Klarna just lost $1 billion. But it's not bad! 🤑; Walmart takes another step towards becoming a bank 🏦; Monzo to IPO soon? 👀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The deal Apple must make: acquiring Goldman Sachs' Consumer Biz would be the M&A of the century 🤯

The neobank popularity contest has one clear winner. But there’s a catch 🧐 [unpacking neobanking strategies that work + what everyone’s missing]

Base is a massive step for Coinbase into the world of Web3, and a critical part of their "Master Plan" 😳 [+ a deeper dive into Coinbase]

Silvergate is fighting for survival 😳 [breaking it down & why it’s important for the crypto industry as a whole]

Stripe's struggling to get fresh capital 😳 [yet another reminder of Stripe’s biggest mistake ever]

Wells Fargo wants to do what other banks are still ignoring 🏦

Wise’s push for diversification 💸 [why it matters + teardown of their brilliant pitch deck and one more read]

Decentralized Twitter in the making. But not from Twitter! 👀 [why it could be huge]

Continuous struggles at N26 👀 [it’s already a trend and it’s somewhat worrying]

Some NFTs could be classified as securities 😳 [why this is a big one?]

As for today, here are the 3 FinTech stories that were changing the world of finance as we know it. It was arguably the most impactful week in 2023 so far, so make sure to check all the above stories.

Klarna just lost $1 billion. But it's not bad! 🤑

The news 🗞 Swedish Buy Now, Pay Later (BNPL) pioneer and giant Klarna just posted their fourth-quarter results and 2022 annual report. The FinTech continues to bleed red ink but it’s not that bad.

Let’s take a closer look to learn why and see what everyone’s missing.

The numbers 📊 Here are the latest key numbers from Klarna:

Klarna has been promising investors a pathway to profitability in 2023, with Q4 figures showing steady growth in gross merchandise volume (GMV) and a 19% uplift in revenue.

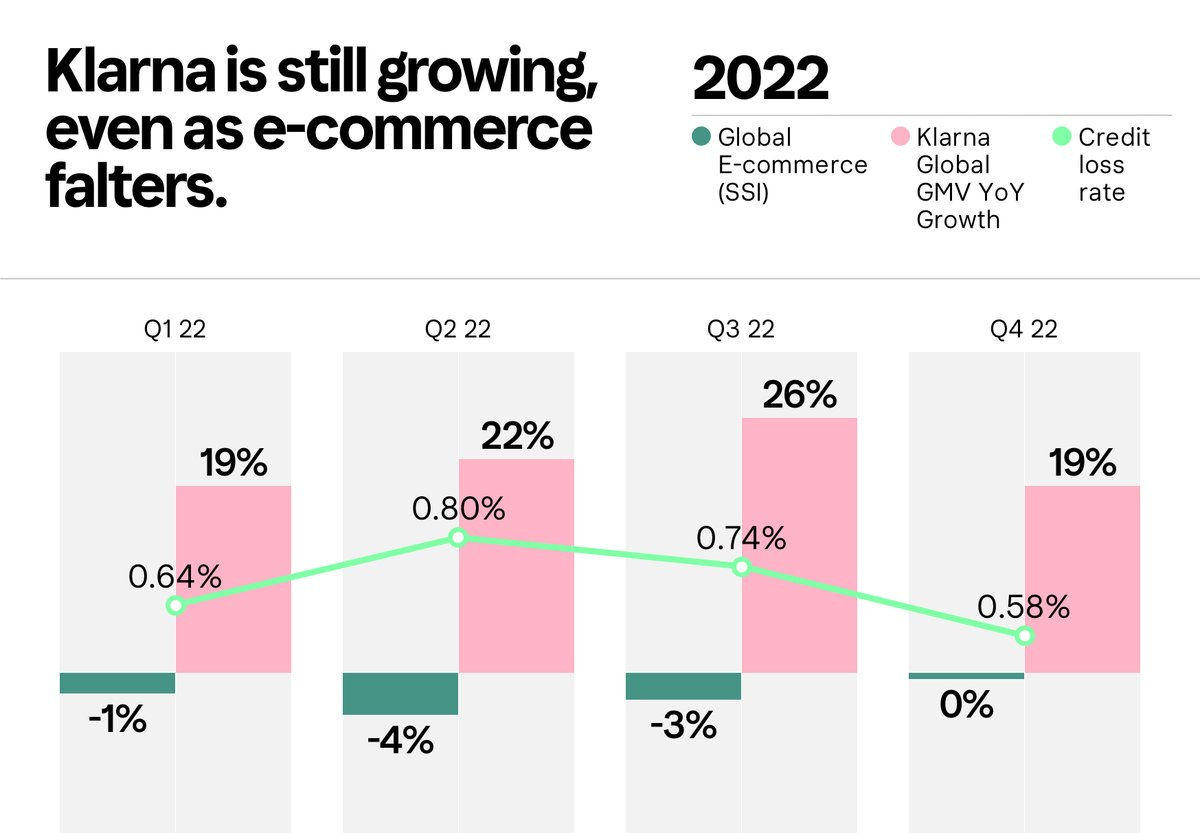

The company managed to grow even as the overall growth in e-commerce has stalled (impressive!):

Q4 figures also show an uplift as operating loss shrank and GMV climbed 19%. With credit loss rates improving, H2 2022 showed a marked turnaround in operating results with a 35% improvement compared to the first half of the year.

Klarna's long-standing ambition to crack the American market appears to be finally coming good, with the US now representing its biggest revenue-generating stream globally.

The Sweden-based FinTech now has more than 8 million monthly active app users in the US, a 33% jump from its February 2022 total. Very good! 👏

Yet, the company still posted a $1 billion loss for 2022. It’s up 47% from a $680 million loss in 2021 and marks the company’s biggest annual loss in its history.

What does it tell us? 🤔 At first glance, the results might seem disappointing and worrying (and they should be!). But if you only see Klarna as a BNPL company, you don’t understand it. Here’s why:

Klarna > BNPL📱 As Ron Shevlin has beautifully put it, the real story about Klarna can’t be revealed by taking a snapshot of its current financial performance or looking at industry sentiment with buy now, pay later.

Indeed, Klarna is an e-commerce platform and a Super App wannabe.

In fact, we must remember that Klarna has launched its actual Super App back in November 2021. It now consolidates everything from shopping, payment management, price comparison (via SEK 9B Priceruner acquisition), and support for products to delivery, and returns.

When it comes to finance, Klarna is already a bank in several countries offering checking and savings accounts, among IBANs and other things.

Also, the BNPL giant recently launched the Pay Now option globally so customers can pay in full wherever Klarna is accepted.

It even has the Klarna Card which lets users pay in installments in-store & online. The Klarna Card integrates into the Klarna app and is connected with its loyalty program, Vibe.

In addition to that, Klarna also has a commerce search that compares thousands of websites to help consumers find the best price for products.

There’s also a shoppable video where retailers share existing social content and campaigns that tell their story and create shoppable content exclusively for Klarna.

Finally, Klarna's Creator Platform provides a one-stop shop for retailers and creators to work together to automate initial outreach, partnerships, and tracking sales and commissions.

Therefore, despite mixed results, one thing is clear - Klarna isn’t building just another alternative to credit cards (=BNPL). Klarna is in the platform business, so it’s much closer to Amazon than any other of its FinTech competitors. And that could be huge.

✈️ THE TAKEAWAY

Looking ahead 🤔 In order to succeed, BNPL providers will need to become shopping destinations. That’s what Affirm AFRM 0.00%↑ has been trying to do with all their initiatives (i.e. Affirm Debit+) and that’s one of the reasons why Block SQ 0.00%↑ has acquired Afterpay. Nevertheless, it seems that so far only Klarna has managed to achieve the scale and featuresness needed to succeed as an e-commerce platform. Although the overall results aren’t great, their strategy seems to be working - Klarna’s marketing revenue is up +131% in 2022, accounting for 10% of total global revenue in Q4 2022; global purchase frequency increased by 23% in FY22 which indicates Klarna might be becoming an intrinsic part of people’s lives; lastly, Klarna improved its credit loss rate by 30%, which means that its underwriting is working well. But they still need to get their act together if they want to win in the long run (i.e. Klarna just made the biggest annual loss in its history yet the CEO's pay is up 35% “in order to hire and retain the best talent” 🤷♂️).

Walmart takes another step towards becoming a bank 🏦

The news 🗞 Retail giant Walmart WMT 0.00%↑ has partnered with Citi C 0.00%↑ to create a platform that links its network of 10,000 small business suppliers in the US to over 70 lenders.

What is it? 🤔 This platform streamlines the loan request process by allowing suppliers to interact with multiple lenders through a single loan request form. Called Bridge, it connects qualifying businesses with lenders that can offer loans of up to $10 million.

The platform is designed to offer suppliers more choices, convenience, and access to capital, while also providing lenders with a more efficient loan evaluation process. Bridge focuses on adding Minority Depository Institutions and Community Development Financial Institutions, with over 20 MDIs and four women-owned institutions on the platform.

✈️ THE TAKEAWAY

Why is this important? 🤔 In short, Walmart's partnership with Citi to offer a lending platform for its small business suppliers has the potential to expand access to capital, increase efficiency, and promote inclusion and diversity. Zooming out, Walmart's move into the lending space could pose a threat to traditional banks and other FinTech lenders that focus on small business lending. With its vast network of suppliers and the convenience of its platform, Walmart could become a major player in this space and potentially disrupt the status quo. Looking at the big picture, this is yet another step Walmart is making toward becoming a bank (& a Super App) in the long-run.

Bonus: Walmart is building a Super App than can change FinTech forever 📲

Monzo to IPO soon? 👀

The (breaking?) news 🗞 UK digital challenger bank Monzo has been approached by investment banks about a potential initial public offering (IPO), according to Business Insider.

More on this 👉 Several banks have approached Monzo interested in handling an IPO, which could go ahead in 2024 or 2025, says BI, citing sources. However, it was noted that the talks are at an exploratory stage and Monzo is said to be in no rush to go public.

Furthermore, BI says Monzo is exploring partnerships and acquisitions in the wealth and trade sectors, with talks ongoing with WealthKernel, a FinTech that offers investing services via APIs.

✈️ THE TAKEAWAY

What does it tell us? 🤔 First and foremost, given Monzo’s strong performance as of late, or as I put it The Monzo Pivot, this is not particularly surprising. The neobank was founded already 8 years ago, so it’s about time the investors and employees cash out some of their shares. Secondly, if Monzo continues to keep their pace, it could actually be one of the more interesting and worthwhile FinTech IPOs (depending on whether they list itself in London or the US). Zooming out, the IPO rumors probably also explain their plans to relaunch in the US. Because when you’re an international neobank - not UK-only, it’s a completely different story. If that line of thought is true, the IPO capital could be used to further fuel the expansion in the US. Add wealth and trading as part of their offering, and it becomes something you just can’t ignore. Watch Monzo more carefully from now on.

Reread: Monzo's license-less US expansion. Smart move or just foolish? 🧐

🔎 What else I’m watching

From around the Block 👀 Block SQ 0.00%↑, which owns retail POS solution Square, money transfer service Cash App, and buy now, pay later (BNPL) firm Afterpay, is on a journey to overall profitability but has work to do, as per PYMNTS. Block CFO and COO Amrita Ahuja put an upbeat spin on the company’s Q4 2022 loss of $114M, telling CNBC this week that “What’s really exciting to me is to see increasing daily utility across each of these ecosystems. Square sellers who took on four or more of our monetized products made up 44% of our gross profit in 2022. It’s up 15 points over three years. For Cash App, we now have five revenue streams that delivered $100M or more in gross profit in 2022. So our customers are finding great value through our platforms, increasing daily utility, and ultimately that’s leading to a more diverse and broad business for us.” On the CNBC appearance, Ahuja doubled down on remarks made on the earnings call, during which she said “We’ll continue to invest with discipline to unlock growth in each of our ecosystems. For Square and Cash App, this includes launching new products for our customers, expanding into new customer segments, and refining our go-to-market approach across our global audiences.” A brilliant commentary that very much falls in line with the bullish case for Block. Reread: Cash App is turning into a FinTech beast we've not seen before 😳

Fight for survival 🏦 Shares in Silvergate SI 0.00%↑ plunged by more than 30% in after-hours trading after the crypto-focused bank warned it will miss the deadline to file its annual report and raised questions about its ability to survive as a going concern. In an SEC filing, Silvergate says it does not "expect to be in a position" to file its annual report by an already extended deadline of 16 March. The bank, which has been heavily impacted by the collapse of crypto exchange FTX, says it is "currently analyzing certain regulatory and other inquiries and investigations that are pending with respect to the Company". In January, Silvergate posted a $1 billion loss for the fourth quarter related to the FTX collapse. However, the bank now says it is still assessing the damage it suffered and warned that the losses could be even greater. Yet another brilliant reminder that diversification matters. Reread: Silvergate Bank is the mirror of the struggling crypto market 📉

💸 Following the Money

Web3 incubator and market maker iBloxx raised $5M to expand its GameFi division.

Landytech, the startup behind investment reporting platform Sesame, has secured $12M in Series B funding. In a round led by Aquiline Technology Growth and with additional investment from existing investor Adelie Capital, the raise follows a $6M Series A in March 2021.

India-based FinTech Cashfree Payments has strengthened its D2C payment offering by acquiring Zecpe, a one-click checkout company.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: