also arrives amid intensifying competition in the stablecoin space. PayPal has already launched its own dollar-pegged token, while London-listed Wise and British digital bank Revolut are reportedly developing similar offerings.

Major U.S. banks are also exploring stablecoin issuance following the passage of the GENIUS Act, which established a regulatory framework for the industry.

THE TAKEAWAY ✈️

What’s next? 🤔 First and foremost, KlarnaUSD signals a broader inflection point for financial services. As stablecoin transaction volumes approach $27 trillion annually, traditional payment rails face mounting competitive pressure. That being said, if executed well, KlarnaUSD is less about incremental revenue now and more about positioning Klarna as a “payments‑native bank” in a world where stablecoins and programmable settlement become mainstream infra. Over the next 5-10 years, this can be a non‑trivial driver of both multiple expansion (as Klarna is seen as infra, not just BNPL) and earnings growth as stablecoin‑based economics scale. The critical variables to monitor will now be regulatory developments across jurisdictions, merchant adoption rates, and whether competitors accelerate their own stablecoin initiatives. But if successful, KlarnaUSD could establish a template for how regulated fintechs leverage blockchain to capture value currently extracted by legacy intermediaries, hence potentially reshaping the competitive dynamics of global commerce.

ICYMI: Klarna’s 3Q 2025: AI-powered BNPL leader trading at 50% discount to intrinsic value? 🤯📉 [unpacking the most important 3Q 2025 financial facts & figures, understanding what they mean, & why Klarna might be worth your time and money in the years to come]

AI shopping tools signal a fundamental shift in how (agentic) commerce will function 🤖🛍️

