Game-changer: first Open-Source Financial LLM is finally here 🤯; Leaked doc shows regulators saved Big VCs & Big Tech from billions of losses after SVB's collapse 😳; Disappointment from Revolut 😔

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Pitch Deck that raised Europe’s biggest-ever Seed round 😳 [or how $105M was put into a 4-week-old startup with no product to take on OpenAI 💸]

JPMorgan strengthens its digital strategy by investing in AI FinTech 💸 [+ more deep dives into how JPM is crushing both FinTechs & Banks]

Are Europe’s top VCs still investing? 🤔 [+ resources on how to fund your startup 10X easier]

Banks are becoming crypto companies: Deutsche Bank applies for crypto license 😳

As for today, here are the 3 fascinating FinTech stories that were changing the world of finance as we know it. This week was super intense in the financial technology space, so make sure to check all the above stories.

Game-changer: the first Open-Source Financial LLM is finally here 🤯

The hit news🔥 That was fast! Meet FinGPT, an open-source financial large language model (LLMs) that aims to democratize Internet-Scale financial data, providing researchers and practitioners with accessible resources to develop FinLLMs and build the future of finance. Which is open.

This is a paradigm shift so let’s take a closer look here.

More on this 👉 Large language models (LLMs) have shown massive potential for revolutionizing natural language processing (NLP) tasks in various domains, sparking significant interest in finance.

Yet, accessing high-quality financial data is one of the biggest challenges for financial LLMs (FinLLMs).

While proprietary models like BloombergGPT have taken advantage of their unique data accumulation, such privileged access calls for an open-source alternative to democratize Internet-scale financial data.

ICYMI: ChatGPT for Finance is here 🤯 [a closer look at BloombergGPT]

This is where FinGPT comes into play aiming to disrupt the finance sector.

Data 📊 Unlike proprietary models, FinGPT takes a data-centric approach and focuses on accessible and transparent resources to develop FinLLMs.

The FinGPT pipeline involves the collection of extensive financial data from a wide array of online sources. These include, but are not limited to the following:

Financial news: websites such as Reuters, CNBC, and Yahoo Finance, among others, are rich sources of financial news and market updates.

Social media: platforms such as Twitter, Facebook, Reddit, Weibo, and others, offer a wealth of information in terms of public sentiment, trending topics, and immediate reactions to financial news and events.

Filings: websites of financial regulatory authorities, such as the SEC in the United States, offer access to company filings.

Trends: websites like Seeking Alpha, Google Trends, and other finance-focused blogs and forums provide access to analysts’ opinions, market predictions, the movement of specific securities or market segments, and investment advice.

The USP 🥊 Potential applications of FinGPT and FinLLMs include:

Robo-advising

Algorithmic trading

Low-code development & more!

And this is just the tip of the iceberg. Given it's open-source, FinGPT will continue to stimulate innovation, democratize FinLLMs, and unlock new opportunities in open finance.

✈️ THE TAKEAWAY

Game-changer 🚀 This will undoubtedly be a game-changer for finance as we know it. At the core, open-source financial LLMs have the potential to revolutionize the future of finance by democratizing access to advanced financial expertise and insights. These FinLLMs, built on open-source frameworks, offer a range of benefits, the most important of which is increased transparency, collaboration, and innovation in the financial services industry. In addition to the aforementioned use cases, they enable individuals and organizations to leverage powerful language models for tasks such as financial analysis, risk assessment, portfolio management, and regulatory compliance. But most importantly, the open-source nature of these FinLLMs encourages developers and researchers to contribute and improve the models, fostering a collective intelligence that drives continuous advancements in the financial technology space. Looking ahead, open-source financial LLMs have a massive potential to level the playing field, empower users with sophisticated financial capabilities, and pave the way for more inclusive and efficient financial systems of the future. Systems that are built on Open Finance.

Bonus: The insurance sector is more and more exploring the benefits of AI 🤖

Generative AI will completely transform FinTech and Banking over the next 3 years 🤖🏦

JPMorgan is developing a ChatGPT-like AI service for investors 😳 [+6 more reads]

FinGPT paper: https://arxiv.org/abs/2306.06031

FinGPT code: https://github.com/AI4Finance-Foundation/FinGPT

The leaked doc shows that regulators saved Big VCs & Big Tech from billions of losses in uninsured SVB deposits 😳

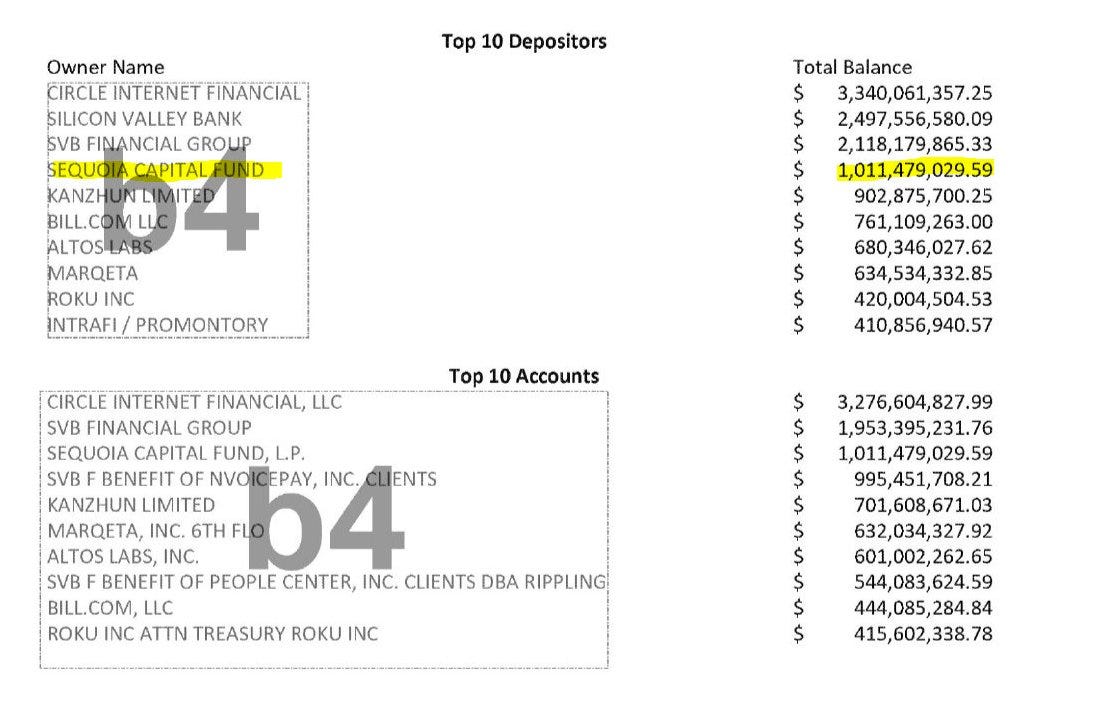

The HOT news🔥 The Federal Deposit Insurance Corporation (FDIC) accidentally posted an un-redacted document to Bloomberg showing that one of the most prominent VC firms Sequoia had $1 billion on deposit at Silicon Valley Bank when it collapsed 😳

This is a pretty wild revelation, so let’s take a closer look.

More on this 👉 We must remember that Silicon Valley Bank had 50% of US VC-backed startups as customers and when it went bust this was the biggest bank collapse in America since 2008.

By providing federal backing for Silicon Valley Bank's entire deposit base, regulators not only protected numerous small tech startups from potential devastation but also extended the safety net to larger companies that faced no immediate risk.

This move, which guaranteed accounts exceeding the $250,000 federal deposit insurance limit, benefited influential firms like Sequoia Capital, the renowned venture capital firm, which had $1 billion deposited with the bank.

The leaked document reveals not only venture capital giant Sequoia but other notable depositors that include:

Circle Internet Financial - listed as SVB’s biggest depositor with a balance of $3.3 billion.

Kanzhun - heavily backed by Chinese giant Tencent, the online recruitment firm had $902.9 million in deposits.

Bill.com BILL 0.54%↑ - the FinTech company had $761.1 million at the bank.

Altos Labs - a life sciences startup that works on cell regeneration, had $680.3 million in deposits with the bank.

Marqeta MQ -0.61%↓ - the payments startup had a total of $634.5 million at the bank.

✈️ THE TAKEAWAY

What does this mean? 🤔 First and foremost, this is yet another proof of how instrumental SVB was for startups and the whole tech ecosystem. With that in mind, the regulatory intervention not only safeguarded the stability of the sector but also ensured the security of significant financial assets held by prominent entities. On the other hand, it’s a bit concerning seeing such a Big Club here. Bailing out VCs and Big Tech with millions to billions of taxpayer money is rather intriguing….

Go deeper and learn more here:

Disappointing new premium plan ‘Ultra’ from Revolut 😔

The launch 🚀 Struggling British FinTech giant Revolut is launching its new “ultimate” membership card, Ultra, that will replace Metal as its top-tier plan.

More on this 👉 At £540 a year, Revolut says the card offers up to £4,100 benefits in return, including subscription bundles with partners for offers on newspapers, exercise classes, VPNs, and co-working spaces worth more than £2,000.

But there’s more. One of the more interesting perks is Tinder Gold. And I’m not joking here 👀

Customers that joined the waitlist will get a 5% cashback on all purchases in their first month (capped at a monthly price plan).

There are reportedly more than 430,000 people on the waitlist in the UK and Europe for the platinum-plated card, which Revolut is positioning as a card of luxury and lifestyle.

✈️ THE TAKEAWAY

Difficult to justify… 🤔 In short, the new Ultra plan seems to make sense for a very niche section of Revolut’s customer base. If you use a lounge more than 10 times per year, use WeWork once a week, and have an FT subscription, then it's a very good deal. If you won't use more than one of those high-end perks, the value simply isn't there. When you look closely at this, the new plan seems almost the same as Metal. No improved cashback is probably the most disappointing thing. Given the weekend charges and the fact that for Lounges you can just buy Priority Pass or get a premium credit card with more benefits, it’s very hard to justify such a high price for Ultra. Maybe Revolut is about to massively downgrade Metal features? Zooming out, it’s also hard to justify the point of fancy cards in the first place (whether metal or platinum) when most people will simply use Apple Pay or Google Pay via mobile…. Sure, some people prefer luxury and like to show off, but it’s hard to expect this to get significant interest.

Someone from Reddit summed it all up elegantly - a tasty cherry on top 🍒:

Revolut product management reminds me of the early 20th-century Russian art movement Suprematism. The feeling of the product manager enjoys supremacy over any sort of user feature, thus a product consisting of purely nothing (see White on White by Kazimir Malevich) is just as legitimate as any other product.

ICYMI: Chaos grips Revolut's fate 😳 [+3 more dives into Revolut]

🔎 What else I’m watching

JPM in Israel 🇮🇱 US-based banking giant JPMorgan JPM 0.05%↑ has announced its expansion in Israel and its decision to enter the commercial banking sector for high-tech commercial banking and companies. The new initiative is part of JP Morgan’s Innovation Economy banking division, which is focused on catering to growth companies, founders, as well as the venture capital community. This adds to the already existing competition in account management and financial products or services for high-tech firms and companies. JPMorgan will prioritize mainly late-stage high-tech companies, offering them solutions such as capital raising support, payment management, or liquidity services. The financial institution is also set to provide strategic advice to venture capital funds, as well as their portfolio companies. ICYMI: JPMorgan is building the largest payments ecosystem in the world 😳

Plaid keeps delivering 💪🏼 US-based data network Plaid has launched Beacon, an anti-fraud network addressed to fintechs and financial institutions. The latest offering is specifically designed to put an end to the ongoing cycle of fraudulent activities that stem from identity theft and compromised accounts. To do this, Beacon leverages a set of APIs that enable real-time, secure information sharing throughout the ecosystem to reduce recurring fraud targeting businesses, safeguard consumers and create a reportedly safer digital finance ecosystem. Reread: Plaid's building the identity layer for Finance 👀

💸 Following the Money

UK-based crypto and digital currency payments platform BoomFi has raised $3.5M in seed funding.

ClimateView, a Swedish startup that's building a climate finance platform, has raised €14M.

UK-based SME B2B payments platform Apron raised a $5.5M seed led by Bessemer, with angel backing from Melio and Klarna’s founders.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: