Robinhood is outrageously cheap right now 😯; Coinbase acquiring a minority stake in Circle is a bold move 😳; Yahoo is a FinTech: Yahoo Finance acquires social investing platform Commonstock 🤑

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

80+ Top Pre-Seed VC Funds & Angel Investors for Startup Founders 💸 [use this to launch your startup with the best in the business]

PayPal is just too good to ignore right now 🤑 [numbers back it up as a brilliant long-term investment + a deep dive into PayPal]

The future of finance is being piloted in LatAm: Nubank to test Brazilian CBDC, Drex 🪙🇧🇷

The worst possible time for a financial technology firm to go public might be now… 👀📉

Checkout.com cuts ties with Binance over money laundering & compliance concerns 🤯

Mastercard to end crypto-to-fiat card partnership with Binance 👀

Downrounds are the new norm 📉😭 [bonus is priceless startup resources for those looking for funding]

As for today, here are the 3 intriguing FinTech stories that were changing the world of finance as we know it. This week was just wild in the financial technology space, so make sure to check all the above stories.

Robinhood is outrageously cheap right now 😯

The news 🗞️ Last week was pretty intense for all things FinTech, so it’s not surprising that some things were missed or left out. And one of the things that’s definitely worth talking about today is Robinhood HOOD 0.00%↑.

The retail trading giant just reported its latest monthly data, which together with its recent quarterly earnings, indicate that it’s currently one of the cheapest public FinTech stocks out there.

Let’s take a closer look and see why it’s worth your time and money.

More on this 👉 Here are the key takeaways from Robinhood’s latest monthly data:

Net Cumulative Funded Accounts (NCFA) at the end of July were 23.2M, up approximately 50k from June 2023.

Monthly Active Users (MAU) increased to 11.0M in July, up approximately 200k from June 2023.

Assets Under Custody (AUC) at the end of July were $94.5B, up 6% from June 2023.

Net Deposits were $1.4B in July, translating to a 19% annualized growth rate relative to June 2023 AUC. Over the last twelve months, Net Deposits were $16.8B, translating to an annual growth rate of 23% relative to July 2022 AUC.

Trading Volumes in July were higher for equities and crypto and lower for options compared to June 2023. Equity Notional Trading Volumes were $69.2B (up 3%). Options Contracts Traded were 106.1M (down 4%). Crypto Notional Trading Volumes were $3.4B (up 3%).

Cash Sweep Balances (your uninvested cash that’s FDIC insured and pays 1.5% Annual Percentage Yield (APY) for regular users or 4.9% for Robinhood Gold members) at the end of July were $12.7B, up $0.8B (7%) from the end of June 2023.

Out of the above, Assets under Custody is probably the most important metric, and Robinhood will soon surpass $100B in AUC. On top of that, it got $800M on Net Deposits directly into Cash Sweep in July alone. Solid.

Now let’s take a look at the key takeaways from Robinhood's Q2 2023 earnings results:

Total net revenues were $486M, up 10% sequentially driven by higher net interest and seasonally higher other revenues. This was a 53% increase compared to Q2 2022.

Net income was $25M compared to a net loss of $295M in Q2 2022. Robinhood achieved GAAP profitability for the first time as a public company.

Adjusted EBITDA was $151M, up 31% sequentially. This is a significant improvement from the ($80) million Adjusted EBITDA loss in Q2 2022.

Average Revenue Per User (ARPU) increased to $84, up 9% sequentially. We’re clearly on the path to 2021 numbers…

✈️ THE TAKEAWAY

Why should you care? 🤔 First and foremost, Robinhood just turned GAAP profitable and has an enterprise value of near zero. To put it another way, HOOD 0.00%↑ at $10 (Robinhood’s current stock price) means $9 billion for the following: $3B for the trading platform & 11M users + $6B of cash. If that doesn’t look like a bargain to you, we must remember that E-Trade was bought for $13B by Morgan Stanley MS 0.00%↑ while TD Ameritrade was bought for $26B by Charles Schwab SCHW 0.00%↑. Sure, some valuations were inflated, but when it comes to users, Robinhood is dominating the space (the data below is not recent but gives a good sense of where things stand):

The above coupled with the strong net revenue growth, improved profitability, and lower expenses are positive signs for Robinhood's business fundamentals and make them outrageously cheap. If you don’t hold any of their stock, now might be one of the best times to reconsider your position.

ICYMI: Robinhood goes UK🇬🇧: Part III 👀 [international expansion is a massive room for growth + lots of bonus reads]

Disclaimer: this isn’t investment advice and I’m a shareholder of Robinhood.

Coinbase acquiring a minority stake in Circle is a bold move 😳

The deal 🤝 Crypto pioneer Coinbase COIN 0.00%↑ has acquired a minority stake in Circle Internet Financial and aims to shut down the Centre Consortium partnership that had issued USD Coin (USDC), the world’s second-largest stablecoin.

This is a bold move with lots at stake, so let’s take a look.

More on this 👉 In light of this development, Circle will take over the complete issuance and governance of USDC in-house. Additionally, USDC will be natively supported on 6 more blockchains, expanding the total number of supported blockchains to 15.

Even though specific details about the additional blockchains have not been disclosed, Circle had previously mentioned plans to include Polkadot, Near, Optimism, and Cosmos in 2023. Coinbase has also introduced its own blockchain called Base.

ICYMI: Coinbase becomes the first publicly traded company to launch its own decentralized blockchain 😳 [why it’s a game-changer and a critical part of their "Master Plan" + a deeper dive into Coinbase]

The exact size of Coinbase's stake in Circle has not been revealed, and no cash exchange took place between the two companies for this stake according to Coindesk.

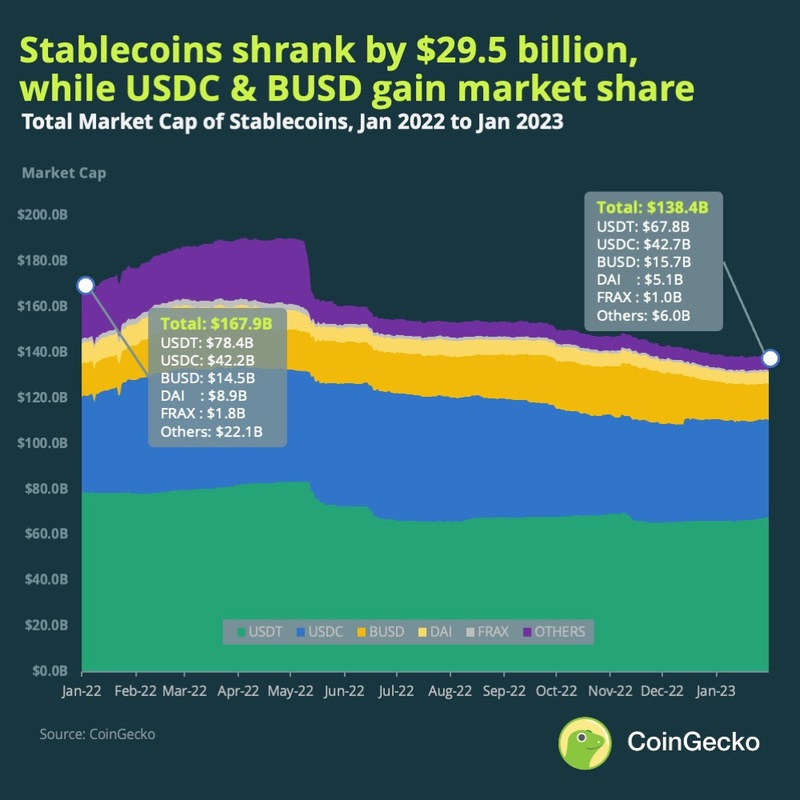

The move comes at a time during tectonic shifts in the world of dollar-pegged stablecoins. Most recently, FinTech giant PayPal PYPL 0.00%↑ took a step to shake up the dominance of Tether’s USDT and USDC by introducing its own PYUSD token. PayPal could prove a worthy contender given its deep ties in payments and remittances.

ICYMI:

✈️ THE TAKEAWAY

What does it mean? 🤔 Let’s look at the big picture first. Seeing this news just after PayPal launched PYUSD is brilliant proof that the stablecoin market is growing. More importantly, the regulatory clarity for stablecoins is increasing around the world (i.e. in Europe, the UK, Singapore, etc.) which is a solid building block for stablecoins to become a global dollar payments rail. Furthermore, given Circle is backed by BlackRock, Fidelity, and hedge fund Marshall Wace, we can expect more USDC applications for tokenized asset settlement. And this is a massive industry on its own. This now brings us to Circle. The crypto company tried to go public via SPAC multiple times yet it didn’t work out. Hence, Coinbase equity could be a way to achieve that exit for Circle investors and/or staff. Finally, we have to talk about Coinbase that’s probably the biggest winner in this deal. If the crypto giant is really trying to build an open financial system, USDC fits elegantly into Coinbase's offerings. It will surely be added on Base. But more importantly, we have to understand that USDC stretches far beyond crypto trading, into areas like foreign exchange, and transfers of funds across borders aka remittances, to name a few. If things go well, Coinbase will probably end up acquiring Circle altogether becoming a global crypto/finance superpower.

ICYMI: Coinbase’s Q2 paints a promising picture 🖼️ [earnings review + why you should be bullish]

Yahoo is a FinTech: Yahoo Finance acquires social investing platform Commonstock 🤑

The deal 🤝 Yahoo, a global online giant renowned for its diverse portfolio of iconic products, has made a strategic move by acquiring Commonstock.

It’s a social platform that lets retail investors link their brokerage accounts share their portfolio's performance and discuss their trades and strategies. Terms of the deal were not disclosed.

This is arguably the first FinTech move by Yahoo, so let’s take a closer look.

More on this 👉 Launched in 2020, the Commonstock app acts as a social layer on top of existing brokerages. Users link their brokerage accounts and share their real-time portfolio (by percent, not dollar amounts), performance, and trades.

Users get real-time alerts when friends buy or sell and can carry out discussions about investment strategies.

The firm, which raised $25 million in 2021 and now has more than $10 billion in connected assets, becomes part of Yahoo Finance, which has over 150 million global monthly users.

✈️ THE TAKEAWAY

What’s next? 🤔 This deal represents the first acquisition under the Yahoo Finance brand since Yahoo was bought by private equity firm Apollo Global Management in 2021. The outlet has long been a leader in market data, news, and analysis, both for professional and retail investors, and the latest acquisition builds on Yahoo's long-term strategy to transform Yahoo Finance into the premier, one-stop destination for retail investors. The potential next step could be transforming Yahoo Finance into a fully functioning social investment app. With its scale and reach, it could really compete with the likes of eToro, or new startups like Shares, or Lightyear. Why bother? Well, social investing could soon be kind of a big deal…

ICYMI: Shares nets $40M to make investing social 💸

Shares wants to be the ‘Louis Vuitton’ of trading apps 👀

Social Investing just got a lot more interesting 💸

🔎 What else I’m watching

iPhone as a POS is on the rise 🚀 J.P. Morgan Payments, the payments arm of banking titan JPMorgan JPM 0.00%↑, has announced the launch of Tap-to-Pay on iPhone for US-based merchant clients to accept in-person, contactless payments, with Sephora as the first customer. The solution helps merchants accept contactless payments using their iPhones, with no requirement for a dedicated payments card reader or additional hardware. ICYMI: Apple's Tap to Pay arrives in the UK, or the Beginning of the End of Physical Payment Terminals 📲

Klarna does more layoffs (kinda) 🤔 Klarna is outsourcing its customer service staff and cutting 250 roles, Sifted reported. The move by the BNPL giant will affect employees in Germany and Sweden. Staff affected have been offered a transfer job at a new employer, Foundever, where they would continue to provide services to Klarna. The news represents the 3rd time that Klarna has slimmed its payroll in the last 15 months. It was the first European FinTech to announce layoffs back in May last year when it cut 10% of its workforce. That was around 650 people. Then in September last year, it laid off another 100 people. Maybe it’s eying an IPO sometime soon? 👀

💸 Following the Money

Velo Payments has announced the acquisition of the payment processing platform YapStone to offer its customers improved payment methods.

Vista Equity Partners have obtained a $5.3B private loan from Oak Hill Advisors and Blue Owl Capital to refinance the debt of Finastra.

US-based crypto custodian BitGo has secured $100M in a Series C financing round, which brought its total valuation to $1.75B.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: