Elon Musk killed the blue bird: welcome to the Everything App 𝕏; Goldman Sachs wants to exit the Apple Card partnership 💳😵; Robinhood goes UK🇬🇧: Part III 👀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Best Startup Cap Table & Returns Model Template 💸 [use this if you want to master your startup's finances]

Meta's Threads raises questions for banks and credit unions 🏦

As for today, here are the 3 fascinating FinTech stories that were changing the world of finance as we know it. This week was absolutely insane in the financial technology space, so make sure to check all the above stories.

Elon Musk killed the blue bird: welcome to the Everything App 𝕏

Note: the first version of this post originally was published on LinkedIn but given the immense impact and interest, I’m sharing a more detailed version here too.

The (breaking) news 🗞 Elon Musk just killed the blue bird. Twitter logo no longer exists 🤯

It will now be X, another step towards the Everything App, or what might become the most powerful FinTech company in the world.

Let’s see what it means and why it’s a big deal.

More on this 👉 The first steps were taken 4 months ago when Twitter Inc. has been merged with X Corp. In March 2023 Twitter as we know it ceased to exist.

The new phase of Twitter will be all about X, which will run on a vision laid out 25 years ago.

A step back 🔙 Everything goes back to the days of X.com, an online bank Elon Musk co-founded with Harris Ficker, Christopher Payne, and Ed Ho in 1999. The company eventually became PayPal PYPL 0.00, which today is one of the largest and most influential payment & finance companies in the world.

ICYMI: PayPal's solid results & why it's one of the strongest cos in the digital money space 💸

Despite the merger, Elon's sentiment for X always remained, and now is probably the best time to make it happen. But on a much greater scale.

The master plan🔥 That's why the CEO of Tesla TSLA 0.00 & SpaceX bought Twitter in October 2022 and described his acquisition as "an accelerant to creating X, the everything app".

A month later, Musk said he will execute the X product plan "with some improvements" which will make Twitter "the most valuable financial institution in the world.

Fast forward to 2023, and it's clear that Elon is walking the talk.

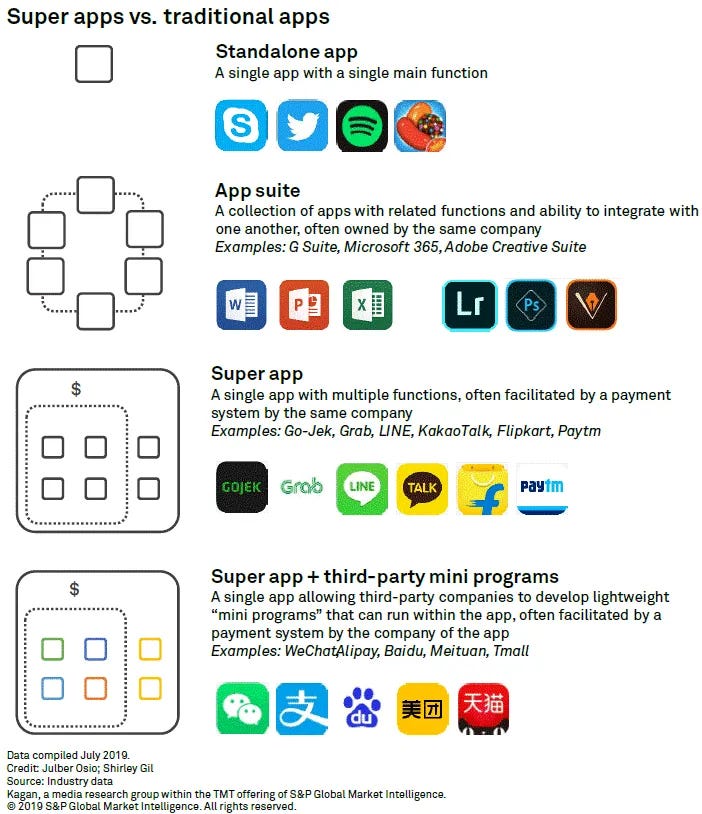

The potential 🚀 With 396 million users, the social media giant could definitely be transformed into an app that does everything.

Not only it could become the first Super App of the West. More importantly, Twitter can evolve into the Super App that PayPal, Klarna, and Revolut always dreamed of.

ICYMI: Klarna just lost $1 billion. But it's not bad! 🤑 [& why you probably don’t understand Klarna well enough]

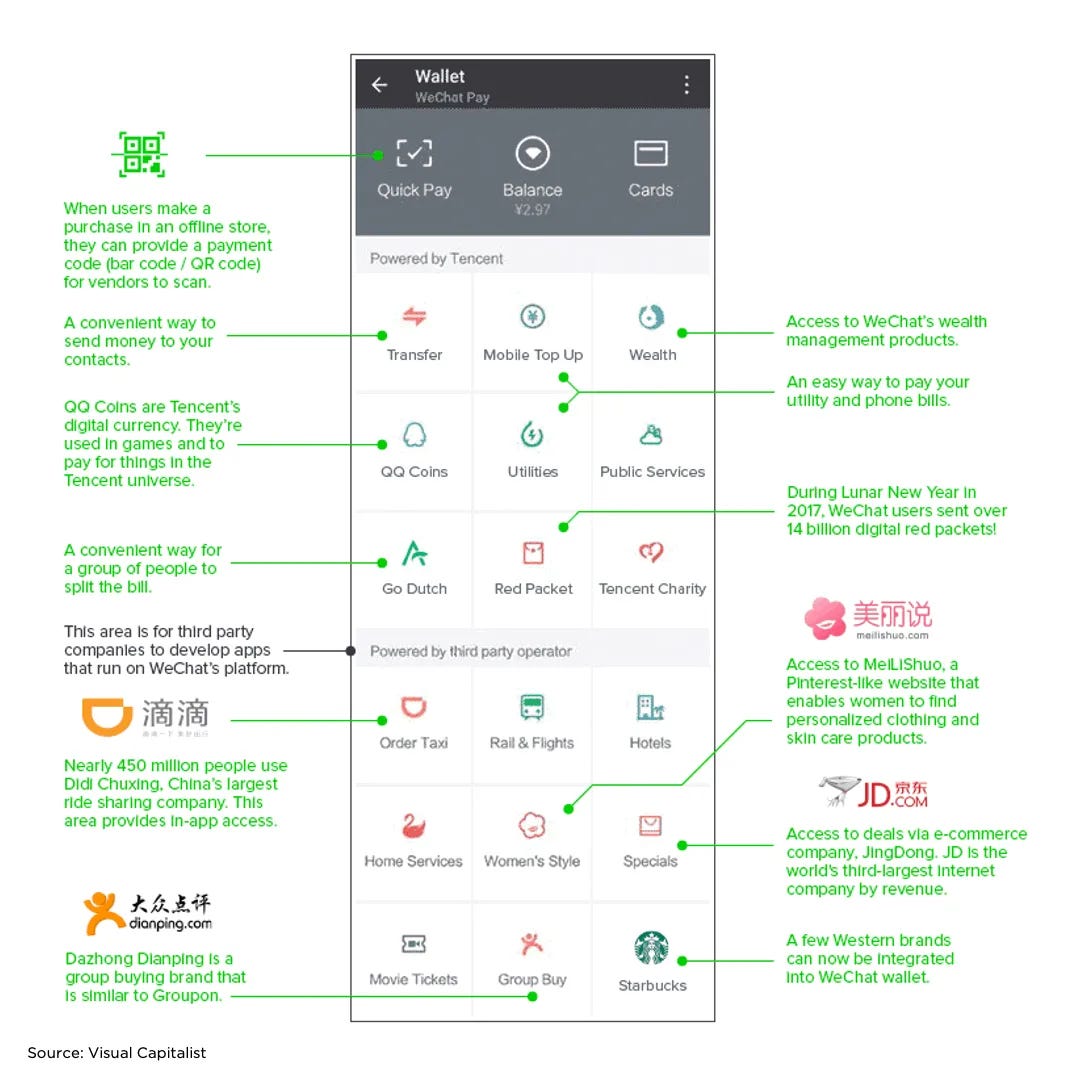

WeChat, the gold standard of Super Apps, today has 1 billion users and brings together social networking, payments, e-commerce, games, news, events, shopping, etc. all in one place.

And it started as a messaging app. Just like Twitter.

But here comes the crazy part.

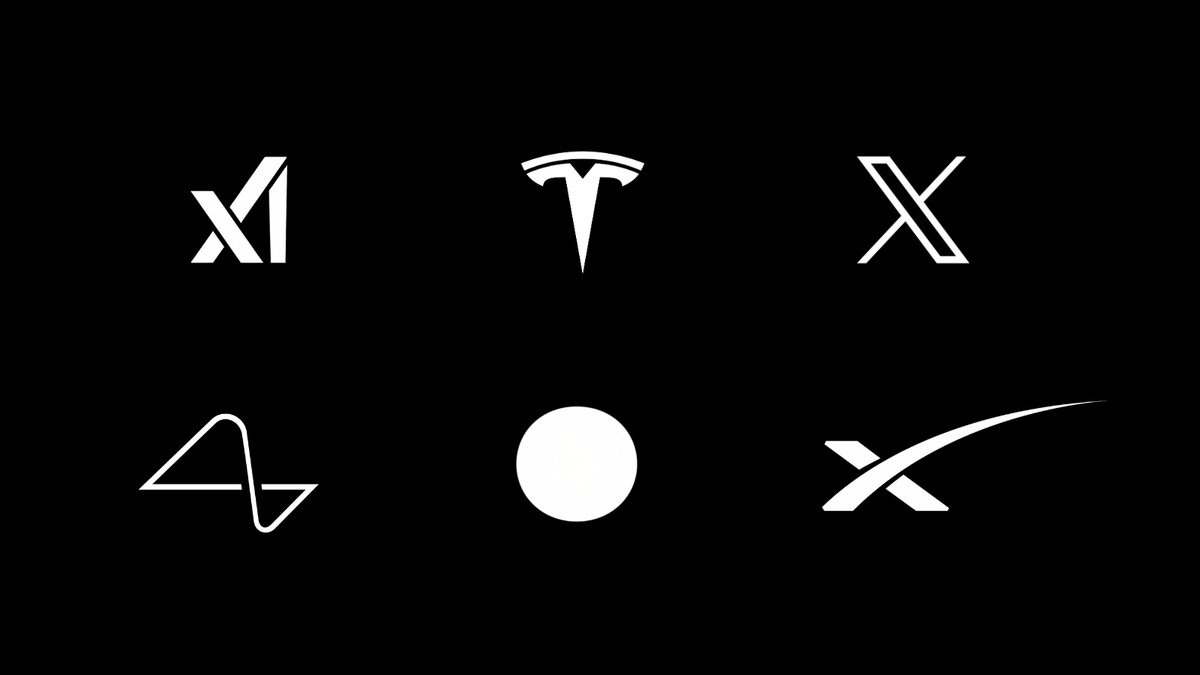

Zoom out 🌍 Just 11 days ago Musk unveiled his latest company xAI. It's an artificial intelligence startup that will be a critical component of the Everything App. With it, Elon now has some really powerful tools at his disposal:

- Nearly 400 million Twitter accounts with years of text to train his AI agents on.

- Starlink satellite network, which can bring internet to all corners of the planet.

- X dot ai, which boasts a team of the top AI researchers on the planet.

The new Muskonomy

✈️ THE TAKEAWAY

Putting the pieces together 🧩 The above is already a super powerful toolbox on its own. When coupled with Tesla’s data and infrastructure, brilliant AI talent from Neuralink, and pretty much abundant capital (he’s the richest man in the world), it’s clear that Musk is slowly yet deliberately putting all the pieces together. It's a herculean task that will require grit, perseverance, and some luck. But one thing is clear:

We're witnessing the beginnings of the most powerful FinTech company in the world that could define the future of the internet.

The Everything App starts today: Twitter launches stock and crypto trading 💸 [+2 more reads]

Goldman Sachs wants to exit the Apple Card partnership 💳😵

The HOT news🔥 As Goldman Sachs GS 0.00 looks to end its credit card partnership with Apple AAPL 0.00, an interesting tidbit has recently come to light - the bank's own underwriting system initially rejected Tim Cook's card application. Ouch 🥶

But let’s take a holistic look at this and see why it matters.

More on this 👉 Goldman Sachs traditionally serves large institutions and high-net-worth individuals. But it entered the retail banking industry with much fanfare in 2016 when the bank introduced Marcus, a digital-only bank designed for everyday consumers, and began offering personal loans to users. The service had attracted over $50 billion in consumer deposits by the time the bank struck its deal with Apple.

Goldman has been Apple's credit card partner since the card's launch in 2019 and has expanded its collaboration to include other banking services for the tech giant (i.t. it’s also powering Apple’s consumer saving account, which was unveiled in April). However, GS has been shifting away from the consumer market, spinning off its digital bank Marcus and creating a new unit that includes the Apple business alongside other operations.

ICYMI: Goldman Sachs' Marcus shows just how difficult FinTech really is 😔

The new unit reported substantial losses in recent years, prompting Goldman's interest in cutting ties with Apple and potentially passing the business to American Express AXP 0.00. However, potential deals with AmEx or other partners like JPMorgan Chase JPM 0.00 might prove challenging, as they are not keen on co-branded cards or taking a secondary branding role.

Apple Finance 🍏🚀 With that in mind, Apple will probably continue moving deeper into financial services directly and may consider bringing much of Goldman's contribution in-house, handling underwriting, fraud prevention, and customer service on its own while potentially working with a less prominent lender for regulatory purposes.

Side note: acquiring GS consumer division or Goldman altogether might be an even bigger thing long term… 👀

ICYMI: The deal Apple needs to make: acquiring Goldman Sachs' Consumer Division would be the M&A of the century 🤯

Anyways, any transition away from Goldman could take up to 18 months to complete, according to reports.

You can’t make this up… 😬 Interestingly, before the Apple Card launch, even Apple's CEO Tim Cook faced a hurdle in getting approved for the card. Goldman's underwriting system rejected his application, not due to his creditworthiness, but because he was a high-profile target for potential fraud. However, the bank eventually made an exception to issue Cook a card. Phew 😮💨

✈️ THE TAKEAWAY

Looking ahead 👀 It’s quite prophetic that one of the most high-profile alliances between a tech and finance company began inauspiciously. But I guess you have to learn the hard way that FinTech is hard, and getting into lending (& doing it profitably) as a new entrant in the market is nearly mission impossible. Given that Goldman is going to have one hell of a hard time getting AmEx (not to mention JPM) to take Apple off its hands, it’s going to be super interesting to follow where this ends. But one thing is clear - Apple won’t be the one that loses here. It rarely does.

Worth reread: Apple might become the First Super App of the West 🍎 [+4 more reads]

Robinhood goes UK🇬🇧: Part III 👀

The news 🗞 US stock trading giant Robinhood HOOD 0.00 has tapped Freetrade executive Jordan Sinclair to lead its renewed plan for a UK launch. Again.

More on this 👉 Sinclar has been approved by the FCA to act as Robinhood UK Ltd CEO, a register shows, as per Bloomberg.

Sinclar has been MD of Europe, at the UK stock trading app Freetrade for a little over a year. Previously, he worked at Barclays.

ICYMI: Freetrade gets a 65% valuation cut 😳 [+ extra reads on Robinhood & Apple]

Robinhood is planning to launch brokerage services for UK retail investors later this year.

Fool me once… 👀 This is the third time the US retail broker is trying to crack the United Kingdom. Robinhood first tried to launch in the UK in 2020, a plan which was postponed and eventually canceled as it dealt with operational problems caused by an explosion of day trading in its core US market during the Covid-19 pandemic.

Next, the stock trading app looked to acquire crypto trading platform Ziglu in 2022 for a whopping $170M, another plan which fell apart after being renegotiated for less than half the amount ($72.5M).

ICYMI: Tinder date doesn't guarantee a relationship: Robinhood kisses goodbye to Ziglu 😢 [+more reads]

✈️ THE TAKEAWAY

So why again? 🤔 From the first sight this seems odd. Payment for order flow (PFOF) - which is probably 90% of Robinhood’s biz - is still illegal in the UK while the market became much more crowded (we must remember that Public and WeBull have recently entered the UK as well). On the other hand, Robinhood today is a completely different business. Despite a massive correction since IPO, the stock is up 51% YTD, it’s expanding into all things money (see below about X1) while searching for new markets to grow (the US has been stalling for quite some time now). With that said, the 3rd time might actually hit home.

Bonus: Robinhood takes on Apple 😮 [+2 more reads]

When 1 + 1 = 3: Robinhood buys credit card startup X1 💳 [it all starts to make sense]

🔎 What else I’m watching

Wave and pay 👋 Amazon AMZN 0.00 is rolling out its palm payment technology to all of its 500+ Whole Foods Market stores in the US. Amazon One is currently available at more than 200 Whole Foods Market locations across the US. First-time users can pre-enroll online with their credit or debit card, Amazon account, and mobile number in just under a minute. They can then complete the enrollment process in seconds by scanning their palm over an Amazon One device the next time they visit a participating store. In total, Amazon has installed the technology at 400 locations across the US, reaching three million users. Reread: Amazon is now in the payments business too. And it could be huge 🤯

Achievement unlocked 🔓 The Bank of Spain has approved the registration of eToro as a service provider of exchange of virtual currency for fiat currency and electronic wallet custody services. We can remember that the online trading platform received a $3.5 billion valuation earlier this year, and has partnered with Twitter to build out the social media giant’s payments and financial features. Also, just yesterday eToro also announced that it has built out a passive investor portfolio comprising solely of shares across 40 leading fintechs.

💸 Following the Money

InsurTech Foxquilt, which is specializing in catering to small businesses and micro-enterprise markets, has secured $12M in a funding round.

Cybersecurity firm Trustmi bolsters payment security with $17M funding.

Contextual cybersecurity platform Cyclops secures $6.4M seed.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: