VC funding in Europe falls to the lowest level on record 😳; Apple is JPMorgan 2.0 👀; N26 is unbelievably overvalued 🤯

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Middle East & Africa’s payments market is a massive digitization opportunity 💸

The landmark EU crypto regulation has officially been passed 🇪🇺

As for today, here are the 3 FinTech stories that were changing the world as we know it. This week was yet another super exciting week in FinTech, so make sure to check all the above stories.

VC funding in Europe falls to the lowest level on record 😳

Following the money 💸 Dealroom recently analyzed the latest venture capital data in Europe, and it’s not great at all.

Just over 2,300 rounds were closed, which is the lowest number since Q3 of 2016. Let’s take a look at the key facts and figures.

ICYMI: OpenAI & Stripe kept the global VC funding alive in Q1 🥲

More on this 👉 Here are the 3 most important things Q1 VC funding in Europe.

First, we must note that although the total funding raised equaled €14.3 billion and it wasn’t that bad, it is the worst since only the third quarter of 2020. More importantly, this is the first time since 2016-17 that a slow Q4 has preceded an even slower Q1. Will this become a trend? 🤔

Second, this undoubtedly hit the unicorn creation in Europe 🦄 And it hit them badly. According to Sifted, just one unicorn was minted from January to March this year. You guessed it - it’s the German AI translation startup DeepL.

ICYMI: ChatGPT for Finance is here, and it’s a game-changer 🤯

That makes Q1 2023 the worst quarter for unicorn creation since Q2 2020, at the height of the pandemic. Ouch 😬

Finally (and unfortunately), FinTech was Q1’s biggest loser. Investment in the financial technology space plummeted by a whopping 83% to $2 billion from the record $9.7 billion the sector hit in the same period last year.

We must remember that FinTech has surpassed 300 rounds each quarter for the past 7 years, thus, Q1’s 212 rounds represents a massive drop off for the one-time darling of European tech. Who took over? According to Sifted, Deeptech, climate tech, and healthtech (have emerged as the region’s frontrunners.

✈️ THE TAKEAWAY

Looking ahead 👀 The latest data clearly shows that ongoing global macroeconomic challenges, including supply chain disruptions, inflation concerns, and geopolitical uncertainties, have impacted investor sentiment and contributed to the slowdown in fundraising activity in Europe. Regulatory changes, especially when it comes to FinTech and PropTech, have created uncertainty and impacted investor confidence, leading to a decline in fundraising activity in these sectors especially. Yet, if you’re doing something at the intersection of Finance and Artificial Intelligence, this could be your best year ever. So keep on building!

Apple is JPMorgan 2.0 👀

It’s finally here!🔥 Apple AAPL 0.62%↑ has finally launched its long-trailed Apple Savings account.

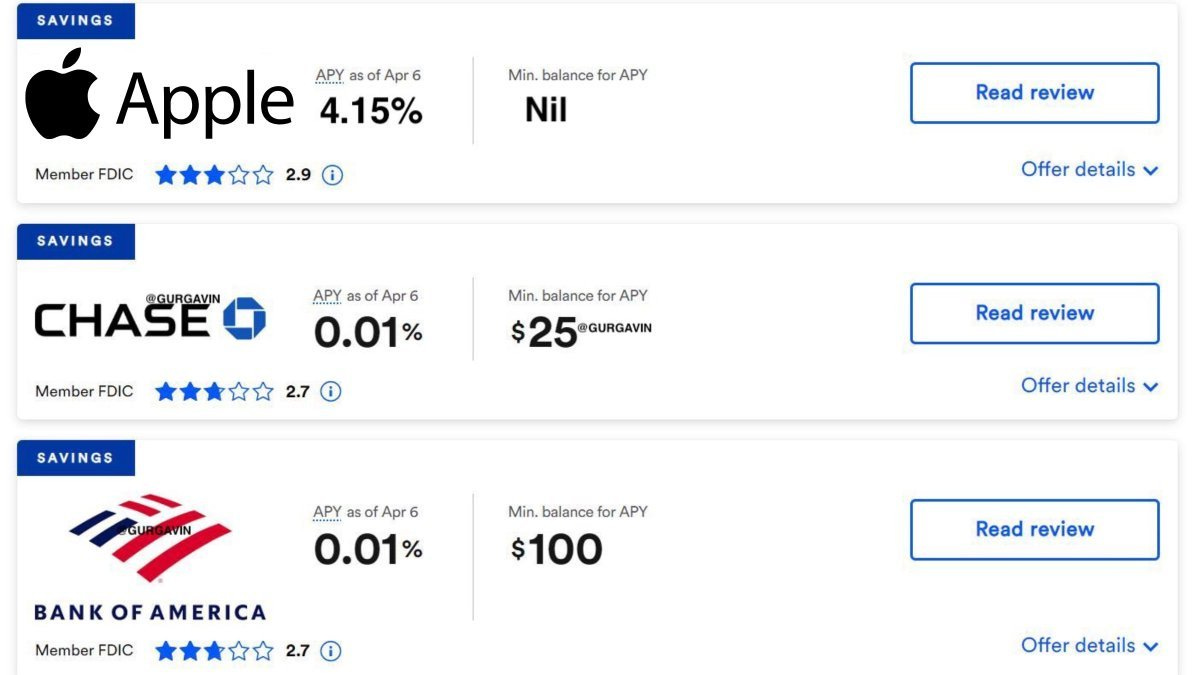

A high-yield Savings account from the tech giant is paying 4.15% APY, which is 10x the national average. This marks yet another stepping stone for Apple that's on its way to becoming the largest bank in the world 😳

More on this 👉 Apple Savings account is done via a partnership with Goldman Sachs GS 0.91%↑. It offers:

The rate that is more than 10x the national average (the average savings account interest rate in America is only 0.35% APY).

No fees, no minimum deposits, and no minimum balance.

Has slick UX/UI and takes <1 minute to set up.

FDIC for a max balance of $250,000

How it works 💸 American users can set up and manage a savings account directly from Apple Card in Wallet.

All Daily Cash rewards earned through the Apple Card will be automatically deposited into the savings account. Users can deposit additional funds through a linked bank account, or from their Apple Cash balance.

Once set up, Apple Card users can keep track of money in Wallet through a Savings dashboard, which shows their account balance and interest accrued over time.

Ties with Goldman 🏦 Goldman has been Apple's partner on the credit card since its launch in 2019. Hence, it’s not surprising the tech giant is launching Savings with them too. What’s interesting is that Goldman itself is paying its customers only 3.9% APY in their high-yield savings account. The fact that Apple managed to get 4.15% APY is yet another reminder of what a massive negotiating power it has and how badly GS wants to tap into Apple’s clientele.

As for Apple, this should serve as a good pilot testing their userbase appetite for a savings product. If it goes well, it might only be a matter of time before Apple buys Goldman Sachs altogether. This seems like a no-brainer to me 🤷♂️

ICYMI: The deal Apple needs to make: acquiring Goldman Sachs' Consumer Division would be the M&A of the century 🤯

On top of that, we must remember that since the 2019 deal, the tech giant has made some moves to ensure independence in the financial services arena. Apple was long-rumored to be using Goldman Sachs for the loans for its new BNPL play. However, Goldman is only facilitating the service as the technical issuer of the loans and the official BIN sponsor, with Apple making the loans directly through a new subsidiary.

ICYMI: Apple Pay Later is finally live 🍎💳

✈️ THE TAKEAWAY

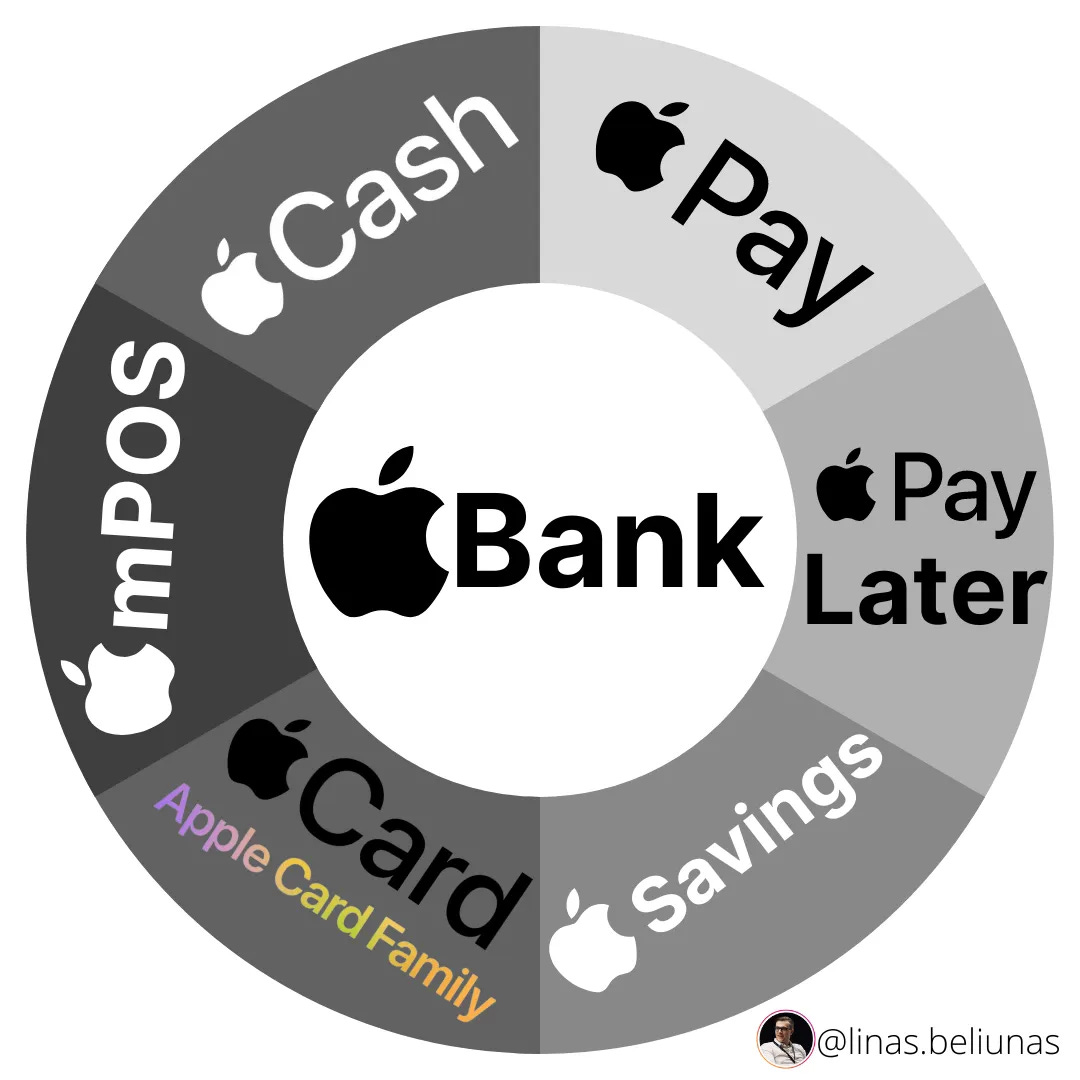

What does this all mean? 🤔 Let’s take a quick step back. Once we do that, we realize that Apple’s 4.15% APY is less than money market funds and 1% lower than the 3-Month Treasury Bill Yield of 5.21%. But most people don't know that and that doesn't matter. What matters here is convenience and brand trust. Apple is miles away in this and that's exactly why it will see a significant demand for this product. Apple Pay, Apple Cash, mPOS, Apple Card, Apple Pay Later, and now Apple Savings. Block by block the tech giant is building the Apple Finance empire that's about to disrupt the financial services space as we know it.

In other words, Apple is building JPMorgan 2.0. And it’s already making a difference - depositors pulled nearly $60 billion from three US banks (Charles Schwab, State Street, and M&T) in the first quarter:

This will only rise and it’s one of the reasons why in his shareholder letter, the CEO of JPM -0.14%↓, Jamie Dimon called out Apple by name as one of their biggest competitors.

Bonus: Apple takes another step towards becoming a bank 🍏🏦

N26 is unbelievably overvalued 🤯

The news 🗞 German insurance giant Allianz is looking to sell its 5% stake in digital bank N26 at a sharp discount, Financial Times reported.

This is a pretty big deal, so let’s take a brief look at it.

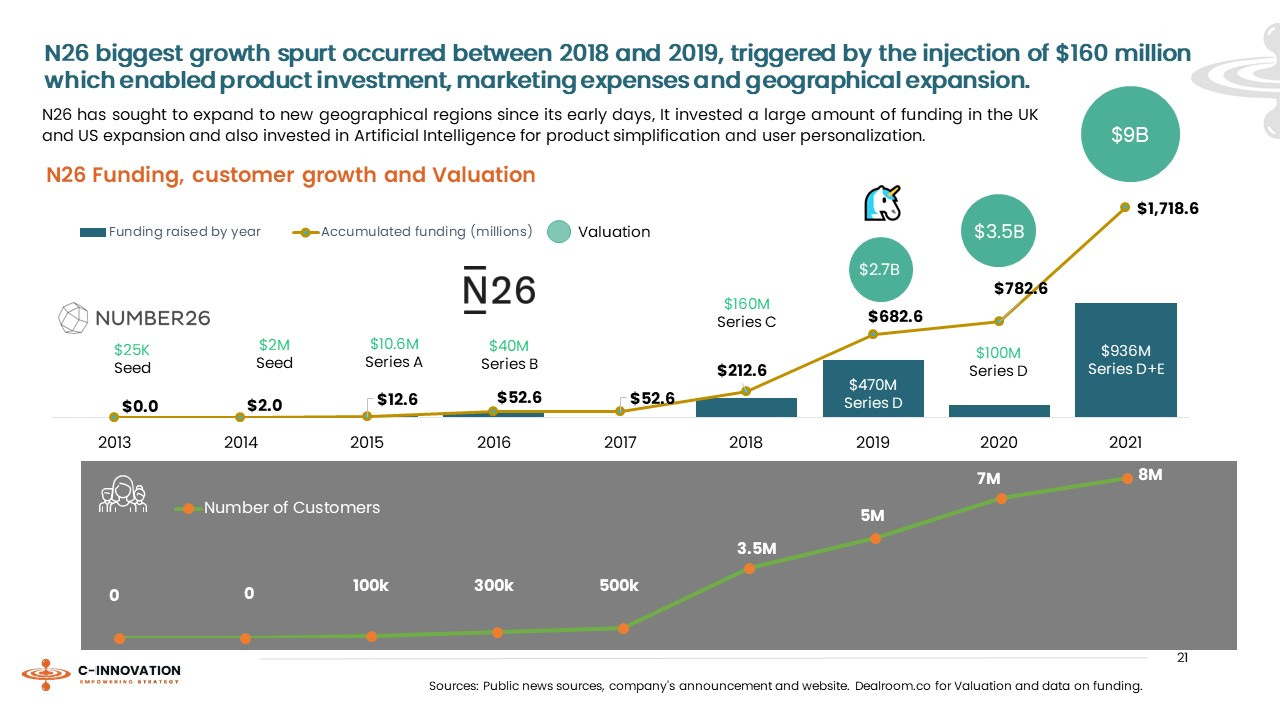

More on this 👉 The venture capital arm of the Munich insurance group Allianz X, one of the group’s largest external investors, has mandated an adviser to offer its stake in German FinTech champion N26. We can remember that the firm built its position in 2018 when it invested alongside China’s Tencent Holdings, taking part in a Series C funding round that raised about $160M at a valuation of less than $1B.

Now the insurer's venture capital arm is selling its stake at a $3 billion valuation, down from N26's $9 billion price tag at its latest funding round in October 2021. That implies a discount of about 68% 🤯

A step back 🐾 Launched in Germany and Austria in January 2015, N26 began as a current account with a Mastercard MA -0.04%↓. It has since moved into areas such as crypto and stock trading, attracting more than 7 million customers in two dozen countries.

The 2021 investment was framed as a “pre-IPO round”. Yet, after tech valuation plunged around the world when interest rates started to rise, N26 pushed back its ambition to list on the stock market.

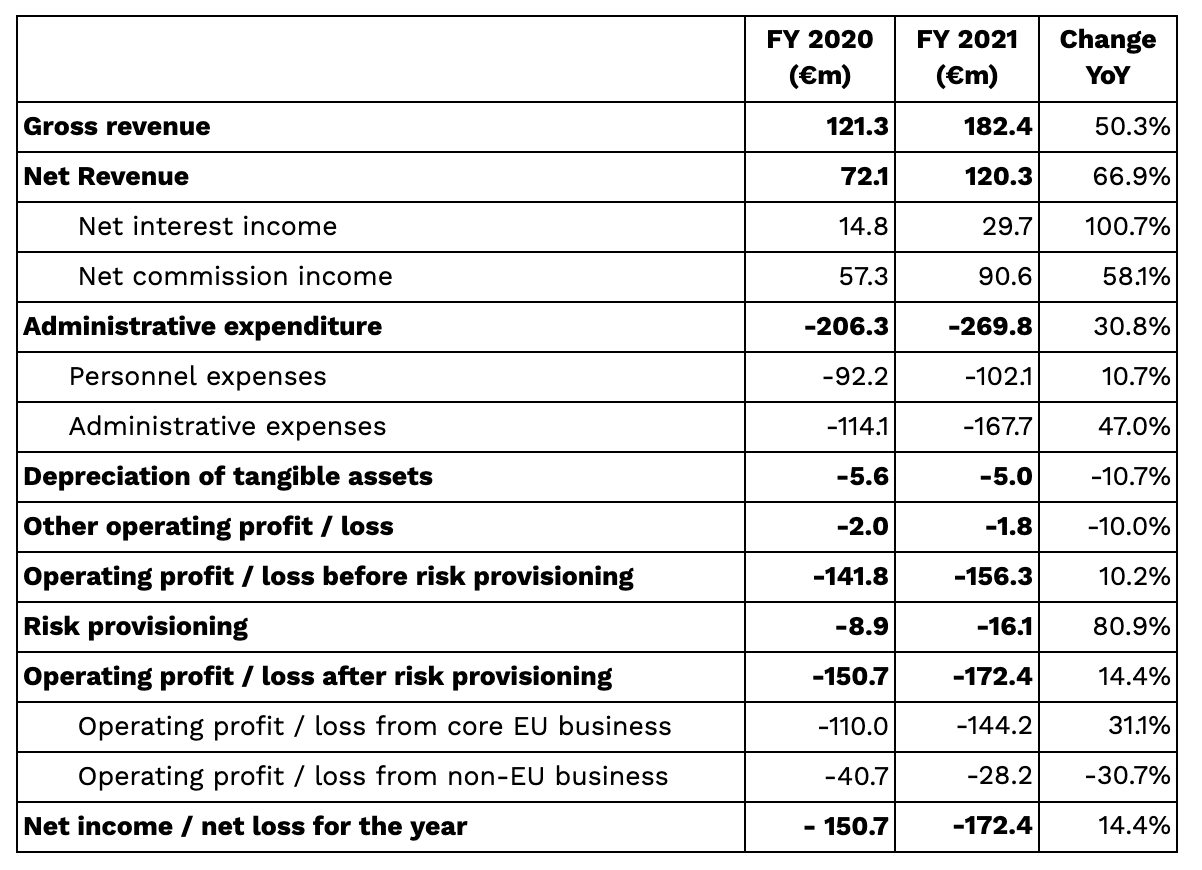

On top of that, the company has faced some stiff headwinds over the last couple of years and in October reported a net loss for the year of €172.4M, 14.45% up on the previous year. That’s bad.

In addition to the C-suite falling apart, the firm is also dealing with a cap imposed by German regulators on the number of new customers it is allowed to onboard each month. The cap was imposed, alongside a fine, in 2021 for lax money laundering controls.

ICYMI: N26 widening losses show what happens when you don't prioritize compliance🚨

✈️ THE TAKEAWAY

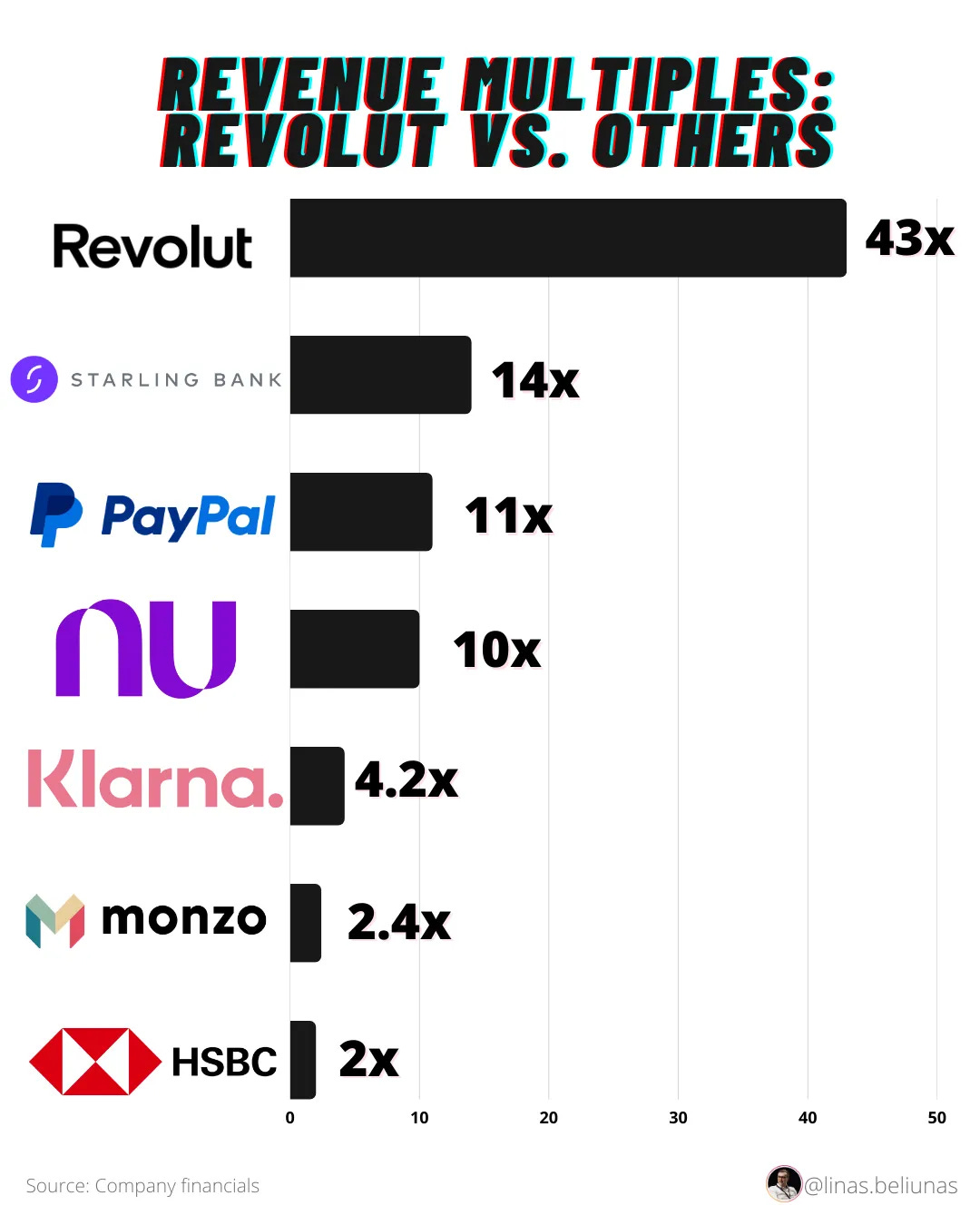

A massive correction is underway 👀 The fresh news about N26 is yet another illustration of the speed at which high-growth startups have fallen out of favor with investors. And it makes a ton of sense as N26 is massively overvalued. If earlier we questioned whether Revolut is worth $33B (spoiler alert: it’s not), it’s pretty obvious there’s no way N26 is worth $9 billion. No way. Just look at the multiples. With a revenue multiple of 43x, Revolut felt outrageous:

N26’s revenue multiple (based on the latest available data) is 45x 🤯 Therefore, a 70% is not only healthy - it’s inevitable.

ICYMI: There’s no way Revolut is worth $33B 🙅🏽♂️ [with lots of bonus reads]

On a positive note…

N26 is shaping a new FinTech ecosystem in Europe 🚀

🔎 What else I’m watching

Ether moves 😎 Ether is holding above $2,000 after it reached an 11-month high on Sunday of $2,141. The cryptocurrency’s upward movement comes after the Ethereum blockchain's Shanghai software upgrade last week, although Simon Peters, an analyst at investment firm eToro, wrote in a morning note that the reaction to the upgrade was largely muted and that ether’s price jump was more of a response to macroeconomic conditions. More here: Ethereum's upgrade is finally complete 📈

More stuff 🐼 Austria-based FinTech Bitpanda has announced including CFDs in its product range. Contracts for Difference, or CFDs, is a financial product that enables speculative trading with borrowed capital. CFDs for trading cryptocurrencies such as Bitcoin, Ethereum, or Solana are available on the company's investment platform under the name "Bitpanda Leverage". These products essentially make it possible to bet on rising or falling prices, also known as going "long" or "short". In practice, this means that if the Bitcoin price rises by 10%, for example, the price of a Bitcoin short CFD with single leverage falls by 10%. A Bitcoin long CFD with double leverage, on the other hand, would rise by 20%. ICYMI: Bitpanda goes B2B, or Bitpanda-as-a-Service

💸 Following the Money

Prestatech, an embedded finance platform, has raised €4M.

KredFin, a business loan fintech, has raised $2.2M.

Fractal, a crypto trading data platform, has raised $6M in new funding. Fractal is developing a platform to provide more transparent clearing and settlement of digital assets.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: