Major milestone achieved: Monzo hits monthly profitability for the first time 🥳; Game-changer: JPMorgan is developing a ChatGPT-like AI service for investors 😳; Nubank + Uber = 🚀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The most powerful pitch deck framework in the world that helped create over $4 trillion in value 💸 [a list of resources to build the next unicorn faster and easier]

Game-changer: the world’s first banking-specific large language model 🤯

Sam Altman's Worldcoin closes one of the biggest crypto funding rounds in 2023 😳

QED raises ~$1 billion to invest in FinTech 💸 [+ bonus reads on how to make your fundraising efforts much easier & 60,000+ startup resources]

As for today, here are the 3 fascinating FinTech stories that were changing the world of finance as we know it. This week was really intense in the financial technology space, so make sure to check all the above stories.

Major milestone achieved: Monzo hits monthly profitability for the first time 🥳

The news 🗞 British challenger bank Monzo has hit profitability for the first time this year. It marks a major milestone for one of the UK’s most renowned digital banks.

Let’s look at the numbers and how we got here.

The numbers 📊 Monzo reported a net operating income of £214.5 million ($266.1 million), almost doubling year-over-year from £114 million.

Losses at the bank nevertheless came in at a substantial £116.3 million — though this was slightly lower than the £119 million net loss Monzo reported in 2022 and allowed the neobank to reach profitability in the first two months of the year.

It also added 1.6 million new customers this year, bringing them up to 7.4 million and more than 10% of the UK population.

How we got here? 🤔 One word - lending. Monzo’s strong revenue performance was mainly driven by a bumper year for its lending business. Challenger bank’s total lending volume reached £759.7 million, almost tripling year-on-year, while net interest income spiked by 382% to £164.2 million.

Subscriptions play an important role in profitability too as paid accounts now total 350,000.

Monzo declined to share a figure on how much of a profit it is making currently. The firm said it is on track to reach full-year profitability by the end of 2024.

✈️ THE TAKEAWAY

Lessons learned💡 Monzo is a brilliant reminder of a story as old as time: lend money + solid risk management = make money. It’s that simple yet 90% of neobanks don’t get it… 🤷♂️ Obviously, you have to be good at it too. And Monzo is really good at what they do - their net promoter score is +67 (even the mighty Apple gets +47), so customers love them. Hence, focus + lending + strong brand makes wonders, and Monzo definitely deserves to be the 7th largest UK retail bank. More about how they got there here:

ICYMI: The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀

Game-changer: JPMorgan is developing a ChatGPT-like AI service for investors 😳

The MASSIVE News🔥 JPMorgan JPM 0.84%↑, one of the biggest and most powerful banks in the world, is developing a ChatGPT-like artificial intelligence service for investors called IndexGPT 😳

It’s a game-changer.

More on this 👉 The banking giant applied to trademark a product called IndexGPT earlier this month. The service will tap cloud computing software using AI for analyzing and selecting securities tailored to customer needs.

The USP 🥊 In the same way you now use OpenAI's ChatGPT for writing or coding, you can soon use JPM's IndexGPT to help pick, analyze, and recommend financial securities like stocks, bonds, commodities, digital assets, etc.

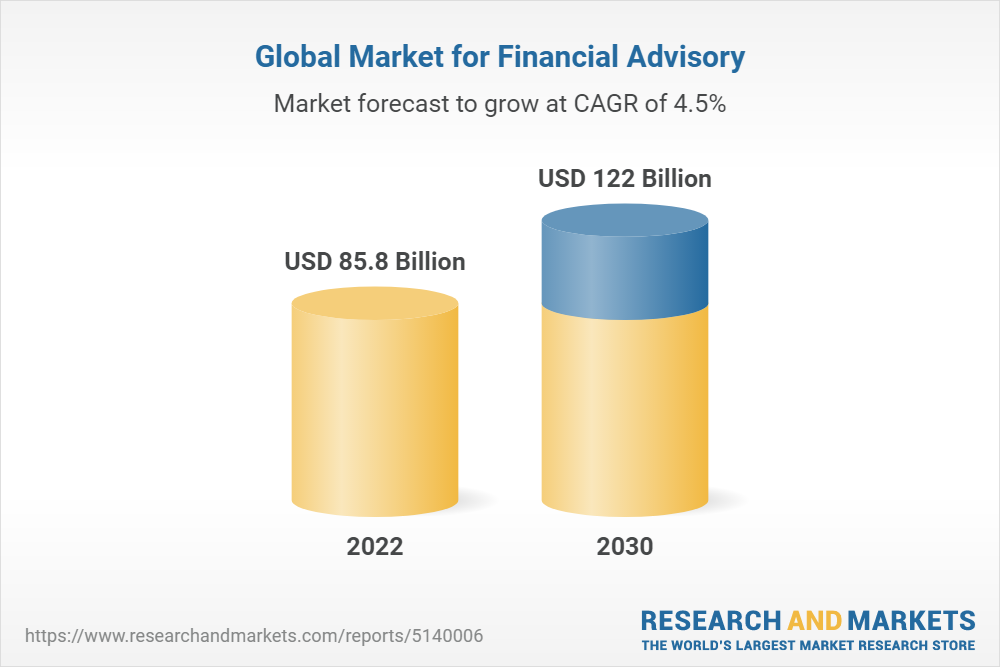

This could be a massive move that can disrupt the traditional financial advisory market currently worth around $90 billion. And that’s just the start.

While banks like Goldman Sachs GS 1.62%↑ and Morgan Stanley MS 1.87%↑ have already begun testing artificial intelligence for internal use, JPMorgan would be the first financial firm to launch a generative AI product directly to its customers.

✈️ THE TAKEAWAY

What’s next? 🤔 This is a big deal but it should come as no surprise. JPM has already built its own ChatGPT-based large language model (LLM) to analyze Federal Reserve statements and speeches to sniff out potential trading signals. On top of that, JPMorgan Chase boss Jamie Dimon earlier revealed that the bank has more than 300 AI use cases in production 🤯 This yet again proves that the banking giant is super serious about the future and Dimon is walking the walk - JPM now employs more than 2,000 data scientists and machine learning engineers to help build out its AI capabilities. The future of finance will never be the same, but JPMorgan will sure be part of it.

ICYMI: JPMorgan has built its own ChatGPT for Finance 😳

The second-largest US bank failure ever & the Microsoft of Banking 🤯 [+4 more bonus reads]

ChatGPT for Finance is here, and it’s a game-changer 🤯

Bonus: The insurance sector is more and more exploring the benefits of AI 🤖

Generative AI will completely transform FinTech and Banking over the next 3 years 🤖🏦

Nubank is strengthening its Super App ecosystem by partnering with Uber 🚀

The news 🗞 Brazil’s FinTech giant Nubank NU 0.87%↑ and Uber UBER 2.43%↑ have partnered to offer customers the ability to pay for Uber trips using NuPay, Nubank's online payment method.

More on this 👉 By linking their NuPay account to the Uber app, customers can make quick and secure payments with just one click. Paying with NuPay also offers exclusive benefits, such as the possibility of receiving an additional credit limit for the transaction.

The USP 🥊 NuPay is a payment method for online purchases available exclusively for Nubank customers. When shopping at an online store that offers NuPay, Nubank customers can select the Buy with Nubank option at checkout and confirm the purchase with their 4-digit password in the Nu app. NuPay can be used for both credit and debit transactions, and service users can choose to pay in full using their available balance or split the payment into up to 24 installments.

Nubank launched the service in May 2022, and it was available at 160 merchants as of April 2023.

✈️ THE TAKEAWAY

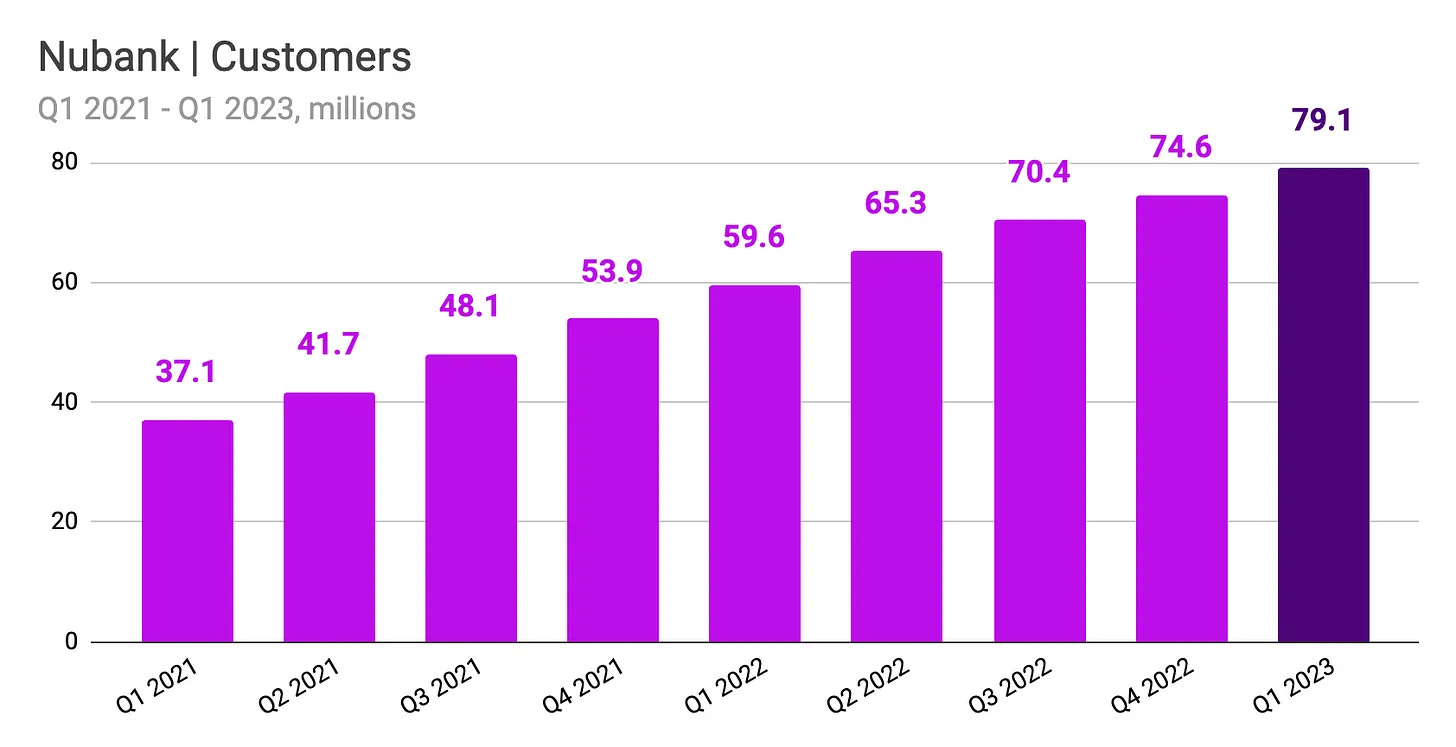

The giant 🇧🇷 The partnership with Uber is yet another move to further strengthen Nubank’s ecosystem - by expanding their services outside of Nu’s Super App ecosystem the Brazilian FinTech giant is basically building the Apple of Finance for LatAm. We must remember that Nubank recently announced reaching the milestone of 80 million customers (as seen above) across its 3 markets, Brazil🇧🇷, Mexico🇲🇽 and Colombia🇨🇴, adding 4.5 million customers just in the first quarter of 2023 alone 🤯 This just proves the scale and influence Nu has across Latin America. Furthermore, the company reported 56M customers having Nubank’s digital accounts, 35M customers using credit card products, and 6M customers taking a personal loan. The crazy part? Every active Nu user is now using nearly 4 Nubank’s products 😳. I’m now even more bullish on them.

Disclaimer: I’m an investor in NU.

ICYMI: The future is purple. Nubank Purple 💜 [a deeper dive into Nu + some more bonus reads]

🔎 What else I’m watching

Teen Spirit 👀 PayPal-owned mobile payment service Venmo launched its new Teen Account solution to offer parents the possibility to open a debit card account for teenagers. Following this launch, parents and legal guardians can open a Venmo Teen Account for children that are in between the age range of 13 and 17 years old. Young adults will be able to send, receive, and spend their money with the guidance of their families. The new product was designed with built-in parental controls over the balance of their teenagers, with oversight capabilities and offerings as well. Smart move to appeal to a younger demographic and further focus on PayPal’s key strengths. ICYMI: PayPal’s focus on efficiency is starting to pay off 💸

Bye, institutions 👋 Digital Currency Group (DCG) is closing its trade execution and prime brokerage services outfit, TradeBlock, citing the crypto winter, broader economy, and US regulatory environment. TradeBlock, which was acquired by DCG's CoinDesk in 2020 before being spun out, will be closed own at the end of May. DCG posted a $1.1 billion loss for 2022 as it faced up to the crypto winter and specifically the collapse of Three Arrows Capital, for which it was the largest creditor. The group's broker unit Genesis also went bankrupt listing debts of around $3.5 billion. This month, DCG reportedly missed a $630 million debt payment owed to Genesis.

Adyen keeps making moves 💪 Global fintech giant Adyen has announced the launch of Payout Services, a solution that allows businesses to send global payouts in real time. With the release of the new service, Adyen leverages its direct connection to RTP banking and card schemes as well as its branch and banking licenses to allow its customers to move funds within a single infrastructure. As a result, any payments can be processed up to three days faster than the industry's customary time. The fintech has a global reach across over 190 countries and active local payouts in over 40 of them. Adyen’s single API offers a solution to businesses that normally would need to manage a diverse network of providers across regions, a complex and time-consuming process. For end users, the platform means getting access to their funds faster. The fintech’s banking infrastructure enables businesses to payout 24/7 in the US, EU, and UK, with no cut-off times or weekend restrictions in these regions. ICYMI: Adyen is the fastest-growing global payments platform 🚀

💸 Following the Money

Global payments and banking infrastructure provider Episode Six has announced the raise of $48M in a Series C funding round, led by Avenir.

Romania-based FlowX.ai has announced the raise of $35M in a Series A funding round for product development and international expansion.

UK-based automated digital identity verification and authentication provider Onfido has acquired US-based Airside Mobile.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: