Is Binance finally having an FTX moment? 😳; Morgan Stanley to launch an AI chatbot powered by OpenAI 🤖💸; Elon Musk continues 𝕏’s expansion into the payments biz 💳

FinTech is Eating the World, 7 September

Hey Everyone,

Good morning! Today’s issue is coming behind schedule but boy it’s worth the wait 🤯 Today we’re going to question whether Binance is finally having an FTX moment (let’s be honest, the smell is not great here…), Morgan Stanley that’s about to launch an AI chatbot powered by OpenAI (following the trends + more dives into AI & Finance), and Elon Musk who continues 𝕏’s expansion into the payments biz (recap of what’s been done & what’s next + a deeper dive into the build of the most powerful FinTech company ever). Let’s jump straight into the intriguing stuff 🌶

Is Binance finally having an FTX moment? 😳

Following the news 🗞️ Binance, the world’s biggest crypto exchange, is facing significant headwinds. And that’s actually an understatement.

In fact, more and more industry insiders are starting to speculate that we might soon be witnessing FTX 2.0. And that would be catastrophic for the whole crypto industry.

Let’s take a look.

Zooming out 🔎 To connect the dots, you always have to zoom out. Below is a good summary of the major negative events for Binance since December. Seeing everything in one place definitely makes you think:

Is this FUD? Could be. But it definitely makes you question things quite a bit.

Exec exodus 💼 Earlier I’ve talked about the massive executive exodus from Binance. Below is a brilliant summary of Binance leadership departures since early 2021:

Of course, departures, resignations, or layoffs is a natural thing that happens in every industry. Not to mention the vibrant and challenging ones like crypto.

Yet, at some point, you should start questioning how the largest exchange in the world, which processes 90% of the world’s crypto volume, has so much executive turnover? Something’s not right here…

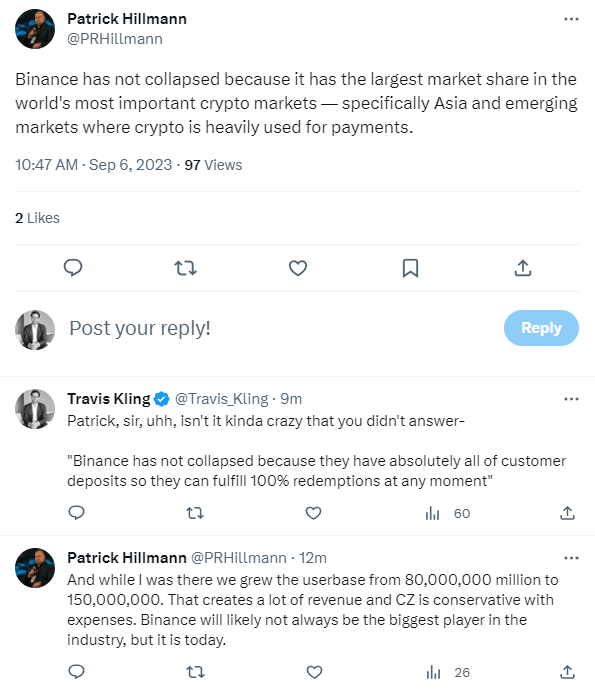

A cheery on top 🍒 If the above wouldn’t be enough, here’s a recent wild response from the former head of PR for Binance:

I will leave this to your own interpretation.

✈️ THE TAKEAWAY

So what’s next? 🤔 We must remember that founded in 2017, Binance is by far the largest crypto exchange in the world. For years it operated without licenses and an official home base, serving traders through its Binance.com platform. As regulators started cracking down on the industry, the company said it would change and become compliant, though it continued to take risks. Now, Binance's challenges are mounting, with probes from multiple global regulators and several lawsuits. These include a lawsuit by the Securities Exchange Commission (SEC) citing 13 counts of securities law violations and another by the Commodity Futures Trading Commission (CFTC). The recent exodus from, legal, compliance, and product units may only hamper Binance's defense efforts, not to mention making business operations increasingly difficult. Zooming out, if Binance would really go down that would undoubtedly be the bottom for the crypto industry, not to mention all the collateral damage and loss of trust in the industry. The only good thing here when looking for parallels with FTX is that the fraudulent exchange collapsed after a $8B withdrawal while Binance was simply unmoved. Will it continue like that? We shall soon find out.

ICYMI: The aftermath of the FTX collapse could be bigger than the earthquake 🌋 [a recap of what happened]

The mindblowing collapse of FTX-linked stocks 🤯 [+6 more bonus reads]