HUGE: Grayscale's victory against the SEC paves the way for Spot Bitcoin ETF approval 💸; Leveraging AI, Klarna is slowly yet steadily building the Google of Shopping 🛍️

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Due Diligence Checklist Template ✅ [use this to streamline the critical DD process & execute smart]

Apple should have bought Goldman Sachs’ PFM unit. Here’s why 🍎 [where’s the value at + lots of deeper dives]

License secured: Elon Musk’s 𝕏 is building a crypto wallet 😳

JPMorgan aims to tap into one of the world's largest retail banking markets 🏦

As for today, here are the 3 fascinating FinTech stories that were transforming the world of finance as we know it. This week was just fantastic in the financial technology space, so make sure to check all the above stories.

HUGE: Grayscale's victory against the SEC paves the way for Spot Bitcoin ETF approval 💸

The news🔥 Asset manager Grayscale Investments has emerged victorious in its lawsuit against the U.S. Securities and Exchange Commission (SEC).

Grayscale’s legal victory regarding the conversion of the Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin exchange-traded fund (ETF) is a monumental development for the cryptocurrency industry.

Let’s take a look.

More on this 👉 In a unanimous ruling, the U.S. Court of Appeals ordered the SEC to review and explain its previous rejection of Grayscale's ETF application. The court stated the SEC failed to adequately justify why it approved bitcoin futures ETFs but denied Grayscale's spot bitcoin ETF given the similarities between the two.

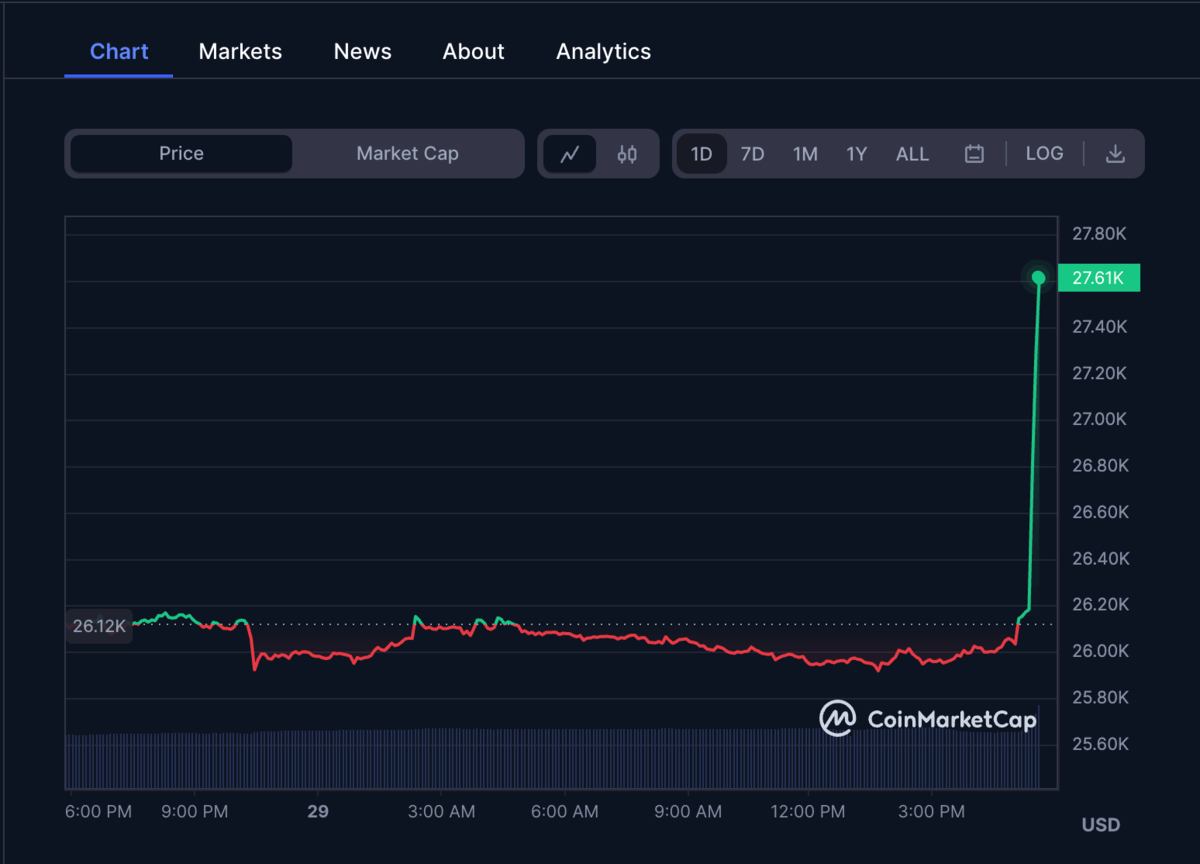

Following the positive news of Grayscale's lawsuit victory, Bitcoin experienced a surge in price. BTC jumped immediately from $26.2k to $27.5k.

✈️ THE TAKEAWAY

BIG win with BIG implications 👀 This is a precedent-setting ruling that opens the door for the likely approval of not only GBTC's conversion to an ETF but also other spot bitcoin ETF applications by major financial institutions like Fidelity FNF 0.00%↑ and BlackRock BLK 0.00%↑. The elimination of GBTC's discount could pour billions into Bitcoin and validate it as a mature investable asset class. Zooming out, this also means greater mainstream adoption, less volatility, and more regulatory clarity for cryptocurrencies. ETF approval may also influence the SEC to become more accommodating toward other crypto-based investment vehicles. This favorable ruling affirms the maturation of Bitcoin as an investable asset. Bullish.

ICYMI: BlackRock’s Bitcoin ETF: a game-changer or just hype? 🤔

More Big names follow BlackRock in filing for a Bitcoin ETF 👀

Leveraging AI, Klarna is slowly yet steadily building the Google of Shopping 🛍️

The numbers 📊 On Monday, I already talked about Klarna. But we must end up the week with it as well since the BNPL pioneer just reported a profitable month for the first time in 3 years 😳

More importantly, by leveraging AI, the FinTech giant is building the Google of Shopping.

Let’s take a look.

More on this 👉 Following a super difficult period that led to massive losses, valuation collapse, and letting go of thousands of employees, the Buy Now, Pay Later heavyweight literally smashed the first half of 2023.

Here are the key takeaways from Klarna's H1 2023:

Klarna returned to profitability in Q2 2023, recording its first month of net profit in June. This was ahead of schedule and highlights Klarna's ability to deliver on its strategic focus of both growth and profitability. Big congrats 👏

Revenue increased 17% year-over-year to SEK 5.5 billion in Q2 2023. Total net operating income was up 21% to SEK 4.8 billion. This reflects prudent financial management and delivering substantial value to customers.

Adjusted total operating expenses before credit losses improved 26% compared to Q2 2022, showing Klarna's focus on optimizing costs while maintaining customer service.

Credit losses decreased 41% compared to Q2 2022 and remained low at 0.39% of gross merchandise volume (GMV) in the first half of 2023. This illustrates Klarna's responsible lending approach. Big one!

GMV increased 14% year-over-year in Q2 2023, driven by the US and UK markets. New partnerships like Airbnb further accelerated GMV growth.

The US market continues to be a key driver of sustainable and profitable growth. The US achieved its third consecutive quarter of gross profit.

Klarna continues to invest in AI to enhance customer offerings and optimize efficiency. Initiatives like personalized shopping feeds in the app demonstrate the benefits AI brings.

S&P assigned a credit rating of BBB-/A-3 to Klarna Bank with a stable outlook, reflecting Klarna's robust position in e-commerce and progress toward profitability

Also, Klarna is the only bank among ChatGPT Enterprise launch customers 👀

Affirm are you watching?

But that's not even the most exciting part.

What's impressive is how steadily yet strategically Klarna has been building its Super App:

When it comes to finance, Klarna is already a bank in several countries offering checking and savings accounts, among IBANs and other things.

Recently it launched the Pay Now option globally so customers can pay in full wherever Klarna is accepted.

It even has the Klarna Card which lets users pay in installments in-store & online. The Klarna Card integrates into the Klarna app and is connected with its loyalty program, Vibe.

Klarna also has a commerce search that compares thousands of websites to help consumers find the best price for products.

There’s also a shoppable video where retailers share existing social content and campaigns that tell their story and create shoppable content exclusively for Klarna.

Finally, Klarna's Creator Platform provides a one-stop shop for retailers and creators to work together to automate initial outreach, partnerships, and tracking sales and commissions.

✈️ THE TAKEAWAY

Zoom out 🔎 That said, it’s clear that Klarna is building the ultimate shopping destination of the future. It's striving to become the Google of Shopping. And if it goes the way it seems to be going right now, Klarna might soon become the most impressive turnaround story in the history of FinTech. Bullish.

ICYMI: Klarna is turning the world pink 👛🌍 [+ some deeper dives into Klarna]

P.S. Klarna’s marketing team deserves a raise:

🔎 What else I’m watching

More Gen AI in finance 👀 Benchmark provider MSCI has extended its partnership with Google Cloud to accelerate its development of generative AI services for the investment industry. According to a statement, the partnership will see MSCI's proprietary data and analytics combined with Google Cloud's AI platform Vertex and various climate-related technology services to develop new products. The development will focus on three areas - risk signals, conversational AI, and climate generative AI - thereby tapping into two of the most in-demand tech trends in the asset management market, AI and ESG investing.

Rising fees on the horizon? 👀 Visa V 0.00%↑ and Mastercard MA 0.00%↑ have been rumored to increase the fees that many merchants pay when they accept customers’ credit cards. According to The Wall Street Journal, credit card companies are planning to implement fee increases starting in October and April. These increases primarily target online purchases, potentially resulting in US merchants paying an additional $502M in fees each year. CMSPI, a consulting company working with merchants, estimated that network fees would account for slightly over half of this revenue, while the remainder would come from interchange fees, also known as swipe fees. ICYMI: The Finance Giants: Visa vs. Mastercard 💳

Chastain's role involved selecting NFTs to be prominently displayed on OpenSea's platform. He was found guilty of exploiting his insider knowledge to profit from trading NFTs featured on OpenSea's homepage. He was charged with generating illicit gains of more than $50,000 through insider trading of NFTs by the FBI and the U.S. Department of Justice. This was the first time that digital assets were used in an insider trading scheme. The charges carried a potential sentence of up to 20 years for each offense. While Chastain's lawyers argued that NFTs are not securities and that the information he used wasn't confidential, the court disagreed and allowed the case to proceed to trial.

💸 Following the Money

San Francisco-based crypto-native fund Momentum Capital has secured a $10M investment from Canada's BM Fund.

Digital payments and commerce provider across the MEA region Network International has invested EGP 1 billion to accelerate economic development in Egypt.

Germany-based Ivy, a company offering a global API for instant bank payments, has secured $20M in a Series A funding round led by Valar Ventures.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Please may you explain this "The elimination of GBTC's discount could pour billions into Bitcoin and validate it as a mature investable asset class." how so? Perhaps you mean the price of the shares will pop on the news so people will give the fund BTC to get more shares, driving its BTC holdings up just so they can sell shares? Still, feels momentary and i thought clients don't get the shares immediately?