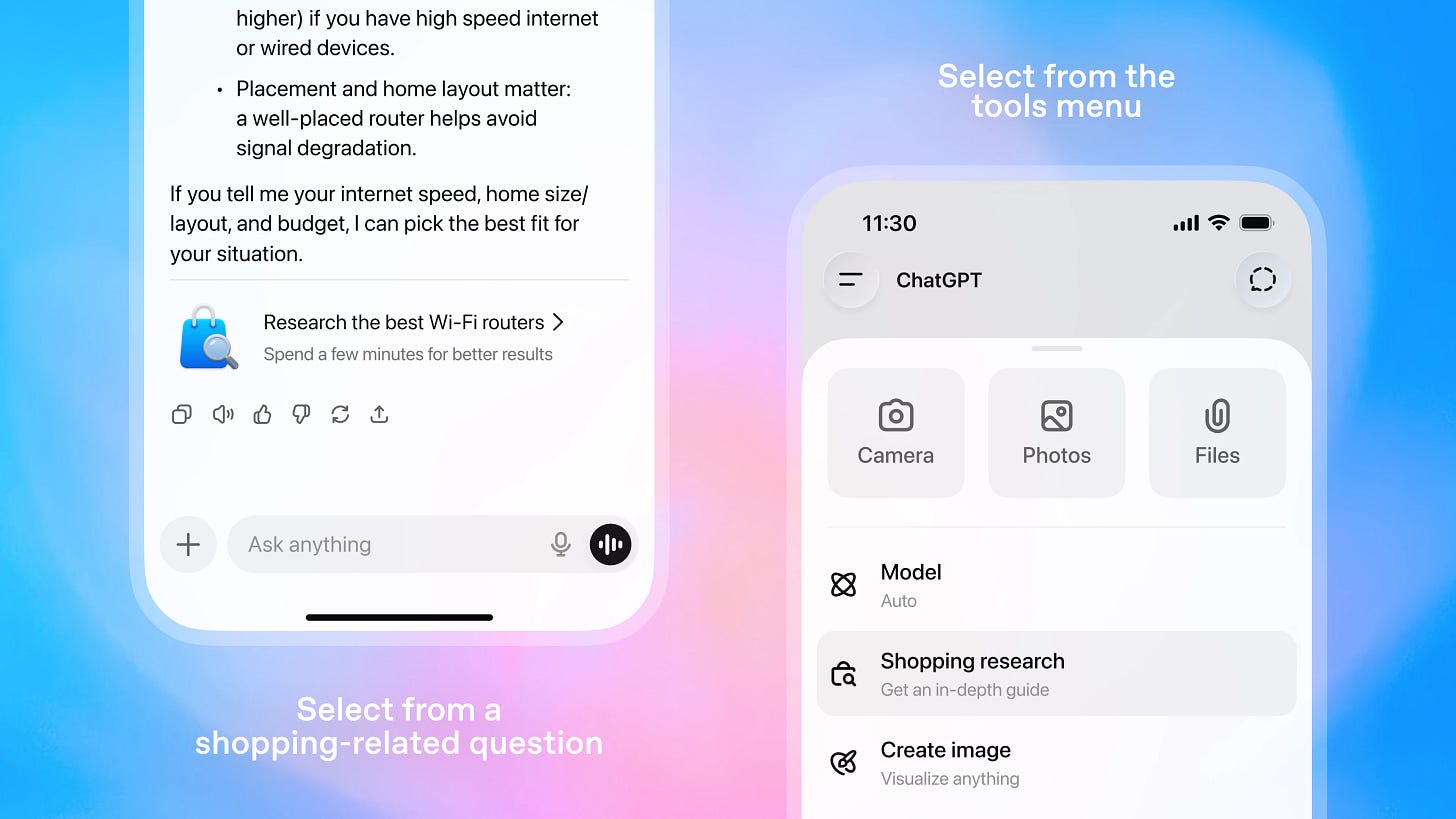

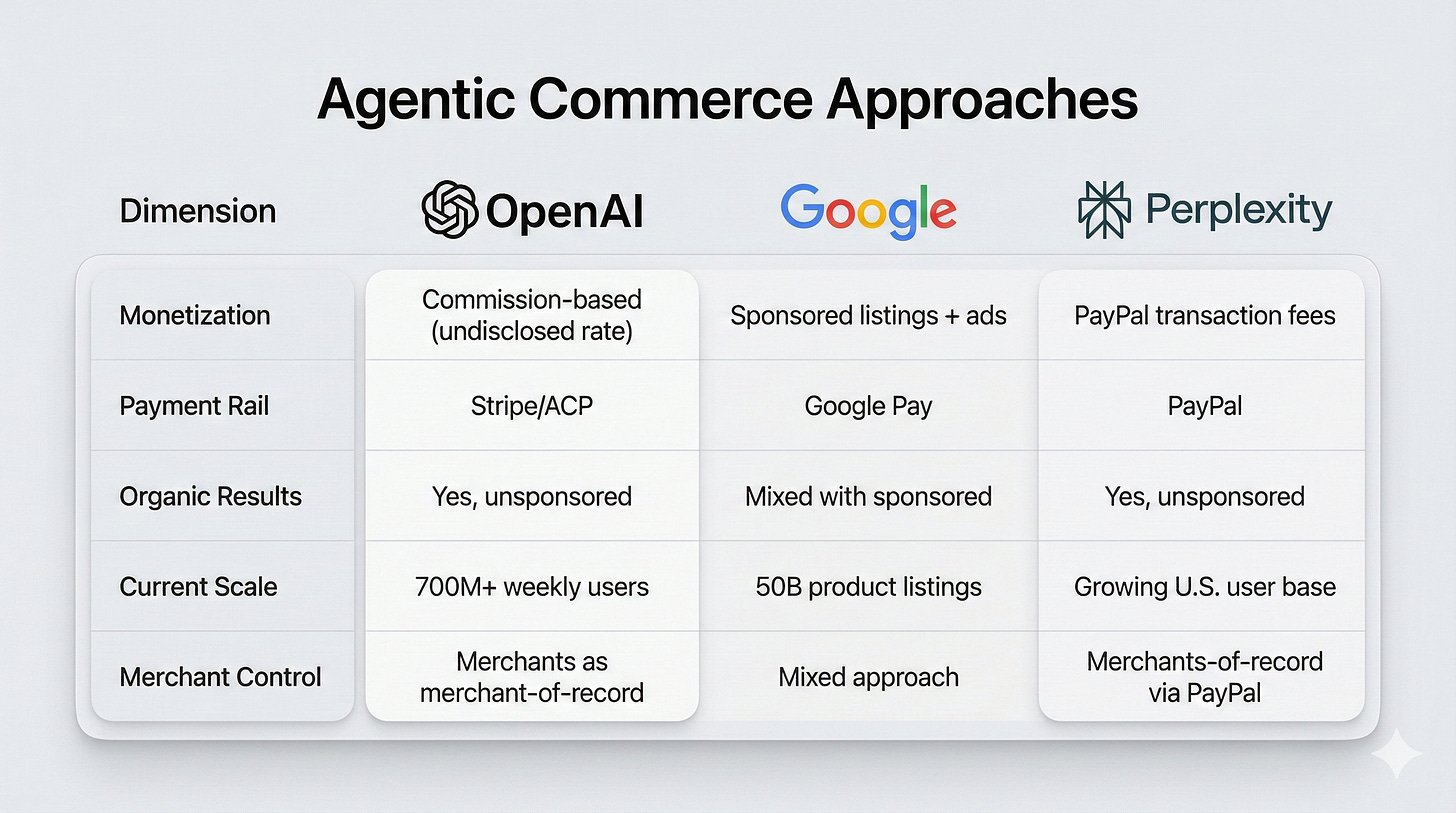

The news 🗞️ $500 billion AI giant OpenAI just launched its shopping research feature inside ChatGPT. While seemingly simple, this move represents far more than a product update - it marks the emergence of a new commercial paradigm where artificial intelligence becomes the primary interface for both consumer discovery and purchasing decisions.

Let’s take a quick look at this, understand why it could be huge & what we can expect next.

More on this 👉 At the core, this feature transforms ChatGPT into a personalized buyer’s guide generator, engaging users in conversational product discovery while pulling real-time pricing, reviews, and availability data from all across the web.

Critically, results remain organic and unsponsored, differentiating OpenAI’s approach from traditional advertising-driven models.

This builds upon the company’s earlier Instant Checkout capability, developed in partnership with Stripe through the open-source Agentic Commerce Protocol.

ICYMI: OpenAI’s integrated AI ecosystem: Browser, Payments, and Finance all converge in Agentic Commerce push 🤖🛍️ [how browser, payments & finance plays all tie perferctly together, what does this indicate & what it means for the future of payments & finance + bonus deep dives into each of them, the agentic AI survival guide & top AI agent startups of 2025 inside]

More on this 👉 Of course, OpenAI is not operating in isolation, and it’s not the only one betting big on the new agentic commerce paradigm.

Google (which is now the 3rd most valuable company in the world, all thanks to AI) has recently deployed its own AI-powered shopping tools featuring conversational search, autonomous checkout capabilities, and even AI-driven calls to local stores for inventory verification - leveraging its Shopping Graph of over 50 billion product listings.

Meanwhile, Perplexity AI has partnered with FinTech heavyweight PayPal to enable seamless in-chat purchases, prioritizing frictionless transaction completion over research depth.

ICYMI: PayPal and Perplexity launch Instant Buy, or the new era of AI-powered commerce 🤖🛍️ [what it’s all about & why you should be paying attention + bonus deep dive into PayPal & more dives into Agentic Commerce and Agentic Finance inside]

Zoom out 🔎 These developments clearly signal a fundamental disruption to the traditional search-and-click commerce model.

→ When consumers delegate product research and purchasing decisions to AI agents, the entire discovery funnel collapses.

→ High-intent queries that once drove billions in search advertising revenue now occur within conversational interfaces, thus bypassing traditional channels entirely.

The infrastructure for this transformation is rapidly materializing too.

Visa, Mastercard, PayPal, and OpenAI/Stripe are all developing tokenization frameworks and programmable payment APIs specifically designed for AI agent transactions, with market projections suggesting agentic payments could grow from $7 billion to $93 billion by 2032.

ICYMI: AI shopping traffic surged 4,700% - now Visa, Google, and OpenAI are racing to control who gets paid 🛍️🤖 [what’s the big picture here + more bonus dives into Agentic Payments & Agentic Commerce inside]

THE TAKEAWAY ✈️

What’s next? 🤔 Looking ahead, we must stress that the implications for financial technology extend well beyond consumer shopping. The same protocols enabling AI-driven purchases will facilitate autonomous B2B payments, dynamic credit decisioning, and agent-to-agent commercial negotiations. Organizations across retail, payments, and financial services therefore face a strategic imperative to develop machine-readable interfaces and agent-compatible infrastructure. The winners in this emerging landscape will hence be those who recognize that we are witnessing not merely the evolution of search or payments, but the foundational restructuring of how economic transactions occur. As AI agents assume greater autonomy in commercial decision-making, the companies that control these conversational gateways - and the payment rails that serve them - will ultimately shape the future architecture of global commerce in the years to come. Agentic is the future 🤖

ICYMI:

🔎 What else I’m watching

Cross River Bank Launches Stablecoin Payments 🏦 Cross River Bank has introduced an offering to power stablecoin payments, unifying fiat and stablecoin flows through a single, interoperable system. This enables companies to move value across chains and traditional rails with bank-grade compliance, eliminating operational sprawl and the need to pre-fund or rebuild ledgers. Cross River aims to reimagine banking with blockchain technology, providing programmability, transparency, and speed within a regulated framework. The solution is currently available to approved partners, with broader availability planned for the future. ICYMI:

AI Agents Excel in Cash Management 💰 Generative AI agents can perform key cash-management tasks without specialized training, according to research by the Bank for International Settlements (BIS). Using prompt-based experiments with ChatGPT, researchers found that AI agents could effectively manage liquidity in real-time gross settlement (RTGS) systems, maintaining liquidity buffers and optimizing payment settlements. The findings suggest that routine cash-management tasks could be automated, potentially reducing operational costs and improving efficiency. ICYMI:

Checkout.com Supports AI Commerce 🛒 Checkout.com is backing the Agentic Commerce Protocol (ACP), an open standard for AI commerce that enables AI agents, people, and businesses to collaborate on purchases. This support allows merchants to offer secure, instant checkouts within AI platforms, maintaining brand control and customer relationships. Checkout.com is working with partners like Visa, Mastercard, and Google to set global standards for secure and intelligent payments. Research indicates that AI-driven commerce could account for 21% of monthly household spending within 5 years. The company is committed to helping merchants prepare for this future with customized tools and solutions. ICYMI: AI shopping traffic surged 4,700% - now Visa, Google, and OpenAI are racing to control who gets paid 🛍️🤖 [what’s the big picture here + more bonus dives into Agentic Payments & Agentic Commerce inside]

💸 Following the Money

Model ML, an AI-based workflow automation startup for deal teams at financial services companies, has raised $75M in Series A financing just one year after launch.

Banking-as-a-Service startup BKN301 has topped up its recent Series B funding round with a £10M credit facility and acquired AI-driven financial analytics and open banking specialist Planky.

Paxos, the regulated blockchain infrastructure platform, announced it has acquired Fordefi, an institutional-grade custody and wallet technology provider.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This has to be your BEST issue ever... Sooo much value - can't believe it's free... Thank you!!